The latest figures show that government debt is the equivalent to nearly $60,000 in deficit spending for every American.

The pace of the increase is slightly stepped-up compared to the last few trillion dollar mileposts.

It took about 14 months for the debt to climb from $17 trillion to $18 trillion, and about the same amount of time to go from $16 trillion to $17 trillion.

Some time ago, Congress passed legislation to increase the debt ceiling up to a certain amount, and borrowing had to stop once that limit was hit.

However, over the last few years the Federal government has suspended the debt ceiling for extended periods, leaving the government free to borrow as much as it needed.

The current suspension period ends in March, 2017 and President Obama is expected to leave office with a total national debt of nearly $20 trillion by the time he leaves.

It is interesting to note that when he took office, the debt was at $10.6 trillion, meaning that already he has added over $8 trillion during his seven years in the White House.

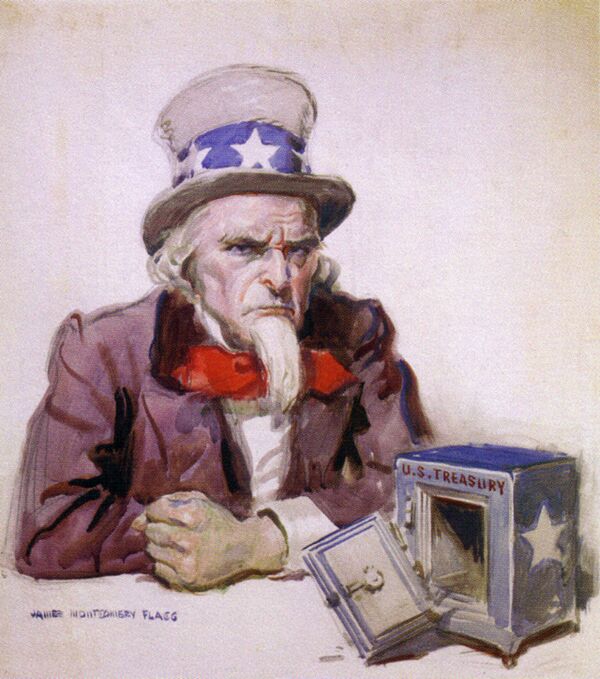

So why is neither Congress nor the Federal government fretting over the figure?

Let’s have a look at what the national debt is all about.

The national debt – or the federal debt — is the total of all the past years' budget deficits, minus what the government has paid off with budget surpluses. A budget deficit is when the government spends more than it collects in taxes in a single year. A budget surplus is when it spends less than it collects.

The Congressional Budget Office warned last week that fiscal 2016 will be the first in which the federal deficit has risen as a share of the economy as a whole since 2009.

Who Owns the US Debt?

There are two basic categories of debt owners:

The other category is the federal accounts, also known as "intragovernmental holdings." Federal accounts records the amount of money that the Treasury has borrowed from itself. That may sound funny, but it means that the Treasury borrows surplus money from one trust fund and gives it to another trust fund. For example, the Treasury might borrow money from Social Security to finance current government spending in another area. At a later date, the government must pay that borrowed money back.

In a separate category, the Federal government owes 13% to the Federal Reserve. The Federal Reserve is not counted as "debt held by federal accounts" because the Federal Reserve is considered independent of the federal government.

The rest is owned by the federal accounts.

First of all, US debt is carefully distributed around the world. The major international investor countries holding its debt are China and Japan. Also in the top ten are Ireland, Switzerland, United Kingdom, Hong Kong, Luxembourg and Taiwan.

According to Russia’s Ridus news agency, none of these countries will attempt get rid of their whole portfolio of bonds at once. The reason is quite simple – the large scale sale will spark panic in the bond market, investors will start selling, bonds will fall in price and, as the result, the value of the debt itself will decrease.

The creditors therefore are trapped by the debtor.

The prices for all strategic commodities – oil, metal, grain – are tied to the dollar.

And the third reason is politics. The US has one of the mightiest armies in the world. And most of its military bases are located on the territories of its top creditors.

The creditors, in turn, are inferior in their military might to the US and have no intention to check the US' actions.