According to Jacob Funk Kirkegaard, a senior fellow of the influential Washington-based Peterson Institute for International Economics, the Eurozone's new emerging strategy now "is implicitly to seek regime change in Athens."

"Only a national unity government committed to implementing the Troika program can in the short term renew the dialogue with Europe and increase the emergency lending provided by the ECB to enable the banks to reopen. It is doubtful that a unity government with Tsipras's Syriza party in it could accomplish that goal. For the Greek banks to reopen, a new government is likely to be required," the economist insisted.

"Instead, Greece's creditors are likely to sit back and watch political turmoil engulf Greece," the economist elaborated, stressing that both Brussels and Washington are dissatisfied with the Tsipras cabinet's "leftist rhetorical anti-austerity" and Greece's rapprochement with Russia.

The economist suggested that such a "hard line" will most likely prompt the Greek population to vote "for parties more friendly to the euro area."

The expert hinted that the so-called Troika of the European Commission, the European Central Bank (ECB), and the International Monetary Fund can prevent Greece from falling into the abyss of an economic crisis, but they would not raise a finger "without a new government in Athens."

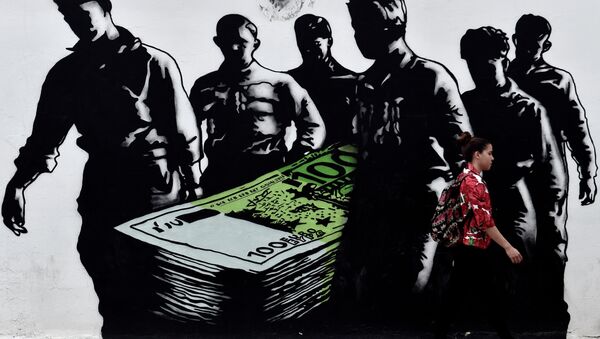

The question remains open whether the Eurozone decision-makers' political course towards Greece is a sort of political and economic blackmailing aimed at ousting of the "undesirable" leftist Syriza party.