https://sputnikglobe.com/20230410/why-us-ban-on-russian-aluminum-may-prove-lucky-break-for-europe-1109331187.html

Why US Ban on Russian Aluminum May Prove Lucky Break for Europe

Why US Ban on Russian Aluminum May Prove Lucky Break for Europe

Sputnik International

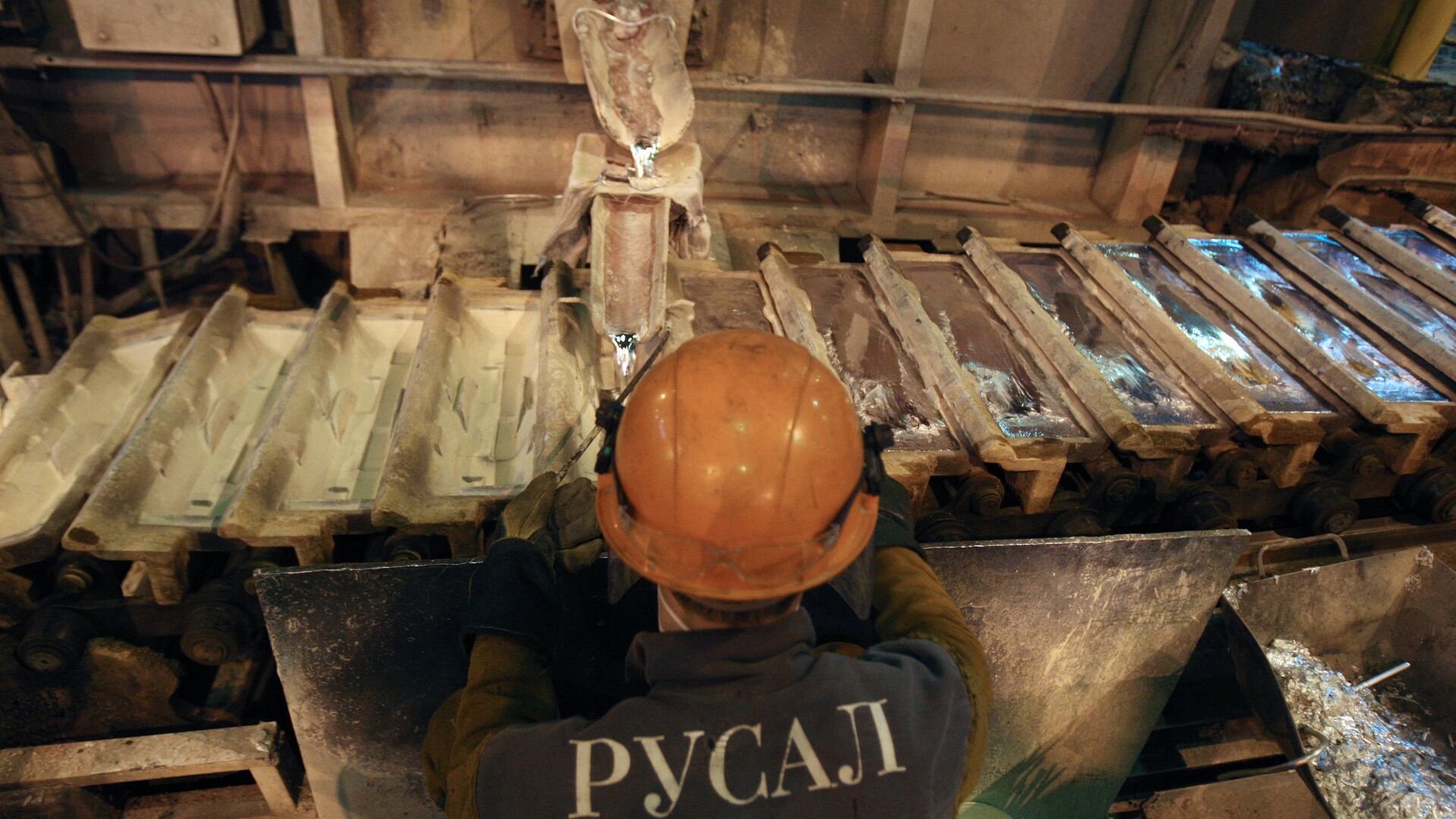

The Biden administration has slapped a 200 percent duty on Russian-made new aluminum and scrap, with the tariffs stepping fully into force this week. While the move was obviously designed to put a dent in Russia’s aluminum producers, American industrialists may ultimately be the ones left holding the bag. Here’s why.

2023-04-10T17:18+0000

2023-04-10T17:18+0000

2023-04-10T18:24+0000

economy

aluminum

rusal

sanctions

tariffs

duties

trade duties

import duties

https://cdn1.img.sputnikglobe.com/img/106655/92/1066559216_0:160:3072:1888_1920x0_80_0_0_2d6ed5a6784030508617e7a48fe04384.jpg

The 200 percent duty on Russian aluminum that entered into force on Monday may cause some economic pain for Russian producers over the short term, but in the long term will leave US manufacturers in an unenviable position, according to Dr. Leonid Khazanov, a leading Russian economist specializing in industry and energy.In an interview with Sputnik, Khazanov explained that formally, Washington’s restrictions are driven by national security concerns, and the interests of “protecting the US’ domestic market from Russian exports.” In reality, the observer said, “we’re talking solely about an attempt to increase sanctions pressure on Russia, based on how the sanctions already introduced seem to have worked very poorly or have had no effect at all.”According to the economist, the inclusion of primary aluminum could be “quite unpleasant” for Russia, since it means producers will have to reorient to other markets, find new clients, or expand sales to existing ones.“The second option is deliveries to Asia – India, China, and possibly Japan, if they want to take it. The Japanese banned the export of aluminum to Russia, although we never bought it from them and on the contrary, Japan itself is a major importer of aluminum, importing about two million tons,” the observer added. Like the Europeans, Japan would probably ask for a discount, “under the pretext of sanctions-related toxicity,” but this may prove acceptable to Russia, since the domestic market “has seen better days” and likely wouldn’t know what do with so much excess metal.Sanctions Danger?Negotiating with Europe could prove difficult, given the sanctions-happy bureaucracy in Brussels, but if national self-interest and restrictions imposed in 2022 are anything to go by (which left non-ferrous metals off the sanctions list), the bloc may cave, Khazanov believes.“What is Europe’s problem right now? On the one hand, their aluminum production has declined sharply. On the other, their automotive production volumes are slowly recovering. It’s not easy for European automakers to live in such conditions; they have few purchasing options. It’s either Russia or the Middle East or China. It’s not advantageous for them to buy from China for political reasons, because for the past 20 years the EU has fought off Chinese aluminum imports in every way possible after they periodically overwhelmed the local market. As for the Middle East, their producers could very easily raise prices. Which leaves Russia. If Europe wants to impose sanctions on Russian aluminum – no problem, they will depend on Chinese and Middle Eastern suppliers. That’s not good for them. The latter could lower prices in order to strengthen their presence, and then jack them up.”As for Russia, its reorientation to new markets away from the US will likely take between six months and a year, and require negotiations, the signing of agreements, logistics, etc., the observer says. Khazanov is hopeful that Russian aluminum giant RUSAL will be able to reorient its production away without reducing output.According to Khazanov, the US is now likely to turn to Canadian aluminum to replace the supplies it once got from Russia, and attempt to increase domestic production. “But it’s unlikely that they will succeed because of the rather high cost of energy resources,” exacerbated by market whims and the lack of state regulation.“If we look at primary aluminum production in the US over the last 10-20 years, we see a systematic drop due to high energy costs, while the production of secondary aluminum has increased as an alternative. In principle, the production of secondary aluminum in the US still has room for expansion, but there is a problem with the availability of scrap, because there is no excess scrap in the US, and would need to be purchased wherever available, most likely Mexico. Accordingly, prices could rise in these conditions,” the economist concluded.

https://sputnikglobe.com/20230408/cost-of-sanctions-foreign-firms-suffer-2-bln-losses-after-leaving-russia-1109269563.html

https://sputnikglobe.com/20230407/biden-extends-emergency-authorizing-russia-sanctions-over-ukraine-for-another-year-1109249057.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

united states, aluminum, russia, rusal, european union, duties, trade, restrictions

united states, aluminum, russia, rusal, european union, duties, trade, restrictions

Why US Ban on Russian Aluminum May Prove Lucky Break for Europe

17:18 GMT 10.04.2023 (Updated: 18:24 GMT 10.04.2023) The Biden administration has slapped a 200 percent duty on new Russian-made aluminum and scrap, with the tariffs stepping fully into force this week. While the move was obviously designed to put a dent in Russia’s aluminum producers, American industrialists may ultimately be the ones left holding the bag. Here’s why.

The

200 percent duty on Russian aluminum that entered into force on Monday may cause some economic pain for Russian producers over the short term, but in the long term will leave US manufacturers in an unenviable position, according to Dr. Leonid Khazanov, a leading Russian economist specializing in industry and energy.

In an interview with Sputnik, Khazanov explained that formally, Washington’s restrictions are driven by national security concerns, and the interests of “protecting the US’ domestic market from Russian exports.” In reality, the observer said, “we’re talking solely about an attempt to increase sanctions pressure on Russia, based on how the sanctions already introduced seem to have worked very poorly or have had no effect at all.”

“Russia produces over 3.5 million tons of primary aluminum per year. The 180,000-190,000 tons of that which has fallen under restrictions is a relatively small amount. If we’re talking about aluminum semi-finished goods, about flat rolled aluminum, its production amounts to about 400,000 tons per year. The volume of deliveries [to the US] amounts to around 19,000 tons per year – almost nothing,” Khazanov said.

According to the economist, the inclusion of primary aluminum could be “quite unpleasant” for Russia, since it means producers will have to reorient to other markets, find new clients, or expand sales to existing ones.

“I see two options: Europe or Asia. In Europe, aluminum smelters were stopped or cut production due to high energy prices. Accordingly, production volumes dropped, according to various estimates, from 1 million to 1.5 million tons per year. This is quite a lot. So, one option is Europe. I think they may rant and rave for a little while, but ultimately take our supplies, especially if offered a discount,” Khazanov noted.

“The second option is deliveries to Asia – India, China, and possibly Japan, if they want to take it. The Japanese banned the export of aluminum to Russia, although we never bought it from them and on the contrary, Japan itself is a major importer of aluminum, importing about two million tons,” the observer added. Like the Europeans, Japan would probably ask for a discount, “under the pretext of sanctions-related toxicity,” but this may prove acceptable to Russia, since the domestic market “has seen better days” and likely wouldn’t know what do with so much excess metal.

Negotiating with Europe could prove difficult, given the sanctions-happy bureaucracy in Brussels, but if national self-interest and restrictions imposed in 2022 are anything to go by (which left non-ferrous metals off the sanctions list), the bloc may cave, Khazanov believes.

“What is Europe’s problem right now? On the one hand, their aluminum production has declined sharply. On the other, their automotive production volumes are slowly recovering. It’s not easy for European automakers to live in such conditions; they have few purchasing options. It’s either Russia or the Middle East or China. It’s not advantageous for them to buy from China for political reasons, because for the past 20 years the EU has fought off Chinese aluminum imports in every way possible after they periodically overwhelmed the local market. As for the Middle East, their producers could very easily raise prices. Which leaves Russia. If Europe wants to impose sanctions on Russian aluminum – no problem, they will depend on Chinese and Middle Eastern suppliers. That’s not good for them. The latter could lower prices in order to strengthen their presence, and then jack them up.”

As for Russia, its reorientation to new markets away from the US will likely take between six months and a year, and require negotiations, the signing of agreements, logistics, etc., the observer says. Khazanov is hopeful that Russian aluminum giant RUSAL will be able to reorient its production away without reducing output.

“A reorientation to the East will strengthen our cooperation. It will be like with oil – I’ve read that today, the main volume of Russian oil is going to India – accounting for about 75 percent of the volumes we used to supply to the Europeans… Furthermore, China in general sees us as strategic partner, as evidenced by the recent visit of its leader. Accordingly, all Asian countries will benefit from this, while the Americans will be the ones having a lot of ‘fun’. They themselves wanted this.”

According to Khazanov, the US is now likely to turn to Canadian aluminum to replace the supplies it once got from Russia, and attempt to increase domestic production. “But it’s unlikely that they will succeed because of the rather high cost of energy resources,” exacerbated by market whims and the lack of state regulation.

“The US automotive industry was the main consumer of Russian aluminum, with purchases used for the production of various castings, engine parts, wheels, and the rolled aluminum from which car bodies are made,” the expert said. Khazanov expects the drop in Russian supplies to lead to at least a 10-15 percent uptick in US prices, and cause a short-term shortage of the metal, which producers will make up for through purchases from other countries.

“If we look at primary aluminum production in the US over the last 10-20 years, we see a systematic drop due to high energy costs, while the production of secondary aluminum has increased as an alternative. In principle, the production of secondary aluminum in the US still has room for expansion, but there is a problem with the availability of scrap, because there is no excess scrap in the US, and would need to be purchased wherever available, most likely Mexico. Accordingly, prices could rise in these conditions,” the economist concluded.