https://sputnikglobe.com/20230911/rubles-share-in-russias-exports-tops-50-percent-as-dedollarization-gains-momentum-1113276778.html

Ruble’s Share in Russia’s Exports Tops 50 Percent as Dedollarization Gains Momentum

Ruble’s Share in Russia’s Exports Tops 50 Percent as Dedollarization Gains Momentum

Sputnik International

The US dollar’s slow, creeping decline as the currency of choice for global trade and central bank reserve holdings accelerated in 2022, when Washington and its allies attempted, and failed, to sanction Russia into submission amid the crisis in Ukraine. Moscow and its partners reacted by ramping up trade in local currencies.

2023-09-11T12:53+0000

2023-09-11T12:53+0000

2023-09-11T12:55+0000

economy

ruslan davydov

russia

washington

federal customs service

european union (eu)

trade

imports

exports

dollar

https://cdn1.img.sputnikglobe.com/img/07e7/08/01/1112326823_0:159:3073:1888_1920x0_80_0_0_98566ce5c328a7d2ffbd2685c6d6c1b4.jpg

The ruble’s share in payments for Russian exports has topped 50 percent, and accounts for more than a third of Russia’s overall foreign trade, acting Federal Customs Service chief Ruslan Davydov has revealed.According to Federal Customs Service data, between January and August of 2023, Russia's overall physical volume of trade has already topped last year’s indicators. However, its overall value is lower due to a drop in global prices for energy resources. “Energy resources still account for two-thirds of our exports in value terms,” Davydov explained.Commenting on reports by Russian business media on the latest EU restrictions prohibiting Russian nationals from importing cars, electronics and personal hygiene products like shampoos, toothpaste and toilet paper into bloc countries, Davydov characterized the measures as “utter nonsense.” “Thank you for not yet prohibiting people from crossing the border in their personal trousers,” he quipped.Global Dedollarization Trend AcceleratingRussia has long been ahead of the curve amid the global trend toward gradual dedollarization, completely dumping the remaining dollar holdings from its National Wealth Fund in 2021 and replacing them with euros, yuan, Japanese and gold. From 2014 onward, Russia also whittled away at its US Treasury debt holdings, which fell from $176.3 billion in 2010 to just $2.4 billion by late 2021.Moscow has lobbied its foreign partners to expand trade in local currencies for years, pointing to currency swap-based payments’ lower volatility compared to the dollar, and the sanctions-related risks associated with the US currency.In 2022, after the US and its allies slapped Russia with nearly 15,000 new sanctions and froze a portion of the country’s foreign reserves, major non-Western countries, including even long-time traditional US allies and partners, began to see the potential dangers associated with the greenback, and turning to other currencies for trade, such as the yuan.At last month’s BRICS summit in Johannesburg, bloc members expressed their intention to increase the use of local currencies in trade and financial transactions between BRICS members and their partners. With the addition of six new regional powerhouse economies from Latin America, Africa and the Middle East to the original five-nation BRICS bloc, the grouping of major non-Western world economies now accounts for some 37 percent of global GDP, compared with about 30 percent for the G7.Dedollarization Won't Be Quick, EasyThe dollar’s share in global foreign exchange reserves has slowly declined for decades, falling from over 71 percent of all reserves at the turn of the 21st century, to about 62 percent a decade ago, to 58 percent at the end of 2022.That said, the dollar remains a powerful financial instrument in world trade, with observers emphasizing that that the global dedollarization process is a “big challenge,” and something that won’t be “quick or easy,” particularly since the currency still accounts for a vast percentage of global trade and foreign currency reserves.

https://sputnikglobe.com/20230826/how-do-brics-stack-up-against-g7-1112913972.html

russia

washington

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

dollar, dedollarization, ruble, russia, united states, currency, trade, reserves, finance, reserve currency, imports, exports

dollar, dedollarization, ruble, russia, united states, currency, trade, reserves, finance, reserve currency, imports, exports

Ruble’s Share in Russia’s Exports Tops 50 Percent as Dedollarization Gains Momentum

12:53 GMT 11.09.2023 (Updated: 12:55 GMT 11.09.2023) The US dollar’s slow, creeping decline as the currency of choice for global trade and central bank reserve holdings accelerated in 2022, when Washington and its allies attempted, and failed, to sanction Russia into submission amid the crisis in Ukraine. Moscow and its partners reacted by ramping up trade in local currencies.

The ruble’s share in payments for Russian exports has topped 50 percent, and accounts for more than a third of Russia’s overall foreign trade, acting Federal Customs Service chief Ruslan Davydov has revealed.

“In the structure of our trade turnover, the ruble’s share is growing very strongly, of course. For example, in exports, over half of payments are in rubles. In imports, payments are still made mainly using the currencies of unfriendly countries; in general, ruble payments account for more than a third of overall trade turnover,” Davydov told Sputnik on the sidelines of the

Eastern Economic Forum in Vladivostok.

According to Federal Customs Service data, between January and August of 2023, Russia's overall physical volume of trade has already topped last year’s indicators. However, its overall value is lower due to a drop in global prices for energy resources. “Energy resources still account for two-thirds of our exports in value terms,” Davydov explained.

Commenting on

reports by Russian business media on the latest EU restrictions prohibiting Russian nationals from importing cars, electronics and personal hygiene products like shampoos, toothpaste and toilet paper into bloc countries, Davydov characterized the measures as “utter nonsense.” “Thank you for not yet prohibiting people from crossing the border in their personal trousers,” he quipped.

Global Dedollarization Trend Accelerating

Russia has long been ahead of the curve amid the global trend toward gradual dedollarization, completely

dumping the remaining dollar holdings from its National Wealth Fund in 2021 and replacing them with euros, yuan, Japanese and gold. From 2014 onward, Russia also

whittled away at its US Treasury debt holdings, which fell from $176.3 billion in 2010 to just $2.4 billion by late 2021.

Moscow has lobbied its foreign partners to expand trade in local currencies for years,

pointing to currency swap-based payments’ lower volatility compared to the dollar, and the sanctions-related risks associated with the US currency.

In 2022, after the US and its allies slapped Russia with

nearly 15,000 new sanctions and froze a portion of the country’s foreign reserves, major non-Western countries,

including even long-time traditional US allies and partners, began to see the potential dangers associated with the greenback, and turning to other currencies for trade, such as the yuan.

At last month’s BRICS

summit in Johannesburg, bloc members expressed their intention to increase the use of local currencies in trade and financial transactions between BRICS members and their partners. With the addition of six new regional powerhouse economies from Latin America, Africa and the Middle East to the original five-nation BRICS bloc, the grouping of major non-Western world economies now accounts for some

37 percent of global GDP, compared with about 30 percent for the G7.

26 August 2023, 18:35 GMT

Dedollarization Won't Be Quick, Easy

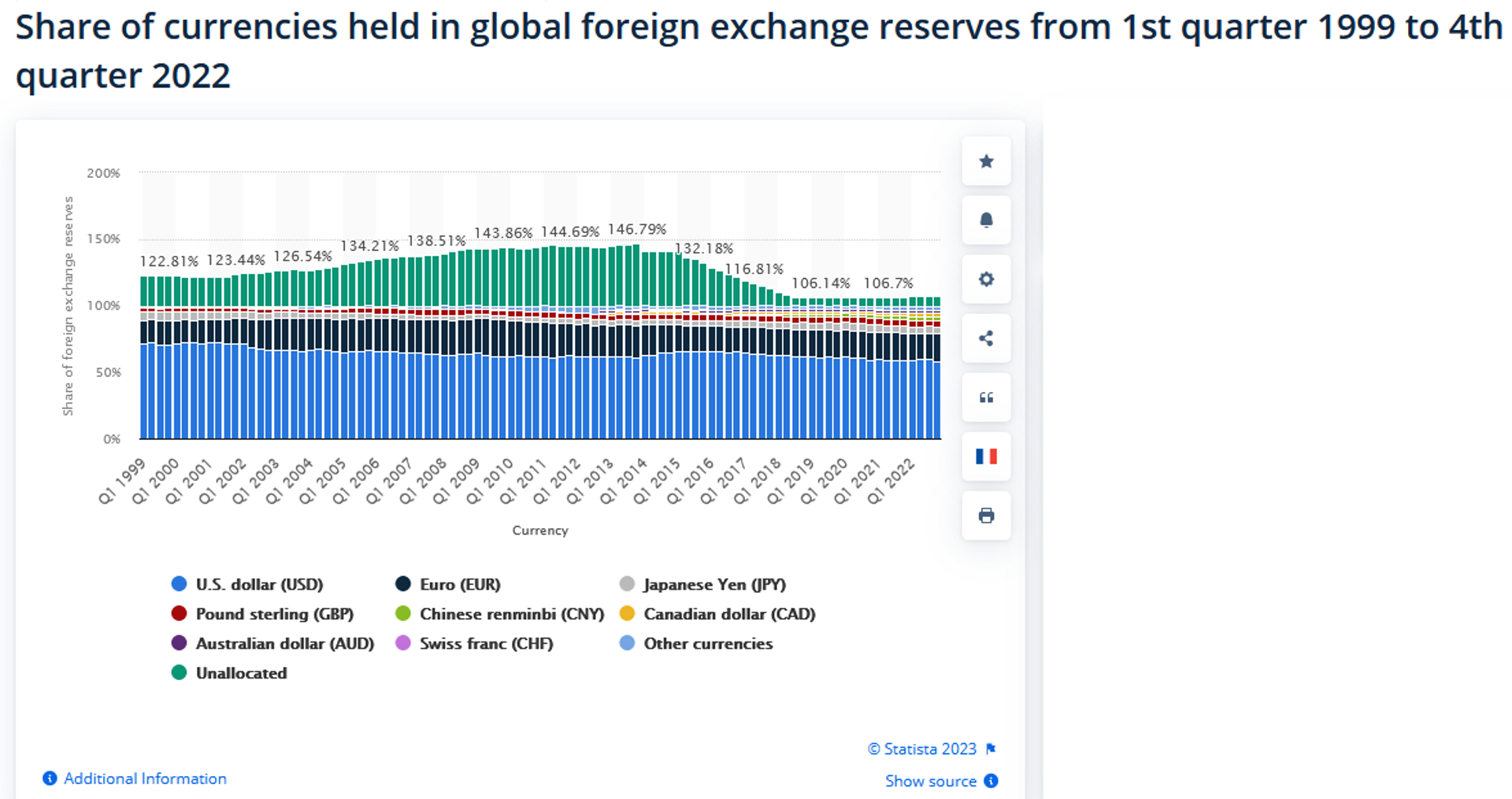

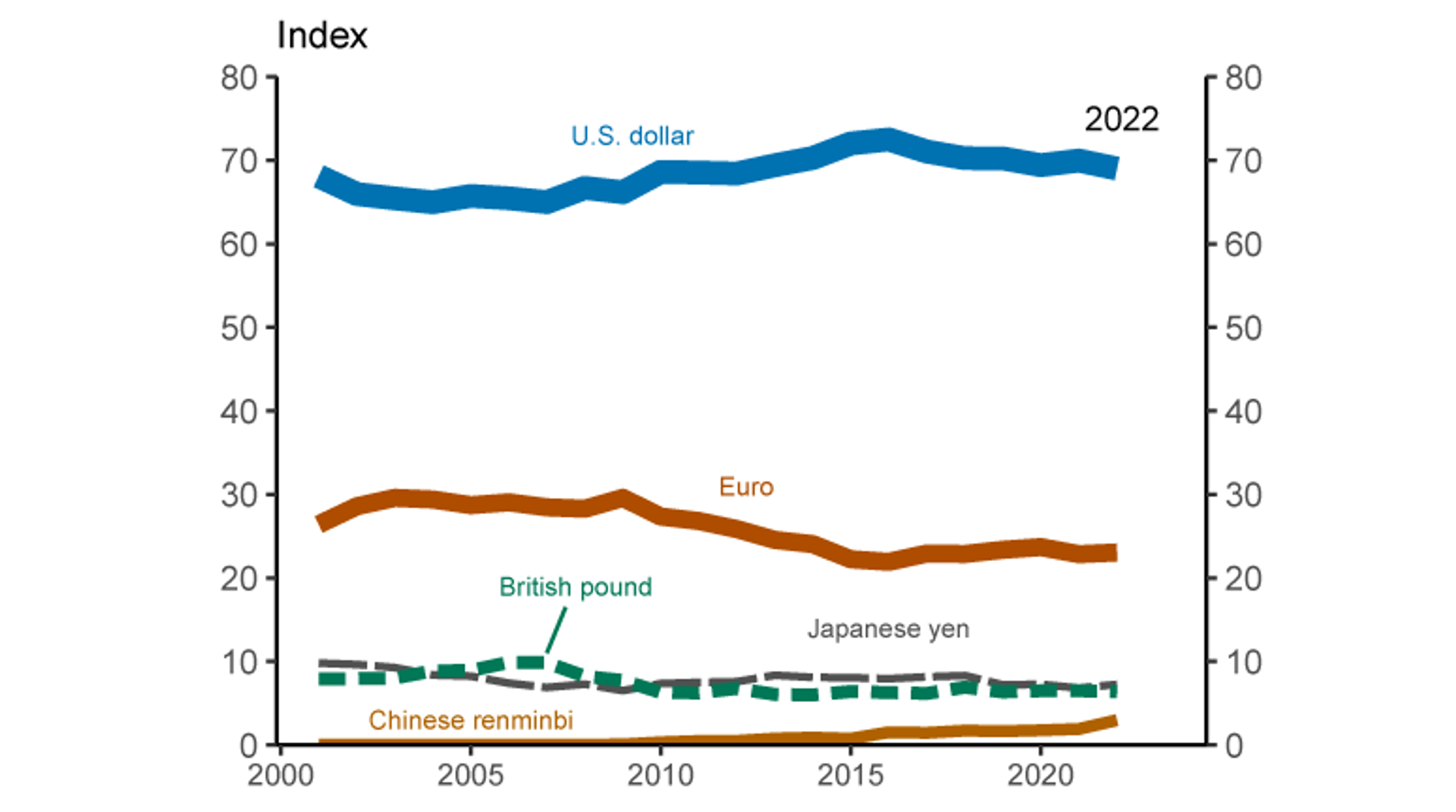

The dollar’s share in global foreign exchange reserves has slowly declined for decades, falling from over 71 percent of all reserves at the turn of the 21st century, to about 62 percent a decade ago, to 58 percent at the end of 2022.

That said, the dollar remains a powerful financial instrument in world trade, with observers emphasizing that that the global dedollarization process is a “big challenge,” and something that

won’t be “quick or easy,” particularly since the currency still accounts for a vast percentage of global trade and foreign currency reserves.