Bankman-Fried Arrest: FTX Founder May Know Whether Foreign Money Flew Into US Politics, Analyst Says

© AFP 2023 / JUSTIN TALLIS

Subscribe

Sam Bankman-Fried, FTX’s founder, was arrested in the Bahamas on December 12 at the request of the US authorities, being charged with wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy, and money laundering.

"Unfortunately, few of the malefactors in US frauds seem to pay prices they so richly deserve. Fraud corrodes essential trust in our system so fraudsters should be severely punished, to lessen potential for others to try to game the system," Charles Ortel, a Wall Street analyst and investigative journalist, told Sputnik.

"In theory, prosecution of these frauds should yield lots of information concerning where missing money may have gone and including which politicians and campaigns may have profited. What could be quite revealing is whether foreign actors, including governments, were using SBF and FTX to garner US foreign aid or favors. Let us hope the public learns the full truth and that attempts to whitewash politically inconvenient details fail," Ortel continued.

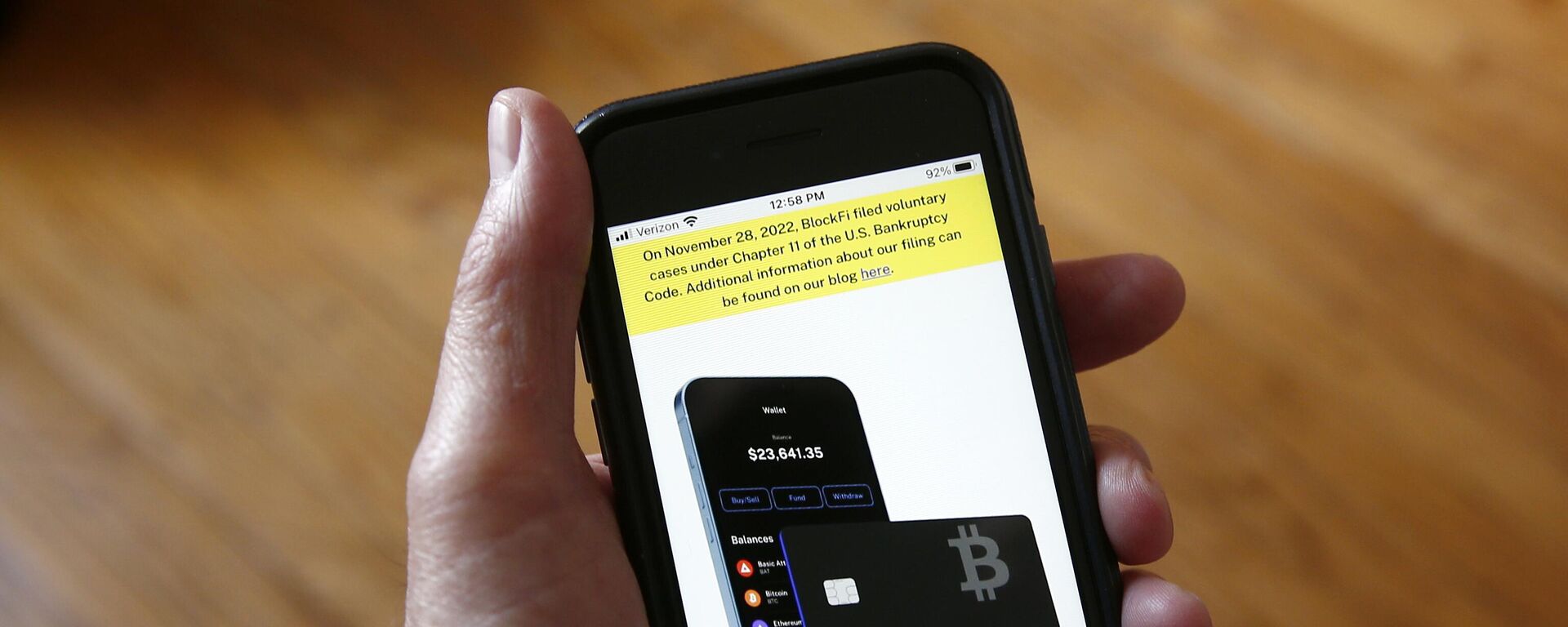

FTX, a Bahamas-based cryptocurrency exchange, was founded in 2019 by Sam Bankman-Fried (SBF). On November 11, 2022, FTX and over a hundred of its affiliates filed for bankruptcy in Delaware.

John Ray III, the new CEO of FTX, who specializes in recovering funds from failed corporations, admitted in court documents on November 17: "Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here." For his part, former Treasury Secretary Lawrence Summers suggested while speaking to an American broadcaster last month that FTX had been mired not just in financial error, but in outright fraud.

3 December 2022, 09:59 GMT

Newly Unsealed Indictment

Prosecutors for the Southern District of New York alleged in their newly unsealed indictment that "from at least May 2019 through November 2022, [Sam] Bankman-Fried engaged in a scheme to defraud equity investors in FTX Trading Ltd."

"Bankman-Fried raised more than $1.8 billion from investors, including US investors, who bought an equity stake in FTX believing that FTX had appropriate controls and risk management measures," the indictment reads. "Unbeknownst to those investors (and to FTX’s trading customers), Bankman-Fried was orchestrating a massive, years-long fraud, diverting billions of dollars of the trading platform’s customer funds for his own personal benefit and to help grow his crypto empire."

According to the prosecutors, from the inception of the cryptocurrency exchange platform SBF diverted FTX customer funds to his affiliates "to grow his empire," and used billions of dollars to make undisclosed private venture investments, political contributions, and real estate purchases. On top of that, Bankman-Fried used one of his affiliates, Alameda (which was reportedly run by his girlfriend), as "his personal piggy bank," the document emphasized.

The indictment also mentioned the fact that the FTX founder engaged "some of the most trustworthy public figures," including Tom Brady, Gisele Bundchen, Steph Curry, and others to promote his company. Moreover, FTX claimed in its market materials that it is "the only major digital asset venue to maintain positive, constructive relationships with regulators and lawmakers."

SBF Was Arrested Before Giving Testimony to Congress

Meanwhile, US netizens are wondering as to why SBF was arrested ahead of his Congressional hearing, which could provide the public with more details about his activities. Some even presumed that it was done deliberately to not allow the FTX founder to spill the beans about his rich and powerful customers.

"Complex frauds take time to unravel so I am prepared to give prosecutors and investigators the benefit of the doubt, for now," remarked Ortel. "At the very least, those in the media who recently likened SBF to Warren Buffett have much to reconsider."

Meanwhile, Miranda Devine, an investigative journalist, specializing in money laundering and fraud issues, tweeted on December 12 that "[US President Joe] Biden's Security and Exchange Commission Chairman Gary Gensler deleted key details of meetings with George Soros, Hillary Clinton and Nancy Pelosi from the public version of his calendar." "Did they discuss FTX and SBF?" the writer asked.

"Devine's observations are noteworthy on their own and also call into question which other Biden (or Trump and Obama) administration officials may have shielded truths about the nature of their meetings with key campaign contributors while in government service," the Wall Street analyst highlighted.

Gary Gensler deserves special attention, according to Ortel. Gensler, the former chairman of the Commodity Futures Trading Commission, served as the 2016 Hillary Clinton campaign's chief financial officer. The Wall Street analyst, who has been conducting a private investigation into the Clinton Foundation's alleged fraud, suspects that Team Clinton "arguably bent if not shredded campaign finance and public disclosures rules at the time and afterwards."

In addition to that, SBF apparently had links to some other politicians in the White House. It is known that on April 22 and May 12, 2022, SBF met with top Biden advisor Steve Ricchetti, as per the Washington Free Beacon, which obtained White House visitor logs.

Why Did Prosecutors Hesitate to Catch SBF Red-Handed?

At the same time, some American netizens expressed disenchantment with New York prosecutors' failure to bust the FTX fraud before the platform collapsed, sent the crypto market into a dive, and stripped SBF's customers of their funds.

Bloomberg broke on November 22, that the US Attorney’s Office for the Southern District of New York, led by Damian Williams, spent several months examining FTX and its affiliates. According to the media, it is unclear whether the prosecutors reached any conclusions before the cryptocurrency exchange firm crumbled.

"Many should have been much more suspicious about the fast rise from obscurity into prominence of SBF and his super strange team," said Ortel. "His fall has been even faster and we still do not know for certain whether he and his colleagues were masterminds or possibly puppets of other sinister people."

"Normally the media would push hard for more details and perhaps they shall. For now we must rely upon independent investigators and maybe Republicans in the US House of Representative to try to unravel this mess," he continued.

Ortel highlighted that one can only hope that "many heads will roll and not only auditors of FTX but those who most aggressively tried to buy favors from politicians."

On the other hand, if one recalls the Jeffrey Epstein and Ghislaine Maxwell's cases, one would admit that none of their rich and powerful friends – who had been allegedly involved in their sex trafficking scheme – have ever been implicated.

Still, US netizens assume that SBF apparently knows a lot about "dark money" flows to US policy makers. Some Twitter users did not rule out that Bankman-Fried could be silenced in some way.

"Strange things seem to happen in western prisons to folks like Epstein or Julian Assange who likely can implicate bad actors on the left and the right in the corrupt, unregulated globalist system," suggested Ortel. "For many reasons, I hope SBF remains alive for a long time so he can be induced to tell the whole truth concerning his actions and those of his co-conspirators, likely including his law professor parents."