https://sputnikglobe.com/20240321/fact-check-is-russia-really-to-blame-for-eus-food-frustration-1117469847.html

Fact Check: Is Russia Really to Blame for EU’s Food Frustration?

Fact Check: Is Russia Really to Blame for EU’s Food Frustration?

Sputnik International

The European Union is preparing tough new restrictions on the import of grain and seed oils from Russia and Belarus at the urging of five of its eastern members, purportedly over the threat that Russian and Belarusian foodstuffs pose to local farmers’ livelihoods. Is that really the case? Sputnik crunched the numbers to find out.

2024-03-21T12:54+0000

2024-03-21T12:54+0000

2024-04-28T18:38+0000

economy

russia

ursula von der leyen

arkady zlochevsky

ukraine

brussels

european union (eu)

eurostat

european commission

export

https://cdn1.img.sputnikglobe.com/img/102531/84/1025318476_0:137:3153:1910_1920x0_80_0_0_1646478a634a8e8c43991d65a1ff6dbb.jpg

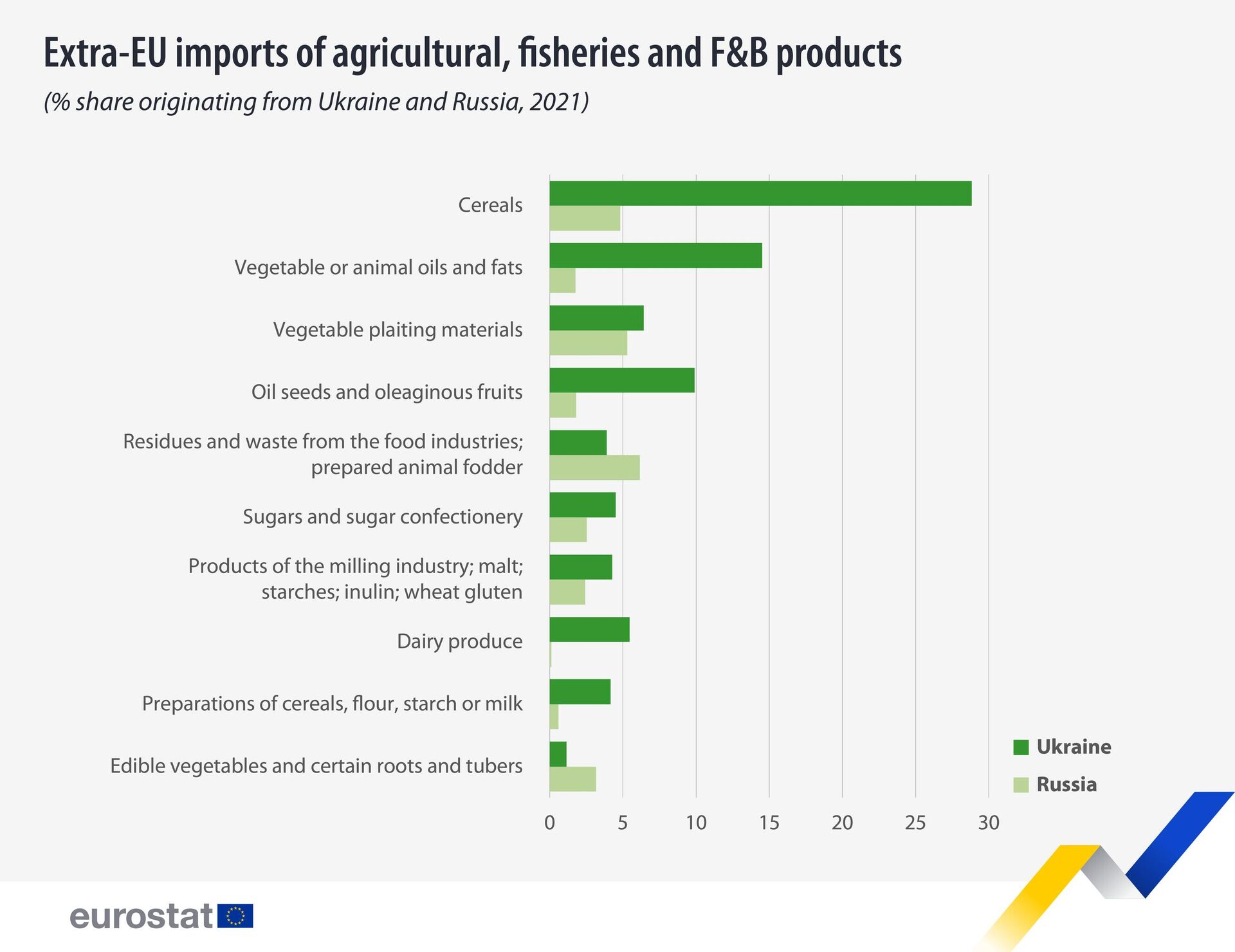

European Commission President Ursula von der Leyen is expected to present bloc leaders with formal proposals on the restriction of food imports from Russia and Belarus on Thursday.EU officials confirmed to Reuters earlier in the week that Brussels was finalizing measures to cap the import of Russian food products to try to stabilize the bloc’s oversaturated market. Informed sources speaking to British business media said the commission will propose a €95 ($103.25 US) per metric ton duty on Russian and Belarusian cereals, and a 50 percent tariff on oil seeds and oil seed-derived products.On Wednesday, Euractive published a joint appeal by the agriculture ministers of Poland, the Baltic States, and the Czech Republic to senior European Commission officials claiming that the “influx of Russian imports exerts pressure on the EU internal market and directly competes with the production of EU farmers,” and must be stopped.Can Russia Be Blamed for EU’s Grain Troubles?The timing of the proposed restrictions is odd, to say the least. Even before the escalation of the Ukraine crisis in 2022, Eurostat figures showed that Russia accounted for less than five percent of all cereals, vegetable or animal oils and fats, oil seeds and oleaginous fruits, sugars and sugar confectionary, milled products, dairy, cereal, flour, starch and milk preparations, and vegetables, roots, and tubers that EU countries purchased from outside the bloc.The same data showed that Ukraine accounted for a much larger share of EU imports – nearly 30 percent of all imported cereals, close to 15 percent of vegetable or animal oils and fats, and 10 percent of oil seeds.Since 2022, the breakdown of the diplomatic and economic relationship between Moscow and Brussels, combined with sanctions and financial, shipping, and insurance restrictions on Russian exporters, led Russia-sourced food imports to the EU to plummet.According to Eurostat, between February 2022 and December 2023, the EU’s total imports from Russia fell by 82 percent, with Russian grain dropping off the EU’s list of top external food sources, accounting for about 1.1 million tons of cereals sold to the bloc between July 2023 and January 2024.Russian agricultural market research firm SovEcon has estimated that the EU now accounts for just two percent of Russia’s global grain exports, with the only exception being sunflower meal, which continues to account for about 1/3 of total foreign sales.“In effect, they will create complications for their own consumers, and not for us; [the tariffs] will not really affect us,” Russian Grain Union President Arkady Zlochevsky told Sputnik this week, commenting on Brussels’ tariff plans.EU Agriculture Commissioner Janusz Wojciechowski admitted earlier this month that “imports of grain from Russia to Poland are negligible,” confirming that Italy and Spain, as well as Latvia and Greece, have traditionally constituted the bloc’s biggest importers.What About Ukraine?A senior EU diplomat told Euractiv this week that the planned restrictions on Russian and Belarusian grain might “have a symbolic value for Ukrainians,” but emphasized that Kiev must now focus on trying to restore “traditional markets” for its foodstuffs in the Middle East and North Africa instead of offloading its foodstuffs in European countries.Despite the conflict raging in the country, Ukrainian agricultural magnates have enjoyed an export bonanza over the past two years, harvesting about 50 million tons of exportable grain and seed oils in 2023, and ramping up exports by 16 percent over 2022 – flooding Europe with cheap foodstuffs difficult for local farmers to compete with.The decision sparked a deluge of Ukrainian grain into the bloc, with Spain, Italy, the Netherlands, Portugal, Belgium, Germany, France, and Romania constituting the largest importers, taking in nearly 12.5 million metric tons of grains between August 2022 and July 2023 alone, and total imports reaching some 20 million tons over the past 48 months, according to Eurostat.Over the past six months, farmers from across the EU have waged a series of protests and guerilla actions, focusing their rage on grain imported from Ukraine, not Russia. The protests have been particularly widespread in Eastern Europe, where farmers and the politicians backing them have expressed fears that large Ukrainian latifundistas with farms of 600,000, 700,000, or even 800,000 hectares could simply steamroll competition from the likes of Romania, Poland, and Bulgaria (where the average farm size is 4.2, 11, and 33 hectares, respectively).Eastern Europe’s food producers have been joined by some Western European heavyweights, with France’s two largest cereal growers unions recently expressing solidarity with their counterparts in Poland in calling for safeguards against Ukrainian imports.The EU reached a provisional deal Wednesday to continue allowing Ukrainian producers tariff-free access to its markets until June of 2025, adding token “safeguard mechanisms” including “tariff-rate quotas if imports of poultry, eggs, sugar, oats, maize, groats and honey exceed the arithmetic mean of quantities imported in 2022 and 2023.”

https://sputnikglobe.com/20240320/eu-will-shoot-itself-in-the-foot-with-tariffs-on-russia-belarus-grain-imports-1117449809.html

https://sputnikglobe.com/20240310/brussels-creates-food-crisis-simulation-amid-farmers-protests-1117237082.html

https://sputnikglobe.com/20240228/we-have-become-our-own-enemy-polish-farmers-remarkable-protest-against-europes-self-destruction-1117028033.html

russia

ukraine

brussels

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

is russia responsible for european farmers crisis, did russia cause european farmers protests, russia, european union, european commission, food, grain, seed oil

is russia responsible for european farmers crisis, did russia cause european farmers protests, russia, european union, european commission, food, grain, seed oil

Fact Check: Is Russia Really to Blame for EU’s Food Frustration?

12:54 GMT 21.03.2024 (Updated: 18:38 GMT 28.04.2024) The European Union is preparing tough new restrictions on the import of grain and seed oils from Russia and Belarus at the urging of five of its eastern members, purportedly over the threat that Russian and Belarusian foodstuffs pose to local farmers’ livelihoods. Is that really the case? Sputnik crunched the numbers to find out.

European Commission President Ursula von der Leyen is expected to present bloc leaders with formal proposals on the restriction of food imports from Russia and Belarus on Thursday.

EU officials

confirmed to

Reuters earlier in the week that Brussels was finalizing measures to cap the import of Russian food products to try to stabilize the bloc’s oversaturated market. Informed sources speaking to British business media

said the commission will propose a

€95 ($103.25 US) per metric ton duty on Russian and Belarusian cereals, and a

50 percent tariff on oil seeds and oil seed-derived products.

On Wednesday, Euractive published a

joint appeal by the agriculture ministers of Poland, the Baltic States, and the Czech Republic to senior European Commission officials claiming that the “influx of Russian imports exerts pressure on the EU internal market and directly competes with the production of EU farmers,” and must be stopped.

Can Russia Be Blamed for EU’s Grain Troubles?

The timing of the proposed restrictions is odd, to say the least. Even before the escalation of the Ukraine crisis in 2022, Eurostat figures

showed that Russia accounted for less than five percent of all cereals, vegetable or animal oils and fats, oil seeds and oleaginous fruits, sugars and sugar confectionary, milled products, dairy, cereal, flour, starch and milk preparations, and vegetables, roots, and tubers that EU countries purchased from outside the bloc.

The same data showed that Ukraine accounted for a much larger share of EU imports – nearly 30 percent of all imported cereals, close to 15 percent of vegetable or animal oils and fats, and 10 percent of oil seeds.

Since 2022, the breakdown of the diplomatic and economic relationship between Moscow and Brussels, combined with sanctions and financial, shipping, and insurance restrictions on Russian exporters, led Russia-sourced food imports to the EU to plummet.

According to Eurostat, between February 2022 and December 2023, the EU’s total imports from Russia fell by

82 percent, with Russian grain

dropping off the EU’s list of top external food sources, accounting for about

1.1 million tons of cereals sold to the bloc between July 2023 and January 2024.

Russian agricultural market research firm SovEcon

has estimated that the EU now accounts for just

two percent of Russia’s global grain exports, with the only exception being sunflower meal, which continues to account for about 1/3 of total foreign sales.

“In effect, they will create complications for their own consumers, and not for us; [the tariffs] will not really affect us,” Russian Grain Union President Arkady Zlochevsky

told Sputnik this week, commenting on Brussels’ tariff plans.

“The European Union is more of a competitor to Russia in the export of agricultural products than a target market,” Union of Grain Exporters Board Chairman Eduard Zernin said. “While there were exports to the EU, they were not on a large scale – hundreds of thousands of tons for main crops and even less for niche crops. These volumes can be easily redirected to more promising markets, such as the Middle East and Africa. Therefore, the proposed ban on the export of Russian agricultural products will not have a significant impact on Russia. However, it may seriously affect some European processors, especially in Italy and Spain,” Zernin explained.

EU Agriculture Commissioner Janusz Wojciechowski

admitted earlier this month that “imports of grain from Russia to Poland are negligible,” confirming that Italy and Spain, as well as

Latvia and Greece, have traditionally constituted the bloc’s biggest importers.

A senior EU diplomat

told Euractiv this week that the planned restrictions on Russian and Belarusian grain might “have a symbolic value for Ukrainians,” but emphasized that Kiev must now focus on trying to restore “traditional markets” for its foodstuffs in the Middle East and North Africa instead of offloading its foodstuffs in European countries.

Despite the conflict raging in the country, Ukrainian agricultural magnates have enjoyed an export bonanza over the past two years, harvesting about 50 million tons of exportable grain and seed oils in 2023, and

ramping up exports by 16 percent over 2022 – flooding Europe with cheap foodstuffs difficult for local farmers to compete with.

This bumper crop of profits was made possible explicitly by the EU’s generous June 2022 decision to lift all restrictions, including customs duties and quotas, on Ukrainian food goods.

The decision sparked a deluge of Ukrainian grain into the bloc, with Spain, Italy, the Netherlands, Portugal, Belgium, Germany, France, and Romania constituting the largest importers, taking in nearly

12.5 million metric tons of grains between August 2022 and July 2023 alone, and total imports reaching some

20 million tons over the past 48 months, according to Eurostat.

Europe’s farmers, already suffering losses thanks to WEF-imposed "green" restrictions on methane, nitrogen, and other gas emissions linked to food production, and stripped of state subsidies for diesel fuel, have been pushed to the breaking point by Ukraine’s dumping of millions of tons of additional grain onto local markets, with many producers fearing they will go under if Brussels doesn’t reverse course soon.

Over the past six months, farmers from across the EU have waged a series of protests and guerilla actions,

focusing their rage on grain imported from Ukraine, not Russia. The protests have been particularly widespread in Eastern Europe, where farmers and the politicians backing them

have expressed fears that large Ukrainian latifundistas with farms of 600,000, 700,000, or even 800,000 hectares could simply steamroll competition from the likes of Romania, Poland, and Bulgaria (where the average farm size is 4.2, 11, and 33 hectares, respectively).

Eastern Europe’s food producers have been joined by some Western European heavyweights, with France’s two largest cereal growers unions recently

expressing solidarity with their counterparts in Poland in calling for safeguards against Ukrainian imports.

The EU

reached a provisional deal Wednesday to continue allowing Ukrainian producers tariff-free access to its markets until June of 2025, adding token “safeguard mechanisms” including

“tariff-rate quotas if imports of poultry, eggs, sugar, oats, maize, groats and honey exceed the arithmetic mean of quantities imported in 2022 and 2023.”But for many European farmers, who are already drowning in cheap Ukrainian grain, the token gesture will likely stand no hope of rescuing them. Hence Eurocrats’ need to try to shift the focus – and the blame – onto Russia.

28 February 2024, 03:13 GMT