https://sputnikglobe.com/20230427/first-republic-bank-going-down-in-flames-hints-at-further-trouble-1109895599.html

First Republic Bank Going Down in Flames Hints at Further Trouble

First Republic Bank Going Down in Flames Hints at Further Trouble

Sputnik International

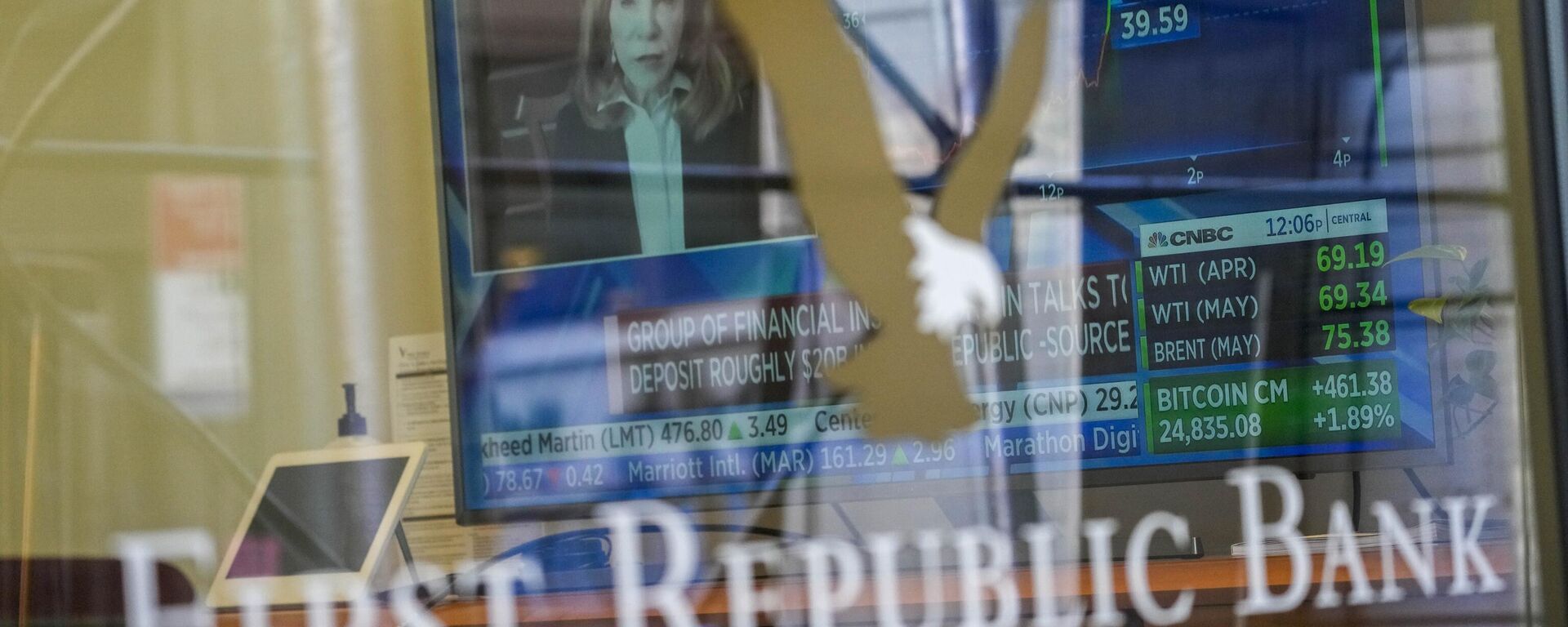

First Republic Bank faced a brutal sell-off earlier this week, with its stock price having gone down by more than 93% since the beginning of this year. As options to save the bank dwindle, banking crisis fears are soaring.

2023-04-27T19:18+0000

2023-04-27T19:18+0000

2023-04-28T08:01+0000

us

analysis

opinion

janet yellen

joe biden

silicon valley

treasury

first republic bank

snl

marc ostwald

https://cdn1.img.sputnikglobe.com/img/07e5/03/04/1082258502_0:87:3332:1961_1920x0_80_0_0_7dbc85f8c7df675321349fefcbaf9327.jpg

"The value of the shares of First Republic Bank is going down essentially because of the news about the conditions of the bank," Fabrizio Carmignani, professor of economics and dean at Griffith Business School, told Sputnik. "Earlier this week, we were told by the bank itself that they're experiencing a significant drop in their deposits, about 40% loss of deposits. And this is a huge hit in terms of financial fragility for the bank. In addition to that, we have to think about the overall context of the banking system at the moment, particularly when it comes to regional banks, banks of the size of First Republic Bank or the Silicon Valley Bank, so the initial collapse of the Silicon Valley Bank has indeed exposed fragilities across the system of regional banks, and markets are responding to that. The shares of First Republic Bank are at the moment targeted by markets. Markets are responding to the bad news that is coming from the bank. And this explains the sharp drop that we have observed in the last couple of days."First Republic Bank, a California-based lender which was founded in 1985, lost over $100 billion in deposits in March as customers withdrew billions of dollars, according to the entity's Monday report. On Tuesday, there was an unprecedented sell-off of First Republic's stock, which saw its price plummet roughly 50%; on Wednesday, it fell by a further 14%, with the New York Stock Exchange halting trading of the bank's shares a staggering 16 times.Earlier, in March, First Republic shares nosedived for the first time, following the collapse of the Silicon Valley (SVB) and Signature banks. SVB and Signature Bank had a significant amount of their assets in interest rate-sensitive financial instruments like government bonds and mortgage-backed securities. As a rule of thumb, when rates go up, bond prices typically go down. Thus, the Federal Reserve's aggressive rate hikes, aimed at taming inflation, have eaten away at the value of the banks' assets.Yellen Promised to Shield Depositors, But Now Treasury is SilentBack in March, Wall Street heavyweights provided First Republic Bank with a hefty lifeline in order to prevent a "contagion." The 11 biggest banks in the US, including Goldman Sachs and Wells Fargo, agreed to deposit $30 billion at First Republic. Almost simultaneously, Treasury Secretary Janet Yellen stepped forward and pledged to protect depositors at smaller US banks after the government had taken over the two unfortunate regional lenders.Still, the Treasury has kept mum so far about the future of First Republic Bank, as the latter appears to be going down in flames. Citing people familiar with the matter, the Financial Times noted that the bank has recently been in touch with the US government and financiers on Wall Street. Nonetheless, the Treasury declined to comment on the matter, when asked by the newspaper.One might ask whether it's not the end and the banking crisis will continue to spread. Earlier, a study was released on March 13, claiming that almost 190 banks could face the fate of SVB if half of their depositors decide to withdraw their funds. According to Ostwald, what is happening now is part of a larger trend provoked by the Federal Reserve's aggressive rate hikes. He does not rule out that more US banks are likely to follow First Republic's suit."It's an economic crisis largely born of the fact that we've had a sharp rise in interest rates to combat inflation," the economist continued. "So it's not in the same sense a systemic threat in the way that we saw back in 2008, which was the major banks, the investment banking side of things. This is far more concentrated in the wholesale and retail banking sector. There will be further banks which struggle, but it is very much more of the ilk of, I would say, the 1980s, 1995 SNL crisis, which was eventually resolved via the RTC solution. And it is basically all to do with the very sharp rise in interest rates, which a lot of people, even when it started, didn't really think it would last as long as it has, that inflation would be as persistent. And the more the Fed has to hike to fight inflation, the more this is likely to become a problem, because there will be even more assets which are underperforming on bank balance sheets simply because of the rise in the interest rates. And in terms of spillover, yes, that's also going to start."He drew attention to the fact that problems in the credit markets in the US have started to emerge with a gradual rise in the default rate. This is coming from a very, very low default rate per se, but it's nevertheless a rising trend, the economist noted, adding that the more money the banks use for covering "bad loans", "the less money that they have to actually lend for the economy at a time when it needs it, given that the economic performance is not exactly wonderful."Recession, Macroeconomic Changes & De-DollarizationThere has been a debate in the US for over a year whether the nation's economy is heading towards recession. Technically, recession – defined as two consecutive quarters of negative gross domestic product (GDP) growth – occurred in the US in the first half of 2022. Still, President Joe Biden at the time denied that the country was on a dangerous track."I do not think that there is any reason to panic and go to banks and withdraw deposits," said Fabrizio Carmignani. "To me, this is not a way to deal with a recession. If anything, bank runs could actually cause a recession, could cause a credit crunch and a recession. So that's definitely something that I don't believe should be done."However, it appears that the trouble in the US banking sector and similar turbulence in Western European banks is a reflection of macroeconomic changes, which includes deglobalization, manifested in increased economic and technological protectionism, and economic decoupling facilitated by sanctions and geopolitical tensions.When it comes to the de-dollarization trend which is emerging across the Global South, triggered both by the West's use of the greenback as a punishing mechanism and the Federal Reserve's interest rate hikes, which have made the dollar particularly expensive, one should brace for a more bifurcated, fractured payment system in the future, according to Ostwald. The greenback will definitely remain an important means of payment, but basically "we are dividing up into trading blocs," he said, to some extent echoing the idea of Russian economists who are predicting the establishment of several trading blocs with different major currencies in each of them.To get more insight from Fabrizio Carmignani on the US economy and the process of de-dollarization, visit our Telegram channel.

https://sputnikglobe.com/20230425/us-first-republic-bank-stocks-drop-nearly-50-after-losing-101-billion-in-deposits-1109831707.html

https://sputnikglobe.com/20230322/every-us-bank-is-at-risk-and-yellens-deceiving-depositors-by-saying-they-are-safe-economist-1108687018.html

https://sputnikglobe.com/20230321/why-the-banking-crisis-is-just-gaining-steam-with-the-global-economy-in-uncharted-waters-1108647804.html

https://sputnikglobe.com/20230413/paul-craig-roberts-washington-shot-itself-in-head-by-facilitating-de-dollarization-1109486264.html

https://sputnikglobe.com/20230414/shrinking-dollar-area-makes-budget-deficits-huge-problem-for-us-1109508132.html

silicon valley

california

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

first republic bank, svb and signature bank collapse, us banking crisis, us federal reserve interest rate hikes, us banks reliance on government bonds, capital withdrawal from banks, domino effect, banking crisis contagion, treasury secretary yellen, treasury vowed to protect depositors, us inflation, us recession

first republic bank, svb and signature bank collapse, us banking crisis, us federal reserve interest rate hikes, us banks reliance on government bonds, capital withdrawal from banks, domino effect, banking crisis contagion, treasury secretary yellen, treasury vowed to protect depositors, us inflation, us recession

First Republic Bank Going Down in Flames Hints at Further Trouble

19:18 GMT 27.04.2023 (Updated: 08:01 GMT 28.04.2023) First Republic Bank faced a brutal sell-off earlier this week, with its stock price having gone down by more than 93% since the beginning of this year. As options to save the bank dwindle, banking crisis fears are soaring.

"The value of the shares of First Republic Bank is going down essentially because of the news about the conditions of the bank," Fabrizio Carmignani, professor of economics and dean at Griffith Business School, told Sputnik. "Earlier this week, we were told by the bank itself that they're experiencing a significant drop in their deposits, about 40% loss of deposits. And this is a huge hit in terms of financial fragility for the bank. In addition to that, we have to think about the overall context of the banking system at the moment, particularly when it comes to regional banks, banks of the size of First Republic Bank or the Silicon Valley Bank, so

the initial collapse of the Silicon Valley Bank has indeed exposed fragilities across the system of regional banks, and markets are responding to that. The shares of First Republic Bank are at the moment targeted by markets. Markets are responding to the bad news that is coming from the bank. And this explains the sharp drop that we have observed in the last couple of days."

First Republic Bank, a California-based lender which was founded in 1985, lost over $100 billion in deposits in March as customers withdrew billions of dollars, according to the entity's Monday report. On Tuesday, there was an unprecedented sell-off of First Republic's stock, which saw its price plummet roughly 50%; on Wednesday, it fell by a further 14%, with the New York Stock Exchange halting trading of the bank's shares a staggering 16 times.

Earlier, in March, First Republic shares nosedived for the first time, following the collapse of the Silicon Valley (SVB) and Signature banks. SVB and Signature Bank had a significant amount of their assets in interest rate-sensitive financial instruments like government bonds and mortgage-backed securities. As a rule of thumb, when rates go up, bond prices typically go down. Thus, the Federal Reserve's aggressive rate hikes, aimed at taming inflation, have eaten away at the value of the banks' assets.

"For First Republic, the situation is not too different," explained Carmignani. "Again, they had a very large portfolio of loans to relatively wealthy customers, but at a very low interest rate. As the interest rate is starting to increase, the value of these loans has declined. Think about a situation where the bank is lending money at a low interest rate, but they have to borrow at high interest rates. So there is a mismatch there and this has caused some significant trouble for First Republic Bank. I wouldn't want to say that the problem is systemic in the sense that all of the banks are going to be affected. I still believe that this is not the same situation that we had in 2008-2009, but certainly for regional banks, mid-sized banks, let's say, there is a pattern now. And this goes back to a large extent to increasing the interest rate."

Yellen Promised to Shield Depositors, But Now Treasury is Silent

Back in March, Wall Street heavyweights provided First Republic Bank with a hefty lifeline in order to prevent a "contagion." The 11 biggest banks in the US, including Goldman Sachs and Wells Fargo, agreed to deposit $30 billion at First Republic. Almost simultaneously, Treasury Secretary

Janet Yellen stepped forward and pledged to protect depositors at smaller US banks after the government had taken over the two unfortunate regional lenders.

Still, the Treasury has kept mum so far about the future of First Republic Bank, as the latter appears to be going down in flames. Citing people familiar with the matter, the Financial Times noted that the bank has recently been in touch with the US government and financiers on Wall Street. Nonetheless, the Treasury declined to comment on the matter, when asked by the newspaper.

"Today comes the unconfirmed, but from reliable sources, news that the Federal Deposit Insurance Corporation (FDIC) is wondering whether it should actually start to reduce its support for First Republic, largely a function of the fact that it's actually struggling to find some sort of way of raising capital, whether that's by selling assets, which for existing shareholders, this isn't exactly going to be encouraging," Marc Ostwald, chief economist at ADM Investor Services International, told Sputnik. "And without that sale, and without the FDIC’s support, the major money center banks who have already poured in money in the form of deposits into First Republic are also balking at the idea of some sort of rescue package. The FDIC itself and indeed the Fed supervisory part would rather not have an FDIC seizure happen. But at the moment, it's proving to be a little bit more tricky."

One might ask whether it's not the end and the banking crisis will continue to spread. Earlier, a study was released on March 13, claiming that almost 190 banks could face the fate of SVB if half of their depositors decide to withdraw their funds. According to Ostwald, what is happening now is part of a larger trend provoked by the Federal Reserve's aggressive rate hikes. He does not rule out that more US banks are likely to follow First Republic's suit.

"It's an economic crisis largely born of the fact that we've had a sharp rise in interest rates to combat inflation," the economist continued. "So it's not in the same sense a systemic threat in the way that we saw back in 2008, which was the major banks, the investment banking side of things. This is far more concentrated in the wholesale and retail banking sector. There will be further banks which struggle, but it is very much more of the ilk of, I would say, the 1980s, 1995 SNL crisis, which was eventually resolved via the RTC solution. And it is basically all to do with the very sharp rise in interest rates, which a lot of people, even when it started, didn't really think it would last as long as it has, that inflation would be as persistent. And the more the Fed has to hike to fight inflation, the more this is likely to become a problem, because there will be even more assets which are underperforming on bank balance sheets simply because of the rise in the interest rates. And in terms of spillover, yes, that's also going to start."

He drew attention to the fact that problems in the credit markets in the US have started to emerge with a gradual rise in the default rate. This is coming from a very, very low default rate per se, but it's nevertheless a rising trend, the economist noted, adding that the more money the banks use for covering "bad loans", "the less money that they have to actually lend for the economy at a time when it needs it, given that the economic performance is not exactly wonderful."

Recession, Macroeconomic Changes & De-Dollarization

There has been a debate in the US for over a year whether the nation's economy is heading towards recession. Technically, recession – defined as two consecutive quarters of negative gross domestic product (GDP) growth – occurred in the US in the first half of 2022. Still, President Joe Biden at the time denied that the country was on a dangerous track.

For its part, the National Bureau of Economic Research (NBER) also argued that a recession should be accompanied by a significant decline in economic activity that is spread across the economy and lasts for several months. According to the NBER, the US is still not in a recession. However, ominous signs continue to surface. What should one do to protect oneself from the potential upcoming recession?

"I do not think that there is any reason to panic and go to banks and withdraw deposits," said Fabrizio Carmignani. "To me, this is not a way to deal with a recession. If anything, bank runs could actually cause a recession, could cause a credit crunch and a recession. So that's definitely something that I don't believe should be done."

"In general, my recommendation is always for households, for individuals, to think about their investment in the long term perspective," the academic continued. "If money is invested, for instance, in the stock market, it's inevitable that there will be periods of time when the stock market goes down. So the investment is losing value, and this is obviously very unpleasant. But on the other hand, if the perspective is a long term perspective, then we know that historically, after a decline in the stock market, there is always a recovery. So, often, when we invest in a short term perspective, we tend to be exposed to the volatility of the market. If instead we invest with a long term perspective, we can count on a long term trend that is generally upward slope and therefore positive. So to me, this difference between the long term and the short term is very important."

However, it appears that the trouble in the US banking sector and similar turbulence in Western European banks is a reflection of macroeconomic changes, which includes deglobalization, manifested in increased economic and technological protectionism, and economic decoupling facilitated by sanctions and geopolitical tensions.

When it comes to the de-dollarization trend which is emerging across the Global South, triggered both by the West's use of the greenback as a

punishing mechanism and the Federal Reserve's interest rate hikes, which have made

the dollar particularly expensive, one should brace for a more bifurcated, fractured payment system in the future, according to Ostwald. The greenback will definitely remain an important means of payment, but basically

"we are dividing up into trading blocs," he said, to some extent echoing the idea of Russian economists who are

predicting the establishment of several trading blocs with different major currencies in each of them.

"I don't really give advice to people. I think one basically always has to do one's own due diligence in terms of: where have you parked your deposits? Do you have deposits in a given institution which are above the insurance threshold and make sure that that is diversified so that your particular deposits are always protected by deposit insurance? And in this sort of world, yes, to a certain extent it does mean people will pursue more in the way of hard assets (…) At the end of the day, you have to look at what the regional and specific national trends are rather than looking at it as a wholesale issue, and the systemic threats in the different regions and indeed across actual individual countries are very, very different."

To get more insight from Fabrizio Carmignani on the US economy and the process of de-dollarization, visit our Telegram channel.