https://sputnikglobe.com/20240420/catch-235-if-west-bans-russian-nuclear-fuel-no-one-will-suffer-except-itself-1118031030.html

Catch-235: If West Bans Russian Nuclear Fuel, No One Will Suffer Except Itself

Catch-235: If West Bans Russian Nuclear Fuel, No One Will Suffer Except Itself

Sputnik International

President Joe Biden announced on Friday that a US domestic firm had managed to produce its first 200 pounds (90 kilograms) of high-assay low-enriched uranium (HALEU), insisting that the US can no longer rely on Russia's nuclear fuel.

2024-04-20T17:00+0000

2024-04-20T17:00+0000

2024-04-20T17:00+0000

joe biden

world

russia

ohio

rosatom

department of energy (doe)

g7

us

europe

nuclear

https://cdn1.img.sputnikglobe.com/img/105199/57/1051995715_0:159:3077:1890_1920x0_80_0_0_19f9f6656ad87b98164dc3706e1dbde6.jpg

The US and its G7 allies were quick to ban Russia's coal, gas, oil and petroleum products, but has so far shied away from placing restrictions on the nation's nuclear fuel. What’s behind the West's hesitation?Enriched Uranium: What is HALEU?President Joe Biden stated on April 19 that the IBEW plant in southern Ohio had produced "the first 200 pounds" (90 kg) of "that powerful enriched uranium", the first ever made in the US. The president stressed that the plant is on track to produce "nearly a ton by the end of the year," adding that it would be enough to power 100,000 homes in the US.The COP28 climate declaration of December 2023 called for tripling of nuclear energy capacity by 2050, and an increase in nuclear development projections by the IEA and the IAEA in a pursuit of a carbon-free future.Next-generation reactors require HALEU to achieve smaller designs — while generating more power per unit of volume — longer operating cycles and increased efficiencies over their predecessors.Back in 2020 the US Department of Energy (DOE) projected that more than 40 metric tons of HALEU will be needed before the end of the decade, with additional amounts required each year, to launch a new fleet of advanced reactors in the US and meet Washington's net-zero targets by 2050.Against this backdrop, Biden's pledge that "nearly a ton" of HALEU is expected to be produced by the end of the year is a far cry from its declared climate goals. In fact, US domestic production of nuclear materials has been in rapid decline since the 2000s. According to the US Energy Information Administration (EIA), US nuclear power plants relied on Russia for 24% of their enrichment services in 2022.In the most optimistic scenario it would take at least five years for the US and western Europe to start producing high-assay low-enriched uranium on a commercial scale, according to Reuters.The crux of the matter is that Russia has a monopoly on HALEU: only Tenex, part of Russia's Rosatom corporation, sells the fuel on a commercial basis.G7's Plans to Abandon Russia's Nuclear FuelThe Group of Seven (G7) developed nations has repeatedly signaled the desire to end their dependence on Russia's nuclear fuel. Last year, Canada, France, Japan, the UK and the US concluded an agreement to "leverage the respective resources and capabilities of each country’s civil nuclear power sectors to undermine Russia's grip on supply chains," according to the group's official statement published on April 16, 2023.In December 2023, the US House of Representatives passed the Prohibiting Russian Uranium Imports Act. The annotation to the bill clarifies that it bans "unirradiated low-enriched uranium" (LEU) that is "produced in Russia or by a Russian entity from being imported into the United States." While the act would bar Russian uranium imports 90 days after enactment, it allows a temporary waiver until January 2028. The legislation is still stalled in the US Senate.The G7's threats and legislative efforts have not prevented the US and EU from stepping up purchases of enriched uranium from Russia's nuclear corporation Rosatom in 2023. The US acquired 702 tons of the fuel, 19 percent more than it did in 2022. The EU saw more than a twofold increase in nuclear fuel imports in cash terms: from €280 million in 2022 to €686 million in 2023, according to the Bellona Foundation, an Oslo-based international environmental NGO.Western energy experts draw attention to the fact that, although Russia's earnings from selling nuclear commodities are much less than its hydrocarbon profits, the nation's atomic sector plays a significant role in the global economy.The G7's threats to dump Russian nuclear fuel cannot discourage the nation, because the lion's share of its revenue comes from the countries outside the West. Rosatom's annual income has been steadily growing from $7.5 billion in 2020 to $11.8 billion in 2022 and around $14 billion in 2023 — of which Western purchases amounted to roughly $2 billion.Under these circumstances the West is facing a "catch-235": it can neither immediately ramp up production of advanced nuclear fuel to meet its needs — let alone replace Russian imports — in the near future, nor can it inflict damage to Moscow by cutting its nuclear fuel revenues.Some observers cite a far more "frightening" potentiality: if Russia decides to retaliate and stop selling its nuclear commodities to the West, the latter could face hard times.

https://sputnikglobe.com/20231205/rosatom-touts-future-of-small-modular-reactors-at-cop28-1115408417.html

https://sputnikglobe.com/20231107/us-acknowledges-critical-dependence-on-russian-nuclear-fuel-imports-1114801458.html

https://sputnikglobe.com/20230420/g7-cant-replace-russias-nuclear-fuel-and-expertise-1109708015.html

https://sputnikglobe.com/20231016/hungary-will-not-replace-rosatom-with-another-nuclear-fuel-supplier--top-diplomat-1114222620.html

russia

ohio

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

russian nuclear fuel, russia's haleu fuel, us next generation nuclear reactors, biden lauds production of 200 pounds of haleu, rosatom, rosatom has monopoly on haleu, west's dependency on russia's nuclear fuel, western sanctions

russian nuclear fuel, russia's haleu fuel, us next generation nuclear reactors, biden lauds production of 200 pounds of haleu, rosatom, rosatom has monopoly on haleu, west's dependency on russia's nuclear fuel, western sanctions

Catch-235: If West Bans Russian Nuclear Fuel, No One Will Suffer Except Itself

President Joe Biden announced on Friday that a US domestic firm had managed to produce its first 200 pounds (90 kilograms) of high-assay low-enriched uranium (HALEU), insisting that the US can no longer rely on Russia's nuclear fuel.

The US and its G7 allies were quick to ban Russia's coal, gas, oil and petroleum products, but has so far shied away from placing restrictions on the nation's nuclear fuel. What’s behind the West's

hesitation?

Enriched Uranium: What is HALEU?

President Joe Biden stated on April 19 that the IBEW plant in southern Ohio had produced "the first 200 pounds" (90 kg) of "that powerful enriched uranium", the first ever made in the US. The president stressed that the plant is on track to produce "nearly a ton by the end of the year," adding that it would be enough to power 100,000 homes in the US.

The "powerful enriched uranium" mentioned by Biden is "high-assay low-enriched uranium" (HALEU) — indispensable for the nation's civil nuclear program. In contrast to "low enriched uranium" (LEU), which is enriched to up to 5 percent of the fissile U-235 isotope, HALEU is enriched to between 5 percent and 20 percent for the use in next-generation reactors designed under the US' 2050 net-zero emissions plan.

The COP28 climate declaration of December 2023 called for tripling of nuclear energy capacity by 2050, and an increase in nuclear development projections by the IEA and the IAEA in a pursuit of a carbon-free future.

5 December 2023, 14:59 GMT

Next-generation reactors require HALEU to achieve smaller designs — while generating more power per unit of volume — longer operating cycles and increased efficiencies over their predecessors.

Back in 2020 the US Department of Energy (DOE) projected that more than 40 metric tons of HALEU will be needed before the end of the decade, with additional amounts required each year, to launch a new fleet of advanced reactors in the US and meet Washington's net-zero targets by 2050.

Against this backdrop, Biden's pledge that "nearly a ton" of HALEU is expected to be produced by the end of the year is a far cry from its declared climate goals. In fact, US domestic production of nuclear materials has been in rapid decline since the 2000s. According to the US Energy Information Administration (EIA), US nuclear power plants relied on Russia for 24% of their enrichment services in 2022.

In the most optimistic scenario it would take at least five years for the US and western Europe to start producing high-assay low-enriched uranium on a commercial scale, according to Reuters.

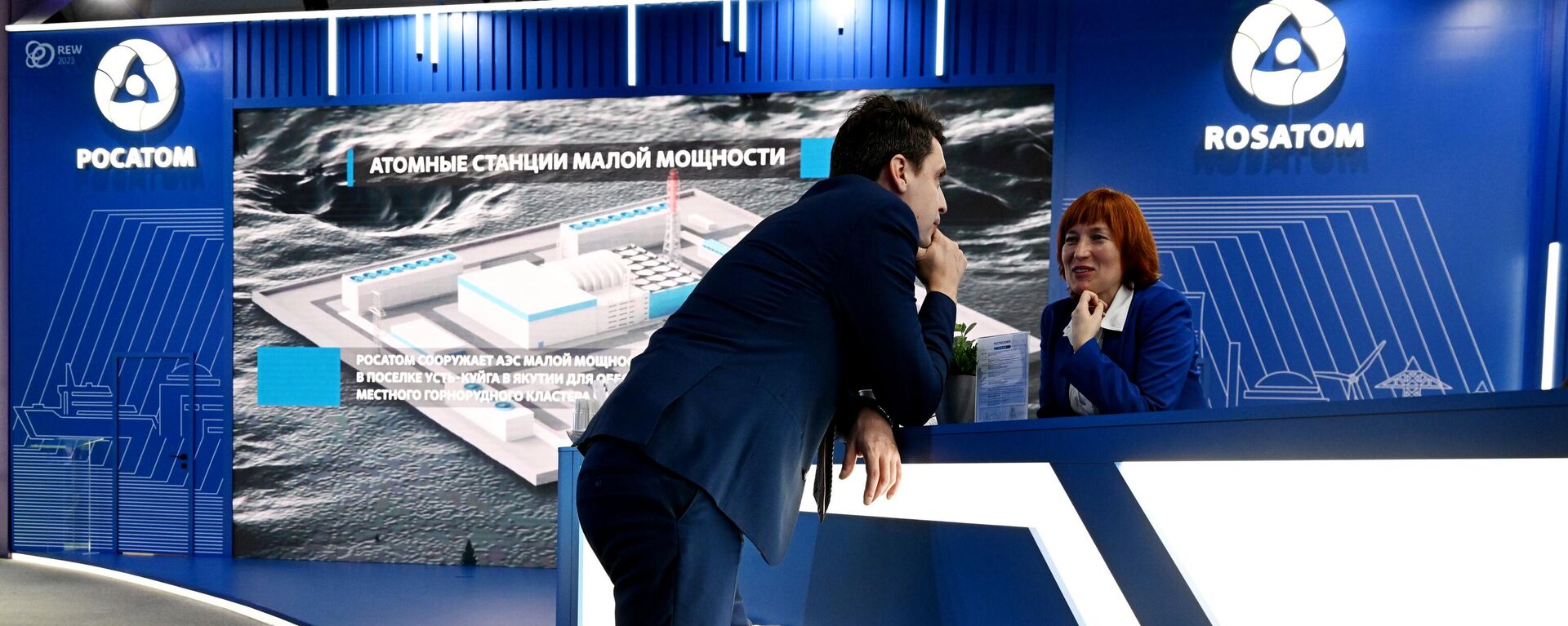

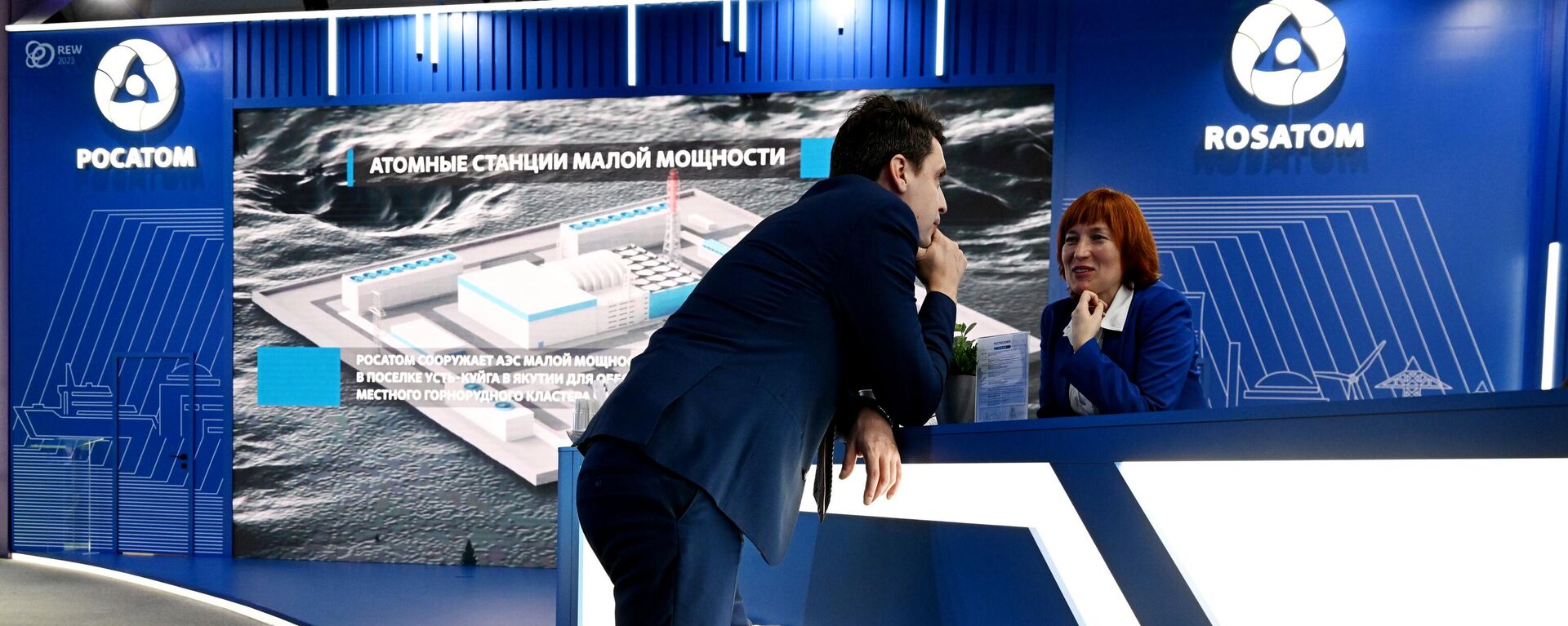

The crux of the matter is that Russia has a monopoly on HALEU: only Tenex, part of Russia's Rosatom corporation, sells the fuel on a commercial basis.

7 November 2023, 19:06 GMT

G7's Plans to Abandon Russia's Nuclear Fuel

The Group of Seven (G7) developed nations has repeatedly signaled the desire to end their

dependence on Russia's nuclear fuel. Last year, Canada, France, Japan, the UK and the US concluded an agreement to "leverage the respective resources and capabilities of each country’s civil nuclear power sectors to undermine Russia's grip on supply chains," according to the group's official statement published on April 16, 2023.

In December 2023, the US House of Representatives passed the Prohibiting Russian Uranium Imports Act. The annotation to the bill clarifies that it bans "unirradiated low-enriched uranium" (LEU) that is "produced in Russia or by a Russian entity from being imported into the United States." While the act would bar Russian uranium imports 90 days after enactment, it allows a temporary waiver until January 2028. The legislation is still stalled in the US Senate.

The G7's threats and legislative efforts have not prevented the US and EU from stepping up purchases of enriched uranium from

Russia's nuclear corporation Rosatom in 2023. The US acquired 702 tons of the fuel, 19 percent more than it did in 2022. The EU saw more than a twofold increase in nuclear fuel imports in cash terms: from €280 million in 2022 to €686 million in 2023, according to the Bellona Foundation, an Oslo-based international environmental NGO.

Western energy experts draw attention to the fact that, although Russia's earnings from selling nuclear commodities are much less than its hydrocarbon profits, the nation's atomic sector plays a significant role in the global economy.

Russia controls almost 50 percent of global uranium enrichment capacity;

Rosatom is way ahead of its Western counterparts in producing LEU and HALEU fuel for nuclear reactors.

Rosatom is a world leader in constructing nuclear reactors abroad: the corporation's portfolio of orders includes 34 reactors in 11 countries.

The G7's threats to dump Russian nuclear fuel cannot discourage the nation, because the lion's share of its revenue comes from the countries outside the West. Rosatom's annual income has been steadily growing from $7.5 billion in 2020 to $11.8 billion in 2022 and around $14 billion in 2023 — of which Western purchases amounted to roughly $2 billion.

Under these circumstances the West is facing a "catch-235": it can neither immediately ramp up production of advanced nuclear fuel to meet its needs — let alone replace Russian imports — in the near future, nor can it inflict damage to Moscow by cutting its nuclear fuel revenues.

Some observers cite a far more "frightening" potentiality: if Russia decides to retaliate and stop selling its nuclear commodities to the West, the latter could face hard times.

16 October 2023, 06:36 GMT