https://sputnikglobe.com/20230605/how-will-saudi-arabias-oil-cuts-affect-energy-market-and-when-will-brent-hit-100-1110928109.html

How Will Saudi Arabia's Oil Cuts Affect Energy Market and When Will Brent Hit $100?

How Will Saudi Arabia's Oil Cuts Affect Energy Market and When Will Brent Hit $100?

Sputnik International

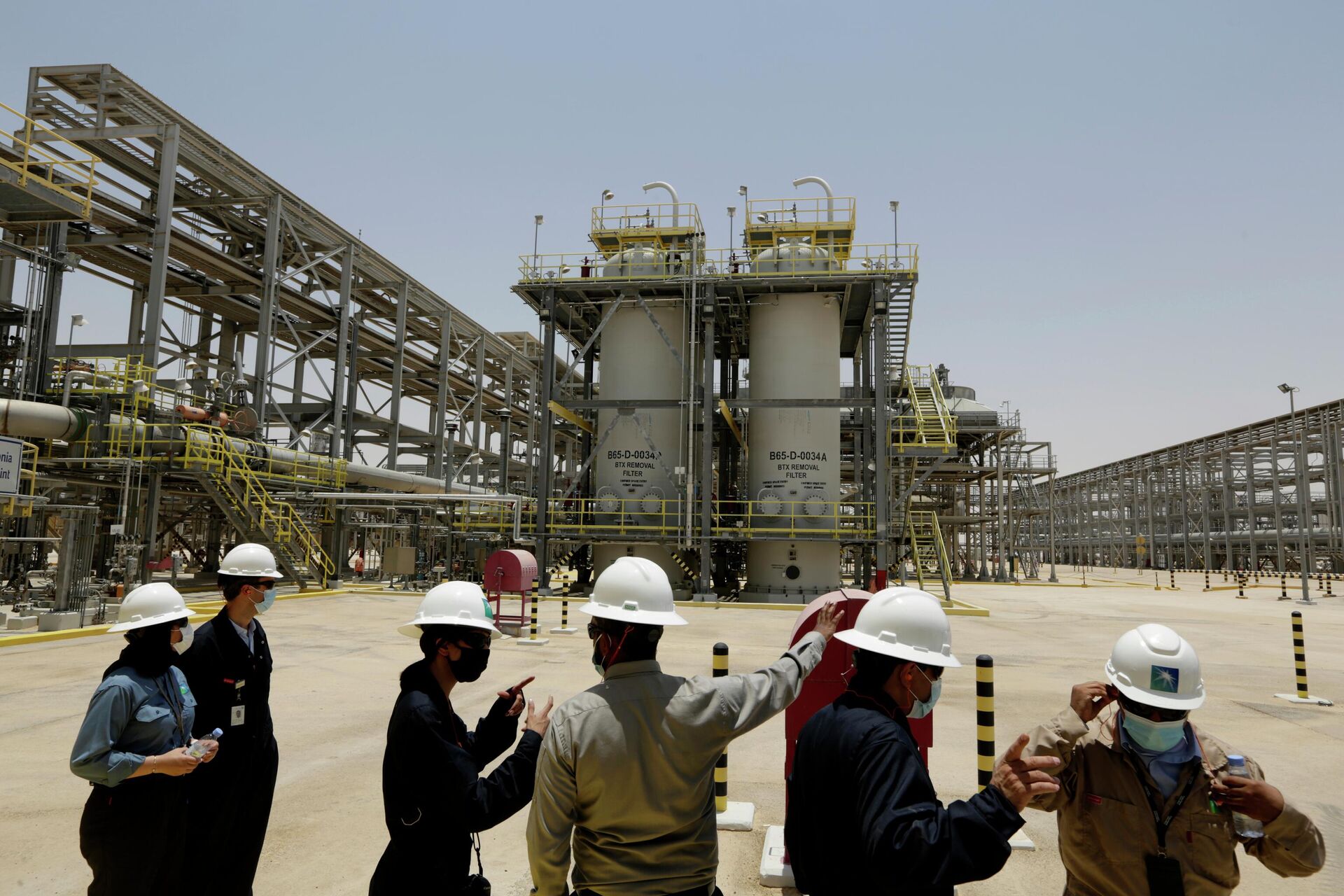

Saudi Arabia has decided to cut its oil production by another million barrels per day starting from July. Meanwhile, OPEC+ signaled that it would proceed with limiting combined oil production to 40.463 million barrels per day through December 2024. How could it affect the global energy market?

2023-06-05T17:19+0000

2023-06-05T17:19+0000

2023-06-05T17:19+0000

analysis

joe biden

saudi arabia

china

washington

riyadh

strategic petroleum reserve (spr)

brent

oil

opinion

https://cdn1.img.sputnikglobe.com/img/107878/82/1078788220_0:52:3000:1740_1920x0_80_0_0_65dc9d3f2dcfdec1e955f16b93bb92c7.jpg

Riyadh's decision to make additional voluntary cuts amid the OPEC+ bloc sticking to its policy of limiting crude production has sent oil prices up by around 2%. Earlier, in April, the group of crude producing countries agreed to limit output in order to balance the world energy market.The OPEC+ decision was made with the consensus of all states that are part of the agreement, Muhammad bin Frihan, financial adviser and member of the Saudi Economic Association, emphasized while talking to Sputnik."The world oil market now needs high prices and a reduction in the surplus of raw materials; key players have done everything to ensure it […] Reducing the level of oil production will equalize the balance between supply and demand in the world market and prevent possible fluctuations in oil prices. It can be called on the whole timely and fair," Frihan said.Ali Bu Khamsin, director general of the Center for Economic Research, agrees that the OPEC+ decision and Saudi cuts will have a positive impact on the global economy, even though the US is likely to be up in arms about it.Will Oil Hit $100 After Saudi Arabia's Output Cut?"The announcement of further voluntary output cuts by Saudi Arabia is significant, as it will lead to a reduction in global oil supply," Mohammed Alhamed, a geopolitical analyst, founder and chairman of the Saudi Elite group, told Sputnik. "This move is expected to support oil prices and reduce the global oil surplus. However, the impact of these cuts on oil prices in the future is uncertain and depends on many factors such as global demand, geopolitical tensions, and the actions of other oil-producing countries. Therefore, it is difficult to say whether the assumption of a $100 rise in prices is fair."Under normal circumstances, a Saudi cut would push Brent crude to $90 a barrel this year and even $100, according to Dr. Mamdouh G. Salameh, an international oil economist and a global energy expert. However, the current circumstances in the market aren’t normal, he added.Still, even before Riyadh's decision on additional cuts, the ING Group, a Dutch multinational financial services company, projected that the oil market could tighten significantly over the second half of 2023. As of June 1, the group's forecast was $96 per barrel (Brent) over the second half of the year from around $73. What's behind the projected rise?• First, global oil demand is expected to grow by 1.9 million barrels per day in 2023 (with more than one million barrels per day of the 1.9MMbbls/d of demand growth set to come from China).• Second, OPEC+ output cuts are to stay for quite a while, with the probability of further supply limitations.At the same time, oil demand of the 38 countries of the Organization for Economic Co-operation and Development (OECD) is likely to be "flat" year-on-year, according to ING. Furthermore, it projected that the US will enter recession later this year, which would lead to "some level of demand destruction."Likewise, Goldman Sachs Research has forecast that Brent crude will rise to $95 per barrel by the end of 2023, and reach $100 per barrel by the end of 2024.What Was Behind Oil Prices Spike and Could It Return?The Biden administration is not interested in soaring energy prices. Last year, Team Biden struggled to lower energy costs as Americans felt pain at the pump. In July 2022, average gasoline prices hit $5.02 a gallon in the US, up from $3.40 in December 2021, facilitating inflation and consumer price rally.Still, one needs to keep in mind that at the root of the oil price spike were two contradictory policies, propelled by the US and its Western allies.First, Team Biden's "green agenda" that dealt a heavy blow to US domestic crude output as well as the collective West's refusal to fund fossil fuel exploration and production in Africa, in particular, and other countries of the Global South.Second, over the last several years, the West has slapped sweeping sanctions on oil producing countries, including Venezuela, Iran, and most recently, Russia. As a result, Washington's expansive sanctions currently cover 29% of the global economy, with 40% of global oil reserves under US restrictions, too, according to DC-based think tank Responsible Statecraft.When oil prices eventually went down late last year, reaching $75 per barrel on December 8, 2022, Team Biden signaled that the mission was accomplished. However, international analysts argue that it was the global economic slowdown, China's COVID measures and delayed recovery, as well as the looming banking crisis in the US that actually sent crude prices down last year and is keeping Brent below $100 per barrel today. The situation could drastically change if non-OECD economic recovery goes full throttle.Saudi Arabia's Independent Energy PolicySaudi Arabia's voluntary cuts and independent energy policies are to some extent driven by Crown Prince Mohammed bin Salman's (MBS) decision to diversify international ties and partnerships, according to Salameh.Riyadh's unwillingness to pump more at a lower price while the US and its allies exercise punitive restrictions and push ahead with cutting greenhouse gas emissions to zero seems to be quite logical, according to Sputnik's interlocutors.Therefore, when President Joe Biden embarked on a trip to Saudi Arabia, asking Riyadh to substantially step up oil production, the kingdom declined.In addition, MBS appears to be tilting towards the China-Russia axis, Salameh presumed.He referred to Riyadh's consistent energy policies within the framework of OPEC+ despite Washington's pressure; the landmark visit of China’s President Xi Jinping to Riyadh in December 2022 and the Saudi-China plan to partially trade oil in yuans; China brokering a deal in Beijing for the resumption of diplomatic relations between Saudi Arabia and Iran; and Saudi Arabia’s public announcement that its Cabinet had approved a plan to join the Shanghai Cooperation Organization (SCO) as a "dialogue partner," to name but a few instances.On top of that, Riyadh's most recent cuts were announced just days before US Secretary of State Antony Blinken’s visit to Saudi Arabia, which could also be seen as a signal to Washington, as per the oil economist.What Does the Future Have in Store for US Energy Policy?Meanwhile, the US needs to replenish its SPR stockpiles after Biden's bold releases. US Energy Secretary Jennifer Granholm said in April that the US would begin buying oil to replenish an emergency stockpile in the June-July timeframe. Still, there's many a slip between the cup and the lip, according to Salameh.According to Salameh, the future has a lot of problems in store for the US energy sector. He argued that "with US shale oil a spent force, the US can’t meaningfully raise production.""This means that US crude imports are bound to continue rising thus adversely impacting both the US economy and the federal budget deficit," the oil economist concluded.

https://sputnikglobe.com/20230605/opec-decision-on-production-cuts-may-cause-global-surge-in-oil-prices---japanese-cabinet-1110913901.html

https://sputnikglobe.com/20230605/crude-spikes-as-saudi-arabia-pledges-to-cut-production-after-opec-meeting-1110911080.html

https://sputnikglobe.com/20230604/saudi-arabia-negotiates-cuts-of-oil-production-quotas-with-african-countries---reports-1110901032.html

https://sputnikglobe.com/20230603/trade-turnover-between-saudi-arabia-brics-tops-160bln-in-2022-1110874086.html

saudi arabia

china

washington

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

opec+, saudi arabia voluntary output cuts, saudi arabia reduces oil production, oil prices, oil prices spike, brent crude, wti, us gasoline prices, anti-russia sanctions, green agenda, climate change, africa, green new deal, joe biden, us inflation, us recession, china covid restrictions, china economic recovery

opec+, saudi arabia voluntary output cuts, saudi arabia reduces oil production, oil prices, oil prices spike, brent crude, wti, us gasoline prices, anti-russia sanctions, green agenda, climate change, africa, green new deal, joe biden, us inflation, us recession, china covid restrictions, china economic recovery

How Will Saudi Arabia's Oil Cuts Affect Energy Market and When Will Brent Hit $100?

Saudi Arabia has decided to cut its oil production by another million barrels per day starting from July. Meanwhile, OPEC+ signaled that it would proceed with limiting combined oil production to 40.463 million barrels per day through December 2024. How could this affect the global energy market?

Riyadh's decision to make additional voluntary cuts amid the OPEC+ bloc sticking to its policy of

limiting crude production has

sent oil prices up by around 2%. Earlier, in April, the group of crude producing countries agreed to limit output in order to balance the world energy market.

"The latest round of OPEC+ quota cuts are consistent with the organization’s efforts to manage the global oil balance in order to achieve 'budget friendly' oil prices," Michael Rothman, president and founder of Cornerstone Analytics, a US-based consultancy focused on macro-energy research, told Sputnik. "The decision yesterday (June 4th) is consistent with that policy with the additional production cut proffered by Saudi Arabia reflecting a tactic to mitigate bearish speculative market influences that have caused current oil prices to stay below their fair value based on the state of the world’s supply/demand situation."

The OPEC+ decision was made with the consensus of all states that are part of the agreement, Muhammad bin Frihan, financial adviser and member of the Saudi Economic Association, emphasized while talking to Sputnik.

"The world oil market now needs high prices and a reduction in the surplus of raw materials; key players have done everything to ensure it […] Reducing the level of oil production will equalize the balance between supply and demand in the world market and prevent possible fluctuations in oil prices. It can be called on the whole timely and fair," Frihan said.

Ali Bu Khamsin, director general of the Center for Economic Research, agrees that the OPEC+ decision and Saudi cuts will have a positive impact on the global economy, even though the US is likely to be up in arms about it.

"Washington always pursues only its own interests, it cares little about other countries," Ali Bu Khamsin told Sputnik. "Naturally, the United States will try to prevent the implementation of this agreement by putting pressure on world markets and with the aim of significantly reducing energy prices. Nevertheless, as experience shows, Washington will not be able to impose its desires on OPEC+ members. Suffice it to recall Biden's unsuccessful visit to the Kingdom of Saudi Arabia. However, Riyadh is not going to make concessions to the detriment of its economic and national interests."

Will Oil Hit $100 After Saudi Arabia's Output Cut?

"The announcement of

further voluntary output cuts by Saudi Arabia is significant, as it will lead to a reduction in global oil supply,"

Mohammed Alhamed, a geopolitical analyst, founder and chairman of the Saudi Elite group, told Sputnik. "This move is expected to support oil prices and reduce the global oil surplus. However, the impact of these cuts on oil prices in the future is uncertain and depends on many factors such as global demand, geopolitical tensions, and the actions of other oil-producing countries. Therefore, it is difficult to say whether the assumption of a $100 rise in prices is fair."

Under normal circumstances, a Saudi cut would push Brent crude to $90 a barrel this year and even $100, according to Dr. Mamdouh G. Salameh, an international oil economist and a global energy expert. However, the current circumstances in the market aren’t normal, he added.

"The reason is that the decline in oil prices over the last three months has had nothing to do with the fundamentals of the market, which remain robust, and everything to do with persistent fears of a banking or financial crisis reminiscent of the 2008 subprime financial crisis triggered by a shaky US banking system," Salameh told Sputnik. "Pressure on prices will continue until these fears subside or disappear altogether. Only then will prices recover their previous losses and resume their surge with Brent crude hitting $90 and even touching $100."

Still, even before Riyadh's decision on additional cuts, the ING Group, a Dutch multinational financial services company, projected that the oil market could tighten significantly over the second half of 2023. As of June 1, the group's forecast was $96 per barrel (Brent) over the second half of the year from around $73. What's behind the projected rise?

• First, global oil demand is expected to grow by 1.9 million barrels per day in 2023 (with more than one million barrels per day of the 1.9MMbbls/d of demand growth set to come from China).

• Second, OPEC+ output cuts are to stay for quite a while, with the probability of further supply limitations.

At the same time, oil demand of the 38 countries of the Organization for Economic Co-operation and Development (OECD) is likely to be "flat" year-on-year, according to ING. Furthermore, it projected that the US will enter recession later this year, which would lead to "some level of demand destruction."

Likewise, Goldman Sachs Research has forecast that Brent crude will rise to $95 per barrel by the end of 2023, and reach $100 per barrel by the end of 2024.

What Was Behind Oil Prices Spike and Could It Return?

The Biden administration is not interested in soaring energy prices. Last year, Team Biden struggled to lower energy costs as Americans felt pain at the pump. In July 2022, average gasoline prices hit $5.02 a gallon in the US, up from $3.40 in December 2021, facilitating inflation and consumer price rally.

Still, one needs to keep in mind that at the root of the oil price spike were two contradictory policies, propelled by the US and its Western allies.

First, Team Biden's "green agenda" that dealt a heavy blow to US domestic crude output as well as the collective West's

refusal to fund fossil fuel exploration and production in Africa, in particular, and other countries of

the Global South.

Second, over the last several years, the West has slapped sweeping sanctions on oil producing countries, including Venezuela, Iran, and most recently, Russia. As a result, Washington's expansive sanctions currently cover 29% of the global economy, with 40% of global oil reserves under US restrictions, too, according to DC-based think tank Responsible Statecraft.

Under these circumstances, the US president tried to pressure OPEC into substantially increasing output, but in vain. In order to stop rallying energy costs, Biden has also released over 200 million barrels of crude since 2021 from the SPR. Still, according to Salameh, it has had little if any effect on energy costs.

When oil prices eventually went down late last year, reaching $75 per barrel on December 8, 2022, Team Biden signaled that the mission was accomplished. However, international analysts argue that it was the global economic slowdown, China's COVID measures and delayed recovery, as well as the looming banking crisis in the US that actually sent crude prices down last year and is keeping Brent below $100 per barrel today. The situation could drastically change if non-OECD economic recovery goes full throttle.

Saudi Arabia's Independent Energy Policy

Saudi Arabia's voluntary cuts and independent energy policies are to some extent driven by Crown Prince Mohammed bin Salman's (MBS) decision to diversify international ties and partnerships, according to Salameh.

Riyadh's unwillingness to pump more at a lower price while the US and its allies exercise punitive restrictions and push ahead with cutting greenhouse gas emissions to zero seems to be quite logical, according to Sputnik's interlocutors.

"The kingdom’s national budget being highly dependent on oil income won’t change in the forecastable future, and the US administration’s anti-oil policies seem pretty set with the unrealistic 'green energy' initiatives expected to exacerbate oil supply issues over the medium term," Michael Rothman explained.

Therefore, when President Joe Biden embarked on a trip to Saudi Arabia, asking Riyadh to substantially step up oil production, the kingdom declined.

In addition, MBS appears to be tilting towards the China-Russia axis, Salameh presumed.

He referred to Riyadh's consistent energy policies within the framework of OPEC+ despite Washington's pressure; the landmark visit of China’s President Xi Jinping to Riyadh in December 2022 and the Saudi-China plan to partially trade oil in yuans; China brokering a deal in Beijing for the resumption of diplomatic relations

between Saudi Arabia and Iran; and Saudi Arabia’s public announcement that its Cabinet had approved a plan to join the Shanghai Cooperation Organization (SCO) as a "dialogue partner," to name but a few instances.

"Other than being the biggest single landmass on Earth and accounting for 40% of the world’s population and 35% of global GDP based on purchasing power parity (PPP), the SCO is a firm believer in a new world order based on a multipolar system," Salameh pointed out.

On top of that, Riyadh's most recent cuts were announced just days before US Secretary of State Antony Blinken’s visit to Saudi Arabia, which could also be seen as a signal to Washington, as per the oil economist.

What Does the Future Have in Store for US Energy Policy?

Meanwhile, the US needs to replenish its SPR stockpiles after Biden's bold releases. US Energy Secretary Jennifer Granholm said in April that the US would begin buying oil to replenish an emergency stockpile in the June-July timeframe. Still, there's many a slip between the cup and the lip, according to Salameh.

"With escalating tension with both Russia and China, the United States needs badly to refill its SPR, but it has been facing two major problems," the oil economist said. "The first is that it wants to buy back the released SPR oil at prices ranging between $68 and $72 a barrel. But despite the recent decline of crude prices, they have never dropped to that level and are most unlikely to drop to that level unless there is a global banking or financial crisis. The second reason is that US shale oil is incapable of raising its production to help refill the SPR. Moreover, there is not much spare oil available in the market for the US to buy."

According to Salameh, the future has a lot of problems in store for the US energy sector. He argued that "with US shale oil a spent force, the US can’t meaningfully raise production."

"This means that US crude imports are bound to continue rising thus adversely impacting both the US economy and the federal budget deficit," the oil economist concluded.