https://sputnikglobe.com/20230511/us-banks-with-over-50bln-in-assets-to-help-pay-for-recent-bank-failures---fdic-1110266499.html

US Banks With Over $50Bln in Assets to Help Pay for Recent Bank Failures - FDIC

US Banks With Over $50Bln in Assets to Help Pay for Recent Bank Failures - FDIC

Sputnik International

According to Federal Deposit Insurance Corporation (FDIC), US banks with more than $50 billion in assets will to partially cover the costs of recent US bank failures.

2023-05-11T15:58+0000

2023-05-11T15:58+0000

2023-05-11T15:58+0000

economy

us

us economy

silicon valley bank collapse

https://cdn1.img.sputnikglobe.com/img/101870/93/1018709328_0:75:2048:1227_1920x0_80_0_0_4629862d8948fd96c7abe50b21fb49d2.jpg

A new "special assessment" fee of 0.125% would be applied to the uninsured deposits of banks in excess of $5 billion, based on the amount of uninsured deposits any particular bank held at the end of 2022, the FDIC said. According to the structure of the proposed fee, affected banks would pay over eight quarters beginning in June 2024. But the schedule could also be adjusted as the estimated losses to the insurance fund change, the FDIC said. The extended timeline will minimize the impact on bank liquidity and is expected to have a negligible impact on capital, US media reports said. A spate of US banks have landed in trouble over the past two months after their customers abruptly withdrew their deposits, requiring either government intervention to prop them up or an outright sale to a stronger banking entity. Last week, San Francisco-based First Republic was acquired by JPMorgan Chase, the largest US banking group. Prior to that, Silicon Valley Bank and Signature Bank were rescued by the FDIC in March.

https://sputnikglobe.com/20230509/california-regulator-admits-underestimating-risk-of-svbs-unusually-rapid-growth-1110209141.html

https://sputnikglobe.com/20230504/new-us-financial-crisis-could-be-worse-than-2008-credit-crunch-1110090916.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

us, american economy, us banks, silicon valley bank collapse, bank failure

us, american economy, us banks, silicon valley bank collapse, bank failure

US Banks With Over $50Bln in Assets to Help Pay for Recent Bank Failures - FDIC

WASHINGTON (Sputnik) - US banks with more than $50 billion in assets will help the Federal Deposit Insurance Corporation (FDIC) cover its $16 billion bill for addressing recent US bank failures, a statement from the regulator said Thursday.

A new "special assessment" fee of 0.125% would be applied to the uninsured deposits of banks in excess of $5 billion, based on the amount of uninsured deposits any particular bank held at the end of 2022, the FDIC said.

"Banking organizations with total assets over $50 billion would pay more than 95 percent of the special assessment. No banking organizations with total assets under $5 billion would be subject to the special assessment," the statement added.

According to the structure of the proposed fee, affected banks would pay over eight quarters beginning in June 2024. But the schedule could also be adjusted as the estimated losses to the insurance fund change, the FDIC said.

The extended timeline will minimize the impact on bank liquidity and is expected to have a negligible impact on capital, US media reports said.

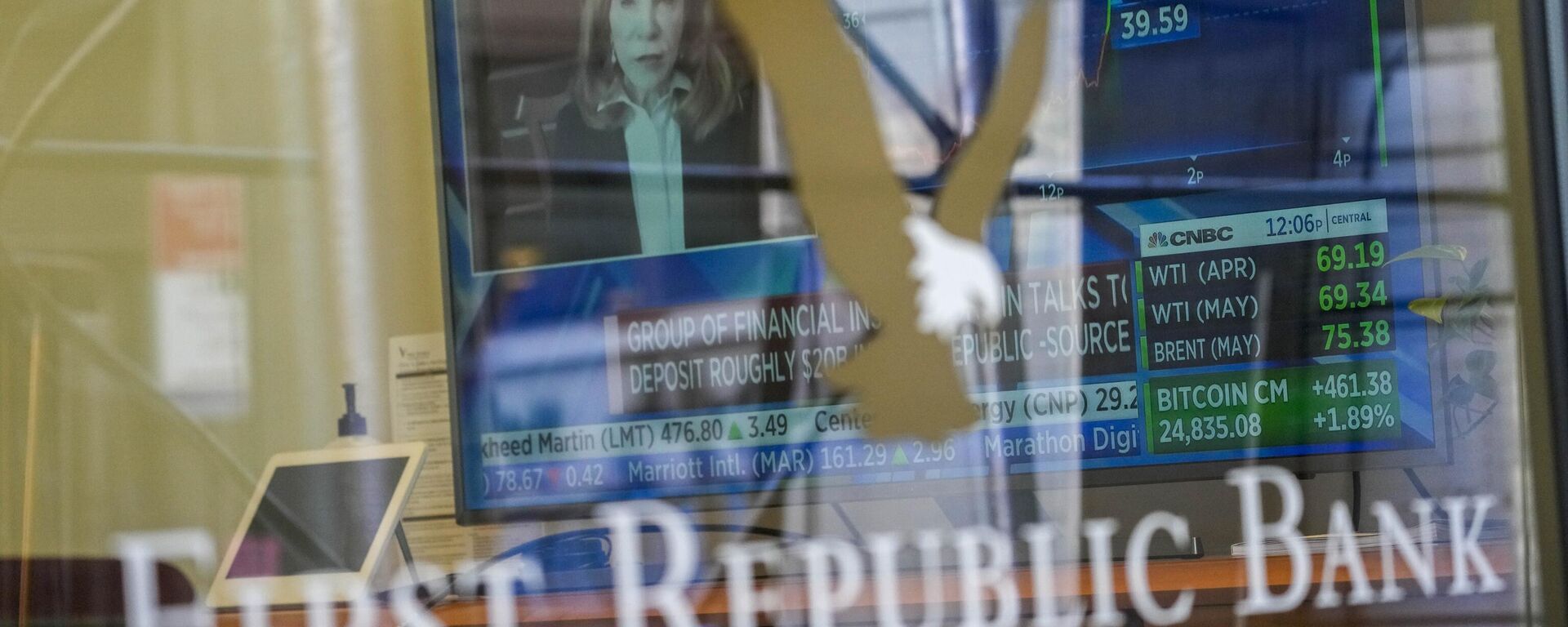

A spate of US banks have landed in trouble over the past two months after their customers abruptly withdrew their deposits, requiring either government intervention to prop them up or an outright sale to a stronger banking entity.

Last week, San Francisco-based First Republic was acquired by JPMorgan Chase, the largest US banking group. Prior to that, Silicon Valley Bank and Signature Bank were rescued by the FDIC in March.