https://sputnikglobe.com/20231029/gold-shoots-past-2000-per-ounce-amid-middle-east-crisis-1114568617.html

Gold Shoots Past $2,000 per Ounce Amid Middle East Crisis

Gold Shoots Past $2,000 per Ounce Amid Middle East Crisis

Sputnik International

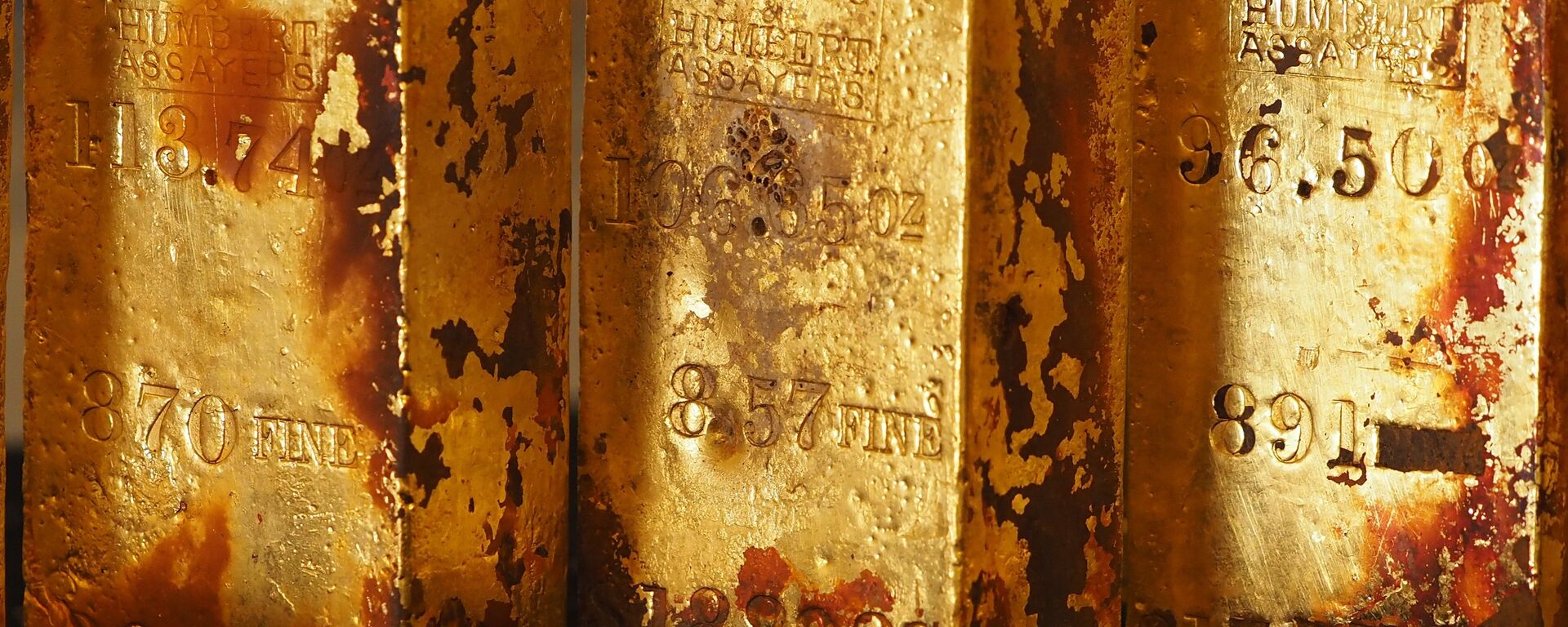

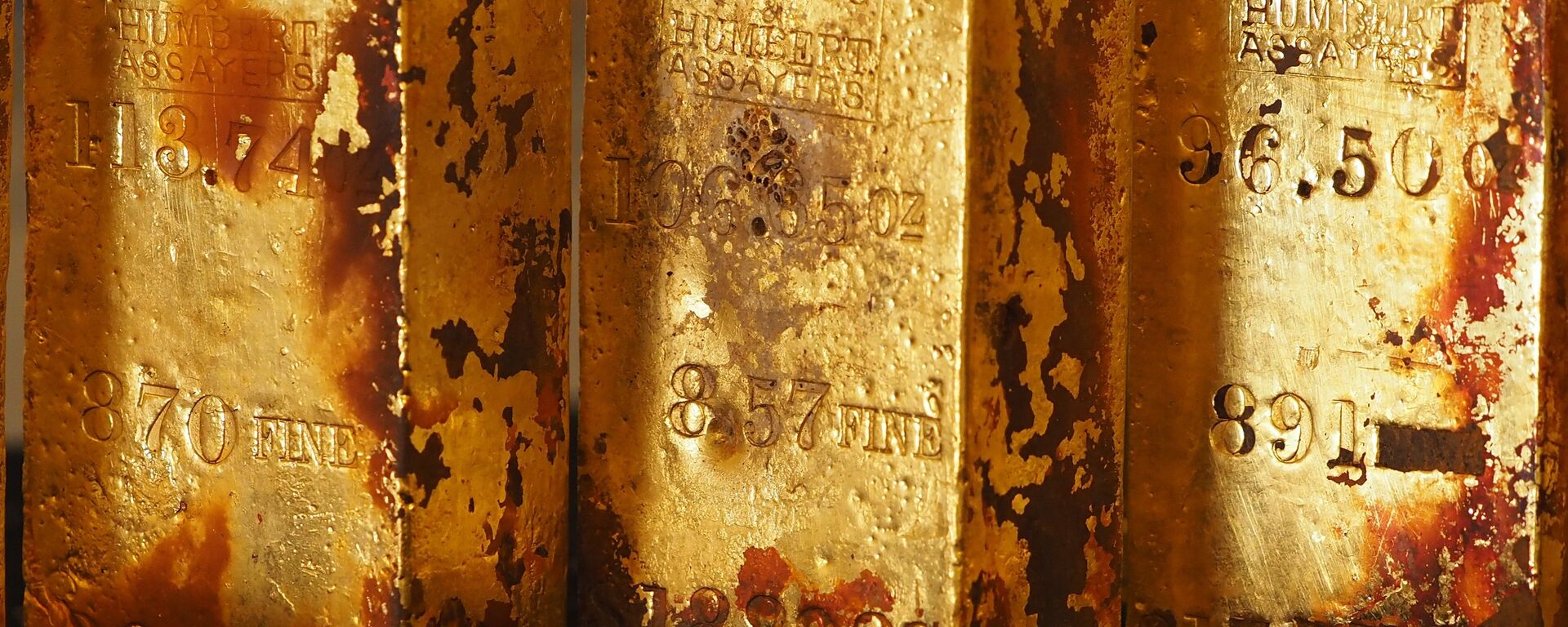

Gold's historical role as a pillar of wealth is undeniable. In today's financial realm, its value often fluctuates counter to both the stock market and the dollar.

2023-10-29T10:06+0000

2023-10-29T10:06+0000

2023-10-29T10:06+0000

economy

business

israel

east

world

dow jones

hamas

https://cdn1.img.sputnikglobe.com/img/07e7/08/09/1112487926_0:131:2648:1621_1920x0_80_0_0_5a95dec92078fc8781f9502d85a4ea2b.jpg

Gold's breaching $2,000 an ounce this year is attributed to its appeal as a safety net for investors, making it a frontrunner against the S&P 500, according to a recent MarketWatch publication.The unexpected 7 October assault by Hamas’ militant wing on Israel has spurred a 10 percent increase in gold's value. Market specialists foresee that the geopolitical unrest in the Middle East will remain a key driver for rising gold prices.Brien Lundin, editor of Gold Newsletter, said that the Palestinian-Israeli crisis "sent shock waves around the world - and sent the price of gold soaring".During tumultuous market periods, investors often gravitate towards gold for its risk-hedging value. Historically, this precious metal has stood as a beacon of safety amid economic downturns, stock market turmoil, international and regional armed conflicts, and pandemics.Data from the Dow Jones Market indicates that as Thursday's trading concluded, the S&P 500 SPX had notched a 7.8 percent rise since the year's commencement. Concurrently, front-month gold futures marked a 9.2 percent increase in the same period.Also, Thursday saw October's front-month contract for Gold GC00 futures up by $3.10 per troy ounce, culminating at a high of $1987.20 - a peak not seen since 16 May, according to FactSet figures. This month alone has witnessed a surge of more than 7.5 percent in its value.Gold's performance in 2022 once again highlighted its standing as a resilient asset. Although its main futures dipped slightly by the year's close, this setback was far less drastic than the S&P 500's 19.4 percent plunge, dividends not included. A similar pattern was evident in 2020, as gold's 24.4 percent boost outshone the S&P 500's 16.3 percent advance.Findings from the World Gold Council’s study indicate that about 24 percent of central banks globally aim to boost their gold reserves by year-end 2023.Central banks in emerging markets are increasingly interested in boosting gold reserves, with 71 percent of surveyed respondents expecting a rise in central bank gold holdings this year, up from 61 percent last year. In the previous year, central banks secured a record 1,136 metric tons of gold because of rising interest rates, increased sanctions against Russia, and rising inflation rates.

https://sputnikglobe.com/20230820/is-it-a-good-idea-to-invest-in-gold-1112742707.html

israel

east

world

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

gold prices, gold, s&p 500, hamas, israel, palestinian-israel conflict, gold's value, middle east, dow jones market, gold futures, world gold council, emerging market central banks, central bank gold holdings, increasing inflation rates, russian sanctions.

gold prices, gold, s&p 500, hamas, israel, palestinian-israel conflict, gold's value, middle east, dow jones market, gold futures, world gold council, emerging market central banks, central bank gold holdings, increasing inflation rates, russian sanctions.

Gold Shoots Past $2,000 per Ounce Amid Middle East Crisis

In today's financial world, the precious metal has become known as a safe haven to which investors throng when the going gets tough in the markets and the dollar.

Gold's breaching $2,000 an ounce this year is attributed to its appeal as a safety net for investors, making it a frontrunner against the S&P 500, according to a recent MarketWatch publication.

The unexpected 7 October assault by Hamas’ militant wing on Israel has spurred a 10 percent increase in

gold's value. Market specialists foresee that the geopolitical unrest in the Middle East will remain a key driver for rising gold prices.

Brien Lundin, editor of Gold Newsletter, said that the Palestinian-Israeli crisis "sent shock waves around the world - and sent the price of gold soaring".

During tumultuous market periods, investors often gravitate towards gold for its risk-hedging value. Historically, this precious metal has stood as a beacon of safety amid economic downturns, stock market turmoil, international and regional armed conflicts, and pandemics.

Data from the Dow Jones Market indicates that as Thursday's trading concluded, the S&P 500 SPX had notched a 7.8 percent rise since the year's commencement. Concurrently, front-month gold futures marked a 9.2 percent increase in the same period.

20 August 2023, 17:14 GMT

Also, Thursday saw October's front-month contract for Gold GC00 futures up by $3.10 per troy ounce, culminating at a high of $1987.20 - a peak not seen since 16 May, according to FactSet figures. This month alone has witnessed a surge of more than 7.5 percent in its value.

Gold's performance in 2022 once again highlighted its standing as a resilient asset. Although its main futures dipped slightly by the year's close, this setback was far less drastic than the S&P 500's 19.4 percent plunge, dividends not included. A similar pattern was evident in 2020, as gold's 24.4 percent boost outshone the S&P 500's 16.3 percent advance.

Findings from the World Gold Council’s study indicate that about

24 percent of central banks globally aim to boost their gold reserves by year-end 2023.

Central banks in emerging markets are increasingly interested in boosting gold reserves, with 71 percent of surveyed respondents expecting a rise in central bank gold holdings this year, up from 61 percent last year. In the previous year, central banks secured a record 1,136 metric tons of gold because of

rising interest rates, increased sanctions against Russia, and rising inflation rates.