https://sputnikglobe.com/20231120/canadas-surging-debt-payments-add-to-trudeaus-polling-woes-1115075469.html

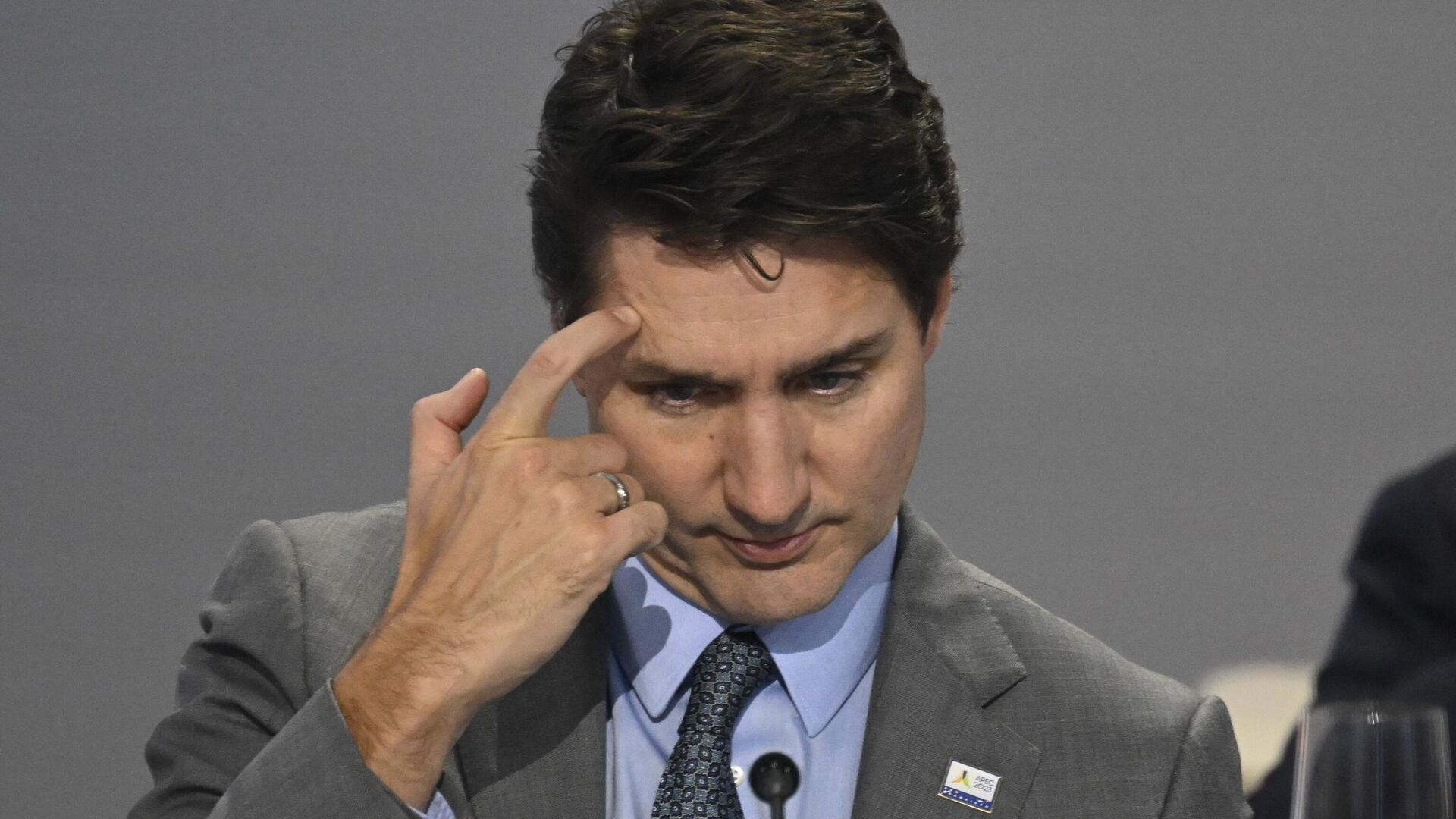

Canada's Surging Debt Payments Add to Trudeau’s Polling Woes

Canada's Surging Debt Payments Add to Trudeau’s Polling Woes

Sputnik International

Canadian Prime Minister Justin Trudeau is forced to contend with sluggish economy, inflation, and rising debt payments dragging his popularity rating to dismal lows ahead of 2025 elections.

2023-11-20T14:19+0000

2023-11-20T14:19+0000

2023-11-20T14:19+0000

world

canada

justin trudeau

economy

chrystia freeland

liberal party

stagflation

inflation

budget deficit

https://cdn1.img.sputnikglobe.com/img/07e7/0b/14/1115074466_0:160:3072:1888_1920x0_80_0_0_018269fc523969ee0b766dd1789af665.jpg

Canadian Prime Minister Justin Trudeau is forced to contend with spiraling challenges threatening to undermine his reelection hopes. A sluggish economy, inflation, and now rising debt payments are adding to the toxic mix that has dragged his popularity rating to dismal lows.With the election coming up in 2025, Trudeau’s embattled government might have hoped that boosted spending could improve its plight with voters. However, all signs are this will not happen, judging by a recent Bloomberg report. The combination of slackening revenue growth and surging interest costs, rendering borrowing increasingly more expensive, can be expected to put a spoke in the wheel for Justin Trudeau. Since establishing a majority government in the wake of the 2015 federal election, his Liberal Party prided itself on a departure from previous years of the Conservatives’ austerity. But now Trudeau, who has dangled promises of lavish spending on social programs and suchlike, may be jolted back to reality.The economic environment has worsened substantially since the March budget drafted by Canada’s Finance Minister Chrystia Freeland, reminded the report. The Bank of Canada, which adhered to a low policy interest rate of close to 0.25 percent during the months of the COVID-19 pandemic, has since embarked upon interest hikes. The rate is now at a 22-year high of 5.0 percent, and given the current level of inflation, the bank kept the door open to further hikes in the future.According to Paul Beaudry, deputy governor at the Bank of Canada, the country is facing the risk of looming stagflation. Accordingly, higher interest rates are elevating the cost of debt for the federal government. In the first eight months of this year, interest charges on federal debt stood at C$28.2 billion ($20.5 billion) – that is a 35 percent hike compared to the same period in 2022.Canada’s Parliamentary Budget Officer Yves Giroux issued a warning in October, saying that higher interest rates would likely result in the economy stagnating in the second half of the year. The CBO also suggested that the federal deficit would surge significantly this fiscal year amid slower government revenue growth and higher expenses. It also projected the debt-to-GDP ratio to go up to 42.6 percent this year. With the federal program expenses anticipated to amount to about 16 percent of the gross domestic product this year, the current woes are feeding into pressures to slash spending.“The federal government needs to reduce its level of program spending, that’s clear… We are at the mercy of international bond markets, and things can turn very quickly,” Randall Bartlett, senior director of Canadian economics at Desjardins Securities, was cited as telling the media.It’s true that Canada’s Freeland and Trudeau have often touted the country’s triple-A ratings from S&P Global Ratings and Moody’s Investors Service, the report stressed. However, the deteriorating situation in the economy was bound to be mirrored in updated fiscal and economic projections, to be published Tuesday. Accordingly, the aforementioned projections will “factor in the cost of new industrial subsidies, wage settlements for public-sector workers and new measures to spur housing construction,” it stated.With an upside risk to the C$40.1 billion (US $30.3 billion) deficit the government is predicted to run in the current fiscal year, no wonder Trudeau and his Liberals are being hammered in the polls by their Conservative opponents.Almost two in three Canadians have a negative impression of the prime minister, and half want him to resign before the next election, a Leger poll for The Canadian Press suggested. Dissatisfaction was blamed on everything ranging from government spending and climate change, to issues such as inflation, housing affordability and health care. On a national scale, 63 percent of respondents were not satisfied with Trudeau's government. Furthermore, Trudeau trailed Conservative Leader Pierre Poilievre on the issue of who would be the best PM, with 27 percent of those surveyed backing Poilievre versus 17 percent - Trudeau.According to Poilievre, the high prices in Canada that were adding to household woes were the result of “Justinflation”

https://sputnikglobe.com/20231025/food-banks-in-canada-registered-record-19mln-visits-in-march-1114479097.html

https://sputnikglobe.com/20231101/over-60-of-canadians-dissatisfied-with-trudeau-government--poll-1114643154.html

canada

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

canada’s prime minister justin trudeau, canada, justin trudeau, poll, trudeau unpopular, trudeau’s embattled government, canada's rising debt payments, canada's 2025 elections, justin trudeau trails pierre poilievre in opinion polls

canada’s prime minister justin trudeau, canada, justin trudeau, poll, trudeau unpopular, trudeau’s embattled government, canada's rising debt payments, canada's 2025 elections, justin trudeau trails pierre poilievre in opinion polls

Canada's Surging Debt Payments Add to Trudeau’s Polling Woes

Canada’s Prime Minister Justin Trudeau will be seeking a fourth term in office in 2025, but there is nothing about his performance to inspire him with optimism, ranging from his dismal poll ratings to the overall economic situation and warnings of looming stagflation.

Canadian Prime Minister

Justin Trudeau is forced to contend with spiraling challenges threatening to undermine his reelection hopes. A sluggish economy, inflation, and now rising debt payments are adding to the toxic mix that has dragged his popularity rating to

dismal lows.

With the election coming up in 2025, Trudeau’s embattled government might have hoped that boosted spending could improve its plight with voters. However, all signs are this will not happen, judging by a recent Bloomberg report. The combination of slackening revenue growth and surging interest costs, rendering borrowing increasingly more expensive, can be expected to put a spoke in the wheel for Justin Trudeau. Since establishing a majority government in the wake of the 2015 federal election, his Liberal Party prided itself on a departure from previous years of the Conservatives’ austerity. But now Trudeau, who has dangled promises of lavish spending on social programs and suchlike, may be jolted back to reality.

25 October 2023, 15:41 GMT

The economic environment has worsened substantially since the March budget drafted by Canada’s Finance Minister Chrystia Freeland, reminded the report. The Bank of Canada, which adhered to a low policy interest rate of close to 0.25 percent during the months of the COVID-19 pandemic, has since embarked upon interest hikes. The rate is now at a 22-year high of 5.0 percent, and given the current level of inflation, the bank kept the door open to further hikes in the future.

According to Paul Beaudry, deputy governor at the Bank of Canada, the country is facing the risk of looming stagflation. Accordingly, higher interest rates are elevating the cost of debt for the federal government. In the first eight months of this year, interest charges on federal debt stood at C$28.2 billion ($20.5 billion) – that is a 35 percent hike compared to the same period in 2022.

Canada’s Parliamentary Budget Officer Yves Giroux issued a warning in October, saying that higher interest rates would likely result in the economy stagnating in the second half of the year. The CBO also suggested that the federal deficit would surge significantly this fiscal year amid slower government revenue growth and higher expenses. It also projected the debt-to-GDP ratio to go up to 42.6 percent this year. With the federal program expenses anticipated to amount to about 16 percent of the gross domestic product this year, the current woes are feeding into pressures to slash spending.

“The federal government needs to reduce its level of program spending, that’s clear… We are at the mercy of international bond markets, and things can turn very quickly,” Randall Bartlett, senior director of Canadian economics at Desjardins Securities, was cited as telling the media.

It’s true that Canada’s Freeland and Trudeau have often touted the country’s triple-A ratings from S&P Global Ratings and Moody’s Investors Service, the report stressed. However, the deteriorating situation in the economy was bound to be mirrored in updated fiscal and economic projections, to be published Tuesday. Accordingly, the aforementioned projections will “factor in the cost of new industrial subsidies, wage settlements for public-sector workers and new measures to spur housing construction,” it stated.

With an upside risk to the

C$40.1 billion (US $30.3 billion) deficit the government is predicted to run in the current fiscal year, no wonder Trudeau and his Liberals are being

hammered in the polls by their Conservative opponents.

Almost two in three Canadians have a negative impression of

the prime minister, and half want him to resign before the next election, a

Leger poll for

The Canadian Press suggested. Dissatisfaction was blamed on everything ranging from government spending and climate change, to issues such as inflation, housing affordability and health care. On a national scale, 63 percent of respondents were not satisfied with Trudeau's government. Furthermore, Trudeau trailed

Conservative Leader Pierre Poilievre on the issue of who would be the best PM, with 27 percent of those surveyed backing Poilievre versus 17 percent - Trudeau.

According to Poilievre, the high prices in Canada that were adding to

household woes were the result of “Justinflation”

1 November 2023, 13:55 GMT