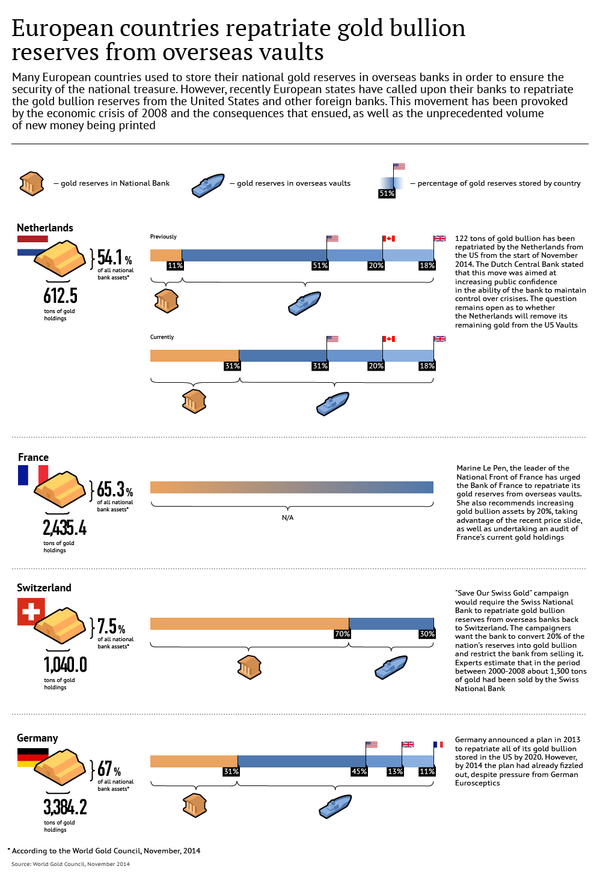

If passed, the referendum would force the Swiss National Bank to convert a fifth of its assets into gold and repatriate all of its overseas bullion.The Swiss National Bank has recently disclosed where it stashes its 1,040 tons of gold: almost a third is kept overseas, in Britain and Canada.

According to Swiss National Bank President Thomas Jordan, 70 per cent of the reserves are stored in Switzerland, 20 per cent with the Bank of England and 10 per cent with the Bank of Canada.

The vote would also require the Swiss central bank to buy large amounts of gold from the global market in order to transform their currency to a gold-based standard.

According to Business Insider, a “yes” result in the referendum will mean the SNB cannot sell its gold reserves and that the nation’s gold must be stored physically in Switzerland. In addition, it would stipulate that at least 20 percent of the bank’s assets must be held in gold.

Experts predict that the national currency may see a steep rise in value, which could put deflationary pressure on Switzerland. This would have a potentially profound affect on the nation’s economy, which relies heavily on exports, as a rise in the value of the franc against the Euro would make Swiss products more expensive. Some are suggesting that the SNB introduce a negative interest rate to counter this issue.

In case the SNB meets the requirements, Switzerland may become the third largest holder of gold reserves after the United States and Germany.