https://sputnikglobe.com/20230801/chinas-rare-earths-ban-may-sink-us-microchip-manufacturing-ambitions-1112322954.html

China’s Rare Earths Export Curbs May Sink US’ Microchip Manufacturing Ambitions

China’s Rare Earths Export Curbs May Sink US’ Microchip Manufacturing Ambitions

Sputnik International

Chinese export controls on germanium and gallium have stepped into effect amid fears that this will mean more expensive microchips, solar panels, cars and even weapons. More significantly, the restrictions threaten to sink the Biden administration’s ambitious domestic microchip manufacturing goals, says China-US trade expert Thomas Pauken II.

2023-08-01T13:50+0000

2023-08-01T13:50+0000

2023-08-01T14:48+0000

economy

joe biden

janet yellen

china

beijing

washington

taiwan semiconductor manufacturing company (tsmc)

ban

restrictions

https://cdn1.img.sputnikglobe.com/img/104850/94/1048509437_0:53:1200:728_1920x0_80_0_0_fa61877215c2b894c98f5ec04635d364.jpg

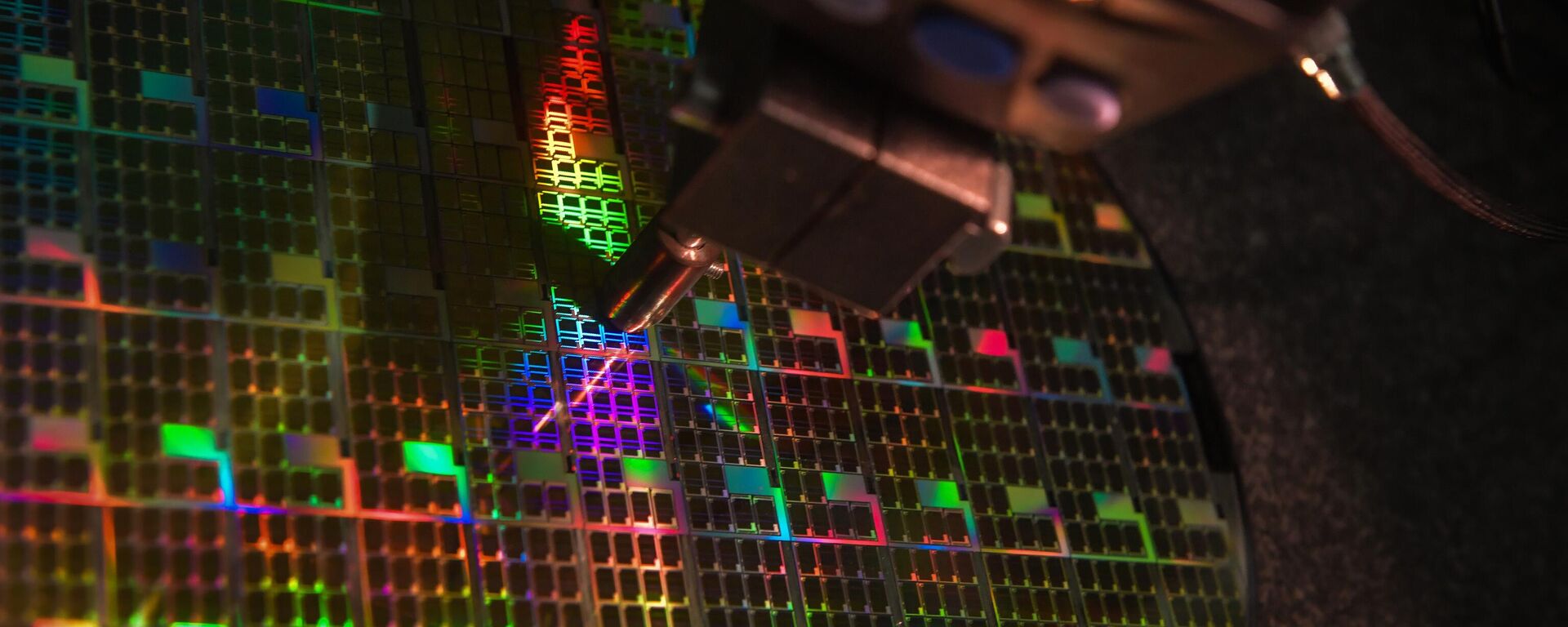

China’s rare earths restrictions officially stepped into force on Tuesday, with the measures, announced last month after Beijing said it needed to protect its “national security and interests,” expected to cause a sharp jump in the cost of an array of advanced manufactured goods, particularly electronics.The export controls, which will require companies seeking to export the pair of rare earth metals to apply for licenses, come in retaliation to a long list of US hostile measures, including restrictions on the import of Chinese high-tech goods.“This is just the beginning,” former Chinese Vice Commerce Minister Wei Jianguo said last month, warning that “China’s tool box has many more types of measures available” should Washington try to retaliate to the rare earths semi-ban.The rare earths restrictions show that Treasury Secretary Janet Yellen’s trip to Beijing last month to try to smooth over tensions clearly failed to get China to alter its position, with the Asian nation taking a harder line in retaliation to Washington’s tech and trade war, and attempts to box in Beijing in East Asia, earlier this year, starting by sanctioning US semiconductor giant Micron Technology in May.Move Could Sink Biden’s Semiconductor Scheme“Obviously, these consequences are going to be devastating to US efforts to promote their manufacturing industry, to create these factories where they’re reshoring back home,” Thomas Pauken II, a veteran consultant and commentator on Asia-Pacific affairs, told Sputnik, referring to the $50+ billion push announced by the Biden administration last year to restore the US’ domestic electronics component manufacturing capabilities. “The thing is, you need these ingredients that are necessary for the chips and the semiconductors,” he said.US Caught UnpreparedPauken believes the US and its allies may not have expected Beijing to go through with its rare earths export restriction threats, judging by the limited reporting on the matter, apart from specialized Washington-based think tanks warning about the “devastating impact” such export controls could have on the US, Europe, Japan, “and much of the world.”Pauken expects the export restrictions to put a “big hurt” on the global economy, but not so much on Beijing, which could even receive a boost to its domestic manufacturing industry as rare earths that once went to other countries will stay in China.The expert stressed that if Washington were clever, it would “rethink” its China policy, and recognize that the get-tough approach to Beijing hasn’t been working, and won’t work, and has instead “been a disaster for the US economy.” Unfortunately, he added, “it doesn’t seem like the US has learned any lessons…so it seems as if they will just continue on with their anti-China legislation.”Options LimitedThe escalating China-US tensions over rare earths has prompted US officials to begin a global search for alternatives, including Mongolia, a landlocked northeast Asian nation estimated to contain nearly 17 percent of global rare earths deposits.“Mongolia is facing a generational opportunity. And that generational opportunity is a need for us to find critical minerals and rare earths in order to achieve our clean energy goals,” Under Secretary of State Jose Fernandez, who traveled to Mongolia in late June, recently told US media.But it’s not as simple as investing in Mongolian rare earths production and extracting resources, Pauken said, pointing to the country’s landlocked status, and US efforts to irritate both of Mongolia’s neighbors, Russia and China.

https://sputnikglobe.com/20230801/chinas-metal-export-controls-may-hit-entities-from-countries-that-cracked-down-on-china-analysts-1112320550.html

https://sputnikglobe.com/20230728/does-the-us-make-their-own-microchips-1112216417.html

https://sputnikglobe.com/20230721/taiwanese-semiconductor-giant-delays-arizona-plant-production-amid-us-china-chip-race-1112027823.html

china

beijing

washington

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

rare earths, rare earth metals, germanium, gallium, china, united states, mongolia, trade, technology, restrictions, retaliation

rare earths, rare earth metals, germanium, gallium, china, united states, mongolia, trade, technology, restrictions, retaliation

China’s Rare Earths Export Curbs May Sink US’ Microchip Manufacturing Ambitions

13:50 GMT 01.08.2023 (Updated: 14:48 GMT 01.08.2023) Chinese export controls on germanium and gallium have stepped into effect amid fears that this will mean more expensive microchips, solar panels, cars, and even weapons. More significantly, the restrictions threaten to sink the Biden administration’s ambitious domestic microchip manufacturing goals, says China-US trade expert Thomas Pauken II.

China’s rare earths restrictions officially stepped into force on Tuesday, with the measures,

announced last month after Beijing said it needed to protect its “national security and interests,” expected to cause a sharp jump in the cost of an array of advanced manufactured goods, particularly electronics.

The export controls, which will require companies seeking to export the pair of rare earth metals to apply for licenses, come in retaliation to a long list of US hostile measures, including restrictions on the import of Chinese high-tech goods.

“This is just the beginning,” former Chinese Vice Commerce Minister Wei Jianguo

said last month, warning that

“China’s tool box has many more types of measures available” should Washington try to retaliate to the rare earths semi-ban.

China produces upwards of 80 percent of the world’s gallium, and 60 percent of its germanium, with experts predicting that it could take “generations” for the US to replace lost Chinese capacity.

The rare earths restrictions show that Treasury Secretary Janet Yellen’s

trip to Beijing last month to try to smooth over tensions clearly failed to get China to alter its position, with the Asian nation taking a harder line in retaliation to Washington’s tech and trade war, and attempts to box in Beijing in East Asia, earlier this year, starting by

sanctioning US semiconductor giant Micron Technology in May.

Gallium and germanium are used in the manufacture of complex semiconductors, including chips with military applications, but also ordinary transistors, diodes, and other electronic components, for use in everything from smartphones and laptops to solar panels, vehicles, and medical equipment.

Move Could Sink Biden’s Semiconductor Scheme

“Obviously, these consequences are going to be devastating to US efforts to promote their manufacturing industry, to create these factories where they’re reshoring back home,”

Thomas Pauken II, a veteran consultant and commentator on Asia-Pacific affairs, told

Sputnik, referring to the

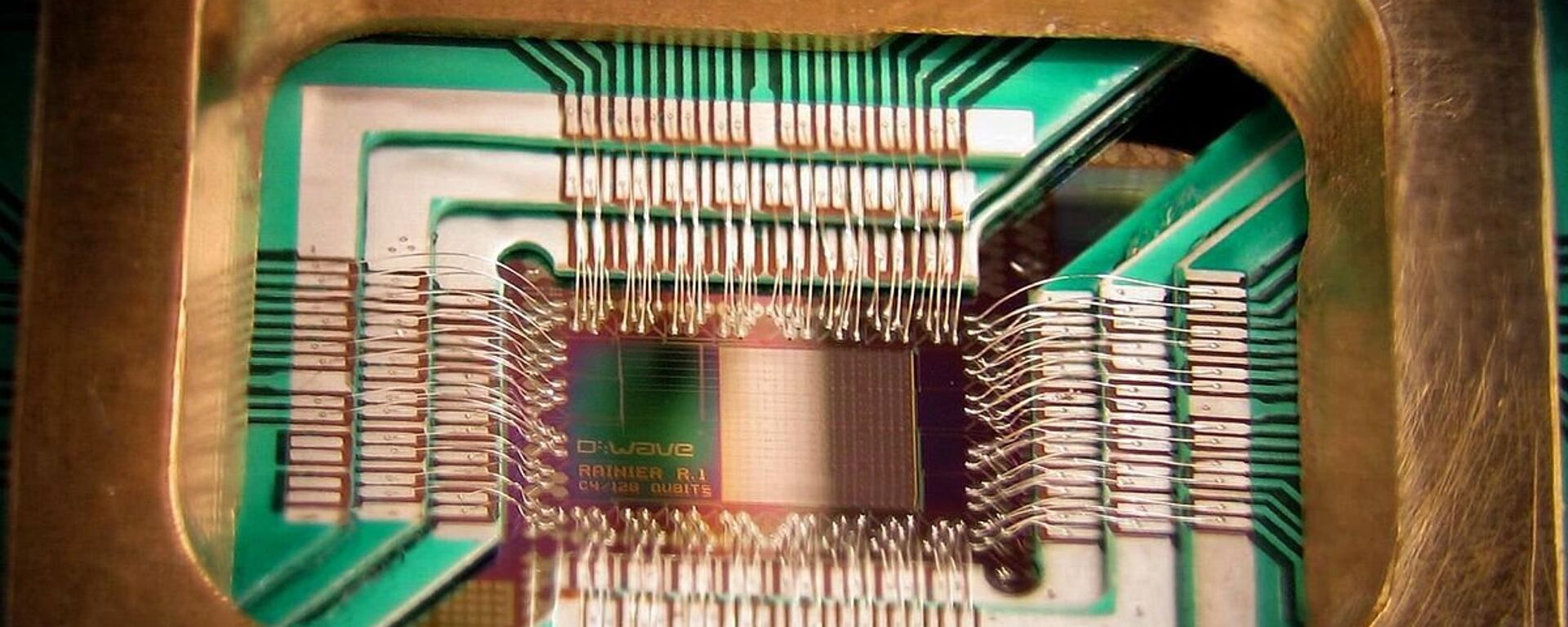

$50+ billion push announced by the Biden administration last year to restore the US’ domestic electronics component manufacturing capabilities. “The thing is, you need these ingredients that are necessary for the chips and the semiconductors,” he said.

“So now I’m hearing that TSMC," the Taiwan-based semiconductor giant, “is now having a rethink about doing their fab or semiconductor foundry that they were thinking about opening in Arizona. Also, there's another story about Intel. They were going to open up this major chip manufacturing plant in Ohio, and now suddenly they're saying, 'Well, maybe we won't open up this factory in Ohio because we lost all our Chinese customers. And because of these export controls we don't have the ability to create all these chips,'” Pauken said.

Pauken believes the US and its allies may not have expected Beijing to go through with its rare earths export restriction threats, judging by the limited reporting on the matter, apart from specialized Washington-based think tanks warning about the “devastating impact” such export controls could have on the US, Europe, Japan, “and much of the world.”

“I think the real story is that the West maybe thought China was bluffing. Maybe they thought that China wasn’t being serious about these export controls. And now that they are starting to go into effect, they are realizing how destructive they can be. The fact of the matter is that the US has not done proper preparations to deal with the counter-sanctions or the counter-attacks led by China…They just thought that if they made all these announcements that they were going after China and all these other countries were following them, then somehow, China was going to wimp out, look scared, and then change their mind under the pressure. But in reality, what China has learned is that you cannot back down under peer pressure coming from Washington,” the observer said.

Pauken expects the export restrictions to put a “big hurt” on the global economy, but not so much on Beijing, which could even receive a boost to its domestic manufacturing industry as rare earths that once went to other countries will stay in China.

The expert stressed that if Washington were clever, it would “rethink” its China policy, and recognize that the get-tough approach to Beijing hasn’t been working, and won’t work, and has instead “been a disaster for the US economy.” Unfortunately, he added, “it doesn’t seem like the US has learned any lessons…so it seems as if they will just continue on with their anti-China legislation.”

“So basically it's a case of if you're tough to China, China will fight back just as tough. If you're nice to China, then China will be nice. Right now, Europe decided they want to support the US and want to push back against China. So, of course, China is not only going after the US, but they're also hitting Europe,” the observer said.

The escalating China-US tensions over rare earths has prompted US officials to begin a global search for alternatives, including Mongolia, a landlocked northeast Asian nation estimated to contain nearly

17 percent of global rare earths deposits.

“Mongolia is facing a generational opportunity. And that generational opportunity is a need for us to find critical minerals and rare earths in order to achieve our clean energy goals,” Under Secretary of State Jose Fernandez, who traveled to Mongolia in late June, recently

told US media.

But it’s not as simple as investing in Mongolian rare earths production and extracting resources, Pauken said, pointing to the country’s landlocked status, and US efforts to irritate both of Mongolia’s neighbors, Russia and China.

“Obviously, you can’t go through Russia,” he said, citing anti-Russian sanctions. “So then they would have to go through China. And obviously, if Europe and the US decide to continue putting pressure on China, then they’re going to make it more difficult for the Mongolian miners to transport their products to the shipping ports,” the observer summed up.