https://sputnikglobe.com/20230405/rare-earths-behemoth-china-mulls-ban-on-export-of-key-magnet-tech-to-us-1109178024.html

Rare Earths Behemoth China Mulls Ban on Export of Key Magnet Tech to US

Rare Earths Behemoth China Mulls Ban on Export of Key Magnet Tech to US

Sputnik International

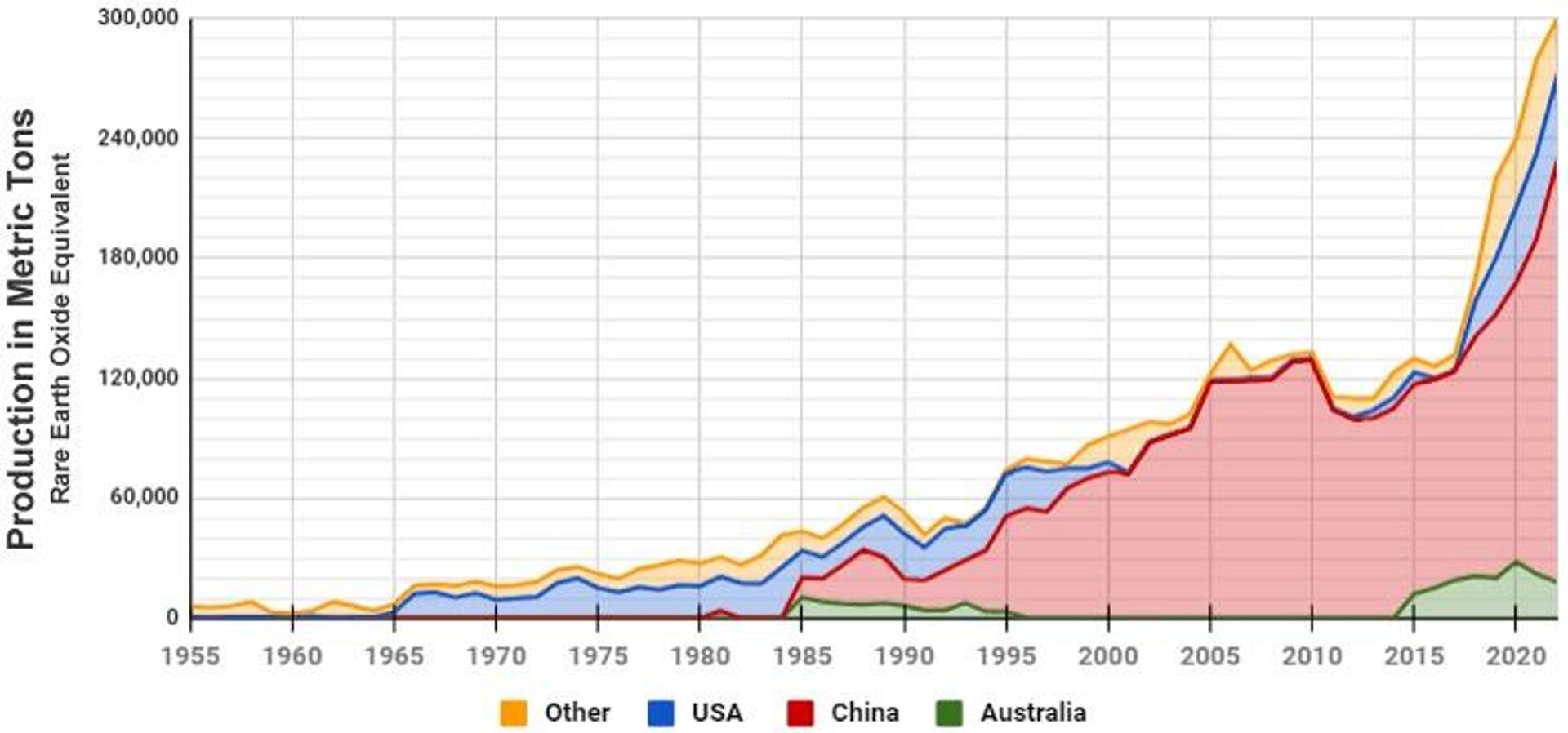

The Asian nation controls the overwhelming majority of the rare earth mining, refining and manufacturing capacity in the world, with the resources used in a broad array of civilian and military applications. US legislators have sought to shore up domestic rare earths production after realizing that Beijing could unplug Washington from its supplies.

2023-04-05T18:58+0000

2023-04-05T18:58+0000

2023-04-05T19:04+0000

economy

china

restrictions

trade restrictions

us

https://cdn1.img.sputnikglobe.com/img/104850/94/1048509437_0:53:1200:728_1920x0_80_0_0_fa61877215c2b894c98f5ec04635d364.jpg

China is considering slapping restrictions on the export of rare-earth magnet technology to the United States on “national security” grounds in response to the Biden administration’s restrictions on the export of advanced microchips to the PRC.According to Asian business media, Chinese officials responsible overseeing an export restrictions list known as the Catalogue of Technologies Prohibited and Restricted from Export are planning to update it for the first time since 2020, and to either restrict or ban outright the export of technologies used in the refining and processing of some rare earth metals.Alloy technologies necessary for the manufacture of high-performance magnets derived from rare earths, including samarium cobalt and neodymium used in the production of electric motors, wind turbine motors and other tech may also be on the chopping block, reports suggest.A draft version of the updated export restrictions list was released late last year, and following a review, the new restrictions could be put in place as soon as later in 2023.These key resources are used in a dizzying array of high technology applications, from industrial robots, electric vehicles, semiconductors and smartphones to vehicles, solar panels and components in missiles, stealth aircraft, satellites, and other military equipment.China built up its rare earths dominance over the past forty years as it opened up to world trade and offered incentives for domestic production. The country accounts for about a third of the world’s known reserves of rare earths, but is among the most active miners, with many Western countries preferring to wind down domestic production in the 1980s, as it is often a dirty and dangerous process. Starting with extraction, China gradually expanded to refining and manufacturing, as well as strategic purchases of rare earths mines around the world.The United States, which until the mid-1980s accounted for the majority of rare earths mining, now has just one active rare earths mine – the Mountain Pass Mine in California, but it too sends most of its extracted materials to China for processing.US lawmakers began sounding the alarm about the PRC’s dominance in the sector in 2022, introducing legislation designed to end China’s “chokehold” on rare minerals production and refining. However, President Biden has blocked measures that would allow US producers to ramp up rare-earths production on federal lands, and has promised to veto legislation proposing an expansion of domestic production.Chinese rare earths industry exports have dismissed the US’ ability to be able to easily or quickly replace China in the sector. In an interview in 2019, Renmin University researcher Chen Xiaoqin told Sputnik that if Washington thought they could find an effective alternative to Chinese supplies, they would have done so a long time ago.

https://sputnikglobe.com/20230316/lack-of-mining-capacity-threatens-to-upend-global-lithium-race-1108482636.html

https://sputnikglobe.com/20230129/why-we-fight-us-openly-salivates-over-ukraines-vast-untapped-titanium-reserves-1106799343.html

china

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

rare earth, metals, china, rare earths, united states, export restrictions, listing, law

rare earth, metals, china, rare earths, united states, export restrictions, listing, law

Rare Earths Behemoth China Mulls Ban on Export of Key Magnet Tech to US

18:58 GMT 05.04.2023 (Updated: 19:04 GMT 05.04.2023) The Asian nation controls the overwhelming majority of the rare earth mining, refining and manufacturing capacity in the world, with these resources used in a wide array of civilian and military applications. US legislators have sought to shore up domestic rare earths production after realizing that Beijing could unplug Washington from its supply.

China is considering slapping restrictions on the export of rare-earth magnet technology to the United States on “national security” grounds in response to the Biden administration’s restrictions on the export of advanced microchips to the PRC.

According to Asian business media, Chinese officials responsible overseeing an export restrictions list known as the Catalogue of Technologies Prohibited and Restricted from Export are

planning to update it for the first time since 2020, and to either restrict or ban outright the export of technologies used in the refining and processing of some rare earth metals.

Alloy technologies necessary for the manufacture of high-performance magnets derived from rare earths, including samarium cobalt and neodymium used in the production of electric motors, wind turbine motors and other tech may also be on the chopping block, reports

suggest.

A draft version of the updated export restrictions list was released late last year, and following a review, the new restrictions could be put in place as soon as later in 2023.

China accounts for more than 60 percent of the world’s rare earth mining, 85 percent of rare earths processing, and over 90 percent of the production of rare earth magnets.

These key resources are used in a dizzying array of high technology applications, from industrial robots, electric vehicles, semiconductors and smartphones to vehicles, solar panels and components in missiles, stealth aircraft, satellites, and other military equipment.

China built up its rare earths dominance

over the past forty years as it opened up to world trade and offered incentives for domestic production. The country accounts for about a third of the world’s known reserves of rare earths, but is among the most active miners, with many Western countries preferring to wind down domestic production in the 1980s, as it is often a dirty and dangerous process. Starting with extraction, China gradually expanded to refining and manufacturing, as well as strategic purchases of rare earths mines around the world.

The United States, which until the mid-1980s

accounted for the majority of rare earths mining, now has just one active rare earths mine – the Mountain Pass Mine in California,

but it too sends most of its extracted materials to China for processing.

US lawmakers began sounding the alarm about the PRC’s dominance in the sector in 2022,

introducing legislation designed to end China’s “chokehold” on rare minerals production and refining. However, President Biden

has blocked measures that would allow US producers to ramp up rare-earths production on federal lands, and

has promised to veto legislation proposing an expansion of domestic production.

Chinese rare earths industry exports have dismissed the US’ ability to be able to easily or quickly replace China in the sector. In an interview in 2019, Renmin University researcher Chen Xiaoqin

told Sputnik that if Washington thought they could find an effective alternative to Chinese supplies, they would have done so a long time ago.

29 January 2023, 12:20 GMT