https://sputnikglobe.com/20230815/yellen-us-concerned-critical-minerals-remain-over-concentrated-in-a-few-hands-1112600067.html

Yellen: US Concerned Critical Minerals Remain Over-Concentrated in A Few Hands

Yellen: US Concerned Critical Minerals Remain Over-Concentrated in A Few Hands

Sputnik International

The US must be alert to the risks of the raw materials for solar panels and other renewable energies being concentrated in just a few countries even as it makes the transition from oil, coal and natural gas.

2023-08-15T03:33+0000

2023-08-15T03:33+0000

2023-08-15T03:32+0000

world

janet yellen

china

las vegas

treasury

us department of energy

international energy agency (iea)

https://cdn1.img.sputnikglobe.com/img/104403/09/1044030900_0:52:1000:615_1920x0_80_0_0_8b28153a8bcfd21fc13c5037baa57038.jpg

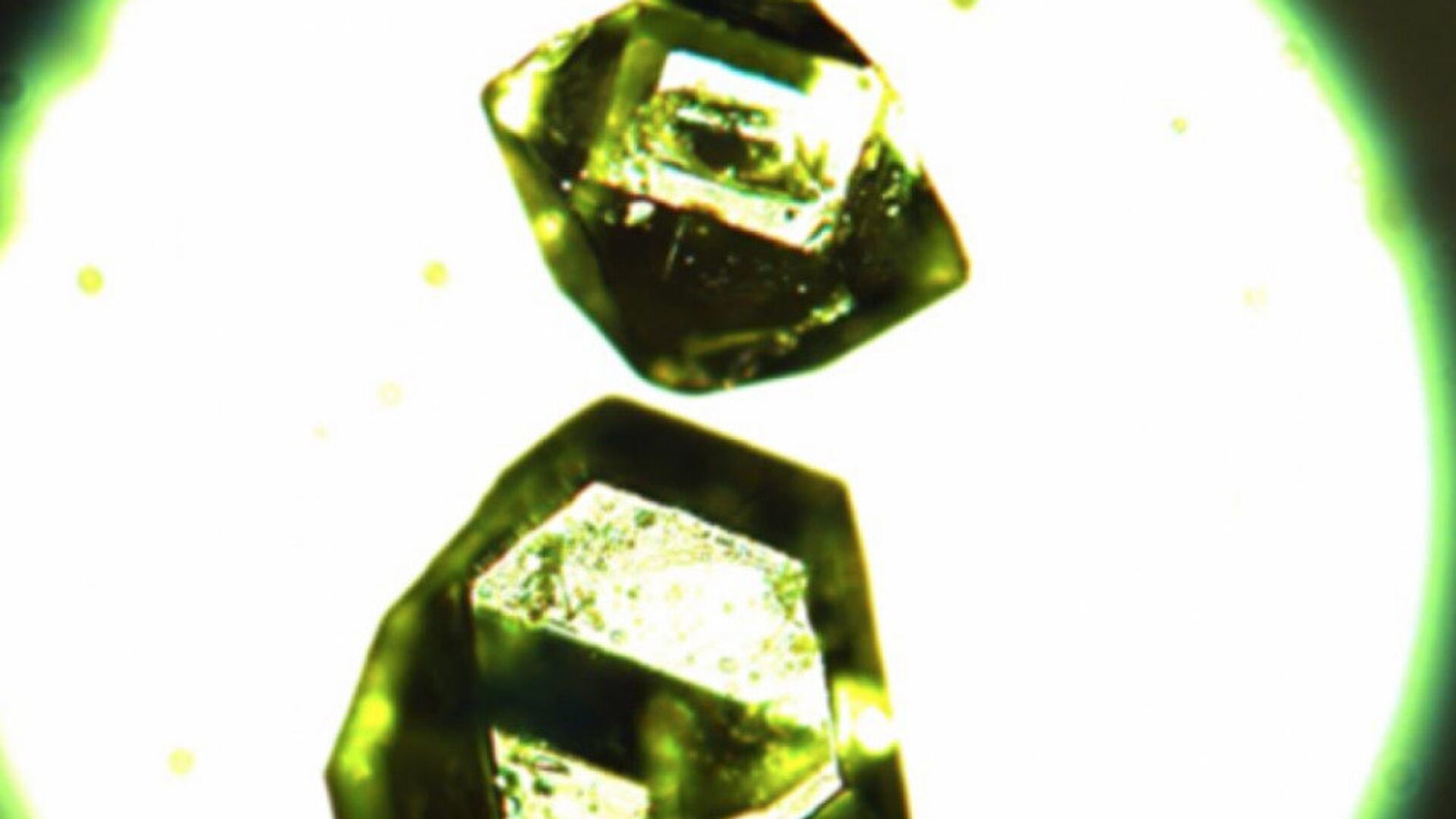

"As we move away from fossil fuels, we remain concerned about the risks of over-concentration in clean energy supply chains," Yellen said on Monday during a speech in Las Vegas ahead of the anniversary of the Inflation Reduction Act.Yellen reminded her audience that while the United States was leading the global agenda on fossil-free energies, the production of key inputs for that change - from batteries to solar panels and other critical minerals - was in the hands of just a few countries. Yellen did not name the countries that are rich in critical minerals deposits, although statistics show Russia and China leading in this front - both countries that the United States does not exactly have great relations with. China, for example, produced more than 98% of the world's gallium, 90% of its magnesium and nearly 85 % of its tungsten in 2022. Yellen said the United States could start by investing in the production of such critical minerals at home. "But we must do more," she said, adding that the United States could, help "re-shore" some of those minerals in non-traditional countries to ensure they are readily available when needed.The US Department of Energy added six elements last month to its expanded list of critical materials defined as indispensable to the clean energy transition with high supply risks. The so-called DoE warned that the list will only grow bigger amid the global race to net-zero emissions and underscored the importance to energy security of establishing reliant and robust critical mineral supply chains. In that list, nickel, platinum, and silicon carbide join lithium and magnesium as critical in the medium term (2025-2035), while graphite, terbium, and iridium join cobalt, gallium, dysprosium and neodymium as elements considered critical in both the short and medium term (from now until 2035). The report, citing data from the Paris-based International Energy Agency, said critical mineral demand will have to grow by up to 600% by 2040 if the world is to achieve net-zero by 2050. The demand for critical minerals is being driven by a surge in the adoption of electric vehicles, which the IEA says could account for 60% of all auto sales by 2030.

https://sputnikglobe.com/20221208/us-senators-introduce-bill-to-reduce-pentagon-reliance-on-china-for-critical-minerals-1105194983.html

china

las vegas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

us treasury secretary janet yellen, critical minerals, raw materials,

us treasury secretary janet yellen, critical minerals, raw materials,

Yellen: US Concerned Critical Minerals Remain Over-Concentrated in A Few Hands

WASHINGTON (August) - The US must be alert to the risks of the raw materials for solar panels and other renewable energies being concentrated in just a few countries even as it makes the transition from oil, coal and natural gas, Treasury Secretary Janet Yellen has said.

"As we move away from fossil fuels, we remain concerned about the risks of over-concentration in clean energy supply chains," Yellen said on Monday during a speech in Las Vegas ahead of the anniversary of the Inflation Reduction Act.

Yellen reminded her audience that while the United States was leading the global agenda on fossil-free energies, the production of key inputs for that change - from batteries to solar panels and other critical minerals - was in the hands of just a few countries.

"It’s important that we build resilient and diversified critical global supply chains that can reduce chokepoints, mitigate disruptions, and protect our economic security," she said.

Yellen did not name the countries that are rich in critical minerals deposits, although statistics show Russia and China leading in this front - both countries that the United States does not exactly have great relations with.

China, for example, produced more than 98% of the world's gallium, 90% of its magnesium and nearly 85 % of its tungsten in 2022.

Yellen said the United States could start by investing in the production of such critical minerals at home.

8 December 2022, 12:15 GMT

"But we must do more," she said, adding that the United States could, help "re-shore" some of those minerals in non-traditional countries to ensure they are readily available when needed.

"Looking beyond our shores, we are also working hard to accelerate the clean energy transition in other countries," Yellen said. "Accelerating these transitions can mean greater demand for US clean energy technologies produced by American workers. It can also bolster global clean energy supply chains."

The US Department of Energy added six elements last month to its expanded list of critical materials defined as indispensable to the clean energy transition with high supply risks. The so-called DoE warned that the list will only grow bigger amid the global race to net-zero emissions and underscored the importance to energy security of establishing reliant and robust critical mineral supply chains.

In that list, nickel, platinum, and silicon carbide join lithium and magnesium as critical in the medium term (2025-2035), while graphite, terbium, and iridium join cobalt, gallium, dysprosium and neodymium as elements considered critical in both the short and medium term (from now until 2035).

The report, citing data from the Paris-based International Energy Agency, said critical mineral demand will have to grow by up to 600% by 2040 if the world is to achieve net-zero by 2050. The demand for critical minerals is being driven by a surge in the adoption of electric vehicles, which the IEA says could account for 60% of all auto sales by 2030.