https://sputnikglobe.com/20220416/musk-twitter-boards-economic-interests-simply-not-aligned-with-shareholders-1094823270.html

Musk: Twitter Board’s ‘Economic Interests Simply Not Aligned With Shareholders’

Musk: Twitter Board’s ‘Economic Interests Simply Not Aligned With Shareholders’

Sputnik International

Influential observers say the public fight for control of Twitter could represent a battle over the future of free speech itself. 16.04.2022, Sputnik International

2022-04-16T22:09+0000

2022-04-16T22:09+0000

2025-04-07T11:00+0000

social media

free speech

jack dorsey

shareholders

takeover

business

elon musk

x (formerly twitter)

viral news

https://cdn1.img.sputnikglobe.com/img/07e6/04/10/1094823226_0:0:3069:1727_1920x0_80_0_0_f3dc242e71bd1d3f6e664a7424989615.jpg

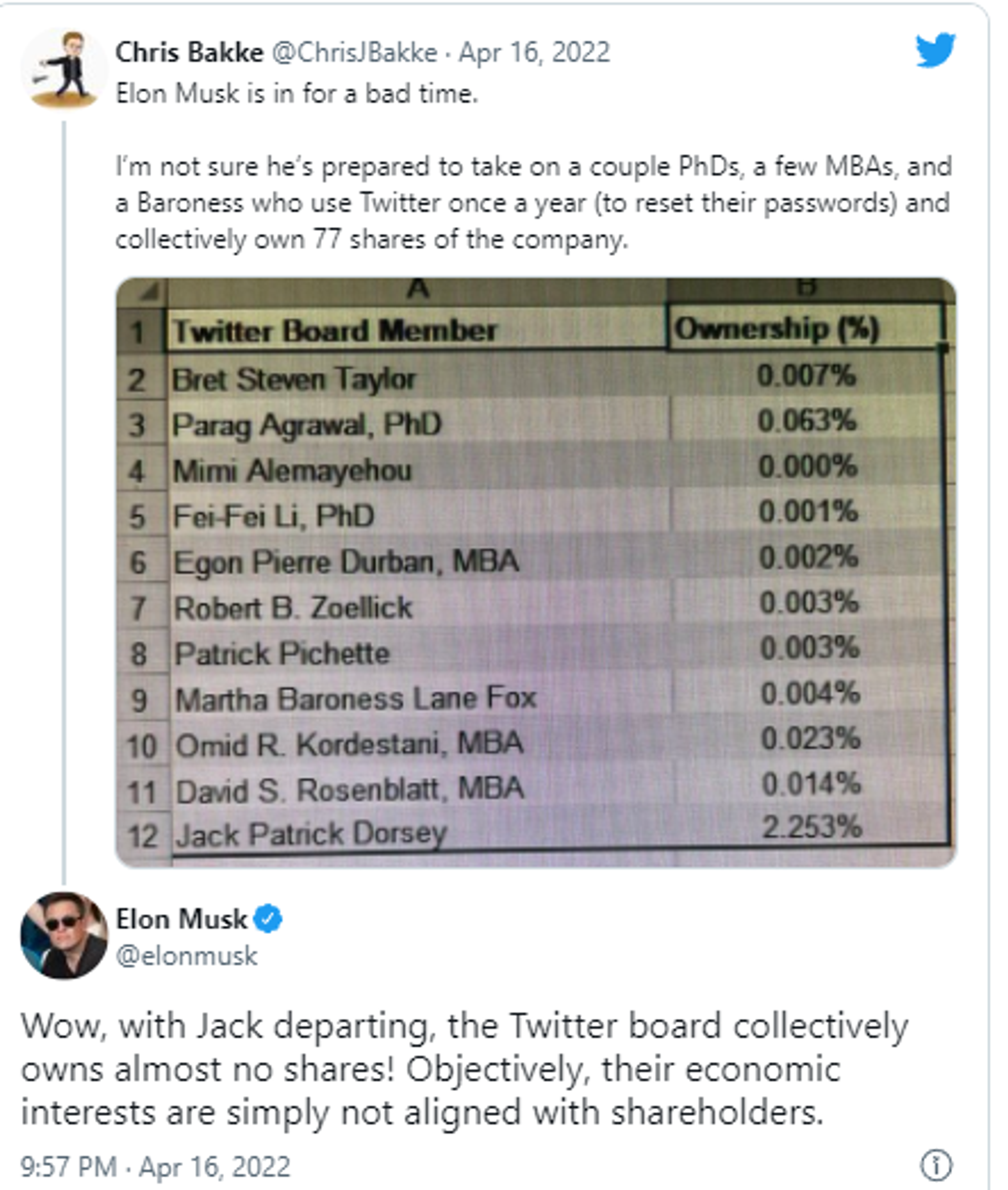

The battle between the board of social media giant Twitter and the world’s richest person continued Saturday as Elon Musk responded to a post claiming that in light of co-founder Jack Dorsey’s departure, the board of Twitter collectively owns a mere 0.12% of the company’s total shares: Just hours before, Musk voiced his agreement with a viral tweet claiming that a successful effort to thwart Musk’s Twitter takeover bid would prove “the game is rigged.”On Friday, it was revealed that Twitter’s board of directors had voted unanimously to adopt a 'limited duration shareholder rights plan,' otherwise known as a 'poison pill,' to allow other shareholders to purchase the shares of anyone who acquires more than 15% of Twitter stock, in an apparent attempt to sabotage Musk’s takeover plans. This came just a day after Musk announced his "final offer" to purchase the company outright for $42 billion, at a mark up of around $6/share.But the billionaire hasn’t just been locking horns with Twitter's board of relative business unknowns, he’s also taken on asset management behemoths like Vanguard and Blackrock, whose combined assets were said to exceed $16.5 trillion in 2021 and who now reportedly control 16.8% of all Twitter shares after Vanguard increased its stake to 10.3% on the heels of Musk’s April 4th announcement that he’d become the company’s largest shareholder.Fox News host Tucker Carlson has publicly suggested Musk could call on those who want to help him “restore free speech” and “democratize” Twitter by buying Twitter shares and pledging their votes to support his takeover effort.

https://sputnikglobe.com/20220416/he-can-call-himself-ceylon-musk-snapdeal-ceo-suggests-tesla-boss-buy-sri-lanka-instead-of-twitter-1094813957.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

social media, free speech, jack dorsey, shareholders, takeover, business, elon musk, x (formerly twitter), viral news

social media, free speech, jack dorsey, shareholders, takeover, business, elon musk, x (formerly twitter), viral news

Musk: Twitter Board’s ‘Economic Interests Simply Not Aligned With Shareholders’

22:09 GMT 16.04.2022 (Updated: 11:00 GMT 07.04.2025) Influential observers say the public fight for control of Twitter could represent a battle over the future of free speech itself.

The battle between the board of social media giant Twitter and the world’s richest person continued Saturday as Elon Musk responded to a

post claiming that in light of co-founder Jack Dorsey’s departure, the board of Twitter collectively owns a mere 0.12% of the company’s total shares:

“Wow, with Jack departing, the Twitter board collectively owns almost no shares!” The Tesla CEO went on to explain that the board’s minuscule financial exposure means that “objectively,” the board’s “economic interests are simply not aligned with shareholders.”

Just hours before, Musk

voiced his agreement with a viral tweet claiming that a successful effort to thwart Musk’s Twitter takeover bid would prove “the game is rigged.”

On Friday, it was revealed that Twitter’s board of directors had voted unanimously to adopt a 'limited duration shareholder rights plan,' otherwise known as a '

poison pill,' to allow other shareholders to purchase the shares of anyone who acquires more than 15% of Twitter stock, in an apparent attempt to sabotage Musk’s takeover plans. This came just a day after Musk announced his "final offer" to purchase the company outright for $42 billion, at a mark up of around $6/share.

His public showdown with Twitter has seen Musk launch a number of barbs at the company, ranging from impassioned demands for free speech–a “social imperative” he said Twitter will not “serve” in its current form –to the absurdist suggestion that the social media giant’s San Francisco HQ be transformed into a homeless shelter since “no one shows up anyway.”

But the billionaire hasn’t just been locking horns with Twitter's board of relative business unknowns, he’s also taken on asset management behemoths like Vanguard and Blackrock, whose combined assets were said to exceed $16.5 trillion in 2021 and who now reportedly control 16.8% of all Twitter shares after Vanguard increased its stake to 10.3% on the heels of Musk’s April 4th announcement that he’d become the company’s largest shareholder.

Musk admitted at a TED talk event in Vancouver that he’s “not sure” if his attempt to purchase Twitter will ultimately succeed, but told host Chris Anderson that “there is” a ‘Plan B,’ before declining to elaborate on what that might entail.

Fox News host Tucker Carlson has

publicly suggested Musk could call on those who want to help him

“restore free speech” and “

democratize” Twitter by buying Twitter shares and pledging their votes to support his takeover effort.