"Our goal is to sharply increase loans to Chinese banks," Dmitriev noted. "At present Chinese banks are very conservative in their approach [to the Russian market]. We have developed a mechanism of joint investments in debt instruments, where we will take more risk onto the RDIF, the Russia-Chinese Investment Fund or in cooperation with our partners in the Middle East, but will receive greater returns in exchange." Overall, the RDIF and its partners have plans to contribute roughly $1.5 billion to the initiative.

"For example, in a $1.5bn loan, we would take on a $200m mezzanine tranche with a higher interest rate, and overall the loan would have a blended interest rate attractive to the Russian company," Dmitriev explained.

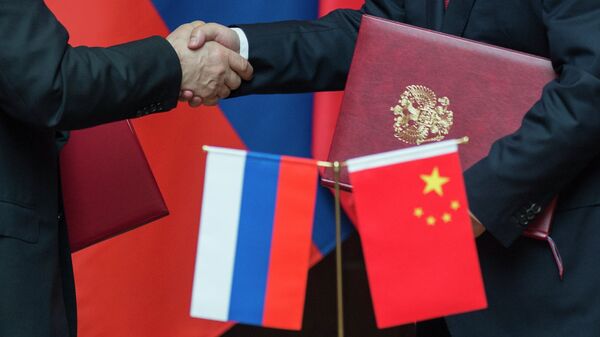

The initiative to attract Chinese investment is meant as an alternative source of financing to Western capital funds, which have raised their rates and restricted Russian borrowing over the past year.

The businessman noted that while Chinese lenders are presently most interested in industrial export-oriented businesses, lending to Russian banks may be possible in the future.

Dmitriev told Vedemosti that he expects up to ten loan deals to be closed by the end of the year.