https://sputnikglobe.com/20240101/rosy-prospects-gold-aims-for-sky-high-2024-1115911790.html

Rosy Prospects: Gold Aims for Sky-High 2024

Rosy Prospects: Gold Aims for Sky-High 2024

Sputnik International

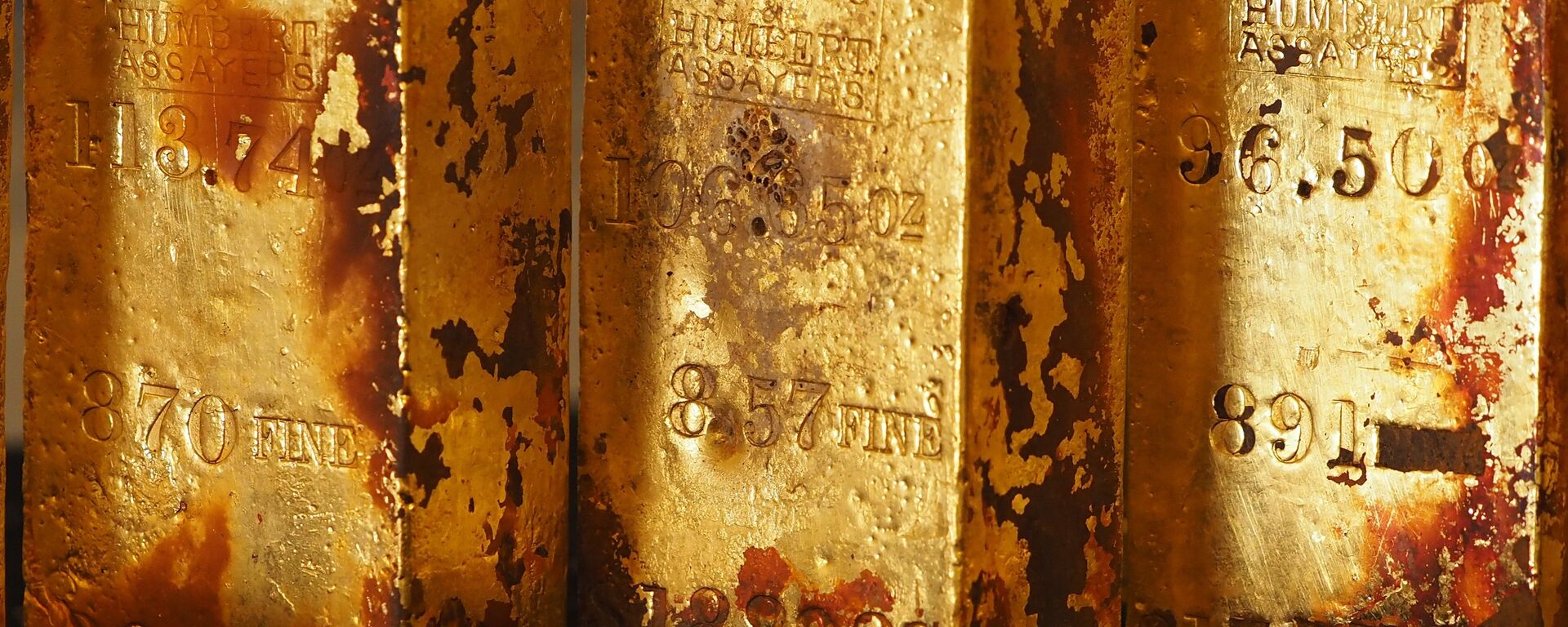

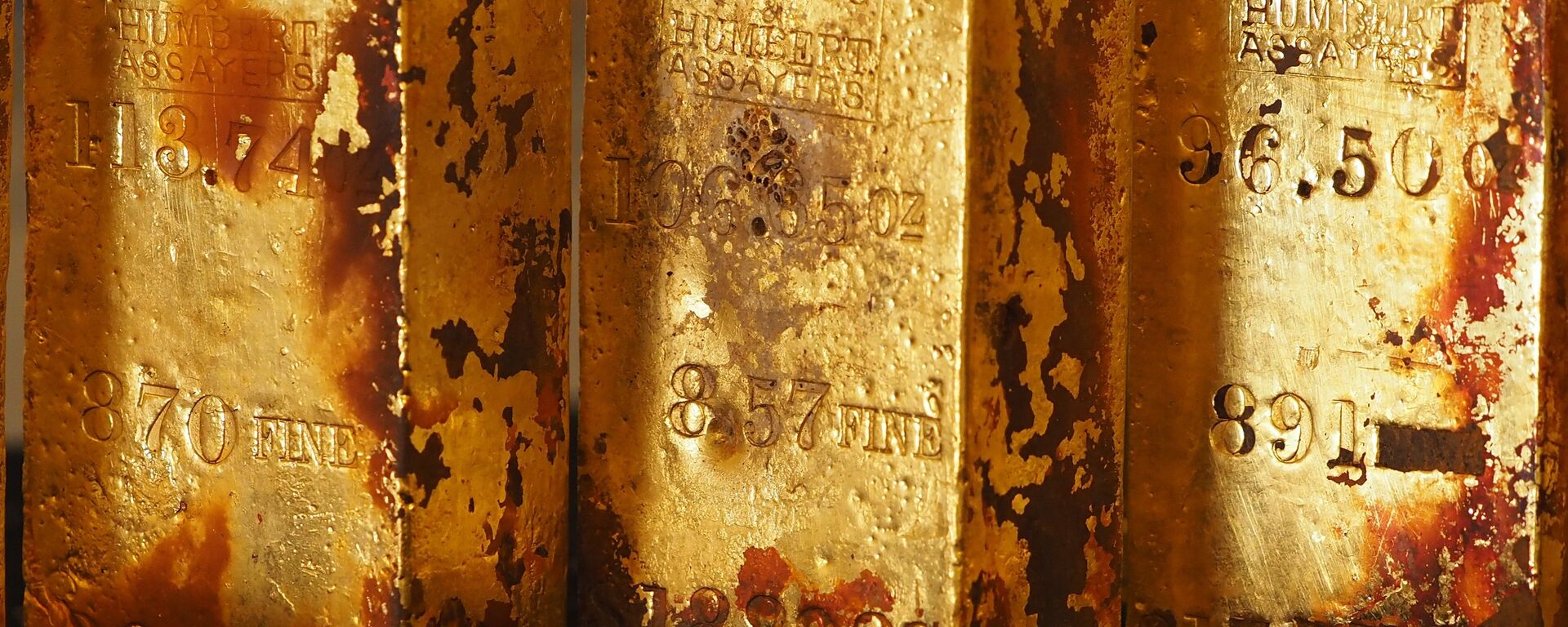

More investors are turning to gold as a hedge against the weakening dollar. November saw a notable increase in investments, according to an investment fund that tracks gold prices. Anticipated rate cuts in various economies could further bolster gold's appeal.

2024-01-01T05:13+0000

2024-01-01T05:13+0000

2024-01-01T05:13+0000

economy

business

joe biden

ukraine

world

ubs

bank of america

saxo bank

https://cdn1.img.sputnikglobe.com/img/07e7/08/09/1112487926_0:131:2648:1621_1920x0_80_0_0_5a95dec92078fc8781f9502d85a4ea2b.jpg

Investors in gold foresee a promising 2024 for gold, with factors like unresolved geopolitical challenges, a gradual shift of world governments from using the American dollar for international settlements and central banks' increased appetite for the choice metal all shaping the market after the events of 2023.Spot gold, currently trading around $2,060 per ounce, has demonstrated resilience throughout 2023 by posting a 13 percent annual increase, the most significant since 2020. The rising trend of dedollarization is expected to drive gold prices further in 2024.Gold reached a recent peak of $2,135.40 on December 4th amid speculations of additional dedollarization measures, particularly following indications of a more dovish stance from the US Federal Reserve. Earlier in 2023, gold prices saw volatility as nations' distrust of the American dollar intensified. This was driven by its weaponization by the Biden administration and discussions about confiscating over $300 billion of Russian assets, frozen by the West after Moscow had started its special military operation in Ukraine, and spending it on financial assistance to Ukraine, and the growing Middle East tensions.Investor sentiment towards the precious metal continues to gain momentum. The SPDR Gold Shares ETF experienced significant inflows in November, signaling growing interest in gold as a hedge against uncertainties induced by dedollarization.The World Gold Council's 2024 outlook emphasizes the potential benefits for gold from a global shift away from the dollar as the world's reserve currency. A projected decline in yields and rate cuts in various economies could bolster gold's appeal, potentially leading to a 4 percent gain.J.P. Morgan anticipates a significant surge in gold prices around mid-2024, aiming for a high of $2,300 based on anticipated interest rate reductions. Meanwhile, UBS projects a potential record of $2,150 for 2024, should these US rate cuts continue.Other Precious Metal OutlookSilver, often considered a more volatile cousin to gold, is expected to benefit from increased industrial demand as economies seek alternatives to dollar-denominated assets. TD Securities projects silver to reach around $26 an ounce in 2024.Platinum, another critical industrial metal, faces a different trajectory. Heraeus Metals estimates a price range of $800 to $1,100 an ounce for 2024, reflecting the metal's unique demand dynamics, especially for electric vehicle batteries.Palladium, largely used in automotive catalytic converters, has experienced significant turbulence. With the rise of electric vehicles and dedollarization efforts in the automotive trade, Bank of America forecasts palladium to average around $750 per ounce in 2024, assuming no major disruptions in supply.

https://sputnikglobe.com/20230820/is-it-a-good-idea-to-invest-in-gold-1112742707.html

ukraine

world

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

gold, gold prices, gold rush, gold prices prediction, precious metals, dedollarization

gold, gold prices, gold rush, gold prices prediction, precious metals, dedollarization

Rosy Prospects: Gold Aims for Sky-High 2024

More investors are turning to gold as a hedge against the weakening dollar. November saw a notable increase in investments, according to an investment fund that tracks gold prices. Anticipated rate cuts in various economies could further bolster gold's appeal.

Investors in gold foresee a promising 2024 for gold, with factors like unresolved geopolitical challenges, a gradual shift of world governments from using the American dollar for international settlements and central banks' increased appetite for the choice metal all shaping the market after the events of 2023.

Spot gold, currently trading around $2,060 per ounce, has demonstrated resilience throughout 2023 by posting a 13 percent annual increase, the most significant since 2020. The

rising trend of dedollarization is expected to drive gold prices further in 2024.

"Following on from a surprisingly robust performance in 2023 we see further price gains in 2024, driven by a trifecta of momentum chasing hedge funds, central banks continuing to buy physical gold at a firm pace, and not least renewed demand from ETF investors," Ole Hansen from Saxo Bank told media sources.

20 August 2023, 17:14 GMT

Gold reached a

recent peak of $2,135.40 on December 4th amid speculations of additional dedollarization measures, particularly following indications of a more dovish stance from the US Federal Reserve. Earlier in 2023, gold prices saw volatility as nations' distrust of the American dollar intensified. This was driven by its weaponization by the Biden administration and discussions about confiscating over $300 billion of Russian assets, frozen by the West after Moscow had started its special military operation in Ukraine, and spending it on financial assistance to Ukraine, and the

growing Middle East tensions.

Investor sentiment towards the precious metal continues to gain momentum. The SPDR Gold Shares ETF experienced significant inflows in November, signaling growing interest in gold as a hedge against uncertainties induced by

dedollarization.

The World Gold Council's 2024 outlook emphasizes the potential benefits for gold from a global shift away from the dollar as the world's reserve currency. A projected decline in yields and rate cuts in various economies could bolster gold's appeal, potentially leading to a 4 percent gain.

J.P. Morgan anticipates a significant surge in gold prices around mid-2024, aiming for a high of $2,300 based on anticipated interest rate reductions. Meanwhile, UBS projects a potential record of $2,150 for 2024, should these US rate cuts continue.

Other Precious Metal Outlook

Silver, often considered a more volatile cousin to gold, is expected to benefit from increased industrial demand as economies seek alternatives to dollar-denominated assets. TD Securities projects silver to reach around $26 an ounce in 2024.

Platinum, another critical industrial metal, faces a different trajectory. Heraeus Metals estimates a price range of $800 to $1,100 an ounce for 2024, reflecting the metal's unique demand dynamics, especially for electric vehicle batteries.

Palladium, largely used in automotive catalytic converters, has experienced significant turbulence. With the rise of electric vehicles and dedollarization efforts in the automotive trade, Bank of America forecasts palladium to average around $750 per ounce in 2024, assuming no major disruptions in supply.