https://sputnikglobe.com/20230721/biden-needs-china-to-bail-out-us-economy-heres-why-1112006490.html

Biden Needs China to Bail Out US Economy: Here's Why

Biden Needs China to Bail Out US Economy: Here's Why

Sputnik International

Janet Yellen's trip with Beijing was widely ridiculed in the media. But geopolitical and financial analyst Tom Luongo said her real mission was to ask China for a cash injection to refill the Biden administration's back account.

2023-07-21T11:00+0000

2023-07-21T11:00+0000

2023-07-21T11:00+0000

economy

us

china

janet yellen

joe biden

jerome powell

janet yellen

beijing

washington

treasury

https://cdn1.img.sputnikglobe.com/img/07e7/07/08/1111756050_0:0:3072:1728_1920x0_80_0_0_62e4b861a61b4c8cafb7465945824caf.jpg

He told Sputnik's New Rules podcast that the Biden administration's financial maneuvers during the debt ceiling stand-off with the Republican-controlled House of Representatives had cleaned out its "checking account"."The Chinese don't have an open capital account, meaning they can buy a whole bunch of US treasuries without affecting the yuan onshore," Luongo continued. "They were the ones that could actually do this, buy a whole bunch of US treasuries, because Yellen needs to refill the Treasury general account since she drained it in order to blackmail the world into thinking the US was going to default over the debt ceiling crisis."The pundit explained how the federal government's new liquidity crisis began."During the debt ceiling crisis back in May, and as we moved into June, the Treasury's general account — basically checking account — was being drawn down," he recalled. "And Yellen was out there every other day screaming, 'Oh my God, we're not going to have any money to pay our bills!' Well, the way the Treasury raises money is by selling Treasuries."Recently published data indicates that Yellen had reason to be concerned about China dumping US Treasuries. China sold more than $22 billion of its US Treasury bonds in May, bringing its total holdings to the lowest level since 2010, according to a report by the US Department of Treasury released on Tuesday. Given this context, the US Treasury Secretary likely traveled to Beijing to urge Chinese leaders to reverse course. But Luongo pointed out the contradiction in Yellen's plan: "if you're buying a Treasury bond, you're selling dollars" — accelerating de-dollarization and undercutting the value of the US fiat currency. "Someone needs to buy treasuries. They could be absorbed by the American domestic markets. But if you do so, you're taking dollars out of the US domestic markets."And he noted that Yellen and Jerome Powell, her successor as Fed chairman, had not been "on the same page" since she was his boss at the central bank."Powell has always been a hawk. Yellen's always been a labor-economist-focused dove." Luongo stressed. "She was the extender, an architect of extra years of zero-bound interest rates and more QE [quantitative easing] when the markets were screaming for her to raise interest rates in her last two years of her second term."Now, thanks to Powell's aggressive policy of raising interest rates in a bid to force down inflation — at the expense of investment and jobs — "We're already starting to see credit growth turn negative."

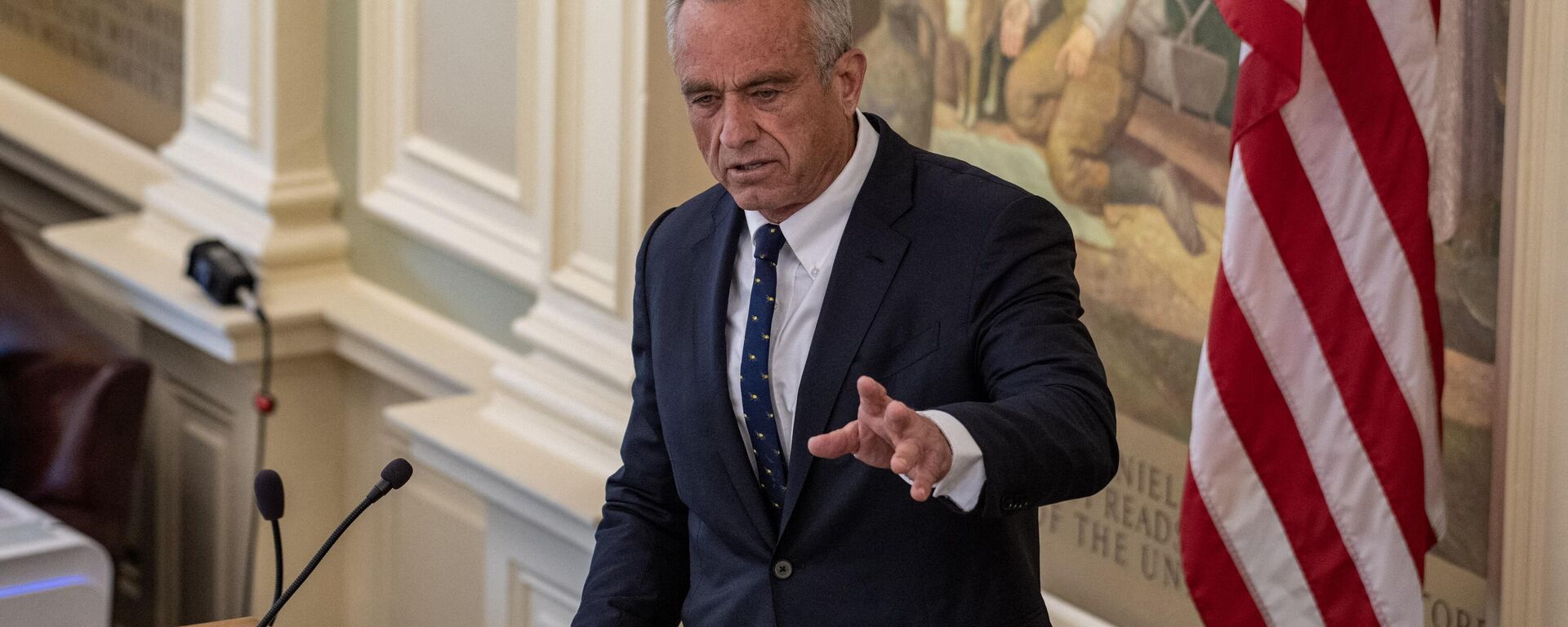

https://sputnikglobe.com/20230719/rfk-jr-floats-plan-to-back-dollar-with-bitcoin-and-end-taxes-on-conversions-1111985289.html

china

beijing

washington

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

James Tweedie

https://cdn1.img.sputnikglobe.com/img/07e4/08/1c/1080307270_0:3:397:400_100x100_80_0_0_7777393b9b18802f2e3c5eaa9cbcc612.png

James Tweedie

https://cdn1.img.sputnikglobe.com/img/07e4/08/1c/1080307270_0:3:397:400_100x100_80_0_0_7777393b9b18802f2e3c5eaa9cbcc612.png

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

James Tweedie

https://cdn1.img.sputnikglobe.com/img/07e4/08/1c/1080307270_0:3:397:400_100x100_80_0_0_7777393b9b18802f2e3c5eaa9cbcc612.png

janet yellen's visit to china, us federal debt ceiling crisis, is there a huge hole in the us treasury's finances?

janet yellen's visit to china, us federal debt ceiling crisis, is there a huge hole in the us treasury's finances?

Biden Needs China to Bail Out US Economy: Here's Why

US Treasury Secretary Janet Yellen's trip with Beijing was widely ridiculed in the media. But geopolitical and financial analyst Tom Luongo, publisher of the newsletter 'Gold, Goats 'n Guns', said her real mission was to beg China for economic aid.

He told Sputnik's New Rules podcast that the Biden administration's financial maneuvers during the

debt ceiling stand-off with the Republican-controlled House of Representatives had cleaned out its "checking account".

"There's a reason why US Treasury Secretary Janet Yellen went to China," he said. "I think Yellen went to Beijing to beg the Chinese to buy US Treasuries."

"The Chinese don't have an open capital account, meaning they can buy a whole bunch of US treasuries without affecting the yuan onshore," Luongo continued. "They were the ones that could actually do this, buy a whole bunch of US treasuries, because Yellen needs to refill the Treasury general account since she drained it in order to blackmail the world into thinking the US was going to default over the debt ceiling crisis."

The pundit explained how the federal government's new liquidity crisis began.

"During the debt ceiling crisis back in May, and as we moved into June, the Treasury's general account — basically checking account — was being drawn down," he recalled. "And Yellen was out there every other day screaming, 'Oh my God, we're not going to have any money to pay our bills!' Well, the way the Treasury raises money is by selling Treasuries."

"The best estimates have been that she would need to raise somewhere between $1 trillion and $1.5 trillion this summer in order to fund the budget deficit of the United States and get the Treasury general account back up to a certain level now, in order for the American government to continue operating in this unbelievably dysfunctional manner," Luongo said.

Recently published data indicates that Yellen had reason to be concerned about China dumping US Treasuries. China sold more than $22 billion of its US Treasury bonds in May, bringing its total holdings to the lowest level since 2010, according to a report by the US Department of Treasury released on Tuesday. Given this context, the US Treasury Secretary likely traveled to Beijing to urge Chinese leaders to reverse course.

But Luongo pointed out the contradiction in Yellen's plan: "if you're buying a Treasury bond, you're selling dollars" — accelerating de-dollarization and undercutting the value of the US fiat currency. "Someone needs to buy treasuries. They could be absorbed by the American domestic markets. But if you do so, you're taking dollars out of the US domestic markets."

And he noted that Yellen and Jerome Powell, her successor as Fed chairman, had not been "on the same page" since she was his boss at the central bank.

"Powell has always been a hawk. Yellen's always been a labor-economist-focused dove." Luongo stressed. "She was the extender, an architect of extra years of zero-bound interest rates and more QE [quantitative easing] when the markets were screaming for her to raise interest rates in her last two years of her second term."

Now, thanks to Powell's aggressive policy of raising interest rates in a bid to force down inflation — at the expense of investment and jobs — "We're already starting to see credit growth turn negative."

"We're starting to see the beginnings of a real credit crunch, which is going to put downward pressure on the American economy," Luongo warned