Winners and Losers From Trump’s Tariff Wars

© AP Photo / Damian Dovarganes

Subscribe

The US is threatening 25% import duties on goods coming from Canada and Mexico, and 10%+ on those from China, starting Feb. 1. Will Americans win or lose from the restrictions? We crunched some numbers to find out.

In 2023, Mexico, China and Canada sold $480 bln, $448 bln, and $429.5 bln worth of goods to the US, respectively. The same year, the US sold $323 bln, $148 bln and $353 bln of goods to these countries.

The massive $533.5 bln US trade deficit with its three top trade partners will give Trump room to maneuver on harsh tariffs that partners can’t easily respond to in kind, while the sheer size of the US economy may complicate finding alternative markets quickly.

How Much Revenue Could Tariffs Bring In?

In 2024, Washington-based taxation research think tank the Tax Foundation estimated that a 10% cross-the-board tariff would raise $2 trln in revenue over the ten-year period 2025-2034. A 20% tariff would raise $3.3 trln, factoring in expected losses to growth.

Revenues on the new restrictions proposed by Trump will depend on how many new tariffs he introduces, and what rate Washington sets.

Who Will Pay?

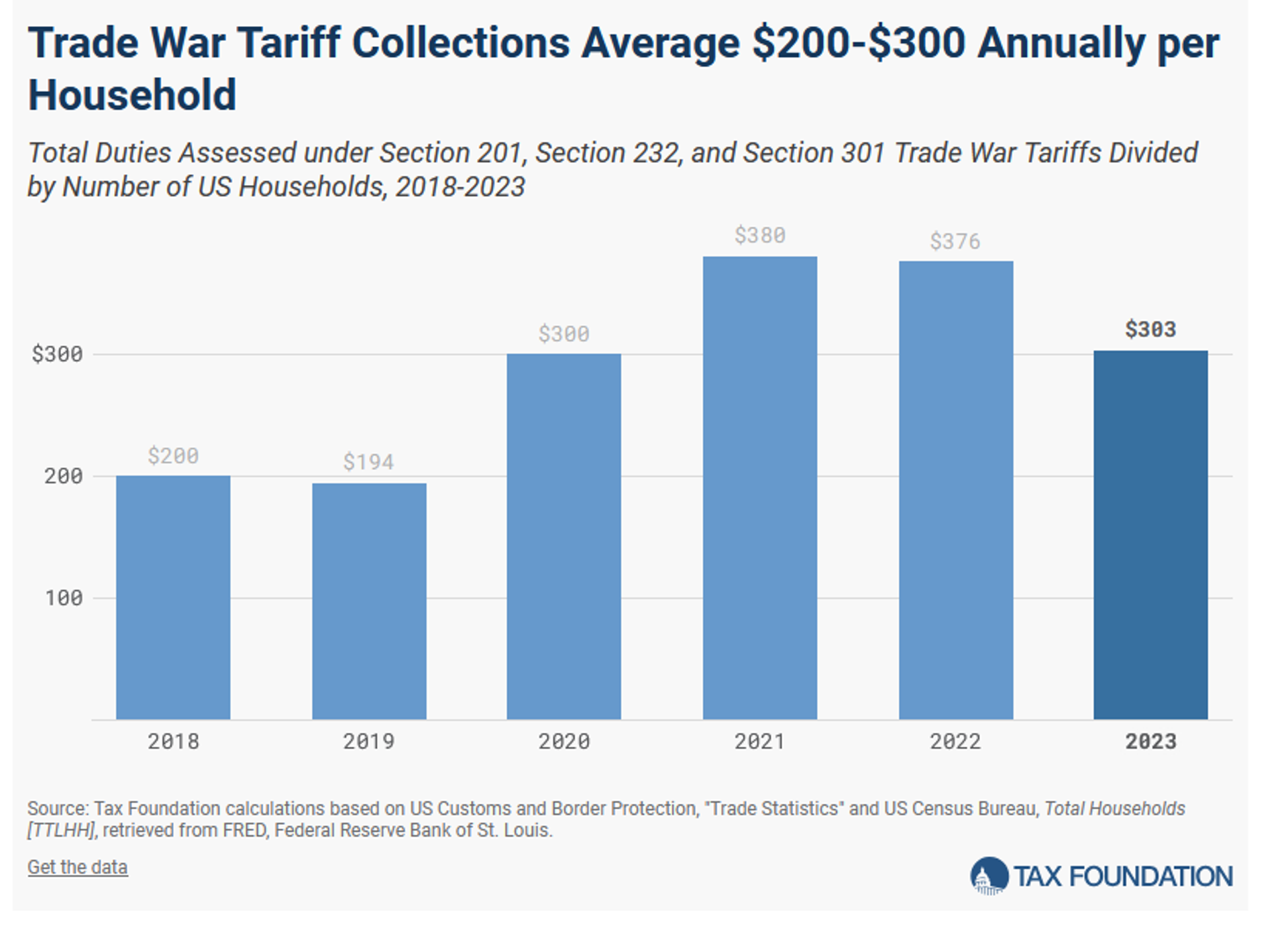

Consumers traditionally pay the immediate costs of tariffs through higher prices on imported goods. During Trump’s first term, when $380 bln worth of goods were affected, households paid an extra $194-$380 per year on average.

Tax Foundation analysis of federal statistics of the economic costs to households of Trump and Biden's tariff wars.

© Photo : Tax Foundation

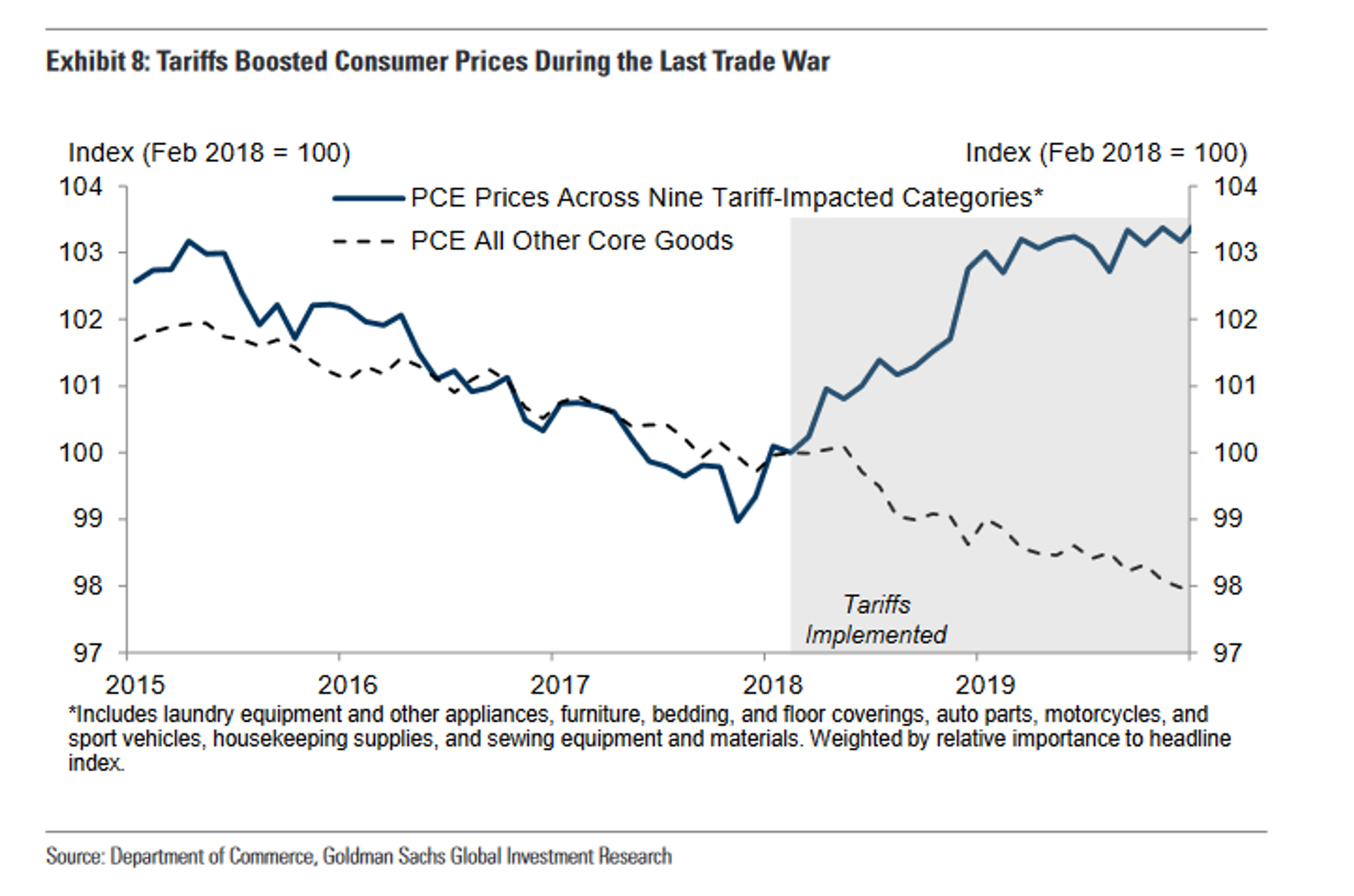

The Trump Tariffs also resulted in a 4% bump in inflation on duty-affected categories, according to a recent analysis by Goldman Sachs.

Inflationary impact of Trump's first term trade war.

© Photo : Goldman Sachs Economics Research

A 2020 study by Brookings found that while tariffs hurt sectors relying on imported inputs, as well as exporters facing retaliation, they created thousands of jobs in the steel industry, some consumer sectors (like washing machines), and energy.

In other cases, like clothing, shoes and household goods, tariffs led companies to shift production to countries not impacted by restrictions, but not set up shop in the US due to the prohibitively high cost of labor and other inputs.

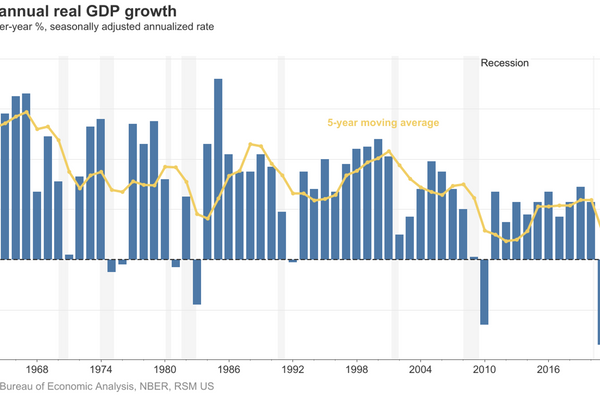

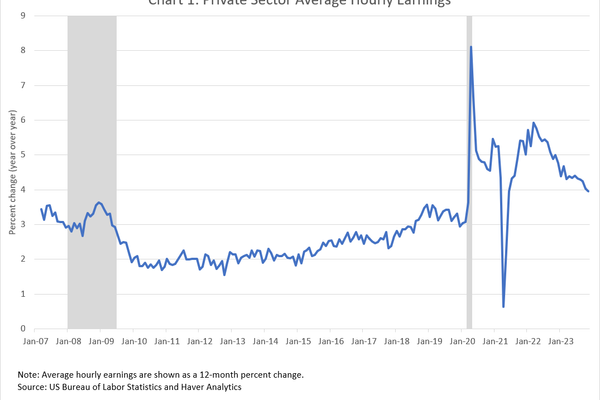

US GDP growth wasn’t noticeably impacted by Trump’s trade wars during his first term, but the period did see growth in wages and declining unemployment before Covid struck.

1/3

© Photo : realeconomy.rsmus.com

US annual real GDP growth year-over-year % seasonally adjusted annualized rate.

2/3

© Photo : Federal Reserve Bank of Atlanta

Private sector average hourly earnings chart compiled by the US Bureau of Labor Statistics and Haver Analytics.

3/3

© Photo : Federal Reserve Bank of St. Louis

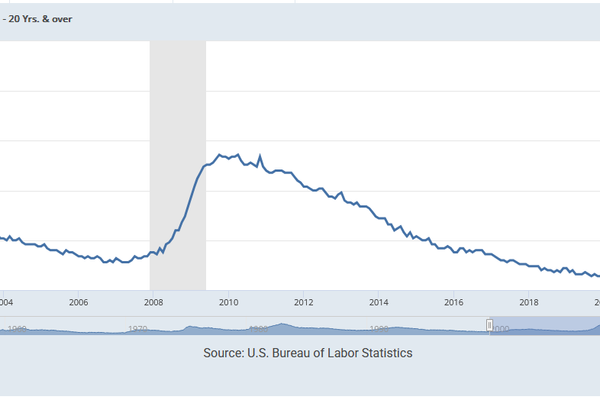

Unemployment years on US residents age 20 years and older.

1/3

© Photo : realeconomy.rsmus.com

US annual real GDP growth year-over-year % seasonally adjusted annualized rate.

2/3

© Photo : Federal Reserve Bank of Atlanta

Private sector average hourly earnings chart compiled by the US Bureau of Labor Statistics and Haver Analytics.

3/3

© Photo : Federal Reserve Bank of St. Louis

Unemployment years on US residents age 20 years and older.

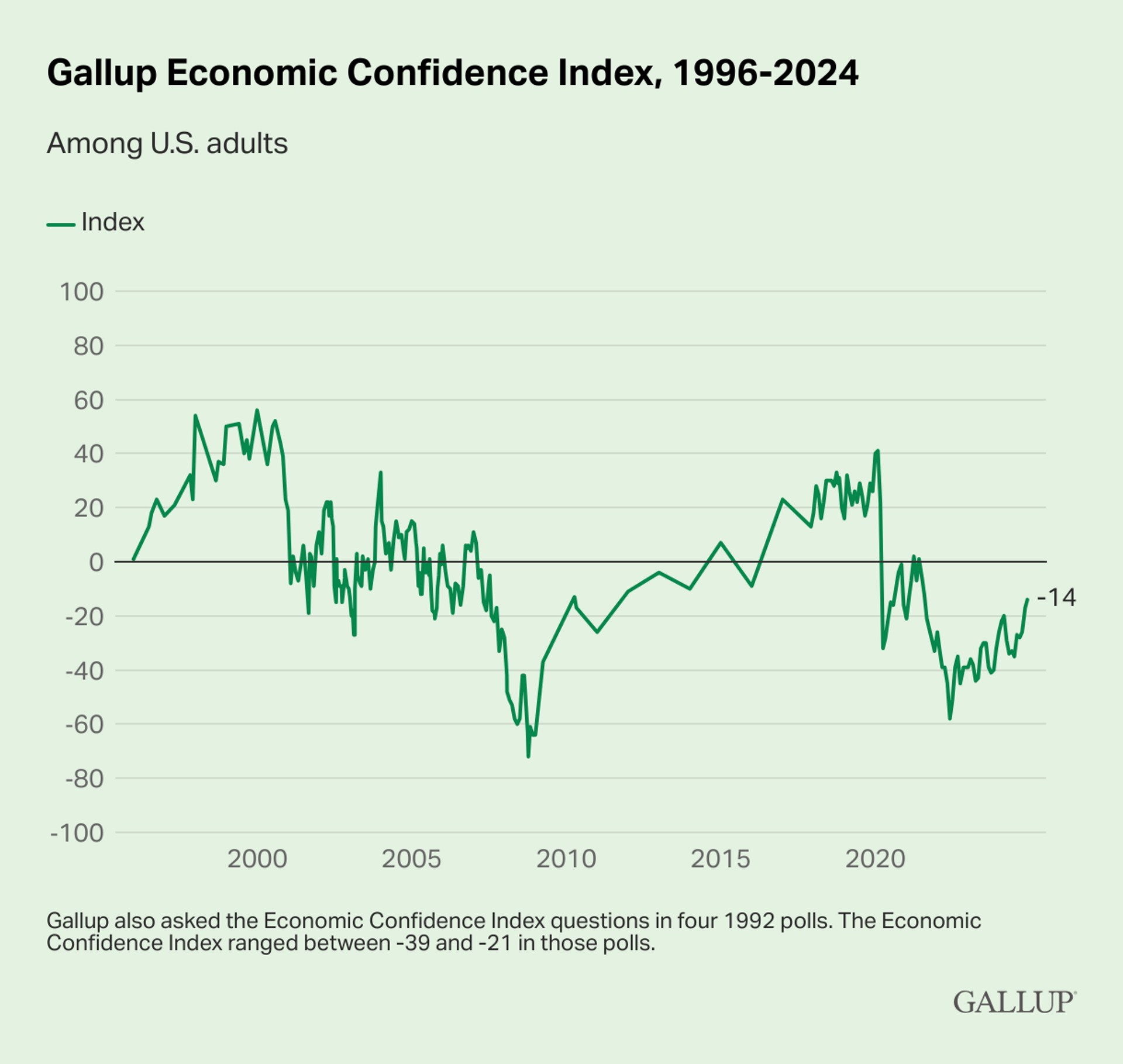

During the same period, the Gallup Economic Confidence Index hit a rating unseen since the early 2000s, while a record 60-68% of Americans found the Trump years a “good time to find a quality job.”

Gallup Economic Confidence Index, 1996-2024

© Photo : Gallup

“Trade Wars Are Good and Easy to Win”?

Trump’s penchant for tariffs is twofold: creating an artificial, duties-derived economic advantage for US producers, and pressuring companies from other countries to enter the US market and set up production through threats of restrictive tariff barriers to keep them out.

The latter strategy proved somewhat effective under Trump’s predecessor. Between 2022-2024, the US sucked hundreds of European industrial enterprises out of the EU through tax incentives and cheaper energy prices.

This occurred as the bloc faced a series of energy and recessionary crises triggered by the conflict in Ukraine, with Brussels exacerbating the problem through its self-destructive move of trying to wean itself off cheap Russian energy without securing supply and price-competitive alternatives.