"Now that they stopped QE, the air is coming out of this bubble," Schiff, CEO of Euro Pacific Capital, told an audience at the SALT conference in Las Vegas.

"We’re not going to get a rate hike in June, we’re not gonna get a rate hike in September," he said, repeating a prediction he's made over the last few weeks. "We're going to get QE4."

Schiff has been expressing skepticism over the quality of the US recovery over recent weeks, criticizing the data being used to portray the US economy as healthy. Instead, he says, it's been artificially propped up by low interest rates, and since the Fed knows that, they won't raise them and risk exposing those underlying weaknesses.

"The reality is the Fed is not intending to raise rates –- not because they don't want to, but because they can't," Schiff told Benzinga in March, explaining that raising rates would trigger another financial crisis, worse than 2008.

"We're trying to pretend we are solvent by keeping interest rates artificially low," Schiff concluded. "But that's worse than the problem."

— Russell Roberts (@EconTalker) May 6, 2015

"Sicker Than Ever"

Schiff has also claimed that many of the supposedly "strong" indicators — like falling unemployment rates — are giving a falsely rosey picture of the situation in the United States. He noted that unemployment is also low because some people have left the job market entirely and many others are still underemployed.

"A lot of people have two [part-time] jobs, but they only want one [full-time] job," Schiff said.

He also predicted that later this year jobs created in anticipation of better economic times ahead will be shed since the recovery "is not going to materialize."

"There is no recovery; the labor force has collapsed," he reiterated at the SALT conference, to audience applause.

— Peter Schiff (@PeterSchiff) May 6, 2015

Schiff denied the suggestion that he's exaggerating the dire circumstances "like Chicken Little," during an interview on CNBC's Futures Now in March.

"I'm not saying the sky is falling," he said. "But the US economy is in a lot of trouble and we haven't recovered from anything, thanks to the Fed the US economy is sicker than ever."

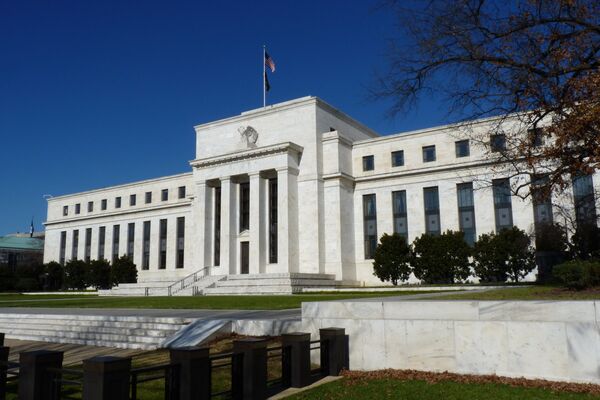

A March policy statement delivered by Federal Reserve Chairwoman Janet Yellen had many anticipating interest rate increases as soon as June, despite her assurances that no timeline had been determined. In previous policy statements the Fed said it was taking a "patient" stance towards interest rate increases, language which they decided to change.

"Just because we removed the word patient from the statement doesn’t mean we are going to be impatient," Chair Janet Yellen told reporters in Washington at the time.

Schiff insisted that any anticipation of higher interest rates any time soon is misplaced, as it would pop the bubble of the artificial recovery.

"Yellen is bluffing," Schiff said. "At some point –- what are they going to do? If they raise rates we are in recession. Big time. And then what they are going to do. If they cut back they will look really foolish."