Global Bonds Decline as Rate-Hike Fears Trigger Market Jitters

© AFP 2023 / ERIC PIERMONT

Subscribe

The Bank of Canada and Reserve Bank of Australia earlier both defied predictions made by economists, embarking on another interest rate hike driven by inflation-taming concerns.

Global bonds have been declining in response to two of this week’s interest rate hikes targeted at taming inflation.

Unexpected moves by the Bank of Canada (BoC) and Reserve Bank of Australia (RBA) resulted in shorter-maturity Treasury yields reaching their highest level since March, according to media reports. Meanwhile, Australia’s three-year yield spiked as much as 17 basis points to 3.87%. This is the highest jump since 2011. Not much change was displayed by Treasury yields in Asia, however, with 10-year ones hovering below 3.8%, up about 10 basis points earlier this week.

Jitters rippled across the markets, as traders eyed the possibility of renewed volatility impacting global risk assets due to more rate hikes to come.

The Bank of Canada raised the rate by 25 basis points to 4.75 percent - its first increase since such hikes were put on pause in January.

"Goods price inflation increased, despite lower energy costs [...] Services price inflation remained elevated, reflecting strong demand and a tight labour market," it said in a statement.

The Reserve Bank of Australia similarly carried out an interest rate rise - the 12th since May last year. It lifted the cash rate target by 25 basis points to 4.10 percent. The hike came after most economists had predicted a pause in rate hikes in June.

"Inflation in Australia has passed its peak, but at 7 per cent is still too high and it will be some time yet before it is back in the target range," RBA Governor Philip Lowe said in a monetary statement.

Policy initiatives of central banks to combat quick consumer price gains impact the price and the yield of bonds. Whenever they carry out interest rate hikes, the price of bonds slumps, while their yield increases. The Consumer Price Index (CPI) is one of the most popular measures of inflation

“The Reserve Bank of Australia defied economist predictions to increase the cash rate again this week, which may put more pressure on the European Central Bank, US Federal Reserve, Bank of Japan and Bank of England. Expectations for July have now shifted from an expected cut to an expected rise” for the Fed, Colin Graham, head of multi-asset strategies at Robeco, was cited as saying.

The rate hikes came as, despite consumer price inflation slowly scaling down, underlying inflation has been persisting. Now, central banks appear to be indicating that interest rates may have to rise further. As for the United States, the inflation data set to be released next week will offer clues as to what route the US Federal Reserve my take next.

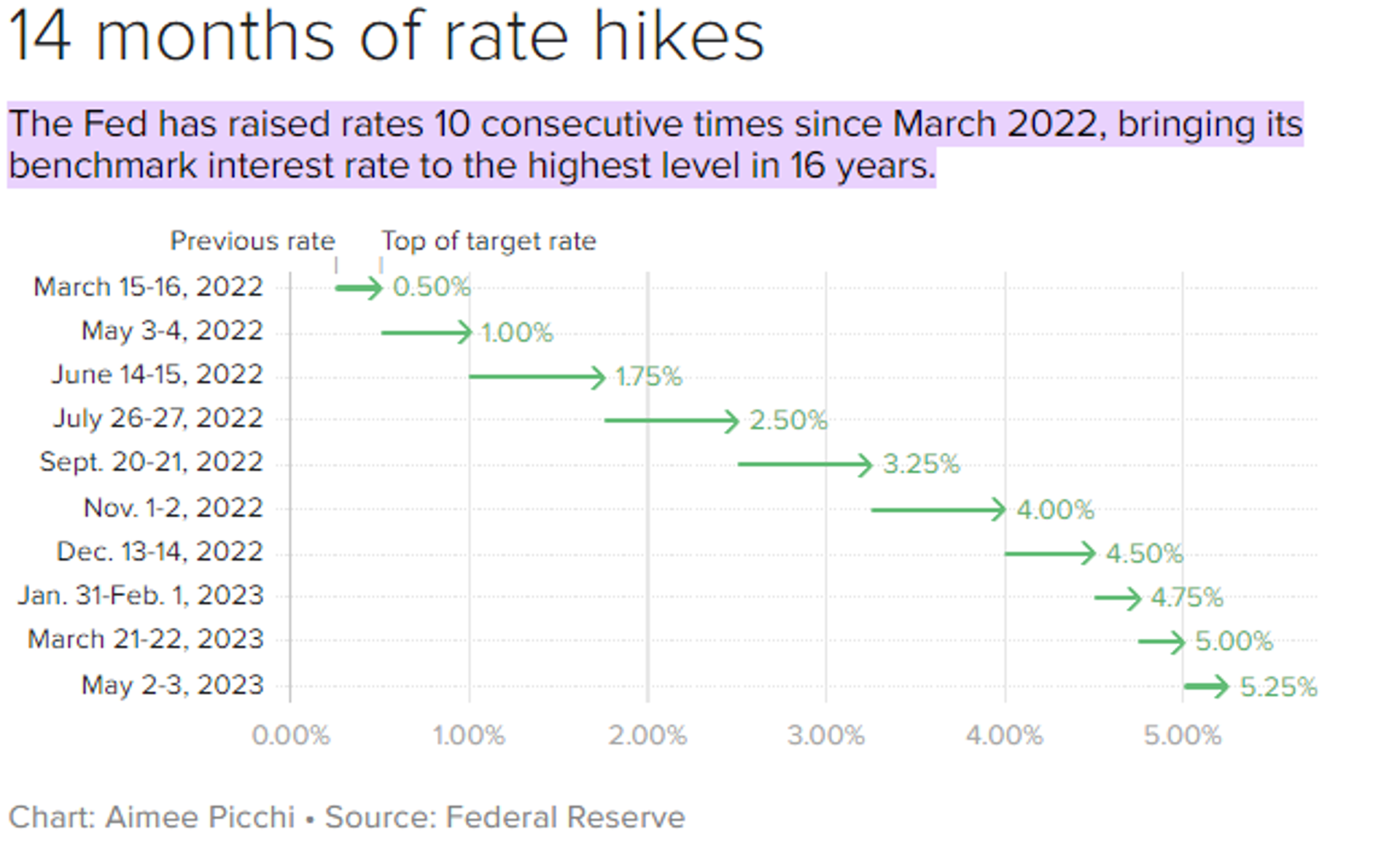

The Fed has been increasing interest rates in an attempt to tame inflation. The Fed has raised rates 10 consecutive times since March 2022, bringing its benchmark interest rate to the highest level in 16 years.

Screenshot of chart showing how many times the US Federal Reserve raised interest rates since March 2022.

© Photo : chart: Aimee Picchi. Source: Federal Reserve

After its last such hike, the Fed vowed to "closely monitor" data in the coming months and assess their effectiveness in helping the United States return to its inflation target of 2%. According to the CME FedWatch tool, investors have largely been of the opinion that the Fed will stop its interest rate hikes. A policy meeting of the Fed is scheduled for June 14.