https://sputnikglobe.com/20231004/russian-industry-tops-business-activity-index-as-economy-built-quite-well-to-adapt-to-sanctions-1113929576.html

Russian Industry Tops Business Activity Index as Economy ‘Built Quite Well’ to Adapt to Sanctions

Russian Industry Tops Business Activity Index as Economy ‘Built Quite Well’ to Adapt to Sanctions

Sputnik International

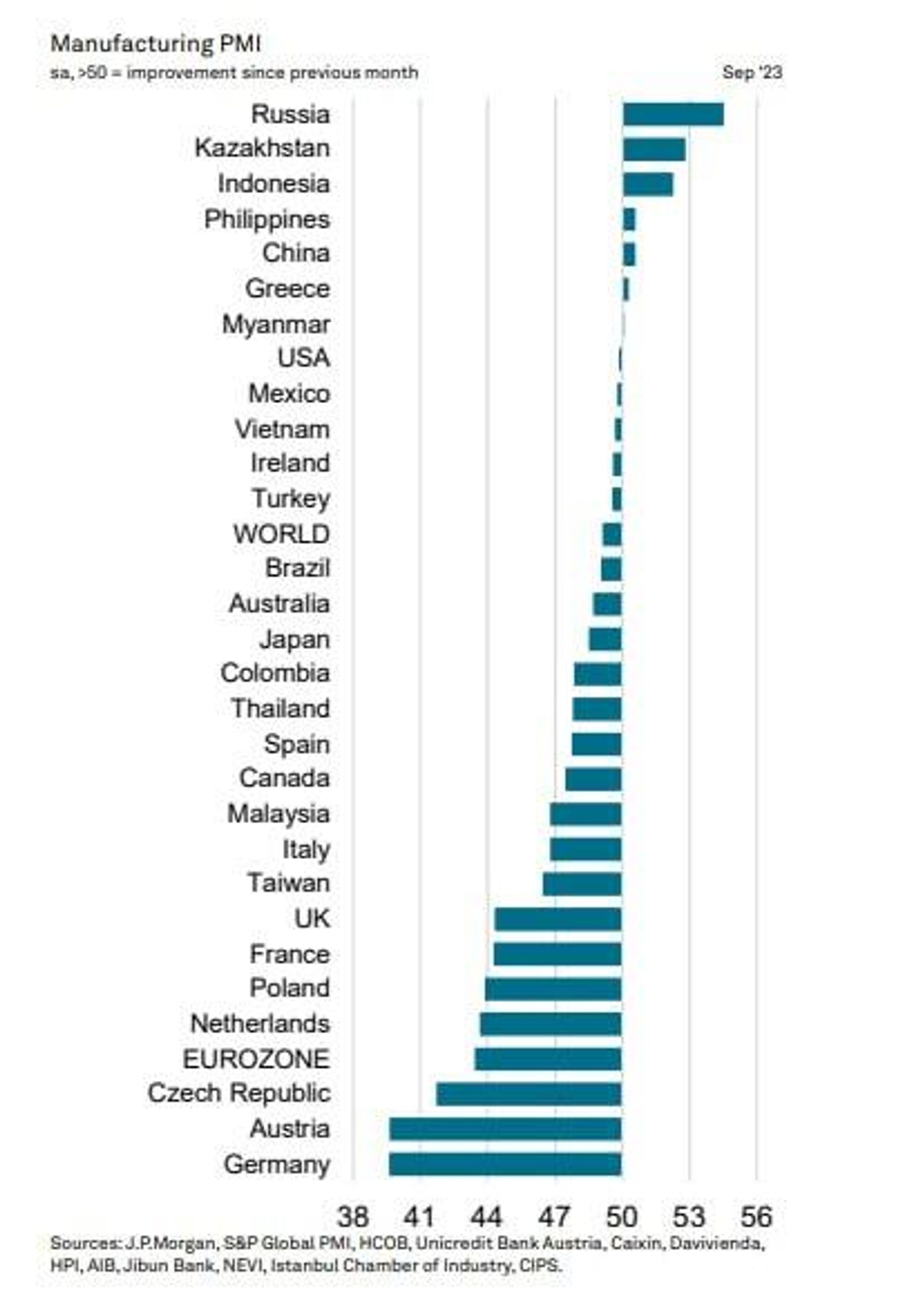

A recent report by JPMorgan Chase placed Russia first in the world in the manufacturing business activity index, despite nearly two years of Western sanctions aimed at strangling the Russian economy.

2023-10-04T18:51+0000

2023-10-04T18:51+0000

2023-10-04T18:51+0000

analysis

jpmorgan chase

pmi

russia

manufacturing

sanctions

import substitution

https://cdn1.img.sputnikglobe.com/img/16059/89/160598914_0:228:2743:1771_1920x0_80_0_0_7a02205b6b4b8766da98f32b746c1343.jpg

A recent report by JPMorgan Chase placed Russia first in the world in the manufacturing business activity index for September, despite nearly two years of Western sanctions aimed at strangling the Russian economy.The Manufacturing Purchasing Managers Index (PMI) report described global manufacturing as remaining “in the doldrums” in September, noting that aside from a handful of nations, all of which were in Asia except for Greece, no countries registered a growth in new trade orders. The nations included Russia, Kazakhstan, China, Indonesia, the Philippines, Greece, and Myanmar.The US saw a very slight contraction, but some of the biggest losers were Eurozone members like Austria, Germany, the Czech Republic, and the Netherlands - nations that once imported Russian energy and other goods, but which have since adopted a boycott, driving up prices across the board and prompting mass protests.Sputnik spoke with several experts about the report and the economic trends it describes.Anton Tabakh, the lead economist of the “Expert RA” rating agency, explained that the report gives a businessman’s-eye-view of the economy, looking at the same metrics they use to anticipate economic patterns.“Therefore, it is impossible to talk about this as a ‘rating,’” he noted. “Thus, no indicators are included there - it is an indicator in itself.”Tabakh explained that Russia was ahead of industrial giants like the US and China because of economic struggles in both countries driven by trends not playing out in Russia.“The same thing is happening in China, but for slightly different reasons,” Tabakh said, noting it was “the crisis in the real estate market and the decline in economic growth."“This is usually the PMI rating - and why do financial sharks look at it? Because it usually shows what will happen in the economy over a period of several months. This is the so-called leading indicator. Not the best, but good enough, that's why everyone is looking at it,” he explained. “That is, it does not show what happened - it is not a rear view mirror. On the contrary, it is an opportunity to look forward. Because it is clear that, as if they are suppliers to large companies, they look at what will be sold there in a few months. And they are purchasing for this purpose.”Andrey Kolganov, doctor of economics, head of the Laboratory of Socio-Economic Systems at the Faculty of Economics of the Moscow State University, told Sputnik that Russian industry was performing at its best in many years.“I don’t know the industry breakdown of JP Morgan’s reporting data because detailed statistics are not disclosed, but according to domestic data, we can say that the manufacturing industry is showing the greatest growth, and it is in the manufacturing industry that the business activity index is now the highest in the last few years - you could say even a record since 2017, approximately. And it is higher than the services business activity index, which has been higher than manufacturing in previous months.”"The number of new orders is growing. It is possible to contain price increases, although there are certain difficulties with inflation. But, nevertheless, such a jump in prices has not yet occurred. The normal employment situation is increasing and, moreover, manufacturing employment continues to grow, albeit at a very slow pace,” Kolganov explained. “But it is already at its highest level in a long time, so there are reasons for optimism.”He noted that as a consequence of the conflict in Ukraine and export deals with other nations, Russia’s defense industry is booming, which has benefited several related economic sectors as well.“As for industries, of course, we do not have statistics on the defense industry, but it is obvious that those enterprises that operate in the defense industry - orders for their products are expanding, output is growing, and accordingly, production is also growing in supplier enterprises that do not produce defense products themselves, but supply for defense products such as, metal blanks, cables, paint - you can list there a list of hundreds and thousands of items that are part of the defense products, which in themselves are not defense products. But the industries that supply these products are also growing in terms of output levels.”Kolganov said US sanctions have failed to crush the Russian economy as US President Joe Biden had predicted because they failed to completely isolate Russia from the world.“We, of course, struggled with the problems of import substitution for a very long time, starting in 2014, when sanctions began to be imposed on us. But nonetheless, some work was done over the previous period and quite a lot of success was achieved in ensuring import substitution, mainly in those industries that were not high-tech. This is where we were able to quickly achieve a high level of supply of domestic products.”Tabakh also explained that the economic weight of the Group of Seven has declined from their domination of some 70% of the world economy 30 years ago, causing the West to overestimate its ability to isolate Russia.“Accordingly, it is clear that depending on one’s own control over the markets, that is, control over the global economy on a scale that would allow this has been lost, perhaps with the exception of the financial sector.”“That is, reasonable measures were taken. Plus, we kept open those markets that allowed us not only to overcome the decline, but even to ensure some growth,” he said, noting that Biden “underestimated the resources of the Russian economy.”Jacques Sapir, director of studies at the School for Advanced Studies in the Social Sciences (EHESS) in Paris, told Sputnik that the PMI report was an indicator the Russian economy would perform well in the coming year.“The leading rank of Russia, which is constant since fall 2022, is a clear indicator that the economy will grow in 2023. Of course, it doesn’t tell us in what proportion. For precise figures it is better to use a paper written by a specialized research institute like the Institute for Economic Forecasting of Moscow. But it clearly shows that sanctions have had only a short-term impact on the Russian economy. Such a fast return to growth, and very probably to a massive growth, was unexpected by Western economists. The main reason is that existing factors of economic resilience and growth in Russia have been seriously undervalued,” he explained.When it comes to sanctions, Sapir said the main factor in this “boomerang effect” was energy exports.“When EU countries decided on sanctions against Russia, they didn’t figure out how much they were dependent on Russian furnished cheap energy,” he explained. “This mistake is now having catastrophic consequences in Germany, and in most EU countries. Russia, to the contrary, has found new clients for its oil and gas.”

https://sputnikglobe.com/20230826/russian-economy-projected-to-grow-25-in-2023-1112912731.html

https://sputnikglobe.com/20230904/russian-fuel-energy-industry-working-very-well-despite-all-sanctions---putin-1113117999.html

https://sputnikglobe.com/20230926/eu-will-not-be-able-to-stop-purchasing-russian-gas-in-near-future-1113679063.html

russia

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

jpmorgan chase; business activity index; western sanctions; economic growth

jpmorgan chase; business activity index; western sanctions; economic growth

Russian Industry Tops Business Activity Index as Economy ‘Built Quite Well’ to Adapt to Sanctions

Russian industry has not just survived Western sanctions, but managed to thrive, recently reaching the top of an international metric of business activity. Experts said the Russian economy has unique properties and that the West overestimated its ability to isolate Russia from trade partners.

A recent

report by JPMorgan Chase placed Russia first in the world in the manufacturing business activity index for September, despite nearly two years of Western sanctions aimed at strangling the Russian economy.

The Manufacturing Purchasing Managers Index (PMI) report described global manufacturing as remaining “in the doldrums” in September, noting that aside from a handful of nations, all of which were in Asia except for Greece, no countries registered a growth in new trade orders. The nations included Russia, Kazakhstan, China, Indonesia, the Philippines, Greece, and Myanmar.

The US saw a very slight contraction, but some of the biggest losers were Eurozone members like Austria, Germany, the Czech Republic, and the Netherlands - nations that once imported Russian energy and other goods, but which have since adopted a boycott, driving up prices across the board and prompting mass protests.

Sputnik spoke with several experts about the report and the economic trends it describes.

Anton Tabakh, the lead economist of the “Expert RA” rating agency, explained that the report gives a businessman’s-eye-view of the economy, looking at the same metrics they use to anticipate economic patterns.

“It is a highly respected survey that has been running for many years. Previously, it was carried out by IHS MARKIT, which was bought by S&P not so long ago. JP Morgan and S&P [Standard & Poor's] publish the figures, which is data from surveys of suppliers. Financial markets are guided by this,” he explained, noting that it is not a rating, but a “kind of indicator. It is not objective in the same sense that, for example, an exchange rate is objective, but it is very respectable.”

“Therefore, it is impossible to talk about this as a ‘rating,’” he noted. “Thus, no indicators are included there - it is an indicator in itself.”

26 August 2023, 16:46 GMT

Tabakh explained that Russia was ahead of industrial giants like the US and China because of economic struggles in both countries driven by trends not playing out in Russia.

“In this case, this is the objective state of the economy. Interest rates are now rising in the United States, and economic activity is slowing. This is not a recession, but it is a slight slowdown in economic activity. So this impacts what companies see,” he said.

“The same thing is happening in China, but for slightly different reasons,” Tabakh said, noting it was “the crisis in the real estate market and the decline in economic growth."

“This is usually the PMI rating - and why do financial sharks look at it? Because it usually shows what will happen in the economy over a period of several months. This is the so-called leading indicator. Not the best, but good enough, that's why everyone is looking at it,” he explained. “That is, it does not show what happened - it is not a rear view mirror. On the contrary, it is an opportunity to look forward. Because it is clear that, as if they are suppliers to large companies, they look at what will be sold there in a few months. And they are purchasing for this purpose.”

Andrey Kolganov, doctor of economics, head of the Laboratory of Socio-Economic Systems at the Faculty of Economics of the Moscow State University, told Sputnik that Russian industry was performing at its best in many years.

“I don’t know the industry breakdown of JP Morgan’s reporting data because detailed statistics are not disclosed, but according to domestic data, we can say that the manufacturing industry is showing the greatest growth, and it is in the manufacturing industry that the business activity index is now the highest in the last few years - you could say even a record since 2017, approximately. And it is higher than the services business activity index, which has been higher than manufacturing in previous months.”

“This is due to the fact that output in the manufacturing industry is growing. And in general, the growth rate of the manufacturing industry is higher than the average for the economy," he said.

"The number of new orders is growing. It is possible to contain price increases, although there are certain difficulties with inflation. But, nevertheless, such a jump in prices has not yet occurred. The normal employment situation is increasing and, moreover, manufacturing employment continues to grow, albeit at a very slow pace,” Kolganov explained. “But it is already at its highest level in a long time, so there are reasons for optimism.”

He noted that as a consequence of the conflict in Ukraine and export deals with other nations, Russia’s defense industry is booming, which has benefited several related economic sectors as well.

4 September 2023, 18:23 GMT

“As for industries, of course, we do not have statistics on the defense industry, but it is obvious that those enterprises that operate in the defense industry - orders for their products are expanding, output is growing, and accordingly, production is also growing in supplier enterprises that do not produce defense products themselves, but supply for defense products such as, metal blanks, cables, paint - you can list there a list of hundreds and thousands of items that are part of the defense products, which in themselves are not defense products. But the industries that supply these products are also growing in terms of output levels.”

Kolganov said US sanctions have failed to crush the Russian economy as US President Joe Biden had predicted because they failed to completely isolate Russia from the world.

“The most obvious thing is that the US’ bet on the complete isolation of the Russian economy within the framework of the world economy turned out to be untenable. The economic blockade of Russia, despite the sanctions imposed and the threats of sanctions against those who cooperate with Russia, this blockade could not be organized. This blockade, in general, turned out to be relatively easy to break through.”

“We, of course, struggled with the problems of import substitution for a very long time, starting in 2014, when sanctions began to be imposed on us. But nonetheless, some work was done over the previous period and quite a lot of success was achieved in ensuring import substitution, mainly in those industries that were not high-tech. This is where we were able to quickly achieve a high level of supply of domestic products.”

“But in some high-tech industries, the level of import substitution has increased slightly. Well, let’s say, if by 2014 our machine-tool industry had a colossal dependence on imports, reaching 95-96%, now the dependence on imports in the machine-tool industry has decreased to 76%. This is, of course, a lot, but this is still less than it was before.”

26 September 2023, 10:31 GMT

Tabakh also explained that the economic weight of the Group of Seven has declined from their domination of some 70% of the world economy 30 years ago, causing the West to overestimate its ability to isolate Russia.

“Accordingly, it is clear that depending on one’s own control over the markets, that is, control over the global economy on a scale that would allow this has been lost, perhaps with the exception of the financial sector.”

"The second reason is the same as why Russian analysts also looked poorly at the prospects: the scale of budget expenditures related to the SMO [special military operation] was not clear, nor the program for anti-sanctions measures. It was not clear how the economy would adapt to this. It turned out that the Russian economy was built quite well for this.”

“That is, reasonable measures were taken. Plus, we kept open those markets that allowed us not only to overcome the decline, but even to ensure some growth,” he said, noting that Biden “underestimated the resources of the Russian economy.”

Jacques Sapir, director of studies at the School for Advanced Studies in the Social Sciences (EHESS) in Paris, told Sputnik that the PMI report was an indicator the Russian economy would perform well in the coming year.

“The leading rank of Russia, which is constant since fall 2022, is a clear indicator that the economy will grow in 2023. Of course, it doesn’t tell us in what proportion. For precise figures it is better to use a paper written by a specialized research institute like the Institute for Economic Forecasting of Moscow. But it clearly shows that sanctions have had only a short-term impact on the Russian economy. Such a fast return to growth, and very probably to a massive growth, was unexpected by Western economists. The main reason is that existing factors of economic resilience and growth in Russia have been seriously undervalued,” he explained.

“The comparison between Russia and some Western economies (Germany, Austria, France) is also extremely interesting as it shows that EU economies will enter a severe recession while Russia will achieve fast growth,” he said, calling it an interesting case of the "‘boomerang effect’ of sanctions indeed.”

When it comes to sanctions, Sapir said the main factor in this “boomerang effect” was energy exports.

“When EU countries decided on sanctions against Russia, they didn’t figure out how much they were dependent on Russian furnished cheap energy,” he explained. “This mistake is now having catastrophic consequences in Germany, and in most EU countries. Russia, to the contrary, has found new clients for its oil and gas.”