Stagflation Threat Looms As Eurozone Is Gripped By Dismal Growth, Stubborn Inflation

09:20 GMT 01.09.2023 (Updated: 10:44 GMT 01.09.2023)

© AFP 2023 / PHILIPPE HUGUEN

Subscribe

Amid the geopolitical shocks and inflation hurdles that have been ravaging the European continent, with the bloc’s economy weakening, the EU found itself plunged into a technical recession in early summer. As households grapple with the cost-of-living crisis, the European Central Bank (ECB) has been resorting to a policy of fiscal tightening.

More dismal news from the European continent shows that slackening economic growth and lingering inflation are raising the specter of stagflation for countries of the eurozone.

Despite the aggressive monetary policy of the European Central Bank aimed at curbing inflation, the consumer price inflation (CPI) rate in the region was 5.3 percent in July 2023, the ECB revealed on Thursday. In fact, inflation has remained above the ECB’s target of 2 percent for around 26 consecutive months, and it has not reached that level in any of the eurozone’s 20 member countries.

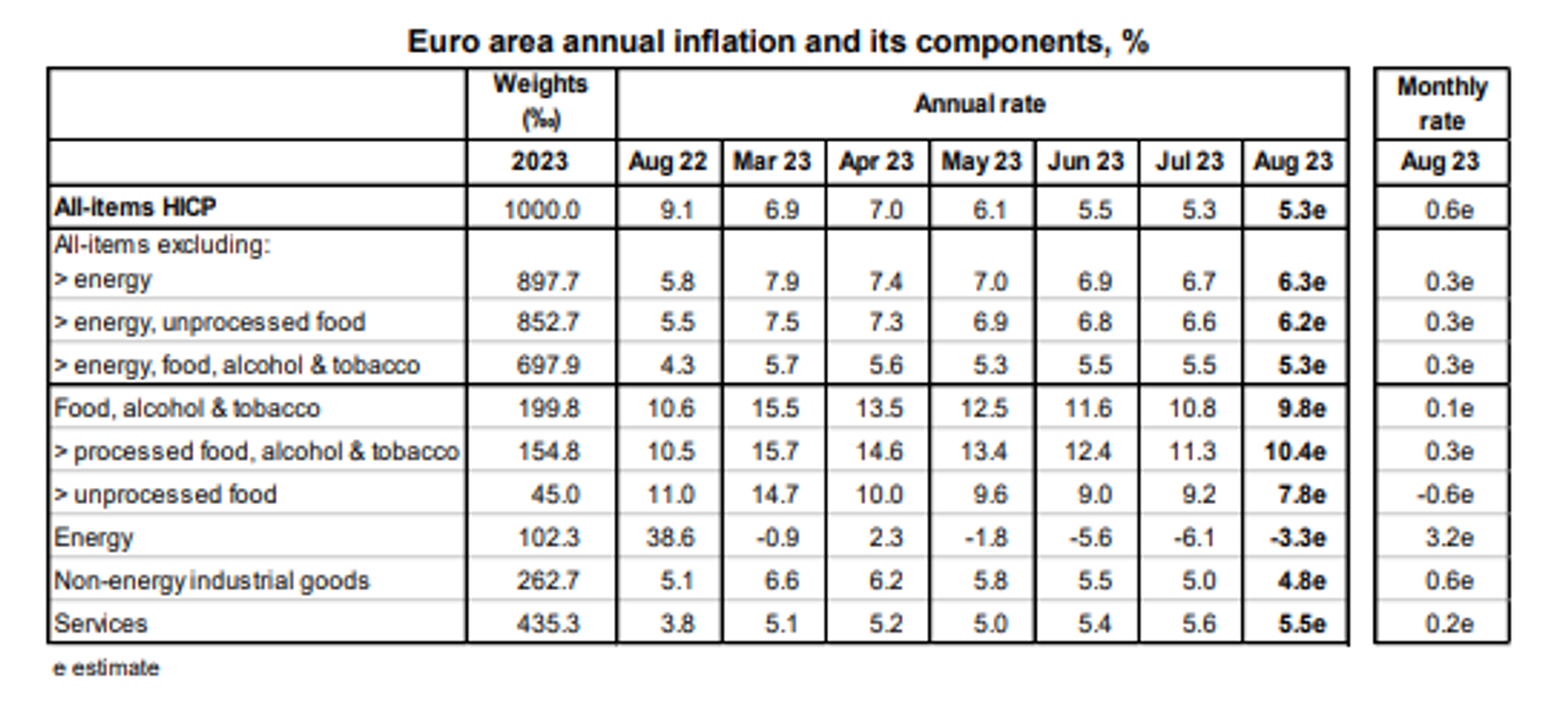

The largest contributor, yet again, has been food inflation, rising 9.8 percent from a year earlier on average.

Screengrab of chart showing Euro area annual inflation and its components, %, released on August 31, 2023, by Eurostat, the statistical office of the European Union.

© Photo : Eurostat

Energy costs soared 3.2 percent in August from the previous month across the euro currency area. Core inflation, at 5.3 percent, was down from 5.5 percent in July. Core HICP inflation is defined as the year-on-year percentage change in the euro area special aggregate "all items excluding energy, food, alcohol and tobacco", according to Eurostat, the statistical office of the European Union. Data from Eurostat also showed the number of unemployed people in the eurozone rose 73,000 in July from June.

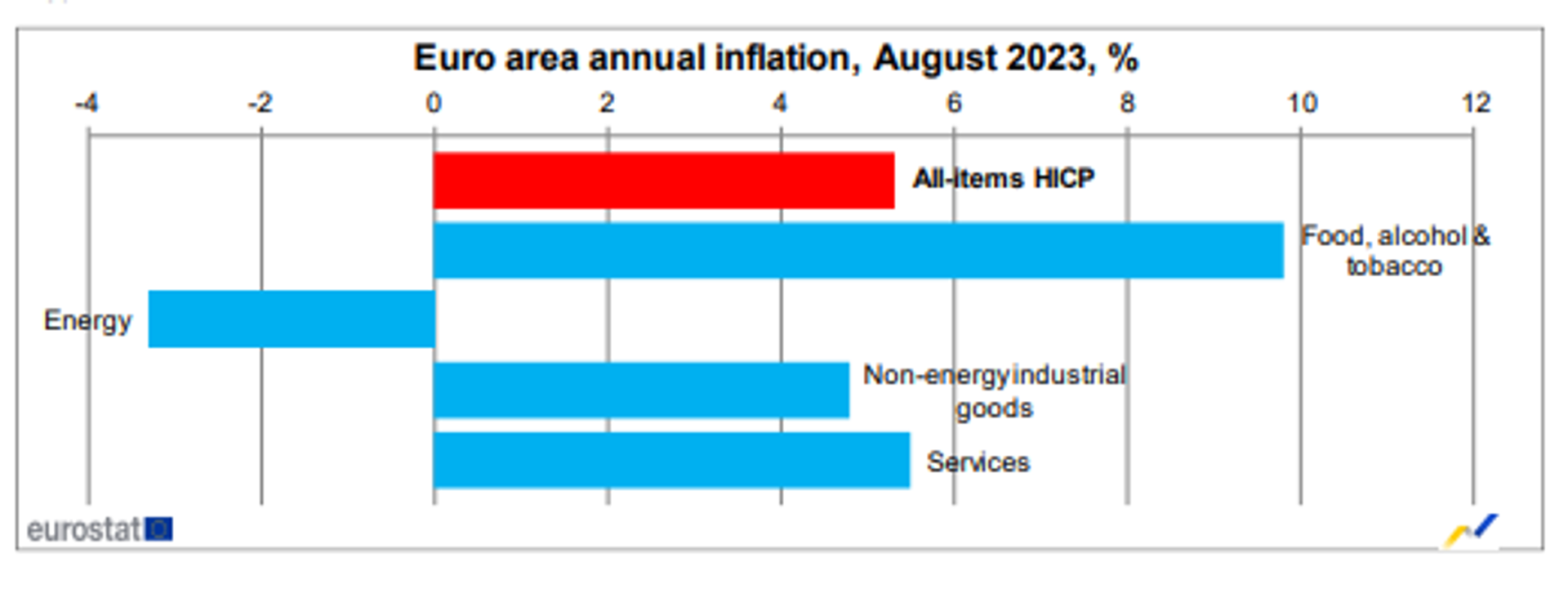

Screengrab of chart showing flash estimate of Euro area annual inflation released on August 31, 2023, by Eurostat, the statistical office of the European Union.

© Photo : @Eurostat

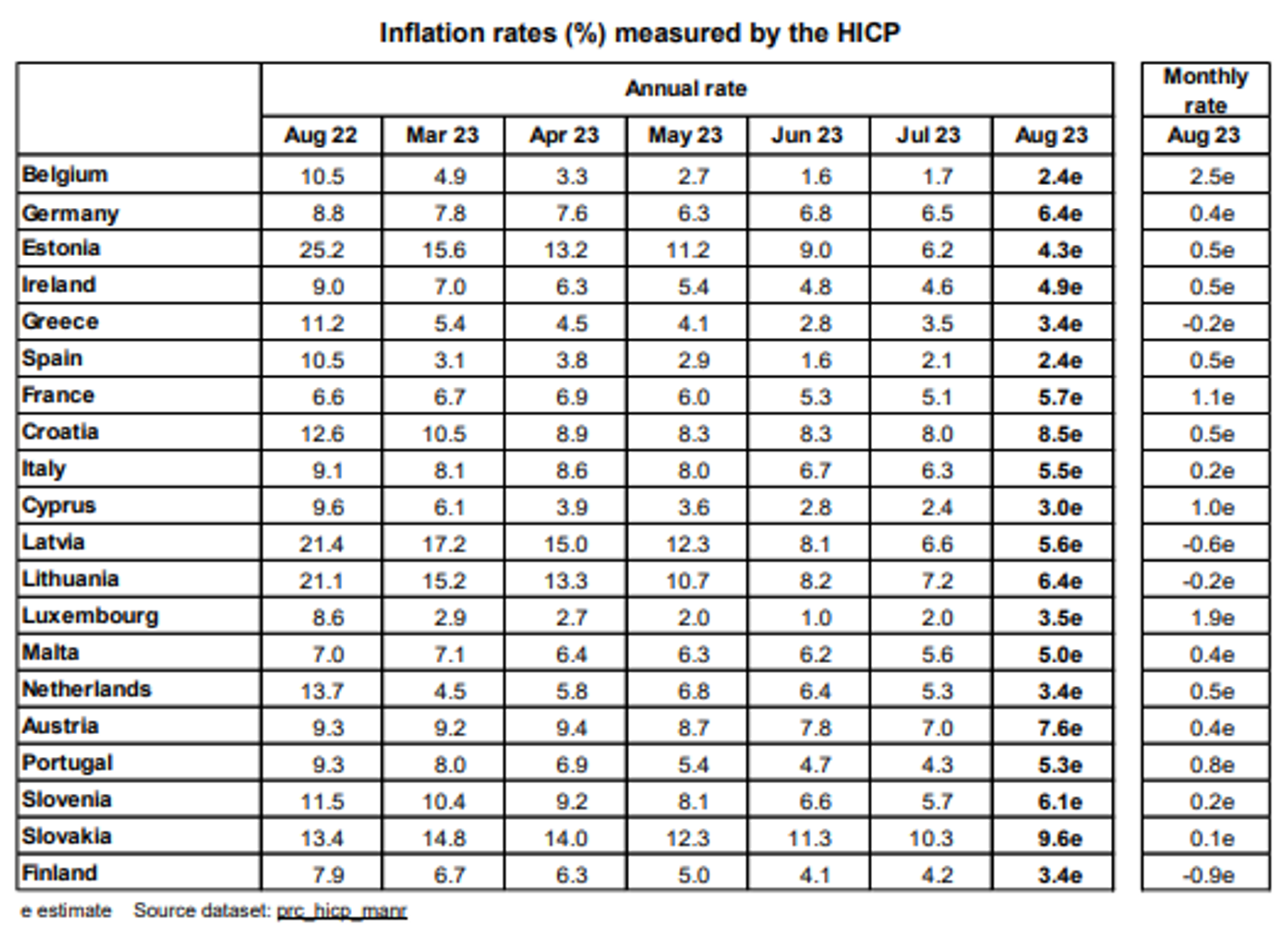

When broken down by country, in France the annual rate of inflation grew to 5.7 percent. In Germany, it was 6.4 percent in August, according to Eurostat. Europe’s largest economy has been in a recession for three straight quarters.

Screengrab of chart showing Inflation rates (%) measured by the HICP released on August 31, 2023, by Eurostat, the statistical office of the European Union.

© Photo : @Eurostat

Although all of the eurozone plummeted into a technical recession in June, it was the industrialized German economy that was hit particularly hard in the wake of the bloc's self-inflicted woes linked to sanctions against Russia over Ukraine. Crippled by the loss of cheap Russian natural gas, along with inflation and recession, Berlin has been facing the prospect of deindustrialization as doing business in Germany becomes unprofitable. German retail sales fell even more than expected in July, plunging 0.8 percent from the previous month, the Federal Statistical Office (Destatis) showed on Thursday.

Hike Or Hold?

With all this data in mind, the ECB is gearing up for its meeting on 14 September, when interest rate settings may be revisited again.

The ECB raised the benchmark rate in the euro area for the ninth consecutive time by a quarter of a percentage point in July. However, at the time, it indicated it could pause rises at its September meeting. At 3.75 percent, it mirrored the highest rate since the launch of the bloc’s currency, the euro, in 1999.

“We might hike, and we might hold... And what is decided in September is not definitive; it may vary from one meeting to the other,” European Central Bank President Christine Lagarde said in July.

According to minutes of the July meeting released on Thursday, it was stated that "concern was also raised that the economy might be entering a phase of stagflation, in contrast to a more benign scenario”.

In late August, appearing at an annual conference of central bankers in Jackson Hole, Wyoming in the United States, Lagarde said that interest rates in the European Union will stay high “as long as necessary” to tame inflation, adding that “though progress is being made, the fight against inflation is not yet won”.

Ahead of the release of the Eurostat data yesterday, Isabel Schnabel, a member of the ECB’s executive board, was cited as saying that “underlying price pressures remain stubbornly high, with domestic factors now being the main drivers of inflation in the euro area”. Accordingly, a “sufficiently restrictive” policy was called on to bring inflation to the bank’s 2 percent target “in a timely manner”, she added.

'Stuck in Stagflation'

Countries on the European continent found themselves bearing the brunt of NATO's proxy confrontation against Russia in Ukraine when they opted to follow in Washington's footsteps and voluntarily stripped themselves of access to Russian energy. Germany and other European economies were, as a result, driven into a recession in 2022 after moving to reject Russian oil and gas purchases. Moscow had warned at the time that the move would result in a catastrophic loss in competitiveness among German industry.

ECB President Lagarde did not mince her words on 25 August at the central bank symposium in Jackson Hole, saying the economic downturn facing most Western economies will probably continue. According to Lagarde, the world may be entering "an age of shifts in economic relationships and breaks in established regularities."

Juggling data and expert forecasts, economists tend to agree with that gloomy prediction.

“The euro area is stuck in stagflation, and we’re not going to come out of it any time soon,” Karsten Junius, chief economist at Bank J Safra Sarasin, Zurich, told media.

“The big concern now is that the European outlook is increasingly stagflationary, with inflation remaining stubborn while there are few signs of growth either,” analysts for Deutsche Bank were cited as writing in a note. A spate of reports also show that money markets place the probability of another rate rise by the ECB this year at 70 percent.