https://sputnikglobe.com/20230301/bidens-semiconductor-subsidies-may-turn-into-taxpayer-funded-romp-as-asian-chip-giants-forge-ahead-1107913159.html

Biden’s Semiconductor Bid Comes Too Little, Too Late

Biden’s Semiconductor Bid Comes Too Little, Too Late

Sputnik International

Washington has outlined the details of a $39 billion program of subsidies incentivizing companies to build semiconductor manufacturing capacity in the USA. Could they restore the US’s long-lost domestic semiconductor sector?

2023-03-01T17:08+0000

2023-03-01T17:08+0000

2023-03-01T17:30+0000

analysis

chips

microchip

semiconductors

taiwan semiconductor manufacturing company (tsmc)

chipmaker

subsidies

https://cdn1.img.sputnikglobe.com/img/07e6/09/01/1100260807_0:161:3071:1888_1920x0_80_0_0_8c56868051685fe609092d64c4398afa.jpg

The Commerce Department officially opened applications for subsidies for chip manufacturing, outlining the conditions companies will have to meet to get some of the tens of billions in taxpayer money doled out to companies under the CHIPS and Science Act passed last year.Commerce “will also be releasing a funding opportunity for semiconductor materials and equipment facilities in the late spring, and one for research and development facilities in the fall,” the release added.The department outlined several priorities for the program, including the requirement that companies which receive $150 million or more share their profits with the government, and submit “workforce development plans” to ensure the recruitment and training of a “large, skilled, and diverse workforce,” including the provision of childcare for employees and construction workers. Taking note of the Biden administration’s ever-present woke agenda, the department also promised special “opportunities for minority-owned, veteran-owned, women-owned, and small businesses.”In a possible bid to preempt questions about America’s commitment to private enterprise, and questions about how the subsidies package could hurt allies, Commerce promised that the US would “coordinate with” its partners “to support a healthy global semiconductor ecosystem that drives innovation and is resilient to a range of disruptions, from cybersecurity threats to natural disasters and pandemics.”An Idea Whose Time Has Come?“$39 billion is a lot of money,” says Chris Devonshire-Ellis, chairman of Dezan Shira & Associates, a pan-Asia professional services firm with over 30 years of experience under its belt.Ross Feingold, a veteran political risk analyst who has spent over two decades advising clients on investment-related political risks in China and Taiwan, echoes this sentiment, noting that on the face of it, the effort to rebuild an American electronics manufacturing base after decades of outsourcing and decline isn’t a bad idea.US Allies Might Grumble, But Asia Will Retain Tech DominanceFeingold believes semiconductor makers among US allies, like South Korea or Taiwan, may take a hit as a result of the US subsidies programs. For example, “no doubt and much to the worry of Samsung and TSMC, some of their employees will choose to remain in the US long term and eventually might become US permanent residents or citizens,” he noted.Still, the US plans shouldn’t be too much of a threat to the Asian giants, the observer believes, since they are so far ahead and so many billions in investment beyond the US commitment, absent some kind of underhanded moves on Washington’s part.Devonshire-Ellis believes the goal of the subsidies isn’t strictly to relocate semiconductor production from Asia to the US, but an attempt by Washington “to keep the development of even faster chips and processors to themselves and to stop countries like China, Russia and India of having immediate access to the latest improvements.”Whether that’s something Washington could actually achieve is another story, Devonshire-Ellis noted, since China is also investing in new processing technologies in a big way. It should also “be remembered that much of the rare earths, gases and metals used in the next generation of computing are found in Asia, not the US. Even with superior tech, no one can build a house without the basic bricks,” he said.Fuzzy DetailsThere are also many details which still need to be ironed out in terms of the subsidies’ incentivizing role, Feingold says. The observer doesn’t expect the profit-sharing aspect of cooperation to be any sort of major disincentive, since companies will likely plan ahead to avoid having to make any outsized payments to the government.At the same time, Feingold notes, non-US companies may have a hard time getting access to funding in light of the increasingly draconian US regulations attempting to decouple China from international chip markets via bans and sanctions.At the same time, the observer noted, big picture-wise, the funding being granted by the CHIPS and Science Act remains just a drop in the bucket compared to what’s needed, “keeping in mind the estimated cost to build a 2nm chip fab can be tens of billions of dollars.”As Asia Times deputy editor David P. Goldman pointed out in a prolific article on the US-China chip war last October, the $50 billion total CHIPS Act offers the equivalent of a meager $8 billion in subsidies per year, while China’s subsidies to its nascent chip industries are already four times larger, meaning the US effort is the equivalent of bringing “a knife to a gunfight.”Another problem, Devonshire-Ellis points out, is that the subsidies plan doesn’t offer details on the profitsharing “threshold” for outlays of $150 million or above. “This may be to circumnavigate [World Trade Organization] rules which do not support government subsidies in international trade,” but could open things up to waste, allowing companies to take the money and run, “implying a lot could be wasted or frittered away.”“Also, there is a risk of China or similar manufacturing countries referring this to the WTO,” Devonshire-Ellis noted. “China already lodged a complaint in December about US semiconductor chip manufacturers about US export controls.” The subsidies could open the US up for further legal trouble under WTO rules, the observer pointed out.Feingold concurs that the subsidies aren’t strictly following the holy canon of the free market capitalism which Washington and the institutions it controls have preached to the world for so long.

https://sputnikglobe.com/20230114/us-japan-agree-to-deepen-cooperation-on-semiconductors-nuclear-energy-1106309597.html

https://sputnikglobe.com/20230226/frenemy-how-us-deprives-germany-of-strategic-autonomy-and-status-as-industrial-powerhouse--1107807263.html

https://sputnikglobe.com/20230129/why-we-fight-us-openly-salivates-over-ukraines-vast-untapped-titanium-reserves-1106799343.html

https://sputnikglobe.com/20230131/really-silly-actions-us-efforts-to-isolate-chinas-tech-sector-will-backfire-expert-says-1106863446.html

https://sputnikglobe.com/20230109/penny-wise-pound-foolish-us-embargo-driving-china-to-pioneer-own-semiconductor-industry-1106173244.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

microchips, semiconductors, industry, subsidies, us, asia, china, taiwan, south korea, pitfalls

microchips, semiconductors, industry, subsidies, us, asia, china, taiwan, south korea, pitfalls

Biden’s Semiconductor Bid Comes Too Little, Too Late

17:08 GMT 01.03.2023 (Updated: 17:30 GMT 01.03.2023) The White House has outlined the details of a $39 billion program of subsidies meant to incentivize companies to build semiconductor manufacturing capacity in the US. What are the terms of the subsidies? Could they restore the US’ long-lost domestic semiconductor sector? Sputnik spoke to a pair of veteran investment experts to find out.

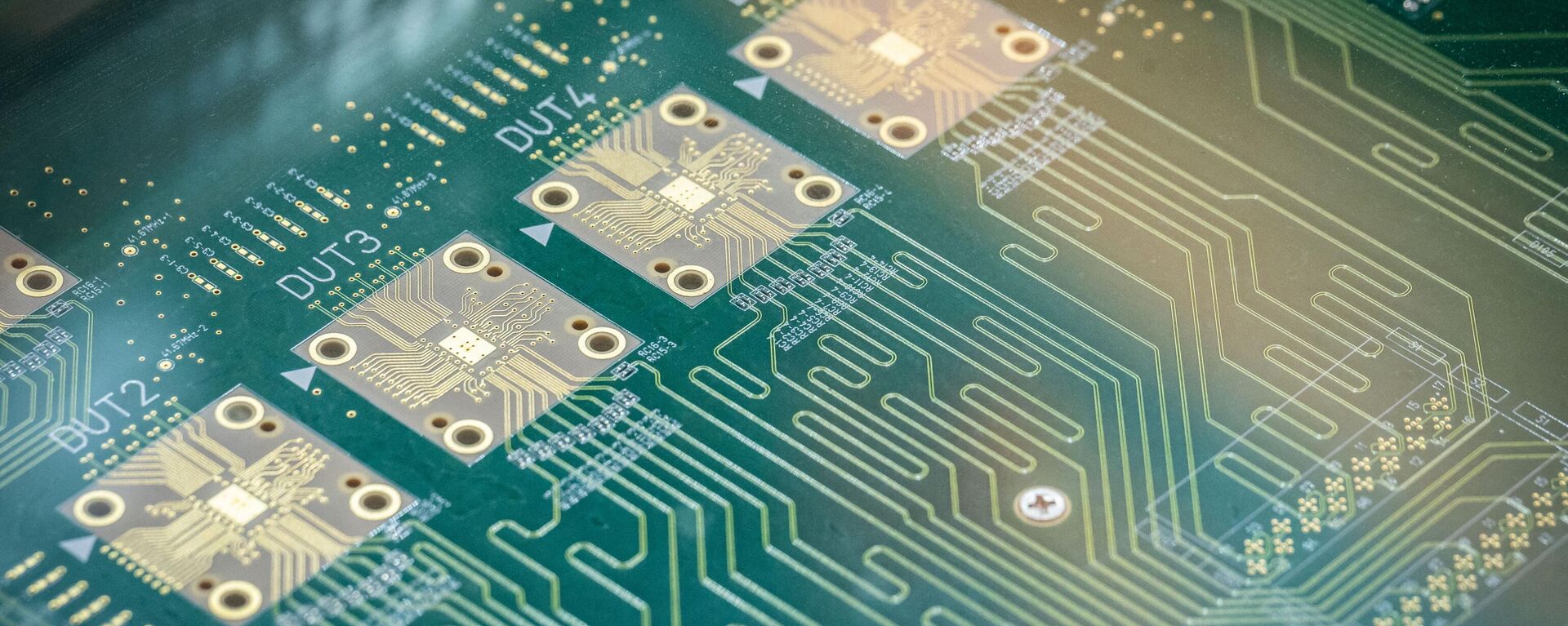

The Commerce Department officially opened applications for subsidies for chip manufacturing, outlining the conditions companies will have to meet to get some of the tens of billions in taxpayer money doled out to companies under the CHIPS and Science Act passed last year.

“The first funding opportunity seeks applications for projects to construct, expand, or modernize commercial facilities for the production of leading-edge, current-generation, and mature-node semiconductors. This includes both front-end wafer fabrication and back-end packaging,” the department

said in a press release Tuesday.

Commerce “will also be releasing a funding opportunity for semiconductor materials and equipment facilities in the late spring, and one for research and development facilities in the fall,” the release added.

The department

outlined several priorities for the program, including the requirement that companies which receive $150 million or more share their profits with the government, and submit “workforce development plans” to ensure the recruitment and training of a “large, skilled, and diverse workforce,” including the provision of childcare for employees and construction workers. Taking note of the Biden administration’s ever-present woke agenda, the department also promised special “opportunities for minority-owned, veteran-owned, women-owned, and small businesses.”

In a possible bid to preempt questions about America’s commitment to private enterprise, and questions about how the subsidies package could hurt allies, Commerce

promised that the US would “coordinate with” its partners “to support a healthy global semiconductor ecosystem that drives innovation and is resilient to a range of disruptions, from cybersecurity threats to natural disasters and pandemics.”

14 January 2023, 08:01 GMT

An Idea Whose Time Has Come?

“$39 billion is a lot of money,” says Chris Devonshire-Ellis, chairman of Dezan Shira & Associates, a pan-Asia professional services firm with over 30 years of experience under its belt.

“On one hand it suggests the support for the US chip manufacturing industry in terms of encouraging innovation and R&D, on the other it implies the US chip manufacturing industry is not in that great shape and requires government intervention and support,” the observer said in an interview with Sputnik.

Ross Feingold, a veteran political risk analyst who has spent over two decades advising clients on investment-related political risks in China and Taiwan, echoes this sentiment, noting that on the face of it, the effort to rebuild an American electronics manufacturing base after decades of outsourcing and decline isn’t a bad idea.

“We shouldn’t underestimate the positive aspects of expanded US chip manufacturing. It does reduce some of the risk on imported chips that led to manufacturing delays for the auto and other industries in recent years. The expansion of US chip manufacturing will result in more knowledge sharing with American stakeholders, including advanced research institutions, universities, engineers, and the US government,” Feingold explained.

US Allies Might Grumble, But Asia Will Retain Tech Dominance

Feingold believes semiconductor makers among US allies, like South Korea or Taiwan, may take a hit as a result of the US subsidies programs. For example, “no doubt and much to the worry of Samsung and TSMC, some of their employees will choose to remain in the US long term and eventually might become US permanent residents or citizens,” he noted.

Still, the US plans shouldn’t be too much of a threat to the Asian giants, the observer believes, since they are so far ahead and so many billions in investment beyond the US commitment, absent some kind of underhanded moves on Washington’s part.

“It’s unlikely that semiconductor production will fully relocate to the US from Asia. Recently announced plans for fabs in the US by Intel, Samsung, TSMC and others will only represent a tiny part of global chip manufacturing capacity by the time the fabs start producing chips. In fact, TSMC has announced plans to expand its manufacturing facilities in Taiwan that will cost tens of billions of dollars, and these are for fabs that will produce the latest generation chips, which as of now TSMC does not plan to produce at its Arizona facility. So whether it’s Samsung or TSMC, their home bases will remain Korea and Taiwan, respectively,” Feingold stressed.

26 February 2023, 04:15 GMT

Devonshire-Ellis believes the goal of the subsidies isn’t strictly to relocate semiconductor production from Asia to the US, but an attempt by Washington “to keep the development of even faster chips and processors to themselves and to stop countries like China, Russia and India of having immediate access to the latest improvements.”

“Much of this is to do with refining AI and data control and analysis. If you possess the most powerful and fastest chips you have a level of superiority. This is the crux of the current struggle. The critics [will] suggest that the US will use such technologies to impose their security system upon the rest of the world,” the observer explained.

Whether that’s something Washington could actually achieve is another story, Devonshire-Ellis noted, since China is also investing in new processing technologies in a big way. It should also “be remembered that much of the rare earths, gases and metals used in the next generation of computing are found in Asia, not the US. Even with superior tech, no one can build a house without the basic bricks,” he said.

29 January 2023, 12:20 GMT

There are also many details which still need to be ironed out in terms of the subsidies’ incentivizing role, Feingold says. The observer doesn’t expect the profit-sharing aspect of cooperation to be any sort of major disincentive, since companies will likely plan ahead to avoid having to make any outsized payments to the government.

At the same time, Feingold notes, non-US companies may have a hard time getting access to funding in light of the increasingly draconian US regulations attempting to decouple China from international chip markets

via bans and sanctions.

31 January 2023, 17:30 GMT

“For non-US companies, answering questions about shareholders (including government shareholders), facilities in China or relationships with customers in China, and other issues will take a lot of time if for no other reason that the applicant will need to gather the information (some of which will need to be translated into English), and lawyers will need to draft the submissions to Commerce, etc. Final decisions about an application might be a long time from now,” Feingold said.

At the same time, the observer noted, big picture-wise, the funding being granted by the CHIPS and Science Act remains just a drop in the bucket compared to what’s needed, “keeping in mind the estimated cost to build a 2nm chip fab can be tens of billions of dollars.”

As Asia Times deputy editor David P. Goldman pointed out in a prolific article on the US-China chip war last October, the $50 billion total CHIPS Act

offers the equivalent of a meager $8 billion in subsidies per year, while China’s subsidies to its nascent chip industries are already four times larger, meaning the US effort is the equivalent of bringing “a knife to a gunfight.”

Another problem, Devonshire-Ellis points out, is that the subsidies plan doesn’t offer details on the profitsharing “threshold” for outlays of $150 million or above. “This may be to circumnavigate [World Trade Organization] rules which do not support government subsidies in international trade,” but could open things up to waste, allowing companies to take the money and run, “implying a lot could be wasted or frittered away.”

“Also, there is a risk of China or similar manufacturing countries referring this to the WTO,” Devonshire-Ellis noted. “China already

lodged a complaint in December about US semiconductor chip manufacturers about US export controls.” The subsidies could open the US up for further legal trouble under WTO rules, the observer pointed out.

9 January 2023, 17:27 GMT

Feingold concurs that the subsidies aren’t strictly following the holy canon of the free market capitalism which Washington and the institutions it controls have preached to the world for so long.

“For Congress and the federal government, the pitfall of the plan is the fundamental shift in thinking towards trying to pick industry winners via direct US government funding. Historically, Republicans generally opposed this, even if Democrats with their close relationship to the labor movement were more supportive. However, the US generally opposed it when other governments around the world subsidized industries and tried to select winners. It remains to be seen whether Congress will repeatedly offer funding for semiconductors, and later, for other industries, but the trend is there, especially considering bipartisan support for the CHIPS and Science Act and willingness of Democrats to subsidize green tech,” the observer concluded.