https://sputnikglobe.com/20230528/what-is-a-recession-and-how-can-you-prepare-for-one-1110657273.html

What is a Recession and How Can You Prepare for One?

What is a Recession and How Can You Prepare for One?

Sputnik International

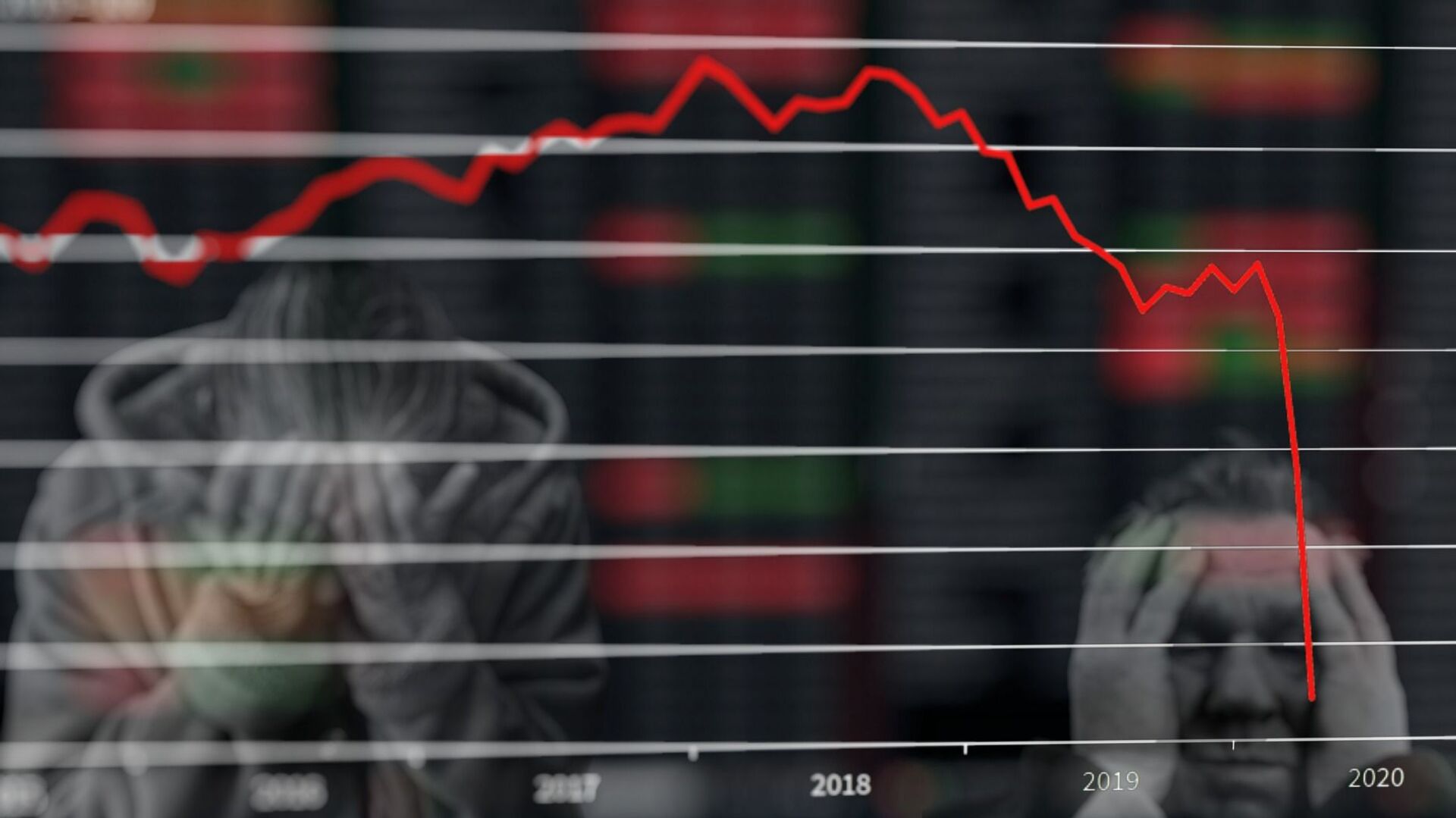

President Biden and GOP House speaker Kevin McCarthy reached a last-minute deal on the debt ceiling Saturday, with Biden boasting that the agreement would prevent a “catastrophic default” and punishing recession. What are recessions? What can ordinary folks do to cushion their blow? Sputnik explains.

2023-05-28T14:51+0000

2023-05-28T14:51+0000

2023-05-28T15:04+0000

joe biden

kevin mccarthy

white house

recession

economic recession

global recession

depression

great depression

economic depression

economic growth

https://cdn1.img.sputnikglobe.com/img/07e5/01/16/1081847401_14:0:1906:1064_1920x0_80_0_0_cf28374b59b82449015effcdd431a39a.jpg

The tentative agreement on the debt ceiling was arrived at just days before the early June deadline after which the US would be expected to default on some or all of its gargantuan $31.8 trillion national debt, plunging the nation into a deep economic crisis and the world economy into chaos.Joe Biden hailed the deal as “good news for the American people,” saying that the “compromise” would prevent Americans’ retirement accounts from being devastated, and stop “millions of jobs” from being wiped out.Not so fast, say economists, bankers and even bookies. Economic experts surveyed by Bloomberg late last year projected about a 70 percent chance of the United States slipping into a recession before 2023 was out, with the metric presently hovering above 65 percent, debt ceiling deal or no debt ceiling deal.A number of factors account for the gloomy predictions, including sluggish consumer spending levels and high interest rates, inflation, the end of federal fiscal stimulus and a string of commercial bank failures earlier this year which shook public faith in the banking sector and left millions of account holders with the jitters.How is a Recession Defined and What Does It Mean?According to its textbook Economics 101 definition, a recession means two consecutive quarters (six months) of negative economic growth.But politics often complicates things. For example, under the above definition, the United States actually slipped into a recession last summer, with real gross domestic product falling by 1.4 percent and 0.9 percent in Q1 and Q2, respectively, according to the Department of Commerce’s Bureau of Economic Analysis figures. Ignoring these numbers, Joe Biden profusely refused to recognize that the country had entered a recession, prompting economic advisors and media toadies to insist that the growth figures in and of themselves were irrelevant, and that definitions should be “more complex,” and take into account things like unemployment and consumer demand. The maneuver worked, and the US finished out 2022 with a GDP growth rate of 2.6 percent.Why was the White House so eager to avoid using the R-word? The answer is that in a market economy, economic reality is defined in part by a little thing called “market confidence,” – that is, the willingness or unwillingness by those with financial resources to make major investments and purchases, instead of, say, keeping money in low-risk instruments like bonds, gold, real estate, etc. instead of buying stocks, or in the case of big companies – things like new economic production capabilities. Had the Biden administration admitted back then that the country had entered a recession, it would have led markets, consumers and businesses to scale back their economic activity, further complicating the troubles caused by raging inflation and high energy costs, and perhaps preventing a return to growth.What Happens in a Recession?Recessions typically result in spiking unemployment, a drop in consumer spending, and usually (but not always) a decline in corporate profits, particularly in those sectors of the economy providing luxury goods and services, rather than basic, must-have amenities like food, energy and shelter.What Causes a Recession?Recessions can be triggered by a broad range of internal and foreign factors - from an overseas conflict triggering a spike in energy costs, to the economic downturn or collapse of a major economy, to a reduction in the aforementioned “market confidence” among consumers and investors, to sudden drops in asset prices, and a credit crunch caused by irresponsible fiscal policy.Many of the above factors can be attributed to man-made policies –like the lax banking regulations which led to irresponsible mortgage lending policy and culminated in the so-called Great Recession of 2008, or the 1929 stock market crash and bank failures resulting in the Great Depression of the 1930s.Additionally, most economists worth their salt concur that recessions are a ‘feature’, rather than a ‘bug’, of market economics, where the endless drive toward the accumulation of capital and the overproduction of commodities inexorably leads to crises. Some economists suggest that interventions by the state in emergencies to prop up economies or save certain sectors from collapse are an erroneous policy – threatening to make even more severe recessions or depressions an inevitability at some point in the future, and prolonging economic pain in the present.The US suffered one of its longest-ever recessions in the late 2000s, with the Great Recession of 2008 lasting over 18 months, and, by some metrics, continuing to be felt by part of the population (but not in terms of corporate earnings or stock market valuations) as late as 2021 – especially by lower income groups and young people.What’s the Difference Between a Recession and a Depression?Merriam-Webster defines a recession as a “downward trend in the business cycle…characterized by a decline in production and employment,” lower household income and spending and delays in large investments or purchases by businesses and households. A depression, meanwhile, is defined as “a major downswing (far more severe than a downward trend) in the business cycle,” and a sharper increase in unemployment, “a serious decline of growth in construction, and great reductions in international trade and capital movements.” Depressions are also often measured in years, and witness the plummeting, rather than dropping GDP.The world hasn’t experienced an economic depression since the 1930s. A localized depression was experienced by Russia and other former Eastern Bloc countries in the 1990s and early 2000s, during which time the GDP in many post-Soviet republics dropped 50 percent or more and entire sectors of the economy were wiped out.Are We Currently in a Recession?That depends on where you are in the world. In Europe, Germany officially slipped into a recession last week after authorities calculated that the country’s economic growth fell by 0.3 percent in the first quarter of 2023 after a 0.5 drop in Q4 of 2022. The EU’s eastern flank has fared even worse, with the Baltic countries of Estonia, Latvia and Lithuania dropping into a recession in 2022, and no end to the downturn in sight.Russia, which has faced unprecedented sanctions pressure culminating in a full-scale economic war by the West, has also faced the sting a recession over the past year, with GDP contracting by 2.1 percent in 2022. However, global financial institutions have recently revised their projections, with the Russian economy expected to return to growth and finish out 2023 0.7 percent richer than it was at the start of the year.How Can You Prepare for and Survive a Recession?There’s a plethora of advice online about how to “recession-proof” your life, from creating a rainy day fund of 3-6 times your monthly salary, to paying down your debts, to diversifying investments to reduce risks.Then there are common sense tips, like making a habit of spending less than you consume (something banks and retailers definitely don’t want you to do), living within your means as much as possible by avoiding risky credit, reducing your debt burden (when it comes to things like mortgage payments), and making financial decisions after careful research and analysis.More intense recession/depression preppers propose additional measures, like building up stocks of easily storable foods, making preparations to live off the land through farming and hunting (if possible) and investing in traditional stores of value like precious metals instead of paper-based fiat money. Studying recent historical examples of survival in times of economic trouble can also offer some useful and potentially life-saving tips.

https://sputnikglobe.com/20230528/biden-says-budget-agreement-represents-compromise-not-everyone-gets-what-they-want-1110646504.html

https://sputnikglobe.com/20230523/us-economists-expect-inflation-interests-rates-to-remain-high-in-2023--survey-1110529757.html

https://sputnikglobe.com/20230512/western-inflation-self-inflicted-problem-with-no-end-in-sight-1110269612.html

https://sputnikglobe.com/20230527/germanys-recession-is-eus-first-falling-domino-1110615851.html

https://sputnikglobe.com/20230503/will-the-us-plunge-into-recession-this-year-1110065190.html

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

recession, depression, economy, downturn, collapse, decline, growth, shrinkage, what is a recession, how is a recession defined, what does a recession mean, what happens in a recession, what causes a recession, depression vs recession, difference between recession and depression, are we in a recession, how can you survive a depression, how can you prepare for a recession

recession, depression, economy, downturn, collapse, decline, growth, shrinkage, what is a recession, how is a recession defined, what does a recession mean, what happens in a recession, what causes a recession, depression vs recession, difference between recession and depression, are we in a recession, how can you survive a depression, how can you prepare for a recession

What is a Recession and How Can You Prepare for One?

14:51 GMT 28.05.2023 (Updated: 15:04 GMT 28.05.2023) President Biden and GOP House speaker Kevin McCarthy reached a last-minute deal on the debt ceiling Saturday, with Biden boasting that the agreement would prevent a “catastrophic default” and punishing recession. What are recessions? What can ordinary folks do to cushion their blow? Sputnik explains.

The tentative agreement on the debt ceiling was arrived at just days before the early June deadline after which the US would be expected to default on some or all of its gargantuan

$31.8 trillion national debt, plunging the nation into a deep economic crisis and the world economy into chaos.

Joe Biden

hailed the deal as “good news for the American people,” saying that the “compromise” would prevent Americans’ retirement accounts from being devastated, and stop “millions of jobs” from being wiped out.

Not so fast, say economists, bankers and even bookies. Economic experts surveyed by Bloomberg late last year projected about a

70 percent chance of the United States slipping into a recession before 2023 was out, with the metric presently hovering

above 65 percent, debt ceiling deal or no debt ceiling deal.

A

number of factors account for the gloomy predictions, including sluggish consumer spending levels and

high interest rates, inflation, the end of federal fiscal stimulus and a string of commercial bank failures earlier this year

which shook public faith in the banking sector and left millions of account holders with the jitters.

How is a Recession Defined and What Does It Mean?

According to its textbook Economics 101 definition, a recession means two consecutive quarters (six months) of negative economic growth.

But politics often complicates things. For example, under the above definition, the United States actually slipped into a recession last summer, with real gross domestic product falling by 1.4 percent and 0.9 percent in Q1 and Q2, respectively, according to the Department of Commerce’s Bureau of Economic Analysis

figures. Ignoring these numbers, Joe Biden

profusely refused to recognize that the country had entered a recession, prompting economic advisors and media toadies to insist that the growth figures in and of themselves were irrelevant, and that definitions should be “more complex,” and

take into account things like unemployment and consumer demand. The maneuver worked, and the US finished out 2022 with a GDP growth rate of 2.6 percent.

Why was the White House so eager to avoid using the R-word? The answer is that in a market economy, economic reality is defined in part by a little thing called “market confidence,” – that is, the willingness or unwillingness by those with financial resources to make major investments and purchases, instead of, say, keeping money in low-risk instruments like bonds, gold, real estate, etc. instead of buying stocks, or in the case of big companies – things like new economic production capabilities. Had the Biden administration admitted back then that the country had entered a recession, it would have led markets, consumers and businesses to scale back their economic activity, further complicating the troubles caused by raging inflation and high energy costs, and perhaps preventing a return to growth.

What Happens in a Recession?

Recessions typically result in spiking unemployment, a drop in consumer spending, and usually (but not always) a decline in corporate profits, particularly in those sectors of the economy providing luxury goods and services, rather than basic, must-have amenities like food, energy and shelter.

Recessions can be triggered by a broad range of internal and foreign factors - from an overseas conflict triggering a spike in energy costs, to the economic downturn or collapse of a major economy, to a reduction in the aforementioned “market confidence” among consumers and investors, to sudden drops in asset prices, and a credit crunch caused by irresponsible fiscal policy.

Many of the above factors can be attributed to man-made policies –like the lax banking regulations which led to irresponsible mortgage lending policy and culminated in the so-called Great Recession of 2008, or the 1929 stock market crash and bank failures resulting in the Great Depression of the 1930s.

Additionally, most economists worth their salt concur that recessions are a ‘feature’, rather than a ‘bug’, of market economics, where the endless drive toward the accumulation of capital and the overproduction of commodities

inexorably leads to crises. Some economists suggest that interventions by the state in emergencies to prop up economies or save certain sectors from collapse are an erroneous policy – threatening to make even more severe recessions or depressions

an inevitability at some point in the future, and prolonging economic pain in the present.

American economic history supports the theory of a market ‘boom and bust cycle’, with the world economic powerhouse suffering nearly 50 recessions since 1776, and facing over 80 years of recessionary years over the past 250 years or so.

The US suffered one of its longest-ever recessions in the late 2000s, with the Great Recession of 2008 lasting over 18 months, and, by some metrics,

continuing to be felt by part of the population (but not in terms of corporate earnings or stock market valuations)

as late as 2021 – especially by lower income groups and young people.

What’s the Difference Between a Recession and a Depression?

Merriam-Webster

defines a recession as a

“downward trend in the business cycle…characterized by a decline in production and employment,” lower household income and spending and delays in large investments or purchases by businesses and households. A depression, meanwhile, is defined as

“a major downswing (far more severe than a downward trend) in the business cycle,” and a sharper increase in unemployment, “a serious decline of growth in construction, and great reductions in international trade and capital movements.” Depressions are also often measured in years, and witness the

plummeting, rather than dropping GDP.

The world hasn’t experienced an economic depression since the 1930s. A localized depression was experienced by Russia and other former Eastern Bloc countries in the 1990s and early 2000s, during which time the GDP in many post-Soviet republics dropped 50 percent or more and entire sectors of the economy were wiped out.

Are We Currently in a Recession?

That depends on where you are in the world. In Europe, Germany officially slipped into a recession last week after authorities calculated that the country’s economic growth

fell by 0.3 percent in the first quarter of 2023 after a 0.5 drop in Q4 of 2022. The EU’s eastern flank has fared even worse, with the Baltic countries of Estonia, Latvia and Lithuania dropping into a recession in 2022, and

no end to the downturn in sight.

Russia, which has faced unprecedented sanctions pressure culminating in a full-scale economic war by the West, has also faced the sting a recession over the past year, with GDP contracting by 2.1 percent in 2022. However, global financial institutions have recently revised their projections, with the Russian economy expected to return to growth and finish out 2023 0.7 percent richer than it was at the start of the year.

How Can You Prepare for and Survive a Recession?

There’s a plethora of advice online about how to “recession-proof” your life, from creating a rainy day fund of 3-6 times your monthly salary, to paying down your debts, to diversifying investments to reduce risks.

Then there are common sense tips, like making a habit of spending less than you consume (something banks and retailers definitely don’t want you to do), living within your means as much as possible by avoiding risky credit, reducing your debt burden (when it comes to things like mortgage payments), and making financial decisions after careful research and analysis.

More intense recession/depression preppers propose additional measures, like building up stocks of easily storable foods, making preparations to live off the land through farming and hunting (if possible) and investing in traditional stores of value like precious metals instead of paper-based fiat money.

Studying recent historical examples of survival in times of economic trouble can also offer some useful and potentially life-saving tips.