https://sputnikglobe.com/20230928/us-china-trade-rift-south-koreas-semiconductor-titans-treads-carefully-1113734553.html

US-China Trade Rift: South Korea's Semiconductor Titans Treads Carefully

US-China Trade Rift: South Korea's Semiconductor Titans Treads Carefully

Sputnik International

South Korea's semiconductor sector, deeply linked to China, occupies a central position in the nation's economy. However, as the United States ramps up efforts to curb China's technological progress, South Korea's vital chip industry is threatened, prompting calls for strategic solutions.

2023-09-28T12:10+0000

2023-09-28T12:10+0000

2023-09-28T12:10+0000

world

garret graves

joe biden

china

south korea

taiwan

taiwan semiconductor manufacturing company (tsmc)

sk hynix

samsung

us department of commerce

https://cdn1.img.sputnikglobe.com/img/07e4/0b/02/1080954125_159:0:3800:2048_1920x0_80_0_0_a46ad46edf1590cce83a64cc2d2bef4d.jpg

South Korea's semiconductor powerhouses, Samsung and SK Hynix, have funneled an outstanding $52 billion to consolidate their operations in the Chinese market that has long been a bedrock of their sales.Nevertheless, the once robust relationship between South Korea's chip industry and China faces increasing pressure from geopolitical forces.One of the pivotal methods the US used to fuel this trade war was implementing export controls and sanctions targeting the sale of advanced semiconductor manufacturing equipment and technology to Chinese firms in two distinct rules on October 7, 2022. The Commerce Department's Bureau of Industry and Security (BIS) has unveiled a series of regulations to constrain China's “ability to both purchase and manufacture certain high-end chips used in military applications.”The US government, citing national security concerns, sought to restrict the export of cutting-edge technologies that China could use for military purposes or to enhance its domestic semiconductor capabilities. The US Department of Commerce added several Chinese companies, including major semiconductor firms like SMIC (Semiconductor Manufacturing International Corporation), to its Entity List.Additionally, the US initiated investigations and imposed tariffs on Chinese semiconductor products. These measures were part of broader trade disputes between the two nations, and they raised costs for Chinese semiconductor companies trying to export their products to the US market. This not only put economic pressure on China's semiconductor industry but also signaled a willingness by the US to use trade policy as a tool to shape the global semiconductor landscape.Furthermore, the US government actively pressured its allies and trading partners to adopt similar export controls and restrictions on semiconductor-related technologies. This created a global environment where China faced difficulties acquiring critical components and equipment necessary for its semiconductor industry's development.The Trump administration succeeded in browbeating the Dutch government to limit the export of extreme ultraviolet (EUV) lithography machines (made by Dutch ASML Holding) to China to deal a blow to the Chinese semiconductor production capabilities. This piece of sophisticated equipment is vital in producing advanced chips.However, the Biden government is upping the ante by seeking to render the chipmaking prowess of China.Chinese Role for South Korean ChipsThe economic well-being and job market of South Korea hinge heavily on its semiconductor industry. The nation confronts a complex situation, standing at the crossroads of its abiding partnership with the United States and China, embroiled in an ongoing trade dispute.Washington has intensified its control over the export of such critical technologies. This move, initiated in October 2022 by the Biden administration, has unsettled South Korea, prompting lobbying in the US to mitigate potential harm to South Korea's semiconductor industry.In mid-October 2022, Samsung and SK Hynix were granted a one-year waiver, providing a reprieve from export regulations. As its expiration is on the horizon, there is a general belief that it could be renewed, though such an outcome is doubtful.Semiconductor production entails massive transnational distribution networks and initiatives aimed at instituting new industry regulations have prompted a thorough evaluation of commercial partnerships across Asia and the West.China plays a dual role as it offers a vast chip customer base and houses substantial production facilities for South Korea’s Samsung and SK Hynix.In the last ten years, China consistently held the lion's share, at one point reaching almost 67 percent of South Korean chip exports. Regardless, this number receded to 55 percent in the previous year, as per an evaluation of South Korean government findings. Moreover, data on semiconductor sales are not made public due to weak demand.However, financial reports produced by subsidiaries of Korean companies in China showed a marked 35 percent decrease in sales in the first six months of 2023.How US Sanctions on China Affect South Korea's Industry Yang Hyang-ja, a former Samsung executive and currently a lawmaker in the National Assembly, has emerged as a prominent voice in South Korean politics on this matter. She has staunchly asserted that the country is a “victim” in the ongoing trade dispute and has proposed tax reductions to support chip manufacturers. This proposal, known as the K-Chips Act, received approval in March. “We are taking a direct hit,” she expressed.Samsung's operational strategy in China involves the production of 40 percent of its NAND chips, a vital component in data storage for devices. SK Hynix, too, has a significant presence in China, where it manufactures 30 percent of its NAND chips and nearly half of its Dynamic random-access memory chips - critical in facilitating short-term storage for PCs and servers.In an official statement, Samsung clarified that its investments have been judiciously made to fulfill the needs of a worldwide customer base and address other pressing demands.The uncertainties spawned by the China-US trade spat impact more than just Samsung and SK Hynix. The Taiwan Semiconductor Manufacturing Company (TSMC), the world's famed semiconductor chip maker, is also in limbo, awaiting word from the US Department of Commerce regarding the outcome of their exemptions from export regulations.The Commerce Department has opted to withhold a formal response on the matter. Instead, they have referred to a statement by Deputy Commerce Secretary Don Graves. During his recent visit to Korea, Graves emphasized the United States' unwavering commitment to exhaust all avenues supporting businesses, ensuring their uninterrupted operations.For Samsung and SK Hynix, a waiver lasting a year or less could impede their progress in the fast-evolving chip-making industry. Staying competitive demands significant investments in equipment, parts, and research. The manufacturing facilities for chips are high-priced, ranging from tens to hundreds of millions of dollars.Semiconductor analyst Song Myung-sup suggests that companies like SK Hynix and Samsung may redirect their production efforts in China to cater to the local market. They could also focus on making less advanced products to circumvent US restrictions.

https://sputnikglobe.com/20230913/us-economic-war-on-russia-and-china-africas-revolt-against-neocolonialism-1113339533.html

https://sputnikglobe.com/20230905/china-reportedly-creates-40-bn-semiconductor-fund-to-blow-off-western-restrictions-1113136163.html

https://sputnikglobe.com/20230810/why-is-tsmc-building-a-multibillion-dollar-semiconductor-chip-factory-in-germany-1112491419.html

china

south korea

taiwan

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Chimauchem Nwosu

https://cdn1.img.sputnikglobe.com/img/07e7/09/01/1113046371_0:99:1536:1635_100x100_80_0_0_9c5c627283eca931c39fe4852bbb301c.jpg

south korea, semiconductor, samsung, sk hynix, chinese chips market, sales, chip industry, geopolitical forces, united states, china, china-us trade dispute, chip technology, semiconductor export regulations, biden administration, semiconductor export waiver, economic upheaval, trade restrictions, chip exports, memory chips, trendforce, nand chips, data storage, dynamic random-access memory chips, pcs, servers, k-chips act, tax reductions, operational strategy, worldwide customer base, taiwan semiconductor manufacturing company, tsmc, us commerce department, deputy commerce secretary don graves, equipment, parts, research, manufacturing facilities, semiconductor analyst, dalian factory, capital expenditure, yongin, strategic investment, sustained growth, technological advancement, semiconductor exports, chip production, semiconductor manufacturing, korean semiconductor chips.

south korea, semiconductor, samsung, sk hynix, chinese chips market, sales, chip industry, geopolitical forces, united states, china, china-us trade dispute, chip technology, semiconductor export regulations, biden administration, semiconductor export waiver, economic upheaval, trade restrictions, chip exports, memory chips, trendforce, nand chips, data storage, dynamic random-access memory chips, pcs, servers, k-chips act, tax reductions, operational strategy, worldwide customer base, taiwan semiconductor manufacturing company, tsmc, us commerce department, deputy commerce secretary don graves, equipment, parts, research, manufacturing facilities, semiconductor analyst, dalian factory, capital expenditure, yongin, strategic investment, sustained growth, technological advancement, semiconductor exports, chip production, semiconductor manufacturing, korean semiconductor chips.

US-China Trade Rift: South Korea's Semiconductor Titans Treads Carefully

South Korea's semiconductor sector, deeply linked to China, occupies a central position in the nation's economy. However, as the United States ramps up efforts to curb China's technological progress, South Korea's vital chip industry is threatened, prompting calls for strategic solutions.

South Korea's semiconductor powerhouses, Samsung and SK Hynix, have funneled an outstanding $52 billion to consolidate their operations in the Chinese market that has long been a bedrock of their sales.

Nevertheless, the once robust relationship between South Korea's chip industry and China faces

increasing pressure from geopolitical forces.

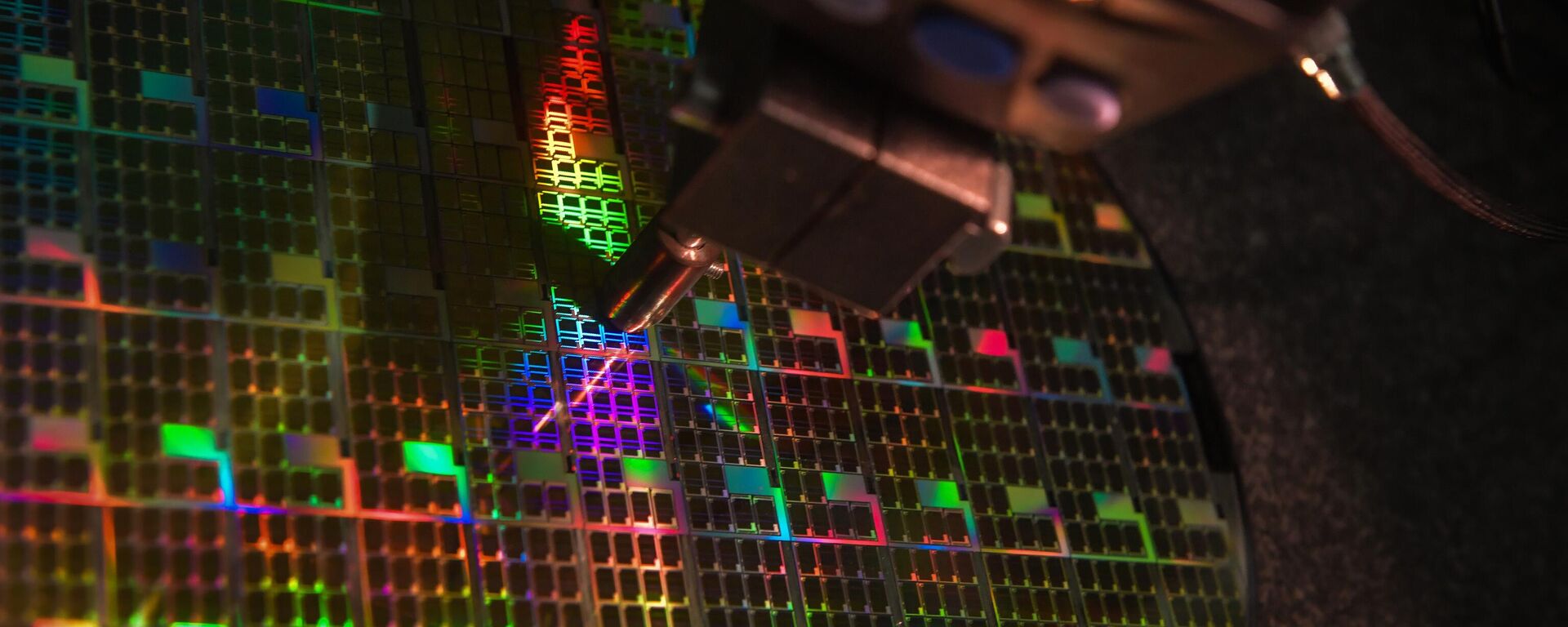

The semiconductor trade war between the United States and China stemmed from a complex interplay of economic, technological, and geopolitical factors. Introducing these controls signifies a considerable departure from the prevailing model that has shaped US export controls for the past 25 years.

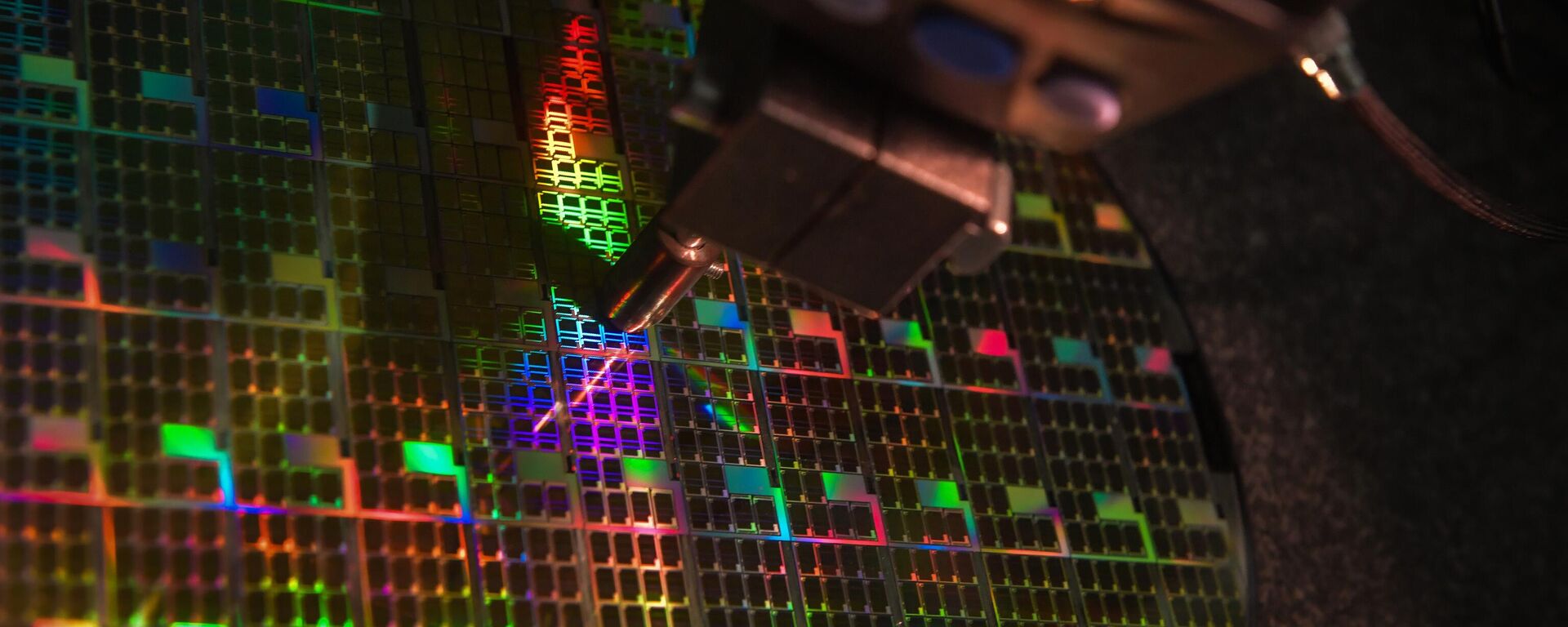

One of the pivotal methods the US used to fuel this trade war was implementing export controls and sanctions targeting the sale of advanced semiconductor manufacturing equipment and technology to Chinese firms in

two distinct

rules on October 7, 2022. The Commerce Department's Bureau of Industry and Security (BIS) has unveiled a series of regulations to constrain China's

“ability to both purchase and manufacture certain high-end chips used in military applications.”The US government, citing national security concerns, sought to restrict the export of cutting-edge technologies that China could use for military purposes or to enhance its domestic semiconductor capabilities. The

US Department of Commerce added several Chinese companies, including major semiconductor firms like SMIC (Semiconductor Manufacturing International Corporation), to its Entity List.

13 September 2023, 14:15 GMT

Additionally, the US initiated investigations and imposed tariffs on Chinese semiconductor products. These measures were part of broader trade disputes between the two nations, and they raised costs for Chinese semiconductor companies trying to export their products to the US market. This not only put economic pressure on China's semiconductor industry but also signaled a willingness by the US to use trade policy as a tool to shape the global semiconductor landscape.

Furthermore, the US government actively pressured its allies and trading partners to adopt similar export controls and restrictions on semiconductor-related technologies. This created a global environment where China faced difficulties acquiring critical components and equipment necessary for its semiconductor industry's development.

The Trump administration succeeded in browbeating the Dutch government to limit the export of extreme ultraviolet (EUV) lithography machines (made by Dutch ASML Holding) to China to deal a blow to the Chinese semiconductor production capabilities. This piece of sophisticated equipment is vital in producing advanced chips.

However, the Biden government is upping the ante by seeking to render the chipmaking prowess of China.

Chinese Role for South Korean Chips

The economic well-being and job market of South Korea hinge heavily on its semiconductor industry. The nation confronts a complex situation, standing at the crossroads of its abiding partnership with the United States and China, embroiled in an ongoing

trade dispute.

Washington has intensified its control over the export of such critical technologies. This move, initiated in October 2022 by the Biden administration, has unsettled South Korea, prompting lobbying in the US to mitigate potential harm to South Korea's semiconductor industry.

5 September 2023, 16:26 GMT

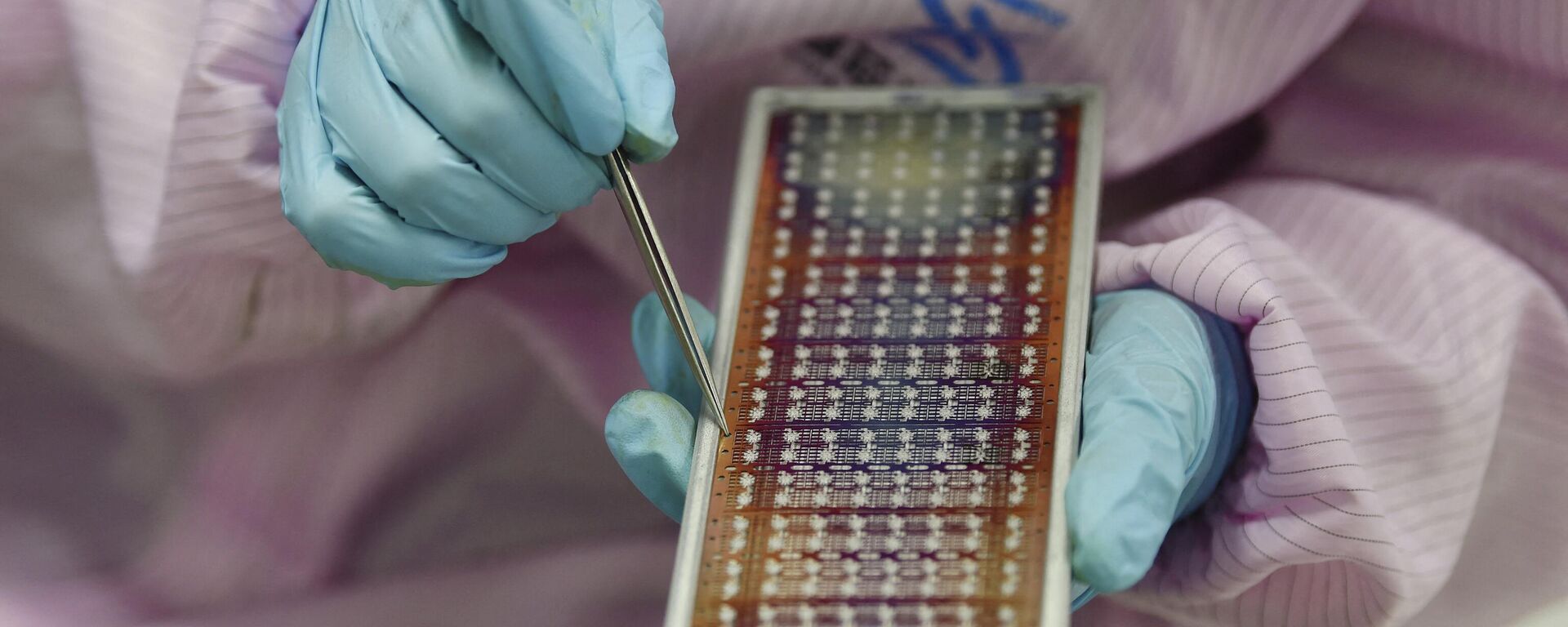

In mid-October 2022, Samsung and SK Hynix were granted a one-year waiver, providing a reprieve from export regulations. As its expiration is on the horizon, there is a general belief that it could be renewed, though such an outcome is doubtful.

“Geopolitical issues have become the biggest risk for companies to manage….Companies cannot resolve this problem alone,” South Korean President Yoon Suk-yeol said in June while addressing a gathering comprising government dignitaries and industry leaders concerning a national semiconductor strategy.

Semiconductor production entails massive transnational distribution networks and initiatives aimed at instituting

new industry regulations have prompted a thorough evaluation of commercial partnerships across Asia and the West.

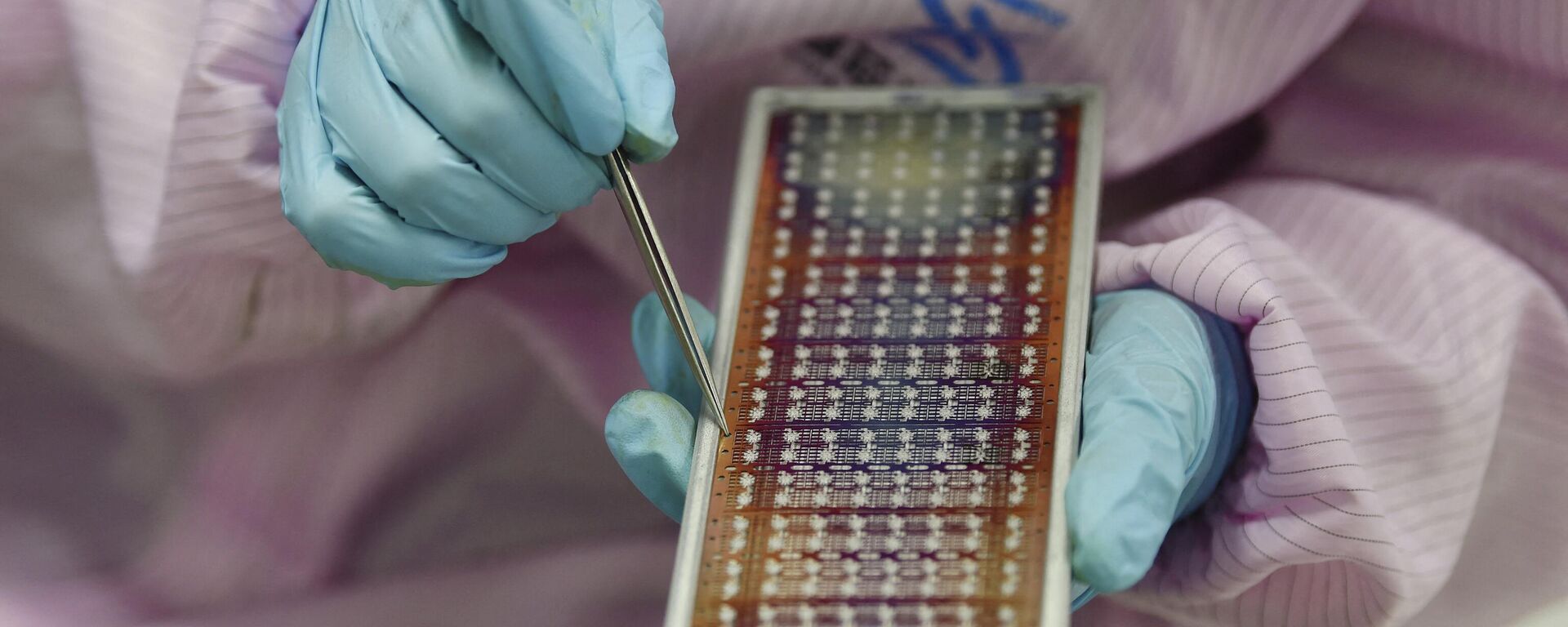

China plays a dual role as it offers a vast chip customer base and houses substantial production facilities for South Korea’s Samsung and SK Hynix.

In the last ten years,

China consistently held the lion's share, at one point reaching almost 67 percent of South Korean chip exports. Regardless, this number receded to 55 percent in the previous year, as per an evaluation of South Korean government findings. Moreover, data on semiconductor sales are not made public due to weak demand.

However, financial reports produced by subsidiaries of Korean companies in China showed a marked 35 percent decrease in sales in the first six months of 2023.

How US Sanctions on China Affect South Korea's Industry

Yang Hyang-ja, a former Samsung executive and currently a lawmaker in the National Assembly, has emerged as a prominent voice in South Korean politics on this matter. She has staunchly asserted that the country is a “victim” in the ongoing trade dispute and has proposed tax reductions to support chip manufacturers. This proposal, known as the K-Chips Act, received approval in March. “We are taking a direct hit,” she expressed.

“To give up the large market that is China? We won’t be able to recover,” Chey Tae-won, SK Hynix’s chairman, disclosed at a news conference in July.

Samsung's operational strategy in China involves the production of 40 percent of its NAND chips, a vital component in data storage for devices. SK Hynix, too, has a significant presence in China, where it manufactures 30 percent of its NAND chips and nearly half of its Dynamic random-access memory chips - critical in facilitating short-term storage for PCs and servers.

In an official statement, Samsung clarified that its investments have been judiciously made to fulfill the needs of a worldwide customer base and address other pressing demands.

The uncertainties spawned by the China-US trade spat impact more than just Samsung and SK Hynix.

The Taiwan Semiconductor Manufacturing Company (TSMC), the world's famed semiconductor chip maker, is also in limbo, awaiting word from the US Department of Commerce regarding the outcome of their exemptions from export regulations.

10 August 2023, 17:39 GMT

The Commerce Department has opted to withhold a formal response on the matter. Instead, they have referred to a statement by Deputy Commerce Secretary Don Graves. During his recent visit to Korea, Graves emphasized the United States' unwavering commitment to exhaust all avenues supporting businesses, ensuring their uninterrupted operations.

For Samsung and SK Hynix, a waiver lasting a year or less could impede their progress in the fast-evolving chip-making industry. Staying competitive demands significant investments in equipment, parts, and research. The manufacturing facilities for chips are high-priced, ranging from tens to hundreds of millions of dollars.

“Rather than wondering what will happen year by year, extending the waiver by two to three years at a time would make people more at ease,” said Lim Hyung-kyu, former chief technology officer.

Semiconductor analyst Song Myung-sup suggests that companies like SK Hynix and Samsung may redirect their production efforts in China to cater to the local market. They could also focus on making less advanced products to circumvent US restrictions.