https://sputnikglobe.com/20241006/chinas-options-for-retaliation-in-highly-charged-dispute-with-eu-over-evs-1120448249.html

China's Options for Retaliation in Highly Charged Dispute With EU Over EVs

China's Options for Retaliation in Highly Charged Dispute With EU Over EVs

Sputnik International

The European Commission took the first shot across the bow in a potential trade war with the People's Republic of China last Friday, voting in favor of tariffs up to 45% on Chinese electric vehicles. Here are Beijing's options for retaliation.

2024-10-06T18:31+0000

2024-10-06T18:31+0000

2024-10-06T18:43+0000

analysis

european union (eu)

china

brussels

beijing

european commission

people's republic of china

chamber of commerce

porsche

bmw

https://cdn1.img.sputnikglobe.com/img/07e8/0a/06/1120448444_0:160:3072:1888_1920x0_80_0_0_2b82e56318a70d26d7956689be88e83e.jpg

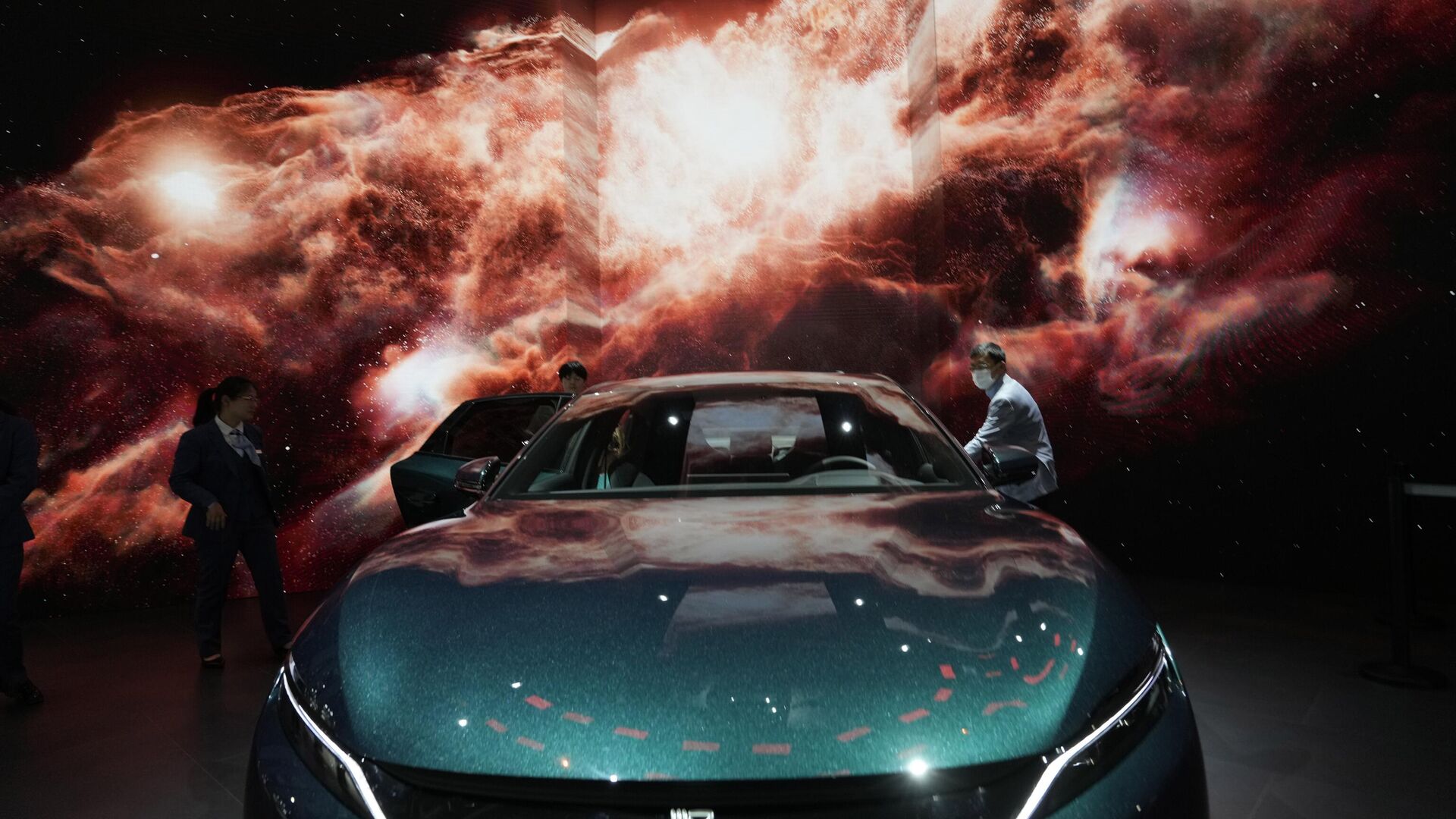

“The goal” of the EU’s tariff hike on Chinese electric vehicles “is to foster a European EV industry” with state backing and support, but could wind up triggering a massive trade war unless both sides adopt “bold ideas and wisdom” to resolve the dispute, Francesco Sisci, a Beijing-based China expert and author, told Sputnik, commenting on last week's EU vote to raise duties on Chinese EVs by double digits.China and the bloc now have until October 30 to prevent the tariffs from being implemented. China's Chamber of Commerce to the EU slammed the vote, calling the investigation by Brussels into subsidies on Chinese EVs which led to the tariff hike a "politically motivated and unjustified protectionist measure."The tariffs could affect up to 31% of all Chinese EV exports. In the first eight months of 2024 alone, China delivered some $8.5 billion worth of electric vehicles to the EU, according to customs data. Belgium proved to be the bloc's biggest buyer, accounting for 55%, or €4.2 billion, of all deliveries. Germany came in second, accounting for 14% (€1.08 billion), and Spain third with 12.5% (€965.23 million) of imports.If an agreement can’t be reached, Beijing has an array of options to hit back at the EU – whose economic prospects have already been dimmed in recent years thanks to soaring energy costs, which have undermined the competitiveness of Europe’s industrial output.China’s options for retaliation may include:

https://sputnikglobe.com/20240929/eu-paints-itself-into-a-corner-with-tariffs-on-chinese-sourced-paint-compounds-1120348824.html

https://sputnikglobe.com/20240912/russian-force-majeure-on-resource-exports-could-clobber-western-economies-heres-why-1120125698.html

china

brussels

beijing

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

how could china respond to european union's tariffs on electric vehicles, why is europe slapping tariffs on chinese evs

how could china respond to european union's tariffs on electric vehicles, why is europe slapping tariffs on chinese evs

China's Options for Retaliation in Highly Charged Dispute With EU Over EVs

18:31 GMT 06.10.2024 (Updated: 18:43 GMT 06.10.2024) The European Commission took the first shot across the bow of a potential trade war with the People's Republic of China last Friday, voting in favor of tariffs up to 45% on Chinese electric vehicles. Here are Beijing's options for retaliation.

“The goal” of the EU’s tariff hike on Chinese electric vehicles “is to foster a European EV industry” with state backing and support, but could wind up triggering a massive trade war unless both sides adopt

“bold ideas and wisdom” to resolve the dispute, Francesco Sisci, a Beijing-based China expert and author, told Sputnik, commenting on last week's EU

vote to raise duties on Chinese EVs by double digits.

China and the bloc now have until October 30 to prevent the tariffs from being implemented. China's Chamber of Commerce to the EU

slammed the vote, calling the investigation by Brussels into subsidies on Chinese EVs which led to the tariff hike a "politically motivated and unjustified protectionist measure."

The tariffs could affect

up to 31% of all Chinese EV exports. In the first eight months of 2024 alone, China delivered some $8.5 billion worth of electric vehicles to the EU, according to

customs data. Belgium proved to be the bloc's biggest buyer, accounting for 55%, or €4.2 billion, of all deliveries. Germany came in second, accounting for 14% (€1.08 billion), and Spain third with 12.5% (€965.23 million) of imports.

“Of course the Chinese can export their EVs to third countries and from there they could sneak cars back into Europe. But these loopholes could be closed and they could not affect the overall trend,” Sisci said, commenting on China’s predicament. The EU “is not backing down on this,” and that World Trade Organization-facilitated mediation “doesn’t work anymore,” requiring a “bilateral agreement the two parties will hopefully sign,” the observer said.

If an agreement can’t be reached, Beijing has an array of options to hit back at the EU – whose economic prospects have already been dimmed in recent years

thanks to soaring energy costs, which have undermined the competitiveness of Europe’s industrial output.

29 September 2024, 14:58 GMT

China’s options for retaliation may include:

Double-digit tariffs on European gas-guzzling big-engine luxury cars like Porsche, Mercedes and BMW.

Duties on European pork, dairy, wine, cognac and other niche food products. Beijing already

announced a probe into the EU’s subsidies for dairy exports in August, complementing similar probes into pork and brandy.

Europe’s chemical and medical device exports have also been put under the microscope by Chinese authorities for possible hidden subsidies. French and Italian luxury exports like perfume could also be targeted.

Other options for retaliation include machinery, industrial inputs, and aerospace products, although economic observers

queried by US business media

don't believe Beijing will go that far unless pressed.

China could also choose a non-tariff route, such as increasing investments in European factories to evade tariffs altogether, for example.

Hundreds of billions of euros are at stake in the China-EU trade spat. In 2023, China exported €515.9 billion worth of goods to the EU, contrasted with €223.6 billion heading the other way, for a total trade deficit with the Asian nation of a whopping €292 billion. The EV tariffs may be designed to close that gap, but could backfire if Beijing fires back with tit-for-tat duties on European goods.

12 September 2024, 19:12 GMT