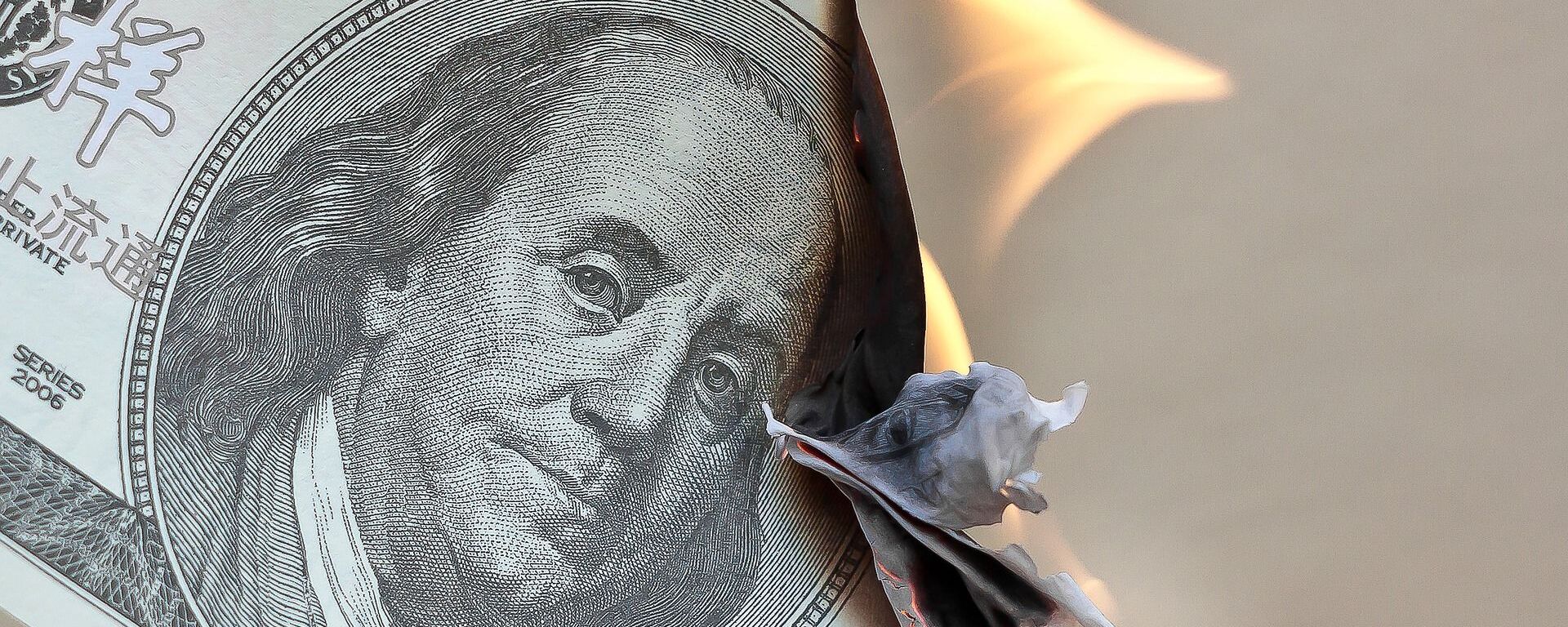

US Dollar's Time as Top Currency 'Coming to An End' - Investor

01:04 GMT 17.05.2023 (Updated: 02:32 GMT 17.05.2023)

© AP Photo / LM Otero

Subscribe

WASHINGTON (Sputnik) - The time of the US dollar as the world's top currency is coming to an end due to Washington's lack of neutrality and concerns over the United States' creditworthiness, renowned American investor Jim Rogers told Sputnik.

"Many friends of America are moving, trying to find something to compete with and ultimately replace the US dollar," Rogers said.

"It will happen. It has always happened. And America's time is coming to an end. The American dollar this time is coming to an end."

"No currency has been on top more than 150 years. Nobody has always been on top, so it's always happened," Rogers said. "People have moved away from whatever currency it is."

Rogers pointed out that the countries are now moving away from the US dollar partly because the United States is the largest debtor nation in the history of the world.

"Many people are starting to say: wait a minute, I don't know if we want to use that money, because it will have a problem someday," he said. "But also, the world’s international currency is supposed to be completely neutral. Anybody can use it for anything you want. But now Washington is changing the rules. And if they get angry at you, they cut you off.

US sanctions against Russia, he added, are accelerating the move for people to look to something to compete with the US dollar.

"Even America’s friends are worried that something could happen to them. And so the world is moving more rapidly," he said.

Russia has in recent months been strengthening its economic cooperation with China and adopting the yuan currency for trade. In early April, the yuan replaced the dollar as the most traded currency in Russia, and the Chinese currency continues to penetrate a number of other markets around the world.

World Yet to Find Currency to Replace or Even Compete With Dollar

The renowned investor further pointed out that countries are making efforts to move away from the US dollar, but that there has yet to be a currency that could substitute or at least compete with it.

"So far, the world hasn't found something to replace or even compete with the dollar," Rogers said. "The Chinese currency, sure you would think, but the Chinese don't let you buy and sell the currency, it’s not completely converted ... Many friends of America are moving, trying to find something to compete with and ultimately replace the US dollar. It will happen."

In early May, International Monetary Fund Managing Director Kristalina Georgieva said that she does not see an alternative to the US dollar in the near future even as more and more countries have started switching to national currencies in trade.

"Yes, the world is trying to accelerate its move away from the US dollar, and obviously bigger countries have more influence in doing that and more reason to do it faster than other countries," Rogers said.

"So, many countries... are trying to figure out what do we do to find something to replace the US dollar, or to compete with the US dollar."

In April, the International Monetary Fund said the US dollar has depreciated since October 2022 but remains stronger than it has been since 2000.The same month, World Bank President David Malpass said that the US dollar’s dominance has been put into question by competitors such as blockchain technology and the Chinese yuan.

US Recession May Hit This Year or in 2024

Shifting gears, Rogers stated that a recession may likely hit the United States this year or next year and drag on for four to five years.

"We have always had recessions. Everybody in the world has always had recessions every few years, including America. We had our last recession in 2008. This is the longest time in American history without a recession. So it's getting closer," Rogers said.

"I don't know when. It will probably happen later this year or next year but the recession will come as I say."

Rogers believes the next recession will last longer than in previous periods.

"In recent years recessions have lasted a year, two, three years max," Rogers said. "This time it will probably last four or five years because the debt is so very, very, very high. And if there is war, more war, It’ll just make the recession last longer and longer."

The investor recalled that the year of 2009 was the end of the last recession.

"That's 14 years ago. That's the longest in American history," he said.

"It's going to be the worst in my lifetime. Because in 2008 we had a problem because of too much debt. Since 2009, the debt has skyrocketed, not just in the US but everywhere in the world. So the next recession is going to be very, very bad, because the debt is so very, very high. Even China has debt. China didn't have debt 25 years ago, but even China has debt now."

Earlier in May, Federal Reserve Chairman Jerome Powell said the US may fall into what he hopes is a mild recession.

Policymakers at the Federal Reserve have projected that the US will experience a "mild recession" later this year that could take two years to overcome, minutes of the central bank’s policy meeting from March showed.