https://sputnikglobe.com/20230113/yellen-warns-congress-of-extraordinary-measures-to-avoid-default-if-debt-limit-hit-next-week-1106299614.html

Yellen Warns Congress of ‘Extraordinary Measures’ to Avoid Default if Debt Limit Hit Next Week

Yellen Warns Congress of ‘Extraordinary Measures’ to Avoid Default if Debt Limit Hit Next Week

Sputnik International

The US Congress has just days to lift the nation’s debt ceiling before the US Treasury will be forced to resort to “extraordinary measures” to avoid a default... 13.01.2023, Sputnik International

2023-01-13T21:47+0000

2023-01-13T21:47+0000

2023-01-13T21:41+0000

americas

us

debt ceiling

republicans

'default scare"

https://cdn1.img.sputnikglobe.com/img/07e6/07/13/1097579774_0:84:2808:1664_1920x0_80_0_0_e4a0827551ddfec94fc164bb47108e26.jpg

“I am writing to inform you that beginning on Thursday, January 19, 2023, the outstanding debt of the United States is projected to reach the statutory limit,” Yellen said to House Speaker Kevin McCarthy (D-CA) in a Friday letter. Those measures, which include slashing commitments to programs such as federal employees’ retirement plans to free up extra cash for Social Security and debt financing, will only buy the federal government a few months’ time, Yellen noted. By June, the United States would be facing a default on its commitments, which would result in downgrading of its credit and is likely to plunge the country into an immediate recession or worse.The debt ceiling as a concept dates to the time of the First World War, when Congress eased the process of authorizing spending bills by authorizing a separate aggregate debt instead of each debt piecemeal. However, in the 21st century the debt ceiling has become a political battleground, with miserly conservatives seeking to strongarm the federal government into making strenuous spending cuts they couldn’t achieve via legislation.During one such struggle in 2011, the US government’s credit rating was downgraded by Standard & Poor’s when Congress approved a debt ceiling increase just hours before a default.Such a showdown could loom on Washington’s horizon, as one of the deals McCarthy reportedly had to cut to win election as House speaker earlier this month included a commitment to force a spending cap on Democrats before Republicans would raise the debt limit. That cap would keep spending levels for fiscal year 2024 at the same as they were in fiscal year 2022, requiring big cuts to the Pentagon’s budget, as well as other programs.McCarthy told reporters earlier this week that he and US President Joe Biden had a “very good conversation” about the debt ceiling debate.However, Democrats seem to be knuckling down for a fight. In a statement on Friday, Senate Majority Leader Chuck Schumer (D-NY) and Rep. Hakeem Jeffries (D-NY), the new House minority leader, said “a default forced by extreme MAGA Republicans could plunge the country into a deep recession and lead to even higher costs for America’s working families on everything from mortgages and car loans to credit card interest rates.”The two Democratic leaders urged Republicans to join them in lifting the debt limit, noting they had done so several times under former US President Donald Trump, Biden’s predecessor. This is the first such battle under Biden’s presidency.

https://sputnikglobe.com/20230110/house-gop-made-no-official-list-of-detailed-concessions-mccarthy-made-to-become-speaker-reports-say-1106204577.html

https://sputnikglobe.com/20230112/latest-us-inflation-report-shows-six-straight-months-of-slowing-although-some-prices-still-rising-1106262278.html

americas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

us, debt ceiling, republicans, 'default scare"

us, debt ceiling, republicans, 'default scare"

Yellen Warns Congress of ‘Extraordinary Measures’ to Avoid Default if Debt Limit Hit Next Week

The US Congress has just days to lift the nation’s debt ceiling before the US Treasury will be forced to resort to “extraordinary measures” to avoid a default, Treasury Secretary Janet Yellen warned on Friday.

“I am writing to inform you that beginning on Thursday, January 19, 2023, the outstanding debt of the United States is projected to reach the statutory limit,” Yellen said to House Speaker Kevin McCarthy (D-CA) in

a Friday letter.

“Once the limit is reached, Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting on its obligations.”

Those measures, which include slashing commitments to programs such as federal employees’ retirement plans to free up extra cash for Social Security and debt financing, will only buy the federal government a few months’ time, Yellen noted.

By June, the United States would be facing a default on its commitments, which would result in downgrading of its credit and is likely to plunge the country into an immediate recession or worse.

10 January 2023, 16:36 GMT

“Failure to meet the government’s obligations would cause irreparable harm to the US economy, the livelihoods of all Americans, and global financial stability,” she added.

The debt ceiling as a concept dates to the time of the First World War, when Congress eased the process of authorizing spending bills by authorizing a separate aggregate debt instead of each debt piecemeal. However, in the 21st century the debt ceiling has become a political battleground, with miserly conservatives seeking to strongarm the federal government into making strenuous spending cuts they couldn’t achieve via legislation.

During one such struggle in 2011, the US government’s

credit rating was downgraded by Standard & Poor’s when Congress approved a debt ceiling increase just hours before a default.

“In the past, even threats that the US government might fail to meet its obligations have caused real harms, including the only credit rating downgrade in the history of our nation in 2011,” Yellen wrote. “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

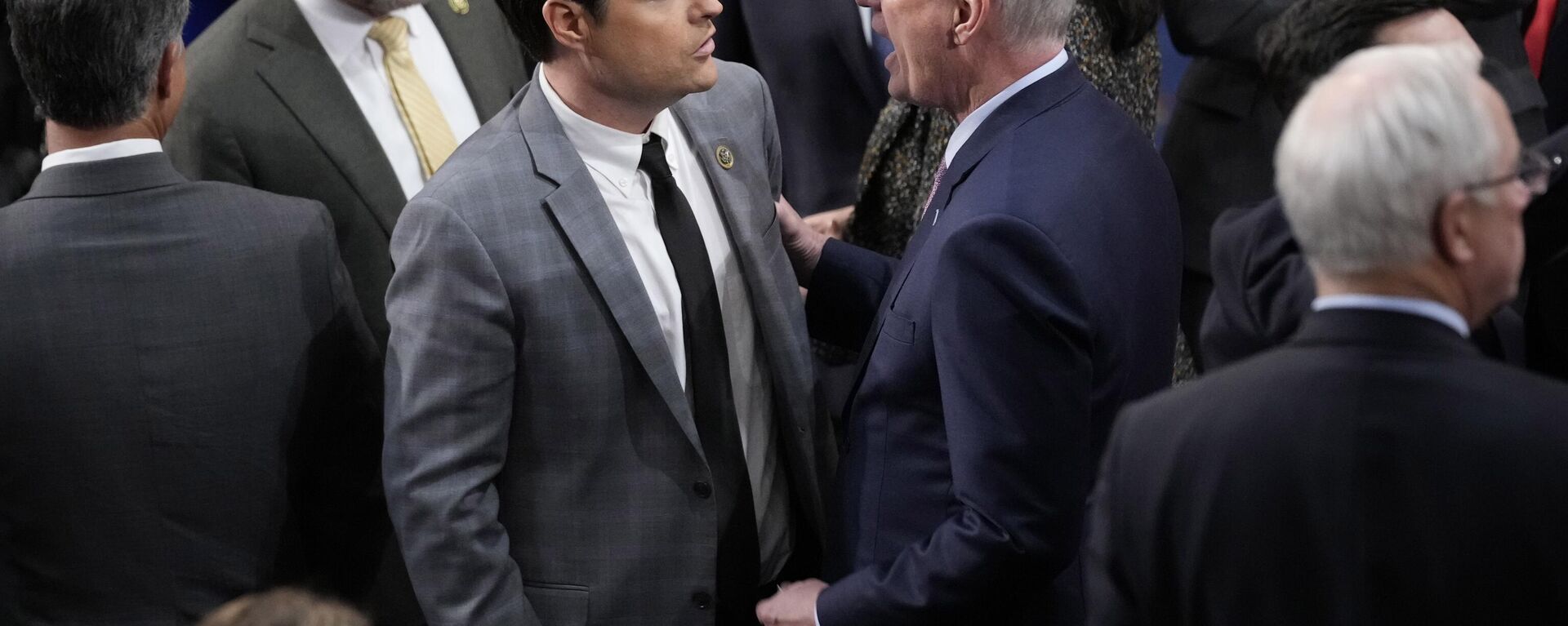

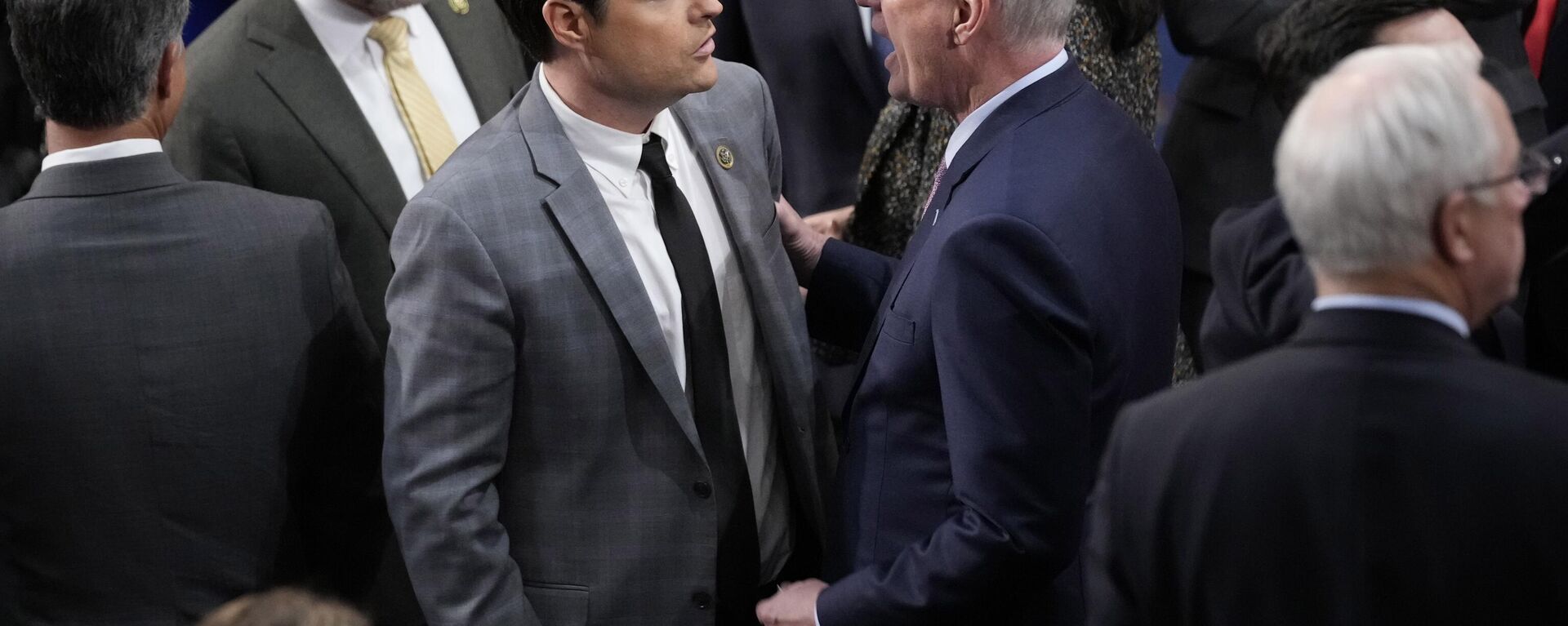

Such a showdown could loom on Washington’s horizon, as one of the deals

McCarthy reportedly had to cut to win election as House speaker earlier this month included a commitment to force a spending cap on Democrats before Republicans would raise the debt limit. That cap would keep spending levels for fiscal year 2024 at the same as they were in fiscal year 2022, requiring big cuts to the Pentagon’s budget, as well as other programs.

12 January 2023, 19:49 GMT

McCarthy told reporters earlier this week that he and US President Joe Biden had a “very good conversation” about the debt ceiling debate.

“We don’t want to put any fiscal problems to our economy and we won’t, but fiscal problems would be continuing to do business as usual,” McCarthy said, adding: “We’ve got to change the way we are spending money.”

However, Democrats seem to be knuckling down for a fight. In a statement on Friday, Senate Majority Leader Chuck Schumer (D-NY) and Rep. Hakeem Jeffries (D-NY), the new House minority leader, said “a default forced by extreme MAGA Republicans could plunge the country into a deep recession and lead to even higher costs for America’s working families on everything from mortgages and car loans to credit card interest rates.”

The two Democratic leaders urged Republicans to join them in lifting the debt limit, noting they had

done so several times under former US President Donald Trump, Biden’s predecessor. This is the first such battle under Biden’s presidency.