https://sputnikglobe.com/20241123/europe-is-hurtling-towards-new-energy-crisis-with-depleted-reserves-short-sighted-russia-sanctions-1120980271.html

Europe is Hurtling Towards New Energy Crisis With Depleted Reserves, Short-Sighted Russia Sanctions

Europe is Hurtling Towards New Energy Crisis With Depleted Reserves, Short-Sighted Russia Sanctions

Sputnik International

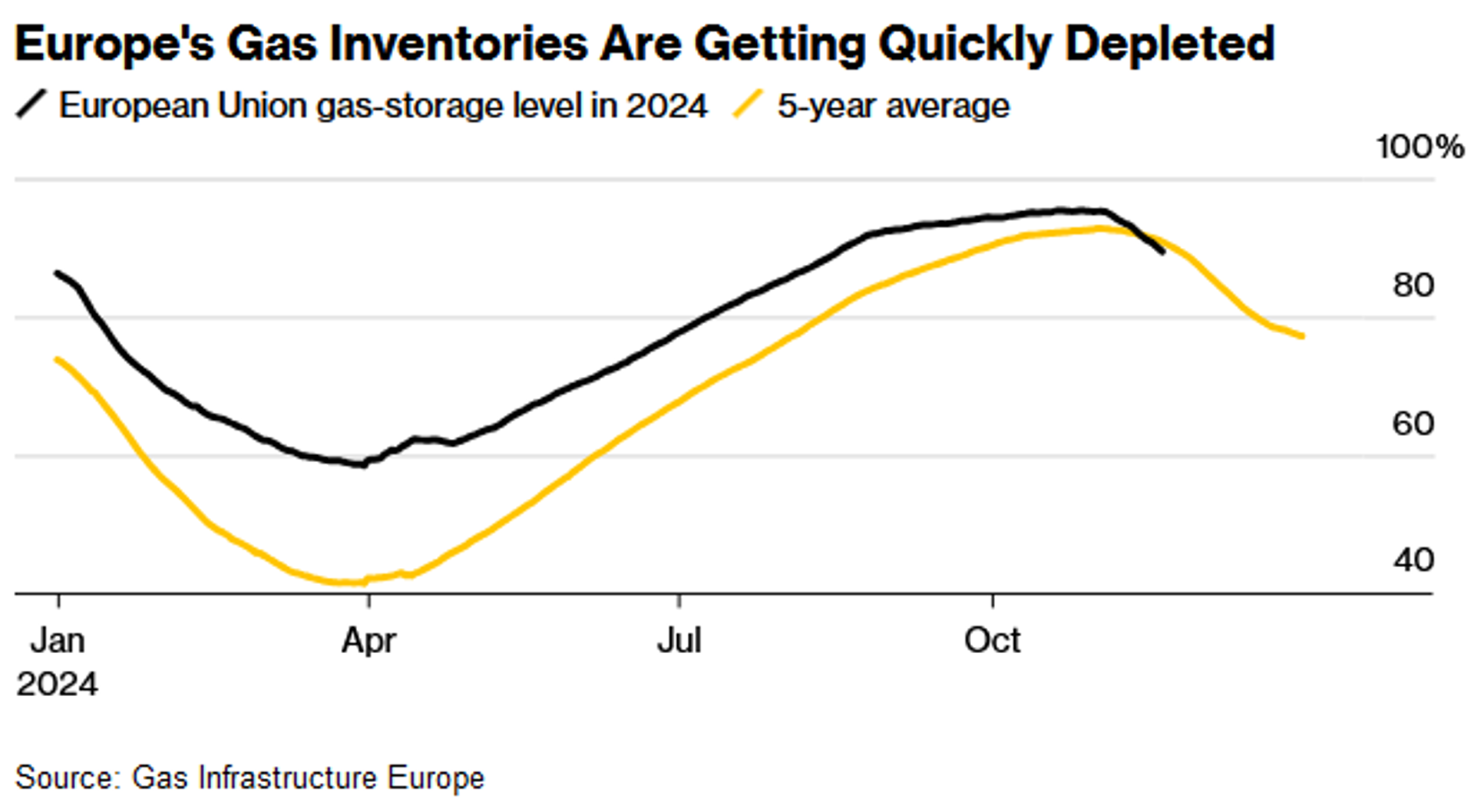

Europe is facing a repeat of the 2022 energy crisis. Gas inventories are fast being depleted after cold late-autumn temperatures increased heating demand. Sources that helped fill reserves in 2024 will be likely unavailable for several reasons, news site Bloomberg warned.

2024-11-23T15:25+0000

2024-11-23T15:25+0000

2024-11-23T15:26+0000

russia

europe

european union (eu)

gazprom

austria

omv

russian economy under sanctions

anti-russian policy

economy

https://cdn1.img.sputnikglobe.com/img/07e6/0b/16/1104559953_0:206:2907:1841_1920x0_80_0_0_2725929b19c49d799424c5ea061b1120.jpg

Europe is facing a repeat of the 2022 energy crisis. Gas inventories are fast being depleted after cold late-autumn temperatures increased heating demand. Sources that helped fill reserves in 2024 will be likely unavailable for several reasons, news site Bloomberg warned.Despite the European Union’s efforts to cut off cheap Russian energy supplies, its gas still reaches central European nations Hungary and Slovakia. Austria also received Russian gas until Russia’s Gazprom suspended supplies to national energy company OMV on November 16. Europe is bracing for a potential end to Russian gas supplies via Ukraine at the end of the year. Kiev announced it would not extend a transit deal contract between Gazprom and Ukraine’s Naftogaz.The US Treasury announced a new round of sanctions against Russia on November 21 that includes Gazprombank and six foreign subsidiaries.Those factors already impact EU gas prices, which have soared by 45% this year to over $500 per thousand cubic meters. Prices for next summer’s gas futures are even higher than for the following winter, projections based on broker data show.Rising gas prices are expected to deepen the consumer cost-of-living crisis and pile pressure on manufacturers.Germany, which has suffered the most from US-led sanctions on Russia and now relies on imports of liquefied natural gas, is once again likely to “suffer the most,” Ole Hansen, head of commodity strategy at Saxo Bank AS warned.Despite the EU’s efforts to end imports of its gas, Russia became the bloc’s largest gas source in September for the first time since spring 2022. Its share reached 23.7%, Sputnik calculated based on data from the European Statistical Office.

https://sputnikglobe.com/20241121/russia-becomes-eus-largest-gas-exporter-for-1st-time-since-may-2022---statistics-1120947211.html

russia

austria

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

is europe facing another energy crisis, will there be an energy crisis in europe this winter, russian economy under sanctions, sanctions against russia,gazprom export, omv, how much russian gas does austria buy, what if russia stopped selling gas to austria, why can't central europe stop buying russian gas, who still buys russian gas in europe, what is share of russian gas eu imports

is europe facing another energy crisis, will there be an energy crisis in europe this winter, russian economy under sanctions, sanctions against russia,gazprom export, omv, how much russian gas does austria buy, what if russia stopped selling gas to austria, why can't central europe stop buying russian gas, who still buys russian gas in europe, what is share of russian gas eu imports

Europe is Hurtling Towards New Energy Crisis With Depleted Reserves, Short-Sighted Russia Sanctions

15:25 GMT 23.11.2024 (Updated: 15:26 GMT 23.11.2024) Gas prices in Europe have exceeded $500 per thousand cubic meters, with futures surging as Russia suspended fuel deliveries to Austria's OMV. The impending expiration of the contract between Ukraine and Gazprom, which allows Russian gas shipments via Ukraine, on January 1 has further fueled concerns over winter supplies.

Europe is facing a repeat of the 2022 energy crisis. Gas inventories are fast being depleted after cold late-autumn temperatures increased heating demand. Sources that helped fill reserves in 2024 will be likely unavailable for several reasons, news site Bloomberg warned.

Despite the European Union’s efforts to cut off cheap Russian energy supplies, its gas still reaches central European nations Hungary and Slovakia. Austria also received Russian gas until Russia’s Gazprom suspended supplies to national energy company OMV on November 16.

Europe is bracing for a potential end to Russian gas supplies via Ukraine at the end of the year. Kiev announced it would not extend a transit deal contract between Gazprom and Ukraine’s Naftogaz.

The US Treasury announced a new round of sanctions against Russia on November 21 that includes Gazprombank and six foreign subsidiaries.

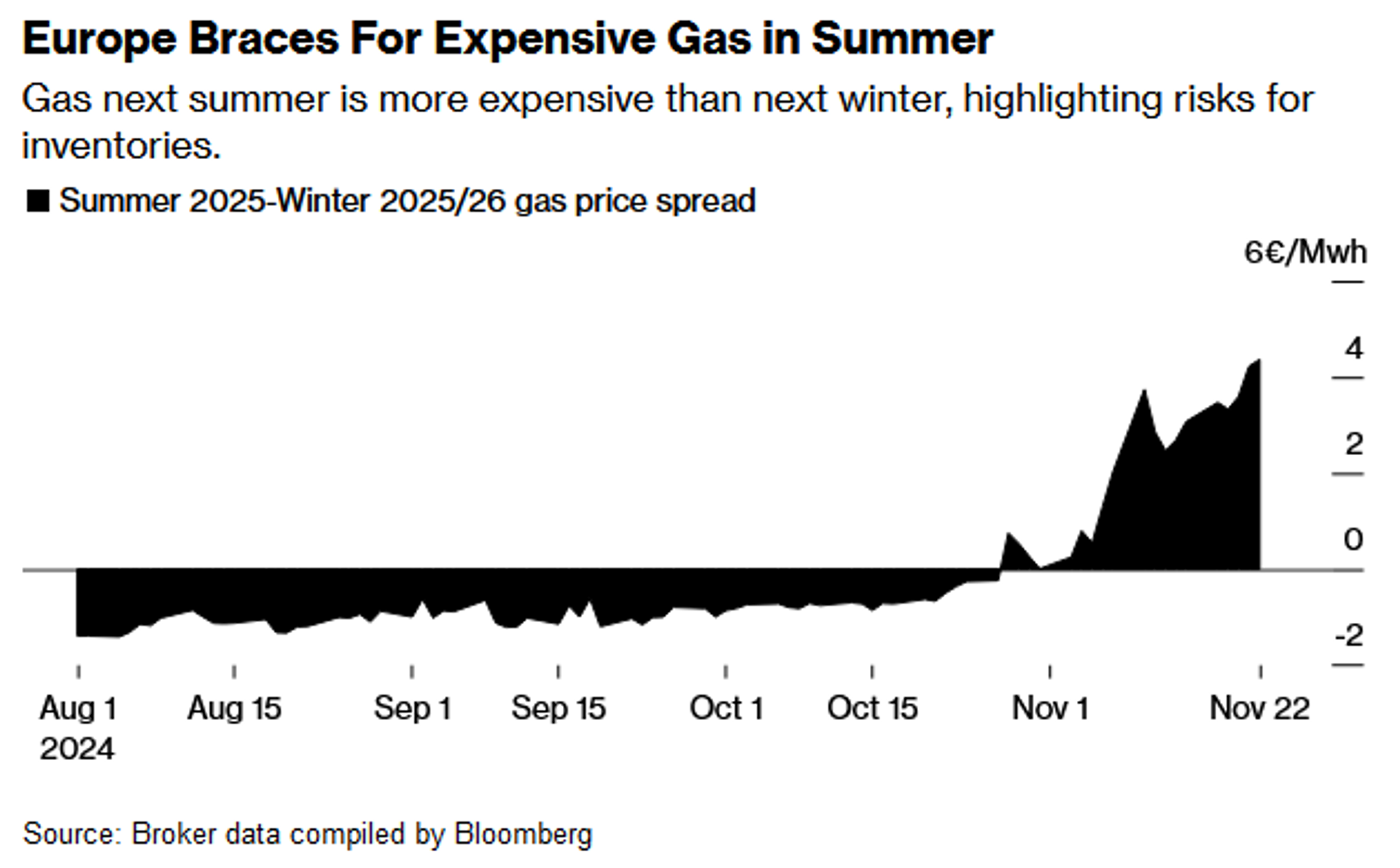

Those factors already impact EU gas prices, which have soared by 45% this year to over $500 per thousand cubic meters. Prices for next summer’s gas futures are even higher than for the following winter, projections based on broker data show.

Rising gas prices are expected to deepen the consumer cost-of-living crisis and pile pressure on manufacturers.

“This is beginning to resemble a 2022 scenario in which the EU purchased gas at any price,” said Arne Lohmann Rasmussen, chief analyst at Global Risk Management.

Germany, which has suffered the most from US-led sanctions on Russia and now relies on imports of liquefied natural gas, is once again likely to “suffer the most,” Ole Hansen, head of commodity strategy at Saxo Bank AS warned.

Despite the EU’s efforts to end imports of its gas, Russia became the bloc’s largest gas source in September for the first time since spring 2022. Its share reached 23.7%, Sputnik calculated based on data from the European Statistical Office.

21 November 2024, 04:40 GMT