https://sputnikglobe.com/20230519/yellen-says-more-bank-mergers-probably-necessary---report-1110469015.html

Yellen Says More Bank Mergers Probably Necessary - Report

Yellen Says More Bank Mergers Probably Necessary - Report

Sputnik International

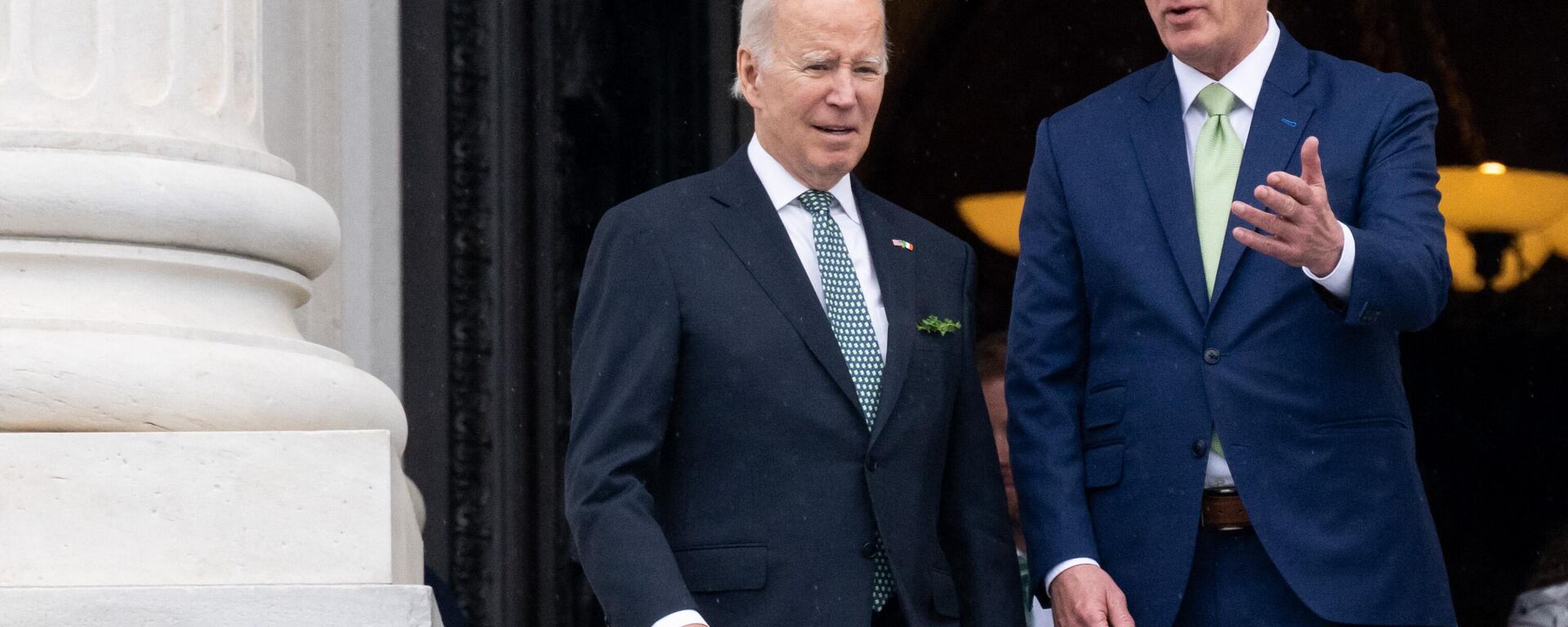

Biden has intervened to block several corporate takeovers, including JetBlue’s purchase of Spirit and Microsoft’s takeover of Activision Blizzard. But it’s singing a different tune when it comes to the country’s largest banks.

2023-05-19T17:38+0000

2023-05-19T17:38+0000

2023-05-19T17:38+0000

americas

banks

corporate merger

janet yellen

us

first republic bank

https://cdn1.img.sputnikglobe.com/img/07e7/05/0b/1110258871_0:0:3073:1730_1920x0_80_0_0_e0734cf8801a2b2c301d738a17a56ceb.jpg

At a meeting with the CEOs of the country’s largest banks, US Treasury Secretary Janet Yellen said that more bank mergers might be necessary as the financial crisis continues to unfold, according to media reports based on people familiar with the matter.A Treasury readout of the meeting said Yellen "reaffirmed the strength and soundness of the US banking system," but did not mention talk of mergers. However, the former Federal Reserve chief did mention them in comments to the media earlier this week.Earlier this month, most of First Republic Bank was sold to JPMorgan by the Federal Deposit Insurance Corporation (FDIC), a government-owned corporation used to safeguard depositors’ funds from bank runs, in a fire sale following a takeover weeks prior. The collapse of First Republic was the second-largest bank failure in US history and followed the third-largest bank failure, that of Silicon Valley Bank, weeks before. Only the collapse of Washington Mutual during the 2008 stock market crash was larger.The decision to allow JPMorgan, the largest bank in the United States, to takeover the majority of First Republic’s assets was sharply criticized by anti-consolidation allies of US President Joe Biden.However, the Biden administration hasn’t been totally accommodating to financiers during the crisis, either: after Silicon Valley Bank and Signature Bank went under in March, Biden said investors wouldn’t enjoy the protection that insured deposit-holders received via the FDIC.The administration has attempted to project an image of stability amid the crisis, which also comes as the Federal Reserve has been raising interest rates for more than a year in an effort to slow down inflation. Economic data released in late April showed that in the first quarter of 2023, the US’ gross domestic product (GDP) grew by just 1.1%, a significant slowdown from the previous quarter’s growth rate of 2.6%. Economic forecasters have predicted the US economy will slow even more as the year progresses, expecting a GDP growth rate of just 0.7% for 2023.Even if the US avoids a default, the crisis could result in a downgrading of the federal government’s credit rating by international observers, as happened during a similar crisis in 2011.

https://sputnikglobe.com/20230518/silicon-valley-bank-execs-criminal-to-pay-themselves-bonuses-before-collapse-1110439855.html

https://sputnikglobe.com/20230519/biden-deal-with-republicans-over-debt-ceiling-would-reward-hostage-taking-1110461153.html

americas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

bank; merger; yellen; treasury; first republic

bank; merger; yellen; treasury; first republic

Yellen Says More Bank Mergers Probably Necessary - Report

The Biden administration has intervened to block several corporate takeovers, including JetBlue’s attempted purchase of Spirit Airlines and Microsoft’s attempted takeover of video game maker Activision Blizzard. However, it’s singing a different tune when it comes to the country’s largest financial institutions.

At a meeting with the CEOs of the country’s largest banks, US Treasury Secretary Janet Yellen said that more bank mergers might be necessary as the financial crisis continues to unfold, according to media reports based on people familiar with the matter.

Yellen reportedly made the remarks in a Thursday meeting with the Bank Policy Institute, a collection of bank CEOs that includes Jamie Dimon of JPMorgan Chase, Brian Moynihan of Bank of America, David Solomon of Goldman Sachs, and more than a dozen others.

A

Treasury readout of the meeting said Yellen "reaffirmed the strength and soundness of the US banking system," but did not mention talk of mergers. However, the former Federal Reserve chief did mention them in comments to the media earlier this week.

"This might be an environment in which we’re going to see more mergers, and you know, that’s something I think the regulators will be open to, if it occurs," Yellen told US media.

Earlier this month, most of First Republic Bank was

sold to JPMorgan by the Federal Deposit Insurance Corporation (FDIC), a government-owned corporation used to safeguard depositors’ funds from bank runs, in a fire sale following a takeover weeks prior. The collapse of First Republic was the second-largest bank failure in US history and followed the third-largest bank failure, that of Silicon Valley Bank, weeks before. Only the collapse of Washington Mutual during the 2008 stock market crash was larger.

The decision to allow JPMorgan, the largest bank in the United States, to takeover the majority of First Republic’s assets was sharply criticized by anti-consolidation allies of US President Joe Biden.

"What happened here is because a bank was under-regulated and started to fail, the federal government has helped JPMorgan Chase get even bigger," US Sen. Elizabeth Warren (D-MA) told reporters. "It may look good today while everything’s flying high, but ultimately if one of those giant banks, JPMorgan Chase, starts to stumble, the American taxpayers are the ones who will be on the line."

However, the Biden administration hasn’t been totally accommodating to financiers during the crisis, either: after Silicon Valley Bank and Signature Bank went under in March, Biden said investors wouldn’t enjoy the protection that insured deposit-holders received via the FDIC.

"Investors in the banks will not be protected," Biden told reporters. "They knowingly took a risk and when the risk didn’t pay off, the investors lose their money. That’s how capitalism works."

The administration has attempted to project an image of stability amid the crisis, which also comes as the Federal Reserve has been raising interest rates for more than a year in an effort to slow down inflation.

Economic data released in late April showed that in the first quarter of 2023, the US’ gross domestic product (GDP) grew by just 1.1%, a significant slowdown from the previous quarter’s growth rate of 2.6%. Economic forecasters have predicted the US economy will slow even more as the year progresses, expecting a GDP growth rate of just 0.7% for 2023.

Yellen has also

issued dire warnings about the outcome of a high-stakes game of financial chicken being played by federal lawmakers, who have failed for four months to break an impasse and raise the debt ceiling. The Treasury chief said the US could default on its debts as soon as June 1 if the ceiling is not raised, which would destroy the country’s credit rating and trigger an economic crisis.

Even if the US avoids a default, the crisis could result in a downgrading of the federal government’s credit rating by international observers, as happened during a similar crisis in 2011.