https://sputnikglobe.com/20221118/imran-khan-blames-regime-change-conspiracy-for-pakistans-economic-woes-1104362001.html

Imran Khan Blames ‘Regime Change Conspiracy’ for Pakistan’s Economic Woes

Imran Khan Blames ‘Regime Change Conspiracy’ for Pakistan’s Economic Woes

Sputnik International

Khan was ousted from power in April in a no-confidence motion introduced in the National Assembly by then-leader of opposition and current PM Shehbaz Sharif... 18.11.2022, Sputnik International

2022-11-18T09:27+0000

2022-11-18T09:27+0000

2023-02-14T08:50+0000

world

imran khan

default

government bonds

shehbaz sharif

climate change

pakistan

floods

https://cdn1.img.sputnikglobe.com/img/07e6/0b/12/1104364844_0:320:3072:2048_1920x0_80_0_0_cc0e5006d62b42622c393673a6b743a7.jpg

Amid mounting fears among international investors of an imminent default in Pakistan, ex-Prime Minister Imran Khan blamed the “regime change conspiracy” for throwing his country’s economy “in a tailspin.” The country’s default risk is measured in terms of five-year CDS, which also serves as a caution to investors about risks associated with buying country-specific bonds on the market. According to Karachi-based research firm Arif Habib Limited, the high CDS indicates a “grave situation,” making it difficult for the government to raise foreign exchange through bonds or commercial borrowings.Default fears have mounted ahead of a December 5 deadline for the government to repay around a $1 billion against the "Sukuk" Islamic bonds, which are set to mature next month, as per local media. Pakistan's Finance Minister Ishaq Dar has tried to assure investors that the government has ample reserves to pay for the Islamic bonds — but that did not save the situation.As per local media reports, Pakistan requires around $23 billion in the current fiscal ending March 2023 in order to meet its foreign obligations.Investor sentiment in Pakistan was hit by the postponement of a visit of Saudi Arabia’s Crown Prince Mohammed bin Salman to Islamabad this month. Bin Salman was expected to announce investments worth $10 billion during his trip. A new date is yet to be announced.Pakistan is also awaiting disbursement of funds from the IMF, with which it entered a $6 billion program in 2019. However, less than half the amount under the IMF package has been disbursed to Islamabad to date owing to its failure to meet the terms of the package. In July, the IMF approved a $1.1 billion tranche for Islamabad under the Extended Fund Facility (EEF), pending approval from the Western lender’s executive board.The talks between the IMF and the Pakistani government for review of the EEF facility were delayed this month owing to Islamabad’s refusal to raise taxes on petrol and bring down the fiscal deficit.Pakistan has been facing a severe crunch of forex reserves to pay for imports and make debt repayments. The economic situation in the country was exacerbated further after devastating floods in July-August, which the government says led to cumulative economic damages of over $30 billion.

https://sputnikglobe.com/20221114/pakistans-imran-khan-still-holds-us-responsible-for-ousting-as-aides-debunk-alleged-u-turn-1104098644.html

pakistan

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2022

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

pakistan deficit, pakistan economy, pakistan economic collapse, imran khan economy, regime change conspiracy, pakistan under shehbaz sharif, who is imran khan, sukuk’ islamic bonds, pakistan's foreign debt, defult debt in pakistan

pakistan deficit, pakistan economy, pakistan economic collapse, imran khan economy, regime change conspiracy, pakistan under shehbaz sharif, who is imran khan, sukuk’ islamic bonds, pakistan's foreign debt, defult debt in pakistan

Imran Khan Blames ‘Regime Change Conspiracy’ for Pakistan’s Economic Woes

09:27 GMT 18.11.2022 (Updated: 08:50 GMT 14.02.2023) Khan was ousted from power in April in a no-confidence motion introduced in the National Assembly by then-leader of opposition and current PM Shehbaz Sharif. Khan alleges that his ouster was directed at the behest of the US due to the Biden administration's unhappiness with the country’s independent foreign policy.

Amid mounting fears among international investors of an imminent default in Pakistan, ex-Prime Minister Imran Khan blamed the “

regime change conspiracy” for throwing his country’s economy “

in a tailspin.”

The country’s default risk is measured in terms of five-year CDS, which also serves as a caution to investors about risks associated with buying country-specific bonds on the market.

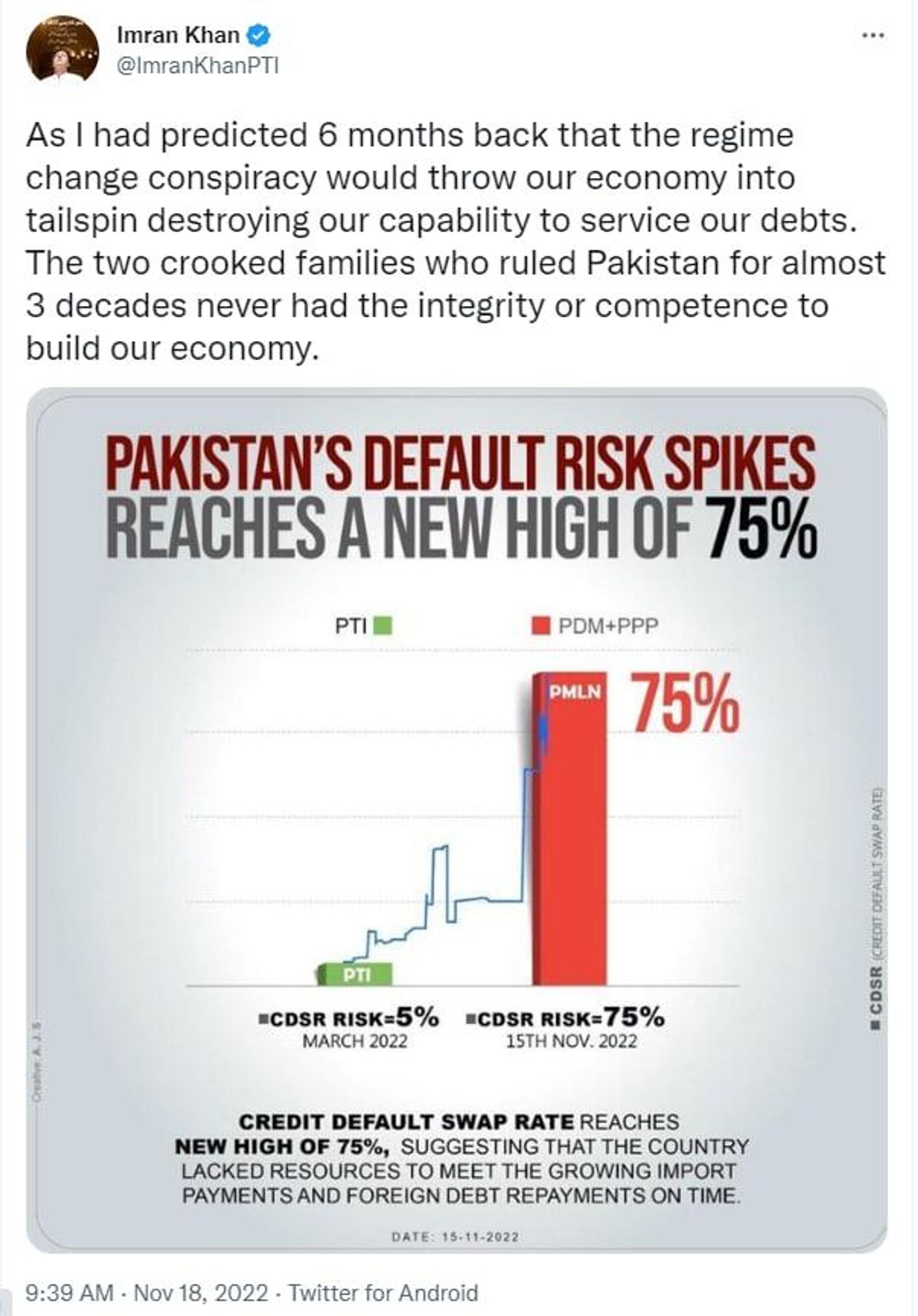

In a tweet posted Friday, Khan shared a graphic showing that Pakistan’s credit default swaps (CDS) hit 75 percent this week, as compared to five percent in March this year, before his Pakistan Tehreek-e-Insaf (PTI) party was removed from power.

According to Karachi-based research firm Arif Habib Limited, the high CDS indicates a “grave situation,” making it difficult for the government to raise foreign exchange through bonds or commercial borrowings.

Default fears have mounted ahead of a December 5 deadline for the government to repay around a $1 billion against the "Sukuk" Islamic bonds, which are set to mature next month, as per local media. Pakistan's Finance Minister Ishaq Dar has tried to assure investors that the government has ample reserves to pay for the Islamic bonds — but that did not save the situation.

As per local media reports, Pakistan requires around $23 billion in the current fiscal ending March 2023 in order to meet its foreign obligations.

14 November 2022, 18:53 GMT

Investor sentiment in Pakistan was hit by the postponement of a visit of Saudi Arabia’s Crown Prince Mohammed bin Salman to Islamabad this month. Bin Salman was expected to announce investments worth $10 billion during his trip. A new date is yet to be announced.

Pakistan is also awaiting disbursement of funds from the IMF, with which it entered a $6 billion program in 2019. However, less than half the amount under the IMF package has been disbursed to Islamabad to date owing to its failure to meet the terms of the package.

In July, the IMF approved a $1.1 billion tranche for Islamabad under the Extended Fund Facility (EEF), pending approval from the Western lender’s executive board.

The talks between the IMF and the Pakistani government for review of the EEF facility were delayed this month owing to Islamabad’s refusal to raise taxes on petrol and bring down the fiscal deficit.

Pakistan has been facing a severe crunch of forex reserves to pay for imports and make debt repayments. The economic situation in the country was

exacerbated further after devastating floods in July-August, which the government says led to cumulative economic damages of over $30 billion.