https://sputnikglobe.com/20240112/how-will-yemen-attacks-affect-global-oil-market-1116134665.html

How Will Yemen Attacks Affect Global Oil Market?

How Will Yemen Attacks Affect Global Oil Market?

Sputnik International

Following the overnight joint US-UK attack against the Yemeni Houthis, there is major uncertainty regarding global oil prices that may skyrocket in case of serious military escalation, but there is a catch.

2024-01-12T19:08+0000

2024-01-12T19:08+0000

2024-01-12T19:08+0000

economy

yemen

united kingdom (uk)

west

houthi

sputnik

federal reserve

brent

red sea crisis

oil prices

https://cdn1.img.sputnikglobe.com/img/07e6/08/17/1099922812_0:96:1436:904_1920x0_80_0_0_8de3e59195d7e20c1c8ac3c01eebd8c1.png

The cost of oil rose slightly due to fears of an escalation of the Yemen conflict and the potential direct involvement of Iran, which would prevent production and transportation throughout the region. The cost of benchmark Brent crude rose 2.5% to over $79 a barrel amid US and British strikes on Houthi bases in Yemen.However, the expert warned against making sensational interpretations of the situation.Despite Yemen enjoying considerable strategic significance when it comes to maritime shipping routes, it is the US dollar that is the decisive factor in global oil prices.The same applies to plausible commercial risks of Iran closing the Strait of Hormuz, halting about 20% of the world's oil flow.The Houthis have been targeting Israeli-linked ships in the Red Sea since last October as a response to large-scale Israeli attacks against the Gaza Strip, which resulted in massive civilian casualties and a devastating humanitarian crisis. An important factor in the ongoing escalation is Yemen's strategic importance in global trade. As a result of the Houthi attacks on vessels passing through the Red Sea, international ships now have to alter their routes to avoid being struck, thus sustaining tangible economic losses.

yemen

united kingdom (uk)

west

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

houthi attacks in the red sea, terrorist attacks in the red sea, why are houthis attacks ships in the red sea, commercial ships under attack in the red sea, who do houthis target, who do houthis attack, who are houtis, red sea attacks, what’s happening in the red sea, why are there attacks in the red sea, us ships in the red sea, us coalition in the red sea, us-led coalition in the red sea, international coalition in the red sea, military hostilities in the red sea, tensions in the red sea

houthi attacks in the red sea, terrorist attacks in the red sea, why are houthis attacks ships in the red sea, commercial ships under attack in the red sea, who do houthis target, who do houthis attack, who are houtis, red sea attacks, what’s happening in the red sea, why are there attacks in the red sea, us ships in the red sea, us coalition in the red sea, us-led coalition in the red sea, international coalition in the red sea, military hostilities in the red sea, tensions in the red sea

How Will Yemen Attacks Affect Global Oil Market?

Following the overnight joint US-UK attack against the Yemeni Houthis, there is major uncertainty regarding global oil prices that may skyrocket if there is serious military escalation. But there is a catch, it seems.

The cost of oil rose slightly due to fears of an

escalation of the Yemen conflict and the potential direct involvement of Iran, which would prevent production and transportation throughout the region. The cost of benchmark Brent crude

rose 2.5% to over $79 a barrel amid US and British strikes on Houthi bases in Yemen.

“Geopolitical events in West Asia could push oil prices higher, but we should not assume that they necessarily will. We could see a spike upward in the short term, but whether the upward pressure on prices will be sustained is an open question,” Alex Krainer, a Europe-based financial analyst and political commentator, told Sputnik.

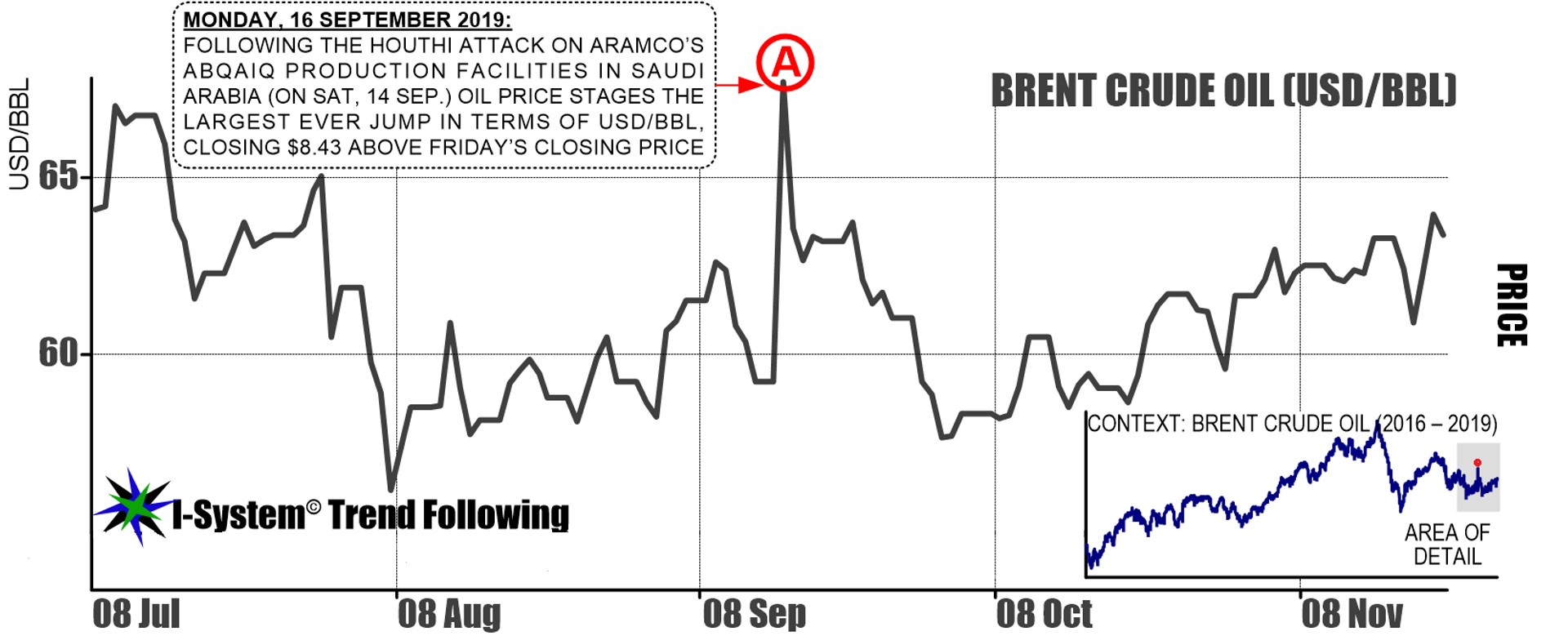

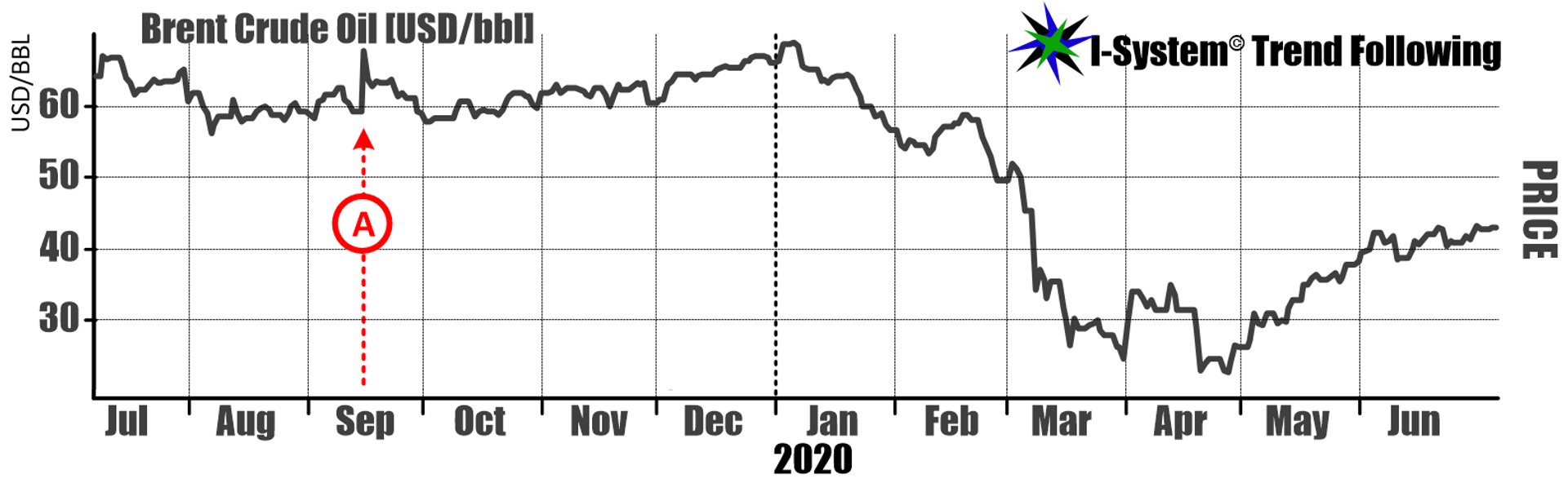

"On Saturday, 14 September, 2019, a missile attack in Saudi Arabia caused substantial damage to Aramco’s Abqaiq oil production facilities. The following Monday, Brent crude oil, which traded just below $60/barrel sustained the largest-ever one-day price jump and closed $8.42/bbl above the previous Friday’s price (this event is marked (A) in the chart below. Expecting further escalations, many in the markets expected that the price would rapidly move toward $100/bbl but this did not happen and the price quickly dropped back below $60/bbl."

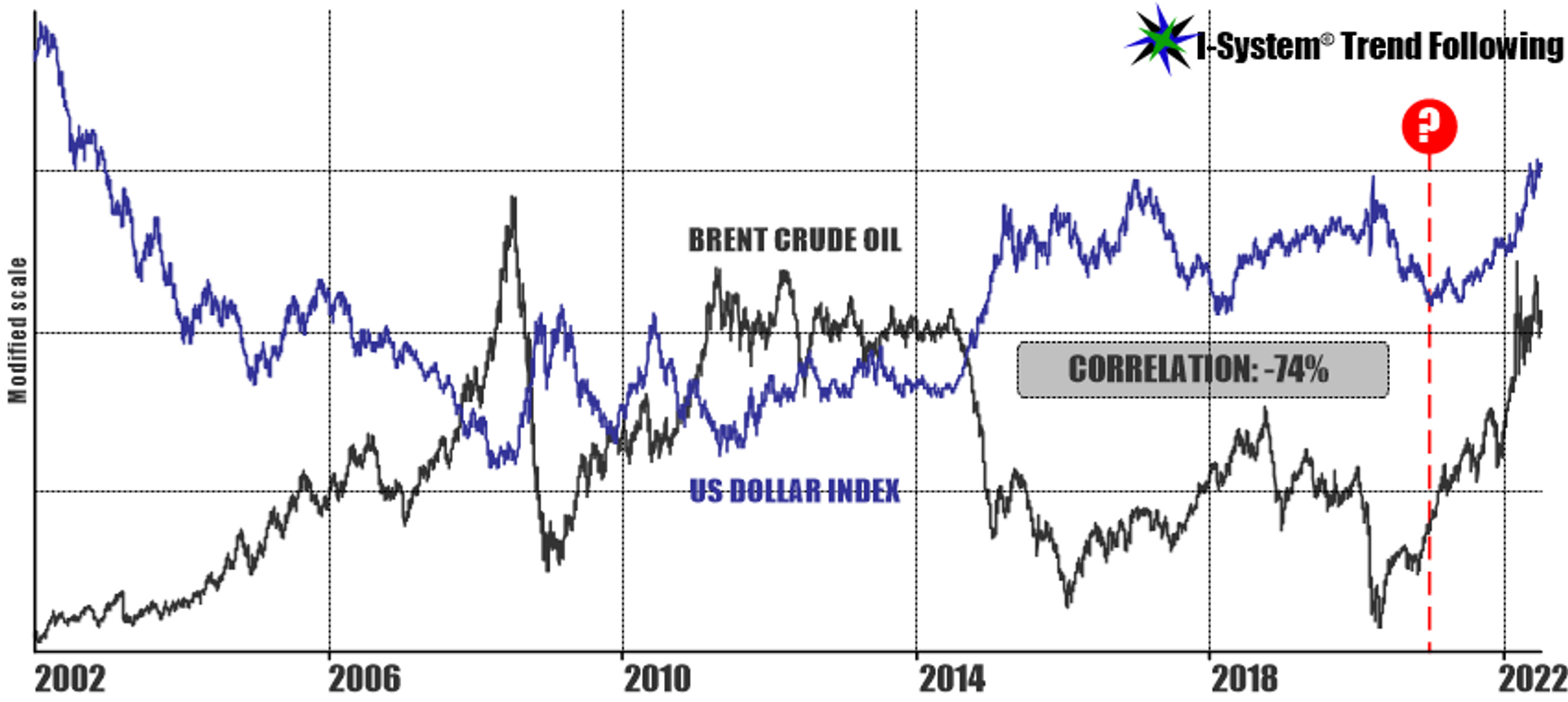

Despite Yemen enjoying considerable strategic significance when it comes to maritime shipping routes, it is the US dollar that is the decisive factor in global oil prices.

“During most of the last 20+ years, the most important single factor influencing oil prices has been the US dollar which has had a very strong inverse correlation to oil prices,” Krainer added.

The same applies to plausible commercial risks of Iran closing the Strait of Hormuz, halting about 20% of the world's oil flow.

“Elements like US economic performance, inflation, Federal Reserve policy, etc. play a much greater role than discernible supply/demand economics and even geopolitics,” Krainer emphasized.

The Houthis have been targeting Israeli-linked ships in the Red Sea since last October as a response to large-scale Israeli attacks against the Gaza Strip, which resulted in massive civilian casualties and a devastating humanitarian crisis.

An important

factor in the ongoing escalation is Yemen's strategic importance in global trade. As a result of the Houthi attacks on vessels passing through the Red Sea, international ships now have to alter their routes to avoid being struck, thus sustaining tangible economic losses.