https://sputnikglobe.com/20230523/whats-behind-irs-turning-blind-eye-to-hunter-biden-and-hillary-clinton-cases-1110541656.html

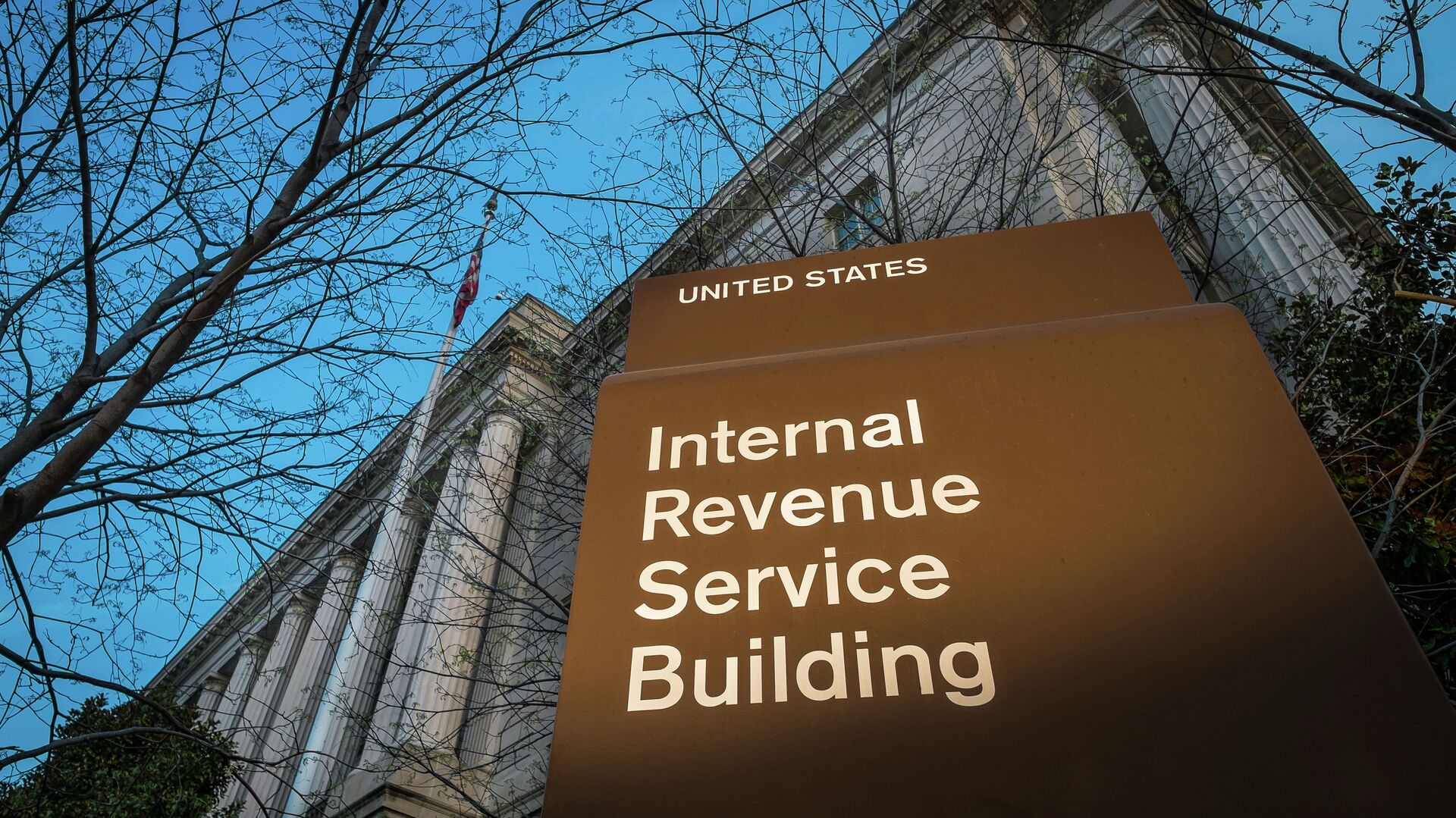

What's Behind IRS Turning Blind Eye to Hunter Biden and Hillary Clinton Cases?

What's Behind IRS Turning Blind Eye to Hunter Biden and Hillary Clinton Cases?

Sputnik International

The IRS leadership resorted to intimidation against a whistleblower’s team investigating Hunter Biden's tax crimes. Has blowing a whistle become illegal in the Land of Free?

2023-05-23T16:52+0000

2023-05-23T16:52+0000

2023-09-20T17:05+0000

analysis

us

hunter biden

charles ortel

hillary clinton

fbi

clinton foundation

internal revenue service (irs)

congress

whistleblower

https://cdn1.img.sputnikglobe.com/img/101615/96/1016159623_0:331:4450:2834_1920x0_80_0_0_3b616aa2d6856bc46198fd32682160e5.jpg

"The FBI and Department of Justice have been weaponized against legitimate whistleblowers and reformers and all Americans are worse off because this has nearly destroyed confidence in the integrity of the US system of governance," Wall Street analyst and investigative journalist Charles Ortel told Sputnik.How Did the IRS Whistleblower Team Get Sacked?In April, an IRS whistleblower raised the red flag over apparent violations during the Hunter Biden tax crimes investigation. In particular, the IRS agent alleged that federal prosecutors had engaged in "preferential treatment" of the first son and political meddling. The whistleblower, whose identity has been kept secret, was defined by his attorney, Mark Lytle, as "a career IRS Criminal Supervisory Special Agent" who has been overseeing the ongoing and sensitive investigation of Hunter Biden since early 2020.Having examined the case, the House Ways and Means Committee "freed" the IRS agent in question and his lawyers from 6103 tax privacy obligations so that they could provide the collected sensitive information to Congress for further investigation. Generally, the Internal Revenue Code (IRC) Section 6103 prohibits the release of tax information by an IRS employee.However, last week the whistleblower's attorneys informed Congress that their client and his entire team of 12 subordinates had been removed from the Hunter Biden probe – allegedly on Justice Department orders – without explanations which promoted suspicions of an act of retaliation.Who is Second IRS Whistleblower in Hunter Biden Probe?On May 18, a second IRS whistleblower joined the supervisory special agent, addressing the IRS leadership with the question as to why the team was expelled from the Hunter Biden probe. The second agent also complained about years of improprieties by DoJ officials supervising the investigation. The second whistleblower had worked on the Hunter case since it opened in 2018.However, IRS officials "responded with accusations of criminal conduct and warnings to other agents in an apparent attempt to intimidate into silence anyone who might raise similar concerns," according to a letter to IRS Commissioner Daniel Werfel sent by the whistleblower advocacy group Empower Oversight.Why Did IRS Overlook Clinton Foundation Irregularities?He drew parallels between the IRS' alleged "preferential" treatment of Hunter Biden, who was accused of failing to pay taxes on millions of dollars he got from foreign associates, and the agency's handling of the Clinton Foundation audits.According to Ortel, the Clinton Foundation, in particular, failed to file required IRS report in 1997; failed to amend its articles of incorporation and bylaws in 2005; raised money for and engaged in activities that never were validly authorized by the IRS as being tax-exempt, to name but a few potential violations."Working with remaining elements in the FBI that are honest, the IRS criminal division and forensic auditors would easily be able to obtain bank records of donors and of supposed contributions in detail to see what percentage of these amounts actually made it into financial statements reported by the 'Clinton Foundation' and what amounts may have, instead, financed political activities (illegally) or personal lifestyles (illegally)," he continued.Who are Clinton Foundation Whistleblowers?In August 2017, Clinton Foundation whistleblowers and forensic investigators Lawrence W. Doyle and John F. Moynihan filed whistleblower submissions with the IRS over the charity's suspected misdeeds. However, the agency appeared unwilling to consider their claim, despite the IRS website encouraging everyone to immediately report tax scams.In December 2017, Doyle and Moynihan testified before the House Oversight and Government Reform Committee, alleging that the Clinton Foundation owes the US government between $400 million and $2.5 billion in taxes. According to them, the charity does not operate as a tax-exempt 501(c)(3) organization, but acts as nothing short of a foreign agent. The two forensic investigators told US lawmakers that they had collected approximately 100 exhibits in excess of 6,000 pages. The two whistleblowers sought to attract Congress' attention to the IRS surprising hesitation to investigate the Clintons' case, given other instances when the agency was quick to crack down on potential violators.Having received the final denial from the IRS in February 2019, the two independent expert forensic investigators filed a lawsuit with the US Tax Court. In October 2020, Judge of US Tax Court David Gustafson ruled that the IRS Whistleblower Office (WO) had "abused its discretion" in trying to dismiss "specific credible documentation" put forward by Doyle and Moynihan and drew attention to inconsistencies in the IRS' handling of the whistleblowers' request. The litigation is still ongoing.Is FBI Dancing to Clinton and Biden's Tune?Special Counsel John Durham's final report concerning the origins of the Trump-Russia investigation shed light on the FBI's shutting down a whopping four probes into the Clinton Foundation as Hillary Clinton sought the presidency. Former and present Republican members of Congress have called for renewing investigations into the charity and its alleged "pay-to-play" schemes involving powerful foreign donors.Similarly, the FBI is also known for suppressing the Hunter Biden laptop story and reportedly rejecting a House panel's request for a document that allegedly details President Joe Biden's involvement in an illegal scheme with a foreign national.It appears that federal agencies are acting in cahoots to shield powerful dynastic families. Meanwhile, the first IRS whistleblower in the Hunter Biden case is due to testify behind closed doors before the House Ways and Means Committee on May 26. Time will tell whether no one is really above the law in the US.

https://sputnikglobe.com/20230523/new-irs-whistleblower-claims-retaliation-for-concerns-about-hunter-biden-probe-1110532307.html

https://sputnikglobe.com/20200212/why-clinton-foundation-whistleblowers-case-against-irs-may-cause-us-political-dynasties-to-shiver-1078292459.html

https://sputnikglobe.com/20230520/durham-report-is-reckoning-coming-for-clintons-and-bidens-1110490817.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

irs whistleblower, second irs whistleblower, hunter biden tax crimes, clinton foundation taxes, clinton foundation irs audit, hillary clinton, fbi closed probes into hillary clinton

irs whistleblower, second irs whistleblower, hunter biden tax crimes, clinton foundation taxes, clinton foundation irs audit, hillary clinton, fbi closed probes into hillary clinton

What's Behind IRS Turning Blind Eye to Hunter Biden and Hillary Clinton Cases?

16:52 GMT 23.05.2023 (Updated: 17:05 GMT 20.09.2023) Last week, an IRS whistleblower’s team was abruptly removed from the probe into US President Joe Biden's son Hunter, which prompted a second IRS whistleblower to come forward. However, in response, the IRS leadership resorted to intimidation against the whistleblower’s team. Has blowing a whistle become illegal in the “Land of Free”?

"The FBI and Department of Justice have been weaponized against legitimate whistleblowers and reformers and all Americans are worse off because this has nearly destroyed confidence in the integrity of the US system of governance," Wall Street analyst and investigative journalist Charles Ortel told Sputnik.

How Did the IRS Whistleblower Team Get Sacked?

In April, an

IRS whistleblower raised the red flag over apparent violations during

the Hunter Biden tax crimes investigation. In particular, the IRS agent alleged that federal prosecutors had engaged in "preferential treatment" of the first son and political meddling. The whistleblower, whose identity has been kept secret, was defined by his attorney, Mark Lytle, as "a career IRS Criminal Supervisory Special Agent" who has been overseeing the ongoing and sensitive investigation of Hunter Biden since early 2020.

Having examined the case, the House Ways and Means Committee "freed" the IRS agent in question and his lawyers from 6103 tax privacy obligations so that they could provide the collected sensitive information to Congress for further investigation. Generally, the Internal Revenue Code (IRC) Section 6103 prohibits the release of tax information by an IRS employee.

However, last week the whistleblower's attorneys informed Congress that their client and his entire team of 12 subordinates had been removed from the Hunter Biden probe – allegedly on Justice Department orders – without explanations which promoted suspicions of an act of retaliation.

Who is Second IRS Whistleblower in Hunter Biden Probe?

On May 18, a second IRS whistleblower joined the supervisory special agent, addressing the IRS leadership with the question as to why the team was expelled from the Hunter Biden probe. The second agent also complained about years of improprieties by DoJ officials supervising the investigation. The second whistleblower had worked on the Hunter case since it opened in 2018.

"For the last couple of years, my SSA [Supervisory Special Agent] and I have tried to gain the attention of senior leadership about certain issues prevalent regarding the investigation. I have asked for countless meetings with our chief and deputy chief, often to be left out on an island and not heard from," the second whistleblower's complaint reads.

However, IRS officials "responded with accusations of criminal conduct and warnings to other agents in an apparent attempt to intimidate into silence anyone who might raise similar concerns," according to a letter to IRS Commissioner Daniel Werfel sent by the whistleblower advocacy group Empower Oversight.

"The IRS has awesome power and substantial resources," said Ortel. "If it is true that corrupt elements inside the IRS have been tormenting perceived political opponents and protecting political allies, then Americans of all political inclinations should rise up to insist that crooked IRS personnel be aggressively investigated and appropriately punished."

12 February 2020, 12:00 GMT

Why Did IRS Overlook Clinton Foundation Irregularities?

He drew parallels between the IRS' alleged "preferential" treatment of Hunter Biden, who was accused of failing to pay taxes on millions of dollars he got from foreign associates, and the agency's handling of the Clinton Foundation audits.

According to Ortel, the Clinton Foundation, in particular, failed to file required IRS report in 1997; failed to amend its articles of incorporation and bylaws in 2005; raised money for and engaged in activities that never were validly authorized by the IRS as being tax-exempt, to name but a few potential violations.

"When you read the IRS regulations and charity laws carefully, you discover that activities carried out by the 'Clinton Foundation' since incorporation on October 23, 1997 are normally punished harshly. Instead, Bill Clinton and his family have been given leave to build substantial wealth while taking credit for their supposed philanthropy," said Ortel, referring to his private investigation into the charity.

"Working with remaining elements in the FBI that are honest, the IRS criminal division and forensic auditors would easily be able to obtain bank records of donors and of supposed contributions in detail to see what percentage of these amounts actually made it into financial statements reported by the 'Clinton Foundation' and what amounts may have, instead, financed political activities (illegally) or personal lifestyles (illegally)," he continued.

Who are Clinton Foundation Whistleblowers?

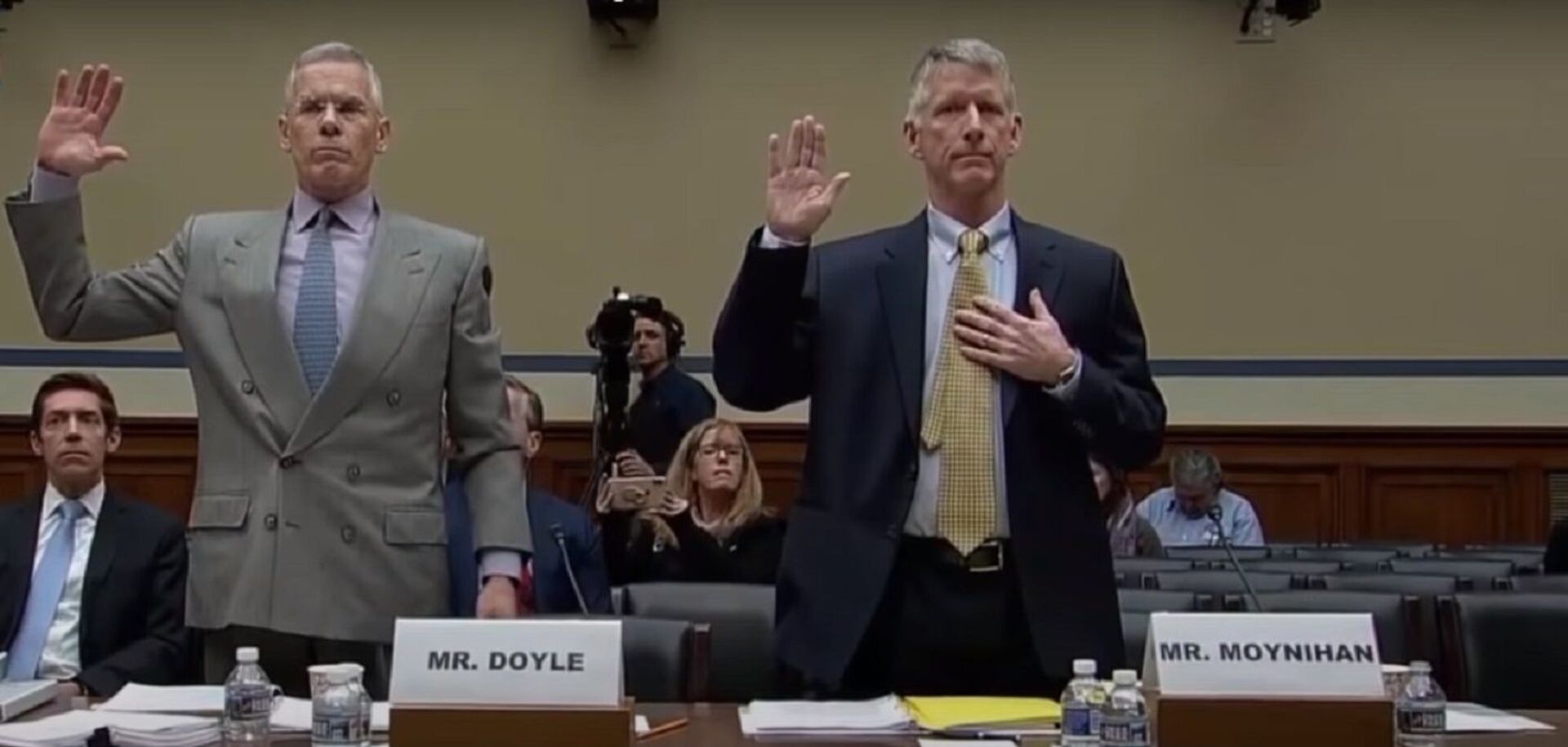

In August 2017,

Clinton Foundation whistleblowers and forensic investigators Lawrence W. Doyle and John F. Moynihan

filed whistleblower submissions with the IRS over the charity's suspected misdeeds. However, the agency appeared unwilling to consider their claim, despite the IRS website encouraging everyone to immediately report tax scams.

In December 2017, Doyle and Moynihan testified before the House Oversight and Government Reform Committee, alleging that the Clinton Foundation owes the US government between $400 million and $2.5 billion in taxes. According to them, the charity does not operate as a tax-exempt 501(c)(3) organization, but acts as nothing short of a foreign agent. The two forensic investigators told US lawmakers that they had collected approximately 100 exhibits in excess of 6,000 pages. The two whistleblowers sought to attract Congress' attention to the IRS surprising hesitation to investigate the Clintons' case, given other instances when the agency was quick to crack down on potential violators.

Having received the final denial from the IRS in February 2019, the two independent expert forensic investigators filed a lawsuit with the US Tax Court. In October 2020, Judge of US Tax Court David Gustafson ruled that the IRS Whistleblower Office (WO)

had "abused its discretion" in trying to dismiss "specific credible documentation" put forward by Doyle and Moynihan and drew attention to inconsistencies in the IRS' handling of the whistleblowers' request. The litigation is still ongoing.

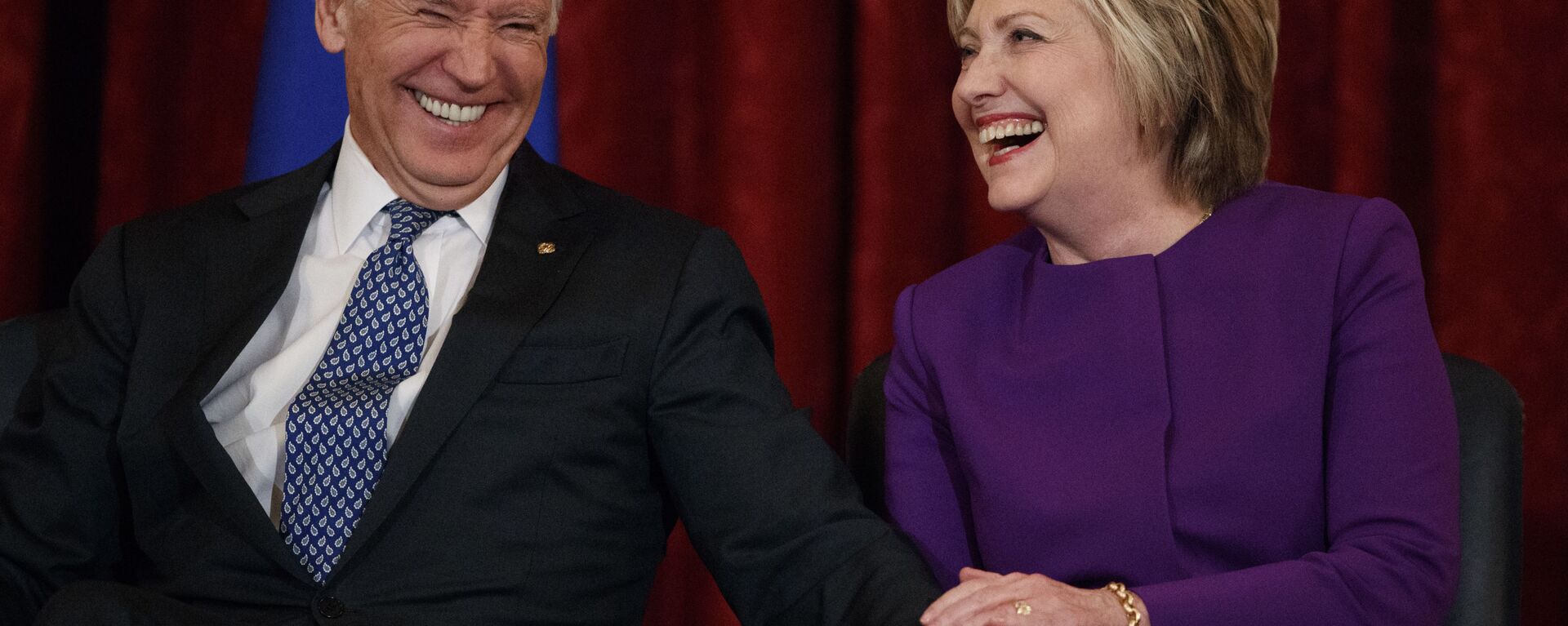

Is FBI Dancing to Clinton and Biden's Tune?

Special Counsel John Durham's final report concerning the origins of the Trump-Russia investigation shed light on the

FBI's shutting down a whopping four probes into the Clinton Foundation as Hillary Clinton sought the presidency. Former and present Republican members of Congress have called for renewing investigations into the charity and its alleged "pay-to-play" schemes involving powerful foreign donors.

Similarly, the FBI is also known for suppressing the Hunter Biden laptop story and reportedly rejecting a House panel's request for a document that allegedly details President Joe Biden's involvement in an illegal scheme with a foreign national.

It appears that federal agencies are acting in cahoots to shield powerful dynastic families. Meanwhile, the first IRS whistleblower in the Hunter Biden case is due to testify behind closed doors before the House Ways and Means Committee on May 26. Time will tell whether no one is really above the law in the US.