https://sputnikglobe.com/20230523/us-treasury-reportedly-asks-if-federal-agencies-can-delay-payments-to-avert-debt-default-1110546437.html

US Treasury Reportedly Asks if Federal Agencies Can Delay Payments to Avert Debt Default

US Treasury Reportedly Asks if Federal Agencies Can Delay Payments to Avert Debt Default

Sputnik International

As a default on the national debt looms ever closer, thanks to an impasse in Congress, the Treasury is rushing to push that date back. According to Tuesday reports, that includes asking federal agencies if they can delay payments.

2023-05-23T19:53+0000

2023-05-23T19:53+0000

2023-05-23T19:48+0000

americas

kevin mccarthy

us treasury

default

debt

us debt ceiling crisis

us

https://cdn1.img.sputnikglobe.com/img/07e6/0b/08/1103905880_0:160:3073:1888_1920x0_80_0_0_c7c74dc28ba9c278de3f78e42a25c0d7.jpg

According to the report, the Treasury sent out memos to federal agencies last week instructing them to ensure the Treasury is closely informed about their spending, including notifying the agency at least two days in advance of all payments between $50 million and $500 million, and five days’ notice for payments above $500 million.In addition, Treasury officials have also asked those agencies about how flexible their payments can be without postponing them beyond their due dates, which would trigger a default.Extraordinary MeasuresThe Treasury has been struggling to find novel ways to forestall a default on the US national debt ever since Congress declined to increase the debt ceiling in January. It has adopted a series of “extraordinary measures,” including postponing payments and immediately spending monthly tax receipts as they come in, to keep the government afloat in the absence of new spending appropriations.Some other measures not yet adopted include selling off or “raiding” bonds held by federal government trust funds, such as the Social Security Trust Fund or the Highway Trust Fund. While it would quickly raise tens of billions of dollars, it would cost the government more money in the long run due to repayment penalties. A less serious but technically possible option is for the Treasury to simply mint a $1 trillion coin - a solution Yellen has dismissed out of hand.A default would likely trigger a downgrading of the government’s credit rating and cause an economic crisis.Political JockeyingDespite the danger, the Republican-controlled House of Representatives and Democrat-controlled Senate and White House have so far failed to reach an agreement to raise the debt ceiling. Republicans, who are ideologically opposed to spending on social programs and who enjoy a new majority in the House, have sought to use the threat of a default to force budgetary concessions out of Democrats, including cuts to their most hated programs, such as the Supplemental Nutrition Assistance Program (SNAP), better known as food stamps.On Tuesday, House Speaker Kevin McCarthy (R-CA) told his GOP colleagues that “we are nowhere near a deal yet.”“I need you all to hang with me on the debt limit,” he said.

https://sputnikglobe.com/20230523/biden-mccarthy-debt-ceiling-talk-yet-to-produce-deal-as-june-1-deadline-draws-near-1110527955.html

https://sputnikglobe.com/20230508/what-should-americans-brace-for-on-the-brink-of-default-1110191569.html

americas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

treasury; debt ceiling; payments; delay

treasury; debt ceiling; payments; delay

US Treasury Reportedly Asks if Federal Agencies Can Delay Payments to Avert Debt Default

As a default on the US national debt looms ever closer, thanks to an impasse in Congress, the US Treasury is rushing to push that date back as far as possible. According to Tuesday reports in US media based on “people familiar with the matter,” that includes asking federal agencies if they can delay payments.

According to the report, the Treasury sent out memos to federal agencies last week instructing them to ensure the Treasury is closely informed about their spending, including notifying the agency at least two days in advance of all payments between $50 million and $500 million, and five days’ notice for payments above $500 million.

“Please stress to your staff the importance of these updates during this time and to ensure that your agency’s reports are accurate,” the memo said. “Your reporting offices should be reconciling reported amounts to actual payment activity to ensure the reliability of these reports during the critical period.”

In addition, Treasury officials have also asked those agencies about how flexible their payments can be without postponing them beyond their due dates, which would trigger a default.

The Treasury has been struggling to find novel ways to forestall a default on the US national debt ever since Congress declined to increase the debt ceiling in January. It has adopted a series of “extraordinary measures,” including postponing payments and immediately spending monthly tax receipts as they come in, to keep the government afloat in the absence of new spending appropriations.

In January, Treasury Secretary Janet Yellen warned the effort could only buy so much time, and earlier this month she set a hard deadline of June 1 for Congress to get past the ideological logjam blocking passage of a new debt ceiling increase.

After that, it’s unclear exactly when the government coffers would run dry, with some optimistic estimates saying it could last until July if there’s no default by the time the June tax receipts come in.

Some other measures not yet adopted include selling off or “raiding” bonds held by federal government trust funds, such as the Social Security Trust Fund or the Highway Trust Fund. While it would quickly raise tens of billions of dollars, it would cost the government more money in the long run due to repayment penalties.

A less serious but technically possible option is for the Treasury to simply mint a $1 trillion coin - a solution Yellen has dismissed out of hand.

A default would likely trigger a downgrading of the government’s credit rating and cause an economic crisis.

Despite the danger, the Republican-controlled House of Representatives and Democrat-controlled Senate and White House have so far failed to reach an agreement to raise the debt ceiling.

Republicans, who are ideologically opposed to spending on social programs and who enjoy a new majority in the House, have sought to use the threat of a default to force budgetary concessions out of Democrats, including cuts to their most hated programs, such as the Supplemental Nutrition Assistance Program (SNAP), better known as food stamps.

The White House has continued to refuse to negotiate, demanding a “clean” debt ceiling bill bereft of mandated cuts or spending caps, which is how it was done until the early 21st century.

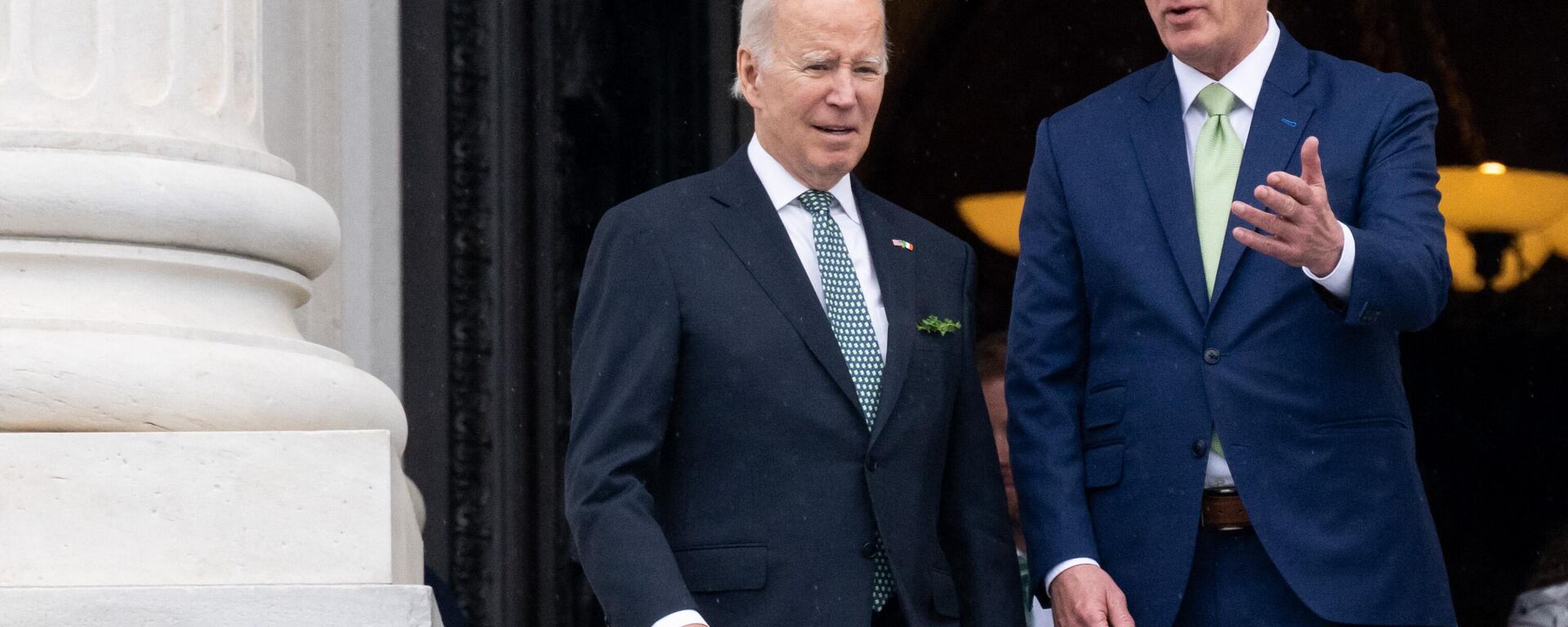

On Tuesday, House Speaker Kevin McCarthy (R-CA) told his GOP colleagues that “we are nowhere near a deal yet.”

“I need you all to hang with me on the debt limit,” he said.