https://sputnikglobe.com/20241202/zinc-price-swings-offer-taste-of-us-tariff-at-any-cost-gamble-targeting-china-1121068647.html

Zinc Price Swings Offer Taste of US Tariff-At-Any-Cost Gamble Targeting China

Zinc Price Swings Offer Taste of US Tariff-At-Any-Cost Gamble Targeting China

Sputnik International

Zinc’s recent price swings reflect the supply pressures of the critical metal that are likely to spill over into 2025, Bloomberg cited analysts as saying.

2024-12-02T10:38+0000

2024-12-02T10:38+0000

2024-12-02T10:38+0000

world

us

donald trump

zinc

china

shanghai

trump tariffs

tariffs

steel

semi-conductors

https://cdn1.img.sputnikglobe.com/img/07e6/0c/0b/1105353411_0:107:2048:1259_1920x0_80_0_0_166a39909602fdd5f71b292fb1e6d8bf.jpg

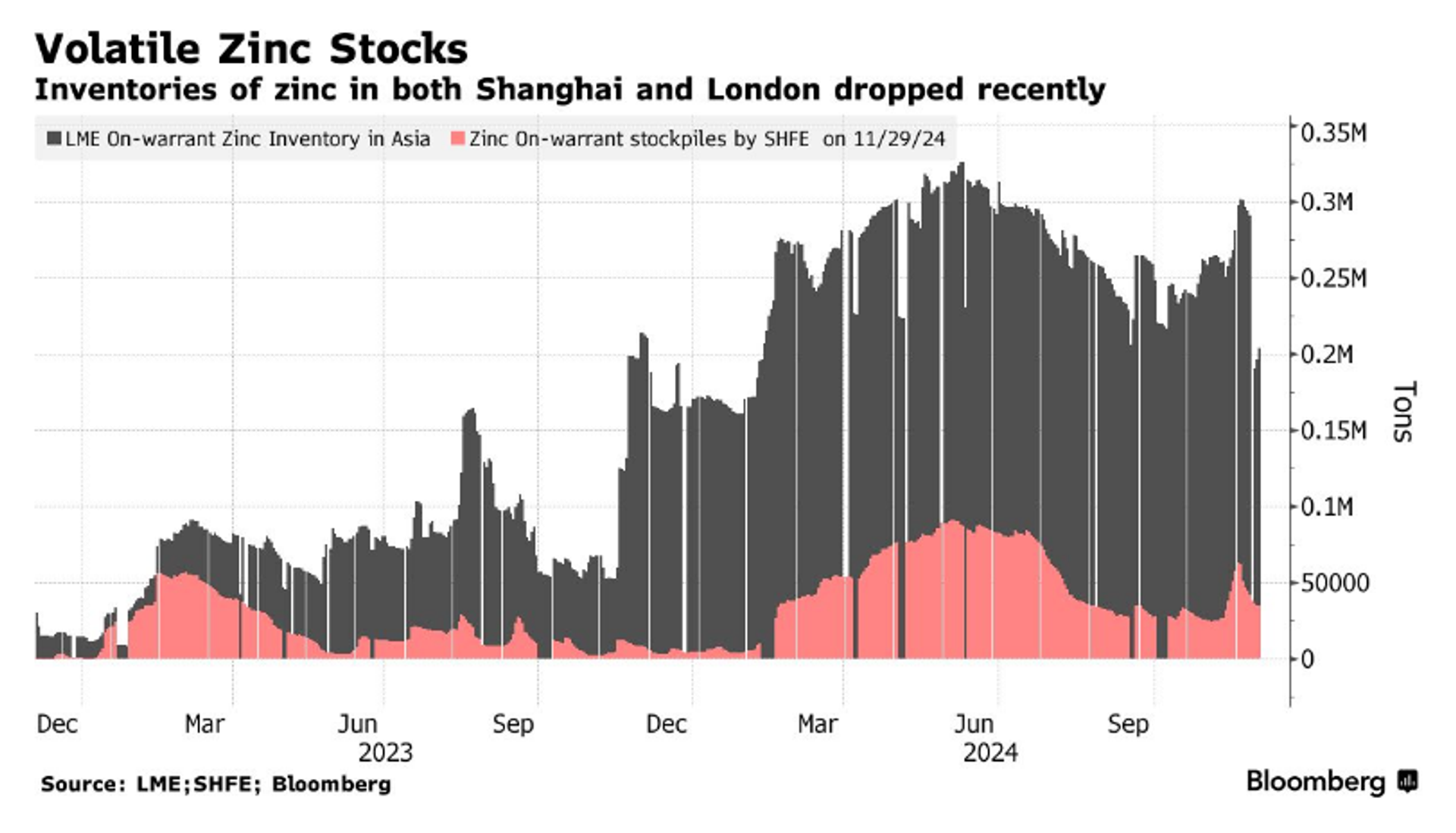

Zinc’s recent price swings reflect the supply pressures of the critical metal that are likely to spill over into 2025, Bloomberg cited analysts as saying. On November 28, zinc prices fell by 2.5%, only to rebound and finish nearly 5% higher on the London Metal Exchange (LME). However, by December 1, the price dropped again, settling at $3,089.50 per ton, a decline of 0.4%. The wave of turbulence on the volatile zinc market offers a taste of potential fallout from US President-elect Donald Trump’s threat to slap additional 10% tariffs on all goods from China. The Asian giant dominates the global market of the rare earth metal, with an annual zinc output of 4.2 million metric tons. Should there be any further flare-ups in the US-China trade feud, this would likely impact both the supply and pricing of this key industrial metal, which is primarily used for corrosion resistance in steel. Additionally, zinc oxide plays a crucial role in the semiconductor industry, particularly in electronic devices.The recent surge in prices was fueled by one of the largest withdrawals of zinc from the LME in over a decade. On the Shanghai Futures Exchange, inventories fell by more than 9,000 tons, reflecting a similar decline in London, attributed to take-out orders from the Trafigura Group, a global trading giant. Worldwide demand for refined zinc is projected to increase by 1.6% to 14.04 million tons in 2025, according to the International Lead and Zinc Study Group.

https://sputnikglobe.com/20241126/neither-china-nor-us-will-benefit-from-waging-trade-war-1121003491.html

china

shanghai

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

zinc’s price swings, why is zinc important, what is zinc used for, which country produces the most zinc, what could new spiral of us-china trade war bring, is there enough supply of zinc on the market, what are rare earth metals

zinc’s price swings, why is zinc important, what is zinc used for, which country produces the most zinc, what could new spiral of us-china trade war bring, is there enough supply of zinc on the market, what are rare earth metals

Zinc Price Swings Offer Taste of US Tariff-At-Any-Cost Gamble Targeting China

US President-elect Donald Trump has repeatedly criticized China's economic policies and recently threatened to add an additional 10% tariff on all goods from the Asian giant.

Zinc’s recent price swings reflect the supply pressures of the

critical metal that are likely to spill over into 2025,

Bloomberg cited analysts as saying.

On November 28, zinc prices fell by 2.5%, only to rebound and finish nearly 5% higher on the London Metal Exchange (LME). However, by December 1, the price dropped again, settling at $3,089.50 per ton, a decline of 0.4%.

The wave of turbulence on the volatile zinc market offers a taste of potential fallout from US President-elect Donald Trump’s threat to slap

additional 10% tariffs on all goods from China.

The Asian giant dominates the global market of the rare earth metal, with an annual zinc output of 4.2 million metric tons.

Should there be any further flare-ups in the US-China trade feud, this would

likely impact both the supply and pricing of this key industrial metal, which is primarily used for corrosion resistance in steel. Additionally, zinc oxide plays a crucial role in the semiconductor industry, particularly in electronic devices.

The recent surge in prices was fueled by one of the largest withdrawals of zinc from the LME in over a decade. On the Shanghai Futures Exchange, inventories fell by more than 9,000 tons, reflecting a similar decline in London, attributed to take-out orders from the Trafigura Group, a global trading giant.

Worldwide demand for refined zinc is projected to increase by 1.6% to 14.04 million tons in 2025, according to the

International Lead and Zinc Study Group.

26 November 2024, 05:34 GMT