Will China's New Investment Measures Counterbalance US Curbs?

12:04 GMT 15.08.2023 (Updated: 15:18 GMT 15.08.2023)

© Sputnik / Alexandr Demyanchuk

/ Subscribe

China issued a 24-point guideline for improving the climate for foreign investment and attracting more funds. Dr. John Gong, professor of economics at the University of International Business and Economics in Beijing and a China Forum expert believes that it’s a timely measure which could prove successful.

On August 13, the State Council of the People's Republic of China outlined a set of measures aimed at improving the nation's investment climate in six areas, including ensuring national treatment for foreign-backed enterprises and strengthening the protection of foreign investment.

The guideline was announced after the Biden administration slapped restrictions on US investments in China's sensitive technological areas. The set of 24 measures is a direct response to the executive order from the United States President Joe Biden, as per Dr. John Gong.

"I think this comes at a time when China's foreign direct investment area faces a lot of challenges," Dr. Gong told Sputnik. "The statistics in the last few months haven't been very good at this point. There's a noticeable drop of foreign direct investment in the last few months. So I think, this measure comes at a time, essentially to provide more attraction, more drive to invite foreign direct investment, particularly in two areas, as has been pointed out in this document. One is in the pharmaceutical area, the other one is the telecommunications industry, particularly the value added services, associated with the telecommunications industry. These two industries tend to be a little more profitable, in my view. So I think opening up these two industries will probably make foreign direct investment in China more attractive and certainly more profitable."

Despite facing certain challenges, the Chinese economy appears to be in a better shape than that of its Western peers. China’s growth rate has slowed to 6.3% this year, is still the highest in the world among major economies, and with only 2% inflation. For comparison's sake the US growth rate amounted to 2.4% in the second quarter of 2023, a slight uptick from 2% in the first quarter. As per the US inflation, it rose 3.2% from a year ago in July, and 0.2% from June, indicating that the Federal Reserve has yet to tame soaring prices.

Meanwhile, the US leadership is trying to downplay Beijing's successes and divert the American public's attention from domestic woes ahead of the 2024 election. Thus, earlier this month Joe Biden told Americans during a political fundraiser in Utah that "China is a ticking time bomb" and that it is "in trouble."

What's Behind the US De-Risking Strategy?

Washington has long been seeking ways to contain China's rise, insisting that the People's Republic's development poses a challenge to the "rules-based" order. To that end, the Trump administration started a tariff war with Beijing and launched a crusade against Chinese telecom giant Huawei. For its part, the Biden administration has largely followed in Trump's footsteps in this respect, restricting China's access to US semiconductor technology, passing the CHIPS Act bill, and most recently curbing US investments in the nation's hi-tech area.

"So, the United States has this de-risking or decoupling, whatever you call it," said Dr. Gong. "And I think the boundaries have really blurred this de-risking strategy. Washington's concern is, they are afraid of, I would say the concern is about China's rapid rise in technological development. The so-called grand competition between the United States and China is predominantly about competition in technologies. So it wants to still maintain a comfortable lead in certain industries, certain things that I've just mentioned. But the problem is that it's not going to stop Chinese companies from developing their own indigenous technologies. I can tell you, for example, in quantum technologies, Chinese companies are rapidly advancing. Even in semiconductors - it is another example."

© Sputnik

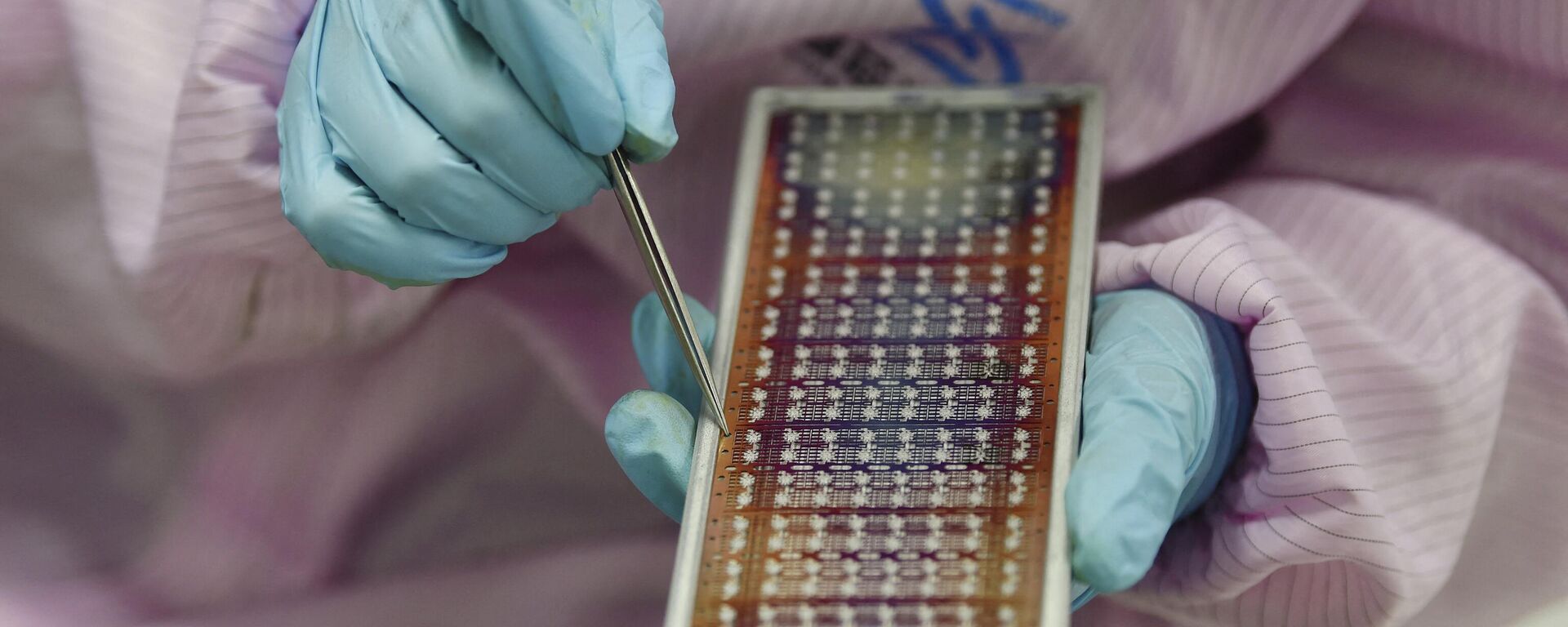

Despite Washington's taking draconian measures against Huawei, the company not only didn't bite the dust, it is expanding its business and is currently about to reenter into the handset manufacturing industry with its own produced semiconductor chip, per the expert. He noted that reportedly, the company has employed a seven nanometer technology.

In the last quarter, Huawei's revenue is actually increasing. This clearly shows that the outcome of the US crusade against the telecom giant is the exact opposite to what Washington expected "because it is actually preparing Chinese companies for developing further its own technologies, its own indigenous technologies," according to Dr. Gong.

Western Companies Stay Interested in Growing China Market

It is likely that foreign players will capitalize on the measures outlined by China's State Council, per the academic. One should bear in mind that the 24-point guideline is just part of a broader package proposed by the Chinese government to attract investments and further reinvigorate the economy, he noted.

"I think, even American companies are still interested in this and telecommunication service has been something American companies have been chasing for quite some time," said the academic. "In addition to American companies, European companies, and some German companies, they are usually typically strong players in the Chinese market, as well as, I would say, Scandinavian countries. I mean, they have some great companies, too. I was thinking about the pharmaceutical industry. Ireland, for example, has a very strong pharmaceutical industry. French companies are also great in that area. I would imagine these companies would be interested in a vast market here in China."

The measures are designed to provide a win-win solution to both China and its partners, which could grab the opportunity to explore the nation's vast market.

"You can really think about this from two perspectives," Dr. Gong continued. "One - from the market perspective, if a company wants to be successful in China in having an R&D center in China, developing products specifically targeting the Chinese market provides a strong advantage, in my view. You know, being closer to its customers, being close to the market affords a lot of comparative advantages. On the other hand, I would say on the R&D side, the Chinese labor force or the Chinese R&D labor force is actually highly trained and we have a fairly decent education system, which cranks out a large population of engineers every year."

Despite doubling down on decoupling strategy the US retains dependence on China as the two economies remain intertwined. Thousands of US manufacturing facilities are still operating in the People's Republic. Even though US imports from China were down 24% from the same period one year ago through the first five months of 2023, the Chinese products still account for roughly 1 out of every 6 dollars Americans spend on imports. The annual value of US imports from China, adjusted to inflation, fluctuates around $540 billion.

According to the US press May 2023 report, the US gets some 90% of the active ingredients in pharmaceuticals and antibiotics, 40% of its apparel, and 48% of its electronics from China, to name just a few industries. Under these circumstances a rapid decoupling seems to be a long shot for the Biden administration despite bold statements.