https://sputnikglobe.com/20231029/bank-of-england-reportedly-set-to-predict-higher-risk-of-economic-recession-for-uk--1114571700.html

Bank of England Reportedly Set to Predict 'Higher Risk of Economic Recession' For UK

Bank of England Reportedly Set to Predict 'Higher Risk of Economic Recession' For UK

Sputnik International

The Bank of England (BoE) is anticipated to predict at its Monetary Policy Committee meeting next week an increased risk of a recession for the UK economy in the months ahead.

2023-10-29T14:44+0000

2023-10-29T14:44+0000

2023-10-29T14:44+0000

united kingdom (uk)

bank of england

economy

recession

economic recession

gdp

gdp drop

inflation

economy

https://cdn1.img.sputnikglobe.com/img/07e7/0a/1d/1114571463_0:161:3070:1888_1920x0_80_0_0_0b0e0dedfb3d9a7dc650d1b1e742c637.jpg

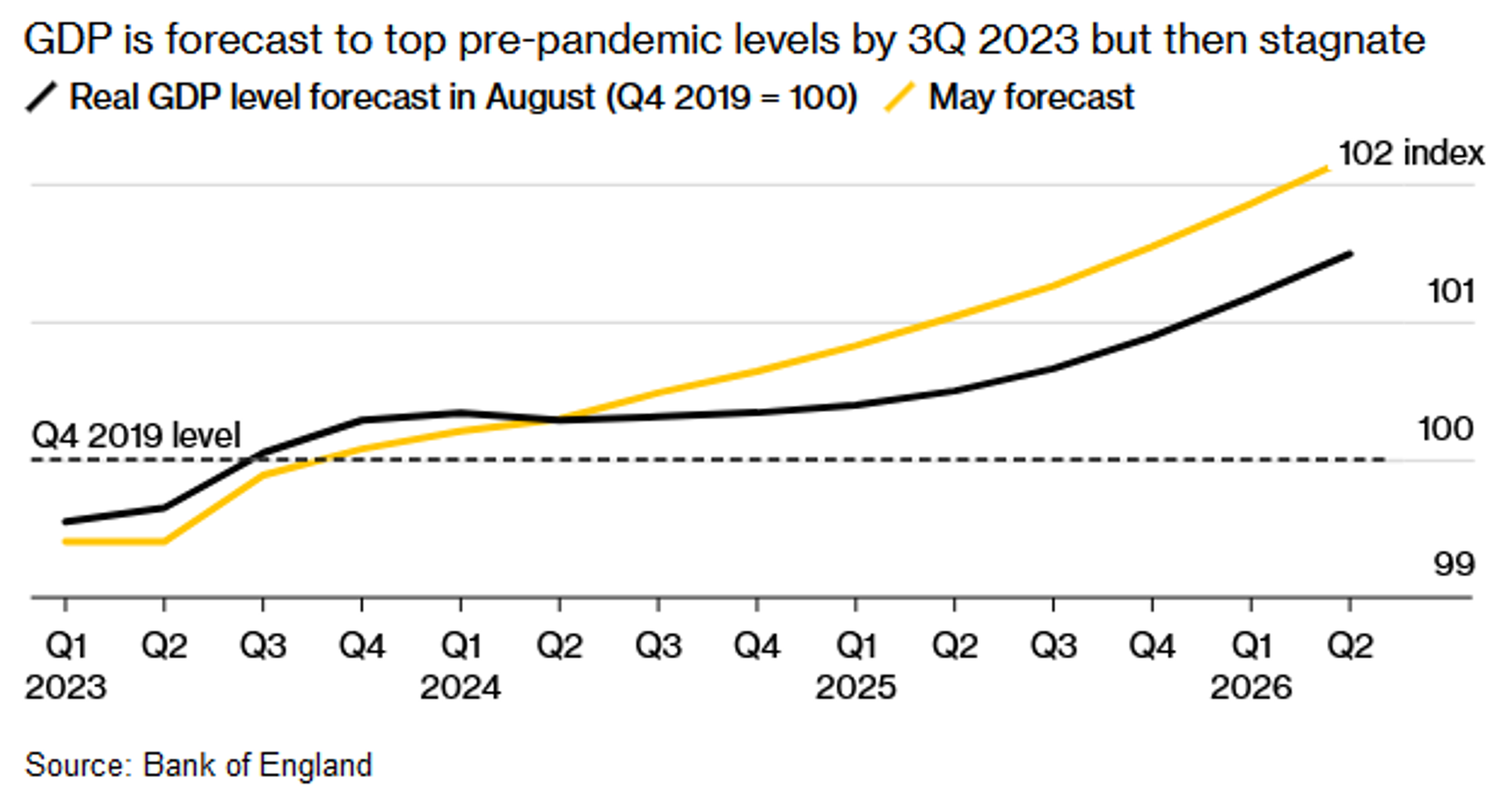

The Bank of England (BoE) is anticipated to predict an increased risk of a recession for the UK economy in the months ahead.As the BoE’s Monetary Policy Committee (MPC) is set to meet on November 2, and market forecasts cited by media suggest the bank will revise down its estimates for gross domestic product (GDP) both for the second half of this year, and for early 2024. Economists referenced in the publications base their assumptions on both official data and surveys, which pointed to a higher recession risk.Back in August, the BoE had anticipated stagnant GDP growth, but the currently expected downgrade would feed into imminent recession chances, as per economists cited by the media reports. Economists referenced in the publications base their assumptions on both official data and surveys, which all pointed to a higher recession risk.The unemployment outlook is forecast to assume an increase of around five percent in the coming months. This figure reflects a surge up from 3.5 percent registered last year, which marked a 50-year low. Furthermore, in September, the Purchasing Managers' Index (PMI) revealed that the private sector had contracted faster than expected, also stoking recession fearsRegarding the Bank of England’s decision pertaining to the interest rate, to be taken on Thursday, economists and investors were cited as envisaging key rate to remain at 5.25 percent for a second consecutive meeting. Judging by what financial market experts are saying, there is a less than 50 percent chance that BoE interest rates will reach 5.5 percent. “We see limited likelihood of further hikes being required,” Moyeen Islam of Barclays Plc was cited as saying.After raising interest rates 14 times in a row since late 2021, at its previous meeting in September, the Bank of England's MPC opted to keep rates on hold, despite inflation remaining high. At the time, the MPC anticipated the GDP to “rise by 0.1% in 2023 Q3, compared with the 0.4% increase incorporated in the August Report.” It had added that “underlying growth was also likely to be weaker than the 0.25% per quarter built into the August projection for the second half of 2023.”The inflation rate in the UK remained at 6.7 percent in September, with core inflation - which excludes costs of such items as energy and food, at 6.1 percent. Britain is experiencing the worst inflation challenges among the Group of Seven, with Moody’s having warned in September that this will likely be the case until at least the end of 2024. Earlier in the month, the UK's rising unemployment rate - currently at 4.3 percent and surpassing its Eurozone counterparts - was seen as signaling an approaching recession.The UK, just like many other European countries, has been facing inflation and an energy crisis in part due to the post-pandemic global economic recession. However, the situation was further exacerbated by the Ukraine crisis, as self-harming Western sanctions against Russia disrupted supply chains around the world, and wreaked havoc on European economies. In the UK, the aforementioned repercussions led to a surge in inflation, and skyrocketing prices of essential items like food and fuel, prompting a wave of strikes across the nation.The Washington-led goal of crippling the Russian economy backfired. The World Bank reported in August that by the end of 2022, Russia's wealth in purchasing power parity (PPP) terms exceeded $5 trillion for the first time, allowing it to surge ahead of Western Europe's three biggest economies: France, the UK, and Germany.

https://sputnikglobe.com/20231014/is-uk-heading-for-recession-job-market-sends-warning-sign-1114198957.html

https://sputnikglobe.com/20230810/russian-economy-overtakes-germany-uk-and-france-despite-western-sanctions-1112511026.html

united kingdom (uk)

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

bank of england, boe, monetary policy committee meeting, higher risk of economic recession, revised down estimates for gross domestic produc, gdp

bank of england, boe, monetary policy committee meeting, higher risk of economic recession, revised down estimates for gross domestic produc, gdp

Bank of England Reportedly Set to Predict 'Higher Risk of Economic Recession' For UK

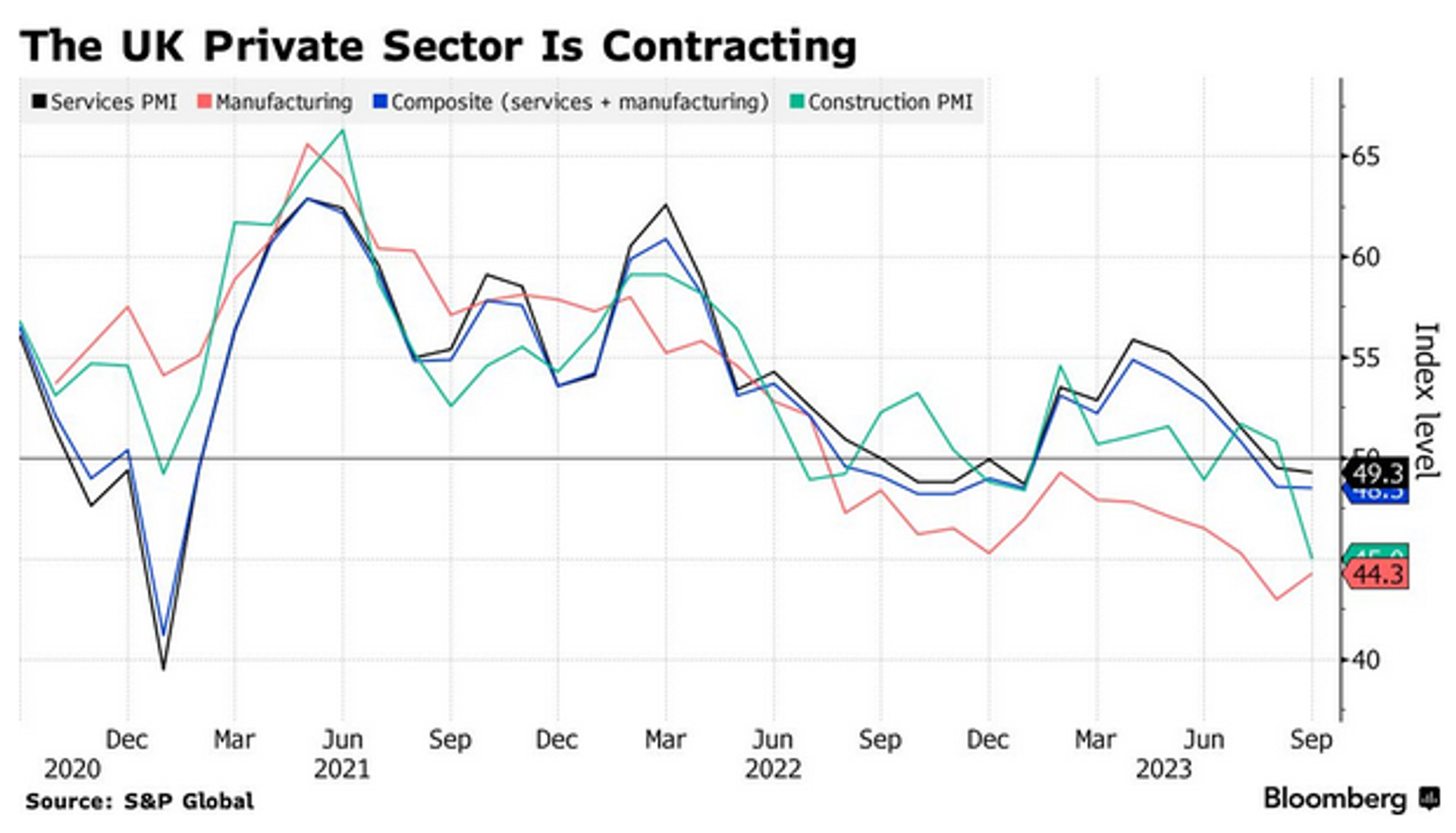

Defying more optimistic forecasts based on very slight growth data earlier in the year, the British economy shrank this summer, with the Office for National Statistics (ONS) revealing an unexpected contraction by 0.5 percent in July, particularly affecting manufacturing, electronics, and the construction sector.

The Bank of England (BoE) is anticipated to predict an increased risk of

a recession for the UK economy in the months ahead.

As the BoE’s Monetary Policy Committee (MPC) is set to meet on November 2, and market forecasts cited by media suggest the bank will revise down its estimates for gross domestic product (GDP) both for the second half of this year, and for early 2024. Economists referenced in the publications base their assumptions on both official data and surveys, which pointed to a higher recession risk.

Back in August, the BoE had anticipated stagnant GDP growth, but the currently expected downgrade would feed into imminent

recession chances, as per economists cited by the media reports. Economists referenced in the publications base their assumptions on both official data and surveys, which all pointed to a higher recession risk.

The unemployment outlook is forecast to assume an increase of around five percent in the coming months. This figure reflects a surge up from 3.5 percent registered last year, which marked a 50-year low.

Furthermore, in September, the Purchasing Managers' Index (PMI) revealed that the private sector had contracted faster than expected, also stoking recession fears

Regarding the Bank of England’s decision pertaining to the

interest rate, to be taken on Thursday, economists and investors were cited as envisaging key rate to remain at

5.25 percent for a second consecutive meeting. Judging by what financial market experts are saying, there is a less than 50 percent chance that BoE interest rates will reach 5.5 percent.

“We see limited likelihood of further hikes being required,” Moyeen Islam of Barclays Plc was cited as saying.

After raising interest rates 14 times in a row since late 2021, at its previous meeting in September, the Bank of England's MPC opted to keep rates on hold, despite inflation remaining high.

At the time, the MPC anticipated the GDP to “rise by 0.1% in 2023 Q3, compared with the 0.4% increase incorporated in the August Report.” It had added that “underlying growth was also likely to be weaker than the 0.25% per quarter built into the August projection for the second half of 2023.”

14 October 2023, 17:07 GMT

The inflation rate in the UK remained at 6.7 percent in September, with core inflation - which excludes costs of such items as energy and food, at 6.1 percent. Britain is experiencing the worst inflation challenges among the Group of Seven, with Moody’s having warned in September that this will likely be the case until at least the end of 2024.

Earlier in the month, the UK's rising unemployment rate - currently at 4.3 percent and surpassing its Eurozone counterparts - was seen as signaling an approaching recession.

The UK, just like many other European countries, has been facing inflation and an energy crisis in part due to the post-pandemic global economic recession. However, the situation was further exacerbated by the Ukraine crisis, as self-harming

Western sanctions against Russia disrupted supply chains around the world, and wreaked havoc on European economies. In the UK, the aforementioned repercussions led to a surge in inflation, and skyrocketing prices of essential items like food and fuel, prompting a wave of

strikes across the nation.

The Washington-led goal of crippling the Russian economy backfired. The

World Bank reported in August that by the end of 2022, Russia's wealth in purchasing power parity (PPP) terms exceeded $5 trillion for the first time, allowing it to surge ahead of Western Europe's three biggest economies: France, the UK, and Germany.

10 August 2023, 17:52 GMT