https://sputnikglobe.com/20230215/rising-inflation-how-new-cpi-and-retail-sales-data-backfired-on-biden-after-sotu-bragging-1107473422.html

Rising Inflation: How New CPI and Retail Sales Data Backfired on Biden After SOTU Bragging

Rising Inflation: How New CPI and Retail Sales Data Backfired on Biden After SOTU Bragging

Sputnik International

US conservatives have seized the opportunity to lambast President Joe Biden over the latest Consumer Price Index (CPI) report, which indicated that inflation... 15.02.2023, Sputnik International

2023-02-15T18:38+0000

2023-02-15T18:38+0000

2023-02-15T18:38+0000

americas

us

inflation

consumer price index (cpi)

recession

retail

retail sector

joe biden

sotu

us economy

https://cdn1.img.sputnikglobe.com/img/07e7/02/09/1107254512_0:0:3072:1728_1920x0_80_0_0_a290ad8b3777a8b1d95e20d2e04c0ef4.jpg

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.5% in January on a seasonally adjusted basis, after increasing 0.1% in December 2022, according to the US Bureau of Labor Statistics. The Tuesday report indicated that the all items index spiked 6.4% before seasonal adjustment over the last 12 months.The CPI – a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services – is a popular gauge for inflation, which appears to be haunting the US economy despite Joe Biden's assertions to the contrary.US conservative outlets nailed it by citing the president's SOTU address, delivered to the nation on February 7: "We have more to do, but here at home, inflation is coming down. Here at home, gas prices are down $1.50 a gallon since their peak. Food inflation is coming down. Inflation has fallen every month for the last six months while take home pay has gone up," Biden declared just a week ago. However, the new inflation data has "nullified" Biden’s boasts, according to American conservatives.Indeed, the Labor Department admitted that rising shelter, gas, and fuel prices took their toll on consumers in January after inflation had shown signs of receding in recent months.According to the report, rising shelter costs accounted for about half the monthly increase, while energy was also a significant contributor. The energy index rose 2% in January, as the gasoline index increased 2.4% over the month. Likewise, the index for natural gas grew 6.7% over the month, and the index for electricity rose 0.5%. Over the past 12 months, the energy index rose 8.7%. The core CPI jumped 0.4% and 5.6% from a year ago, against respective estimates of 0.3% and 5.5%.The soaring prices mean a loss in real pay for American workers: thus, average hourly earnings fell 0.2% for the month and were down 1.8% from a year ago, according to a separate report by the US Bureau of Labor Statistics.At the same time, the latest retail sales data showed that Americans are continuing to spend despite high inflation and soaring prices. According to the Commerce Department, the measure of how much consumers spent on a number of everyday goods, including cars, food, and gasoline, grew 3% last month. The figure marked the biggest monthly surge since March 2021On the one hand, the increase indicates the resilience of consumers despite higher prices and interest rate increases. On the other hand, the strong buying adds more fuel to inflation, which could make the Federal Reserve even more aggressive in raising interest rates to curb the trend.Even though a high rate could tame inflation, it also increases borrowing costs , backfires on investment prices, and raises the risk of recession. Therefore, the combined CPI and retail sales data sent stocks down on Wall Street on Wednesday. On February 15, Standard & Poor’s 500 Index, the Dow Jones Industrial Average, and the Nasdaq Composite were all 0.6% lower.

https://sputnikglobe.com/20230213/is-the-us-economy-really-on-track-to-revival-devil-is-always-in-the-details-1107383806.html

americas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

consumer price index, retail sales, us inflation, federal reserve's interest rate hikes, us recession, energy prices are soaring in the us, joe biden's sotu speech, wall street stocks going down

consumer price index, retail sales, us inflation, federal reserve's interest rate hikes, us recession, energy prices are soaring in the us, joe biden's sotu speech, wall street stocks going down

Rising Inflation: How New CPI and Retail Sales Data Backfired on Biden After SOTU Bragging

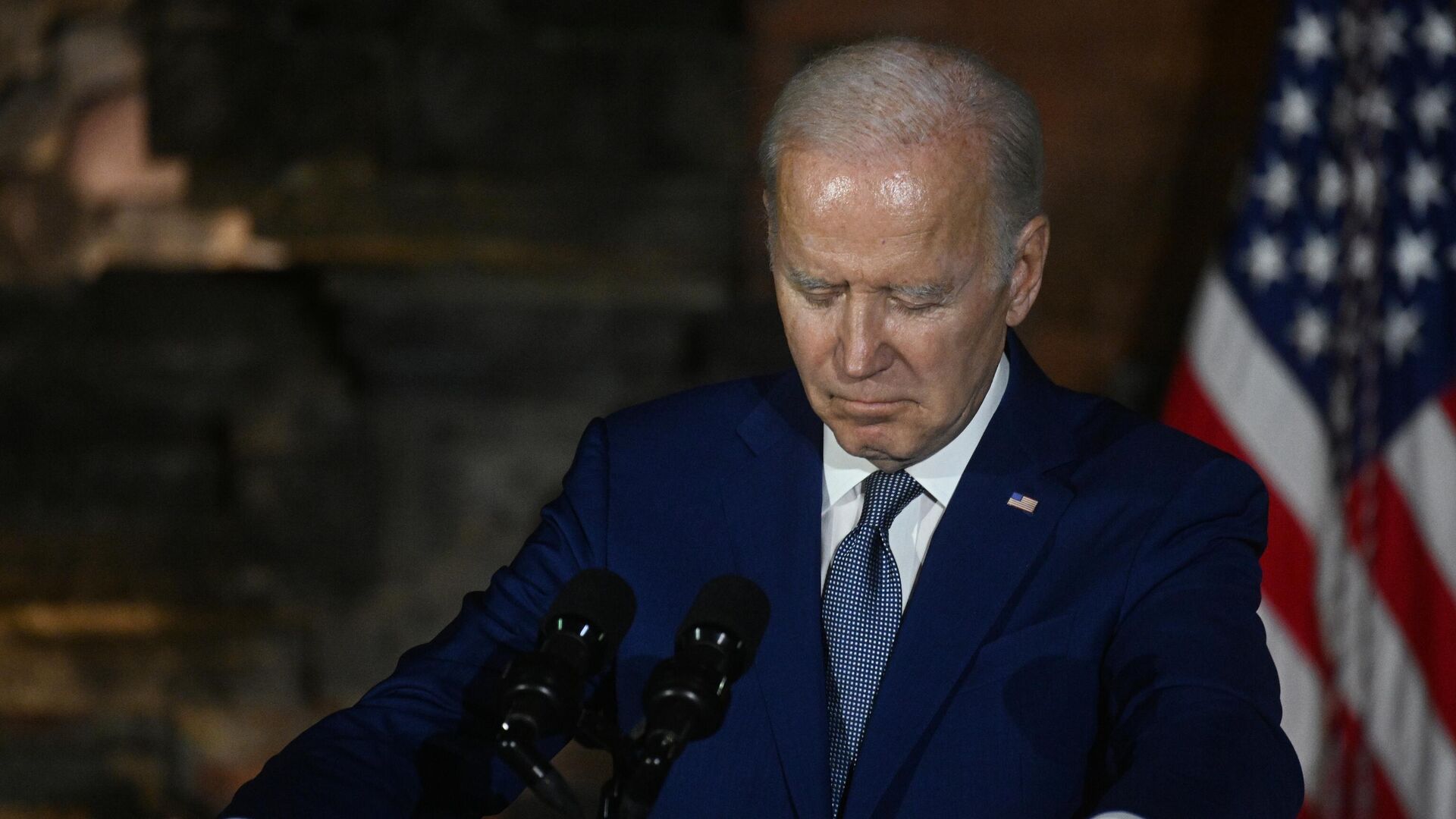

US conservatives have seized the opportunity to lambast President Joe Biden over the latest Consumer Price Index (CPI) report, which indicated that inflation has still not been tamed, contrary to what the US president bragged about in his State of the Union (SOTU) speech.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.5% in January on a seasonally adjusted basis, after increasing 0.1% in December 2022, according to the US Bureau of Labor Statistics. The Tuesday report indicated that

the all items index spiked 6.4% before seasonal adjustment over the last 12 months.

The CPI – a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services – is a popular gauge for inflation, which appears to be haunting the US economy despite Joe Biden's assertions to the contrary.

US conservative outlets nailed it by citing the president's SOTU address, delivered to the nation on February 7: "We have more to do, but here at home, inflation is coming down. Here at home, gas prices are down $1.50 a gallon since their peak. Food inflation is coming down. Inflation has fallen every month for the last six months while take home pay has gone up," Biden declared just a week ago. However, the new inflation data has "nullified" Biden’s boasts, according to American conservatives.

Indeed, the Labor Department admitted that rising shelter, gas, and fuel prices took their toll on consumers in January after inflation had shown signs of receding in recent months.

13 February 2023, 16:50 GMT

According to the report, rising shelter costs accounted for about half the monthly increase, while energy was also a significant contributor. The energy index rose 2% in January, as the gasoline index increased 2.4% over the month. Likewise, the index for natural gas grew 6.7% over the month, and the index for electricity rose 0.5%. Over the past 12 months, the energy index rose 8.7%. The core CPI jumped 0.4% and 5.6% from a year ago, against respective estimates of 0.3% and 5.5%.

The soaring prices mean a loss in real pay for American workers: thus, average hourly earnings fell 0.2% for the month and were down 1.8% from a year ago, according to a separate report by the US Bureau of Labor Statistics.

At the same time, the latest retail sales data showed that Americans are continuing to spend despite high inflation and soaring prices. According to the Commerce Department, the measure of how much consumers spent on a number of everyday goods, including cars, food, and gasoline, grew 3% last month. The figure marked the biggest monthly surge since March 2021

On the one hand, the increase indicates the resilience of consumers despite higher prices and interest rate increases. On the other hand, the strong buying adds more fuel to inflation, which could

make the Federal Reserve even more aggressive in raising interest rates to curb the trend.

Even though a high rate could tame inflation, it also increases borrowing costs , backfires on investment prices, and raises the risk of recession. Therefore, the combined CPI and retail sales data sent stocks down on Wall Street on Wednesday. On February 15, Standard & Poor’s 500 Index, the Dow Jones Industrial Average, and the Nasdaq Composite were all 0.6% lower.