https://sputnikglobe.com/20231028/eurozone-economy-forecast-facing-period-of-stagnation-amid-possibly-shrunk-gdp--1114548915.html

Eurozone Economy Forecast Facing Period of Stagnation Amid Possibly 'Shrunk' GDP

Eurozone Economy Forecast Facing Period of Stagnation Amid Possibly 'Shrunk' GDP

Sputnik International

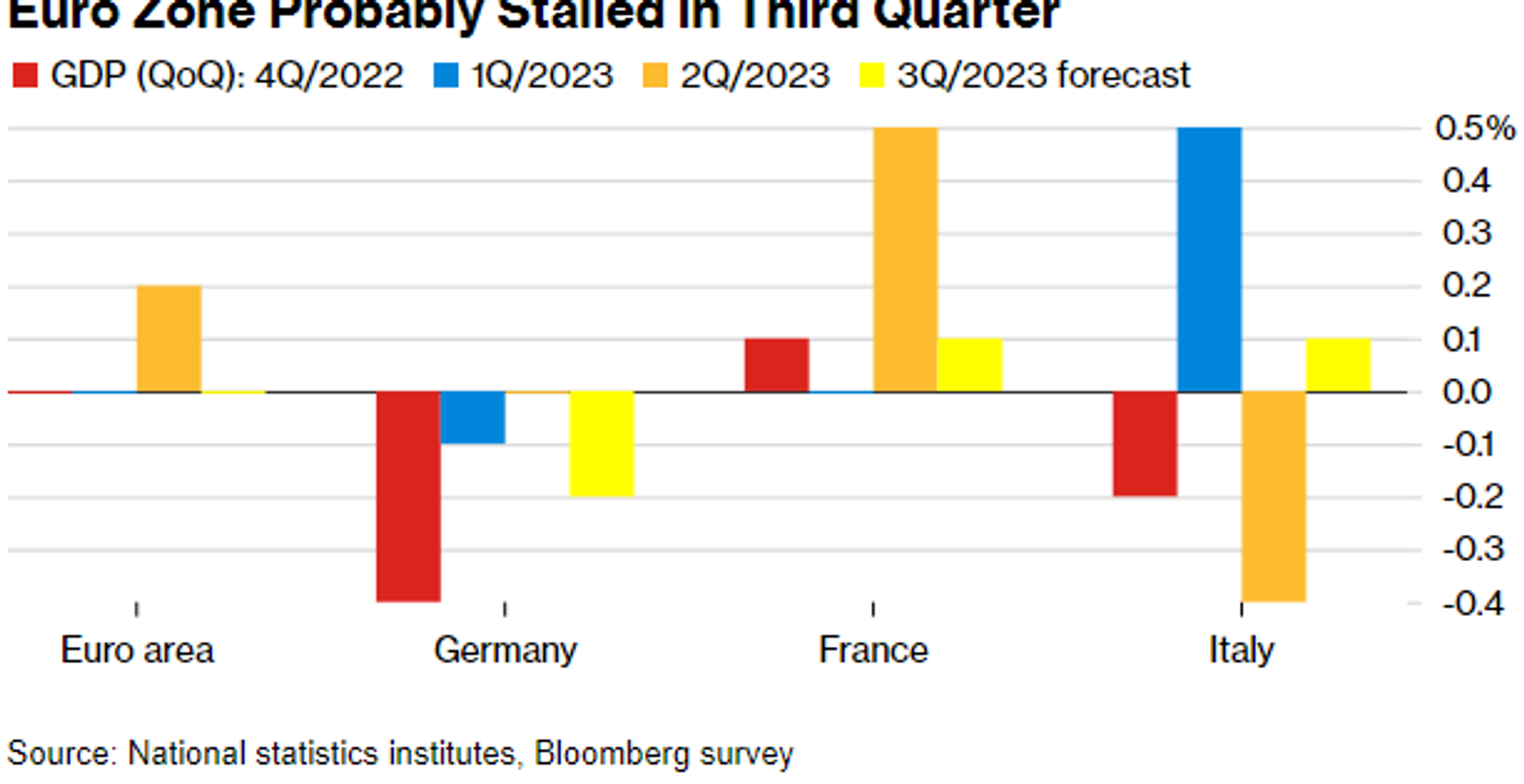

The economy of the Eurozone economy may have contracted in the third quarter (3Q), claim forecasters cited in a media report.

2023-10-28T12:13+0000

2023-10-28T12:13+0000

2023-10-28T12:13+0000

economy

european union (eu)

interest rate

interest rates

economy

euro

european central bank

christine lagarde

gdp

eurozone

https://cdn1.img.sputnikglobe.com/img/07e7/0a/1c/1114547335_0:160:3072:1888_1920x0_80_0_0_b5358faa40cf1b9a4e58679dab43a4e8.jpg

The economy of the embattled Eurozone economy may have contracted in the third quarter (3Q), now facing a period of stagnation, forecasters claim, as cited in a media report.Ahead of next week’s release of 3Q (July, August, September) economic data by Eurostat for the member states of the European Union (EU) that have adopted the euro as their currency, economists appear convinced that figures will point to the gross domestic product (GDP) having stalled or shrunk. They added that this outcome was fallout from successive interest rate hikes carried out by the European Central Bank (ECB).Considered the broadest indicator of an economy's wellbeing, GDP measures whether the economy is growing, if at all, and appraises inflation-adjusted value of produced goods and services.But even that should be seen as a relatively optimistic forecast, as cited economists at Barclays believe the economy of the Eurozone could be in a recession.Ahead of the third quarter GDP data from the EU's statistical agency on Germany, Austria, and Belgium, expected to be released on October 30, economists were cited as faulting Berlin for the dismal Eurozone data.Heavily-industrialized Germany was hit harder than other EU members by self-harming sanctions leveled upon Russian gas, oil and coal imports over Ukraine. The bombing of the Nord Stream 1 and 2 pipelines also took a toll. Three out of four Nord Stream pipelines running from Russia to Germany under the Baltic Sea to provide Western Europe with natural gas were targeted in an act of deliberate sabotage last year. Germany has been forced to spend more on alternative gas sources than it used to for cheap and reliable Russian energy.If the Eurostat reports do indeed point to a contraction, as forecast by economists, this will be the first such GDP drop since the start of the COVID-19 pandemic in 2020. Regarding other aspects, next week’s reports are expected to state that headline inflation is at 3.1 percent, which appears to not be far away from the target goal of two percent. Earlier in October, European Central Bank President Christine Lagarde is believed to have warned that the economy of the region is likely to face stagnation in successive quarters.In early summer, the EU was plunged into a technical recession, grappling with slackening economic activity and inflation hurdles. In the third quarter, the Eurozone’s economy shrank, with several factors contributing to this, such as decline in demand in the region, higher borrowing costs, soaring prices, and choked consumer spending as households felt the pinch of the cost-of-living crisis. As part of the aggressive monetary policy of the European Central Bank aimed at curbing inflation, it raised its key interest rate to a record high of four percent on September 14 – its 10th such move in 14 months. When indicating that it was likely to be its last such hike, Christine Lagarde said at the time, in a reference to the bank’s two percent target:“Based on its current assessment, the governing council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”Since then, the key rate is set to remain at a record high of four percent, the Central Bank said, with the ECB president saying that further decisions would be "data-dependent," as "after 10 successive hikes, now is not the time for forward guidance.”

https://sputnikglobe.com/20231011/eu-economy-stagnating-as-bloc-tries-to-abandon-russian-energy---putin-1114095156.html

https://sputnikglobe.com/20231006/eurozone-economy-on-course-for-recession-in-late-2023-as-output-mired-in-downturn-1113984677.html

germany

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

eurozone economy, eurozone economy may have contracted, third quarter, 3q, eurozone stagnation, eurozone recession, persistent eurozone inflation, eurozone technical recession,

eurozone economy, eurozone economy may have contracted, third quarter, 3q, eurozone stagnation, eurozone recession, persistent eurozone inflation, eurozone technical recession,

Eurozone Economy Forecast Facing Period of Stagnation Amid Possibly 'Shrunk' GDP

Earlier in October, economists predicted that amid slackening economic growth, the Eurozone was likely to slide into recession by late 2023.

The economy of the embattled

Eurozone economy may have contracted in the third quarter (3Q), now facing a period of stagnation, forecasters claim, as cited in a media report.

Ahead of next week’s release of 3Q (July, August, September) economic data by

Eurostat for the member states of the European Union (EU) that have adopted the euro as their currency, economists appear convinced that figures will point to the

gross domestic product (GDP) having

stalled or

shrunk. They added that this outcome was fallout from successive

interest rate hikes carried out by the European Central Bank (ECB).

Considered the broadest indicator of an economy's wellbeing, GDP measures whether the economy is growing, if at all, and appraises inflation-adjusted value of produced goods and services.

But even that should be seen as a relatively optimistic forecast, as cited economists at

Barclays believe the economy of the Eurozone could be

in a recession.

Ahead of the third quarter GDP data from the EU's statistical agency on Germany, Austria, and Belgium, expected to be released on October 30, economists were cited as faulting Berlin for the dismal Eurozone data.

Heavily-industrialized Germany was hit harder than other EU members by

self-harming sanctions leveled upon Russian gas, oil and coal imports over Ukraine. The

bombing of the Nord Stream 1 and 2 pipelines also took a toll.

Three out of four Nord Stream pipelines running from Russia to Germany under the Baltic Sea to provide Western Europe with natural gas were targeted in an act of deliberate sabotage last year. Germany has been forced to spend more on alternative gas sources than it used to for cheap and reliable Russian energy.

11 October 2023, 12:28 GMT

If the Eurostat reports do indeed point to a contraction, as forecast by economists, this will be the first such GDP drop since the start of the COVID-19 pandemic in 2020. Regarding other aspects, next week’s reports are expected to state that headline inflation is at 3.1 percent, which appears to not be far away from the target goal of two percent. Earlier in October, European Central Bank President Christine Lagarde is believed to have warned that the economy of the region is likely to face stagnation in successive quarters.

In early summer, the EU was plunged into a technical recession, grappling with

slackening economic activity and inflation hurdles. In the third quarter, the Eurozone’s economy shrank, with several factors contributing to this, such as decline in demand in the region, higher borrowing costs, soaring prices, and choked consumer spending as households felt the pinch of the

cost-of-living crisis. As part of the aggressive monetary policy of the European Central Bank aimed at curbing inflation, it raised its key interest rate to a record high of four percent on September 14 – its 10th such move in 14 months. When indicating that it was likely to be its last such hike, Christine Lagarde said at the time, in a reference to the bank’s two percent target:

“Based on its current assessment, the governing council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

Since then, the key rate is set to remain at a record high of four percent, the Central Bank said, with the ECB president saying that further decisions would be "data-dependent," as "after 10 successive hikes, now is not the time for forward guidance.”

6 October 2023, 16:18 GMT