US Anti-China Chip Ban Worsens Shortages, Inflation in Bid for 'Sovereign Capability'

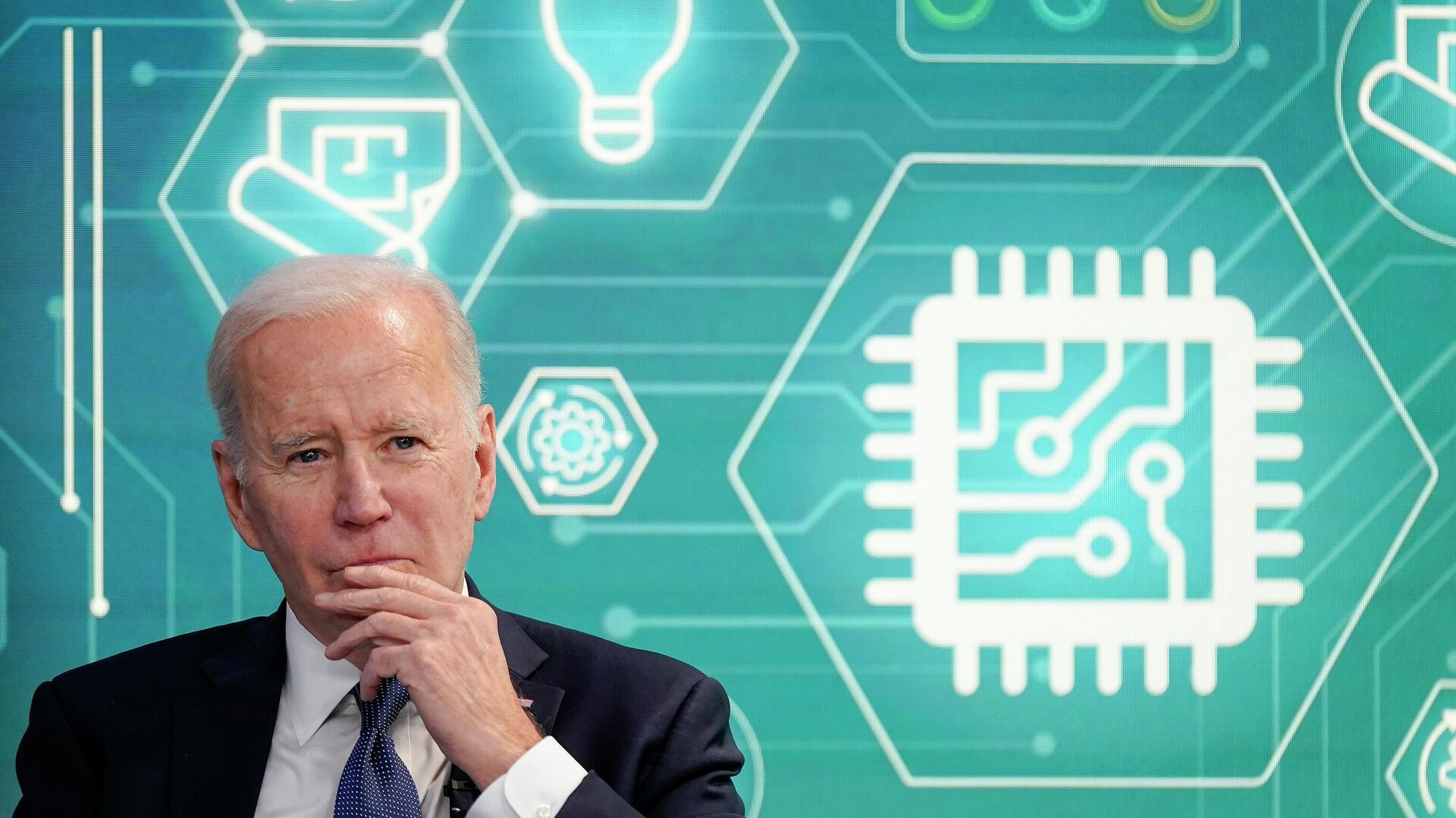

© AP Photo / Patrick Semansky

Subscribe

WASHINGTON (Sputnik) - The Biden administration's new export restrictions on American semiconductor technology sent to China will exacerbate global supply shortages and inflame inflation in the United States as Washington looks to become less reliant on foreign sources, experts told Sputnik.

In October, the Biden administration expanded controls on the export of semiconductor technology to China to restrict Beijing's ability to make certain high-end microchips used in military applications.

However, some companies have already complained about the potential negative impacts of the restrictions, such as higher costs and supply chain issues. The US-based company KLA, which provides testing and measuring equipment for the semiconductor industry, projects a $600 million to $900 million loss in revenue in 2023 considering China was its largest revenue contributor.

Moreover, the move comes as the world continues to struggle with semiconductor shortages, a shortfall that cost the US economy $240 billion in 2021.

Boosting Chip Shortages, Costs & Inflation

Although the crisis has eased from its peak in May, microchip lead times still averaged more than 25 weeks in October, Bloomberg reported citing Susquehanna. The chip shortage crisis will not be considered "over" until average lead times fall to between 10 and 14 weeks, the report said.

SEMI, a US-based trade association group representing electronics manufacturing supply chain companies, expressed concerns about the potential impact of the restrictions.

"We believe it is vitally important that the US government implements these rules in close collaboration with and inputs from our key international partners in order to limit unintended adverse consequences that could reverberate through the domestic supply chain of this critical industry," a SEMI spokesperson told Sputnik.

Texas A&M University's Associate Department Head of Electrical & Computer Engineering, Professor Stavros Kalafatis, believes the new export controls will only make the global semiconductor shortfall even worse.

"Short term, this will exacerbate the shortage of chips that would go into IoT, Cars, sensors, etc.," Kalafatis said. "The majority of these chips get manufactured in China on low end fabs, which I expect use US equipment as there are not many, if any, Chinese semiconductor equipment manufacturers."

Although it will create more local high-skilled jobs in the US, he added, the downside is higher costs.

"The bad news is that in general we [US employees] get paid more than the Chinese, so the cost of manufacture will go up and that will impact consumers, feeding already high inflation," Kalafatis said.

Macquarie University Electrical Engineering Professor Darren Bagnall said the shortage of semiconductor chips creates serious issues for many national economies and the defense industry. Moreover, he added, the supply chain is under threat due to tensions with China.

"Most production takes place in Taiwan, and access to these chips is somewhat at risk given current geopolitical tensions," Bagnall said.

Bagnall warned that to alleviate the shortage will be expensive because it will require building state-of-the art manufacturing capability, buying advanced equipment, and developing expertise.

Kalafatis also fears the long-term implications the restrictions will have on product quality and development.

"In my humble opinion, less competition leads to inferior products," Kalafatis said. "So, even though this is unavoidable, we are probably looking at another era like the 70’s and 80’s where a few companies dominate the market and do not innovate."

US-China Chip Race

The race is on between the US and China to capture the booming microchip industry which saw all-time records in both annual sales ($555.9 billion) and shipments (1.15 trillion) in 2021, according to the Semiconductor Industry Association (SIA).

And the long-term outlook remains strong. Fortune Business Insights projects the chip market could hit $1.4 trillion by 2029.

The Biden administration is focused on boosting US market share and making America less dependent on China for semiconductor fabrication.

Earlier this year, US President Joe Biden signed an executive which included $52 billion in subsidies for domestic semiconductor manufacturers that the White House said would create at least 40,000 jobs in the United States.

Meanwhile, the Taiwan Semiconductor Manufacturing Company (TSMC) announced earlier in November that it will build a $12 billion plant in Phoenix, Arizona, that will manufacture advanced semiconductor chips, creating 1,600 new high-end jobs.

Bagnall underscored that in addition to security issues, the US strategy is about enhancing national economic strength and independence.

"At this time, for the sake of defense implications, and as it happens economic implications, the race is on to gain ‘sovereign capability,’" Bagnall told Sputnik.

Kalafatis warned, however, that the new restrictions will likely force China to develop its own semiconductor technology and equipment, placing them on a path to become a competitor to US companies in a few years.

The Chinese Foreign Ministry said the United States abuses export control measures to target Chinese companies, while preserving its own technological hegemony.

Beijing also said Washington's policy departs from the principle of fair competition and violates international economic and trade norms.