https://sputnikglobe.com/20230916/jeffrey-sachs-us-sanctions-against-russia-and-china-destined-to-fail-1113405612.html

Jeffrey Sachs: US Sanctions Against Russia and China Destined to Fail

Jeffrey Sachs: US Sanctions Against Russia and China Destined to Fail

Sputnik International

The US overestimated its capabilities when trying to undermine Russia and China's economies, the Columbia University economist told Sputnik's New Rules podcast.

2023-09-16T12:00+0000

2023-09-16T12:00+0000

2023-09-16T18:32+0000

jeffrey sachs

china

russia

washington

brics

european union (eu)

joe biden

opinion

nord stream

international monetary fund

https://cdn1.img.sputnikglobe.com/img/07e7/03/16/1108672524_0:94:3307:1954_1920x0_80_0_0_337084faaf6665d443ecccf6c99f04ff.jpg

Sanctions have failed to bring Russia to its knees, as the nation's economy has proved to be far more resilient than Western policymakers ever imagined.Back in March-February 2022 they projected that a bunch of restrictions would be effectively a knockout punch against the Russian economy, that they would bring military production to a halt and that they could even potentially cause mass political unrest. None of that has materialized. Why did Western analysts get Russia so wrong?"Russia not only has vast domestic capacity in the economy, which Western analysts underestimated, but it has continuing trade links with most of the world and oil that it didn't sell to Europe directly, it sold to Asia. And a lot of that oil turned around and came back to Europe anyway at higher prices for Europe, but through Asian middlemen. So the sanctions regime is generally a failure. And in the case of Russia, it failed in two fundamental ways. One, not achieving at all the aims of the sanctions. And two, not even hindering the Russian economy to any significant extent," the professor continued.What's Behind Russia's Economic Resilience?Western politicians have a long record of belittling Russia's economy. Barack Obama used to call the Russian economy small, weak, isolated and "in tatters"; late Senator John McCain went even so far as to smear Russia as "a gas station masquerading as a country"; late ex-Secretary of State Madeleine Albright predicted that Russia would be "economically crippled and strategically vulnerable" after launching its special operation in Ukraine; Joe Biden asserted to the press in March 2022 that the Russian ruble was almost "reduced to rubble.""So there was a lot of ignorance, I would say, in the West or make believe or wish fulfillment in Western capitals, especially Washington, about what Russia can and can't do and what would happen with the sanctions. I remember at the start of the sanctions, of course, in the conversations that I had with Washington, they really did believe this was the absolute definitive weapon cutting Russia out of SWIFT. This was going to be it. This was somehow so dramatic, it would decisively end the conflict. Yeah, completely naive."Who Has Forged the Biggest Alliance?In addition, the US miscalculated its capability of drumming support for its initiatives, according to the professor. It has turned out that the US alliance is not that big, actually. The US has the UK, the EU, Japan, South Korea, Australia and New Zealand, but the group constitutes just 10 to 12% of the world population, meaning that it's not a dominant power, he noted.When one looks at the gross domestic product (GDP) indicator, one would see that the main industrialized powers, known as the Group of Seven (G7), constitute about 30% of world GDP measured at international prices. At the same time, BRICS 11, the expanded version of the five-member group of developing nations, accounts for 37% of world output, seven percentage points greater than the G7. And all BRICS members are actively engaged with Russia, the professor emphasized.Why US Can't Stop China's RiseAnother member of BRICS, China, has also been targeted by Washington, being seen as the most "comprehensive and serious challenge" to US security. However, most recently, US thought leaders declared the end of China's economic miracle while US President Joe Biden called the People's Republic a "ticking time bomb.""China is a ticking time bomb ... China is in trouble. China was growing at 8% a year to maintain growth. Now close to 2% a year," the US president claimed in early August, misstating the nation's growth indicators. In reality, in the second quarter of 2023 the Chinese economy expanded by 6.3% year-on-year which is the highest in the world among major economies.The economist explained that advanced complex economies sometimes face slowdowns and even recession. That happened to the US; that happened to Europe. "But to use the early glimmerings of a little bit slower growth than had been forecast to mean the end of China's growth prospects is absurd," he said.Besides, there's no evidence whatsoever that China is getting stuck at the level of economic development, he continued: "China is a powerhouse of scientific research, a powerhouse of innovation, a powerhouse of new productivity, and it has a worldwide market for its export goods." And the US is trying to break this, the economist underscored.Still, US policymakers have apparently forgotten that there is a big world out there, the professor highlighted. Even if China's ability to export to the US is curtailed by Washington, "China will develop continuing robust trade relations with most of the world and will continue to have, in fact, export-led growth with most of the world or much of the world," he said.Who is the Biggest Loser From Sanctions?While Western sanctions have failed to cripple Russia's economy and hinder China's rise, they at the same time have given a boost to the development of the two countries, prompting them to explore new markets, develop new technologies and forge new partnerships.For instance, over the past two years, one has seen Chinese auto companies become major players on the international market, even overtaking German car producers. And one of the major markets for Chinese cars has been the Russian market, in large part because last year a lot of Western brands, a lot of Japanese brands left the Russian market, which created a void that the Chinese companies could fill."If there is a particular loser from all of this, it's the German industry which had probably the closest symbiotic relationship with the Russian economy over the last 30 years," added the professor.Germany is the only G7 nation that will see economic contraction this year, according to the International Monetary Fund (IMF). The IMF attributes the trend to weak production output as well as a contraction in two consecutive quarters (Q4 in 2022 and Q1 in 2023). The latter factor prompted international economists to conclude in mid-July that the country had fallen into a technical recession.The destruction of the Nord Stream natural gas pipelines, as well as Berlin's decision to follow in Washington's footsteps and slap energy sanctions on Russia, backfired on German manufacturers, leading to relocation of businesses and, eventually, deindustrialization."All of the fervor against Nord Stream, for example, was a part of the US desire to ensure that Germany and Russia never got too cozy economically," Sachs remarked.So, in the end, the Western sanctions policy has not led to any kind of a deep, prolonged crisis for either Russia or China. Quite the contrary, according to the professor."The more energetic and dynamic part of the world, the faster growing part of the world quantitatively, is not on the US-European side of the story," Sachs concluded.

https://sputnikglobe.com/20230825/pepe-escobar-brics-11---strategic-tour-de-force-1112882830.html

https://sputnikglobe.com/20230914/us-plan-to-contain-china-rehearsed-in-ukraine-1113365490.html

https://sputnikglobe.com/20230803/chinas-rare-earth-metals-ban-hits-us-chip-trade-restrictions-where-it-hurts-1112340326.html

https://sputnikglobe.com/20230908/most-austrians-believe-russia-sanctions-harm-eu-citizens---survey-1113215654.html

https://sputnikglobe.com/20230824/whats-behind-decline-of-germany-1112852729.html

china

russia

washington

ukraine

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

russia, china, us sanctions, russian economy, russian economy resilience, us sanctions failed to cripple russian economy, ukraine conflict, war in ukraine, us failed to isolate russia, china export ban, us semiconductor ban, us containing china, china's rise, brics, brics expansion, brics 11, brics gdp, group of seven, group of industrialized nations, global economy, jeffrey sachs, germany deindustrialization, western sanctions boomeranged, europe recession

russia, china, us sanctions, russian economy, russian economy resilience, us sanctions failed to cripple russian economy, ukraine conflict, war in ukraine, us failed to isolate russia, china export ban, us semiconductor ban, us containing china, china's rise, brics, brics expansion, brics 11, brics gdp, group of seven, group of industrialized nations, global economy, jeffrey sachs, germany deindustrialization, western sanctions boomeranged, europe recession

Sanctions have failed to bring Russia to its knees, as the nation's economy has proved to be far more resilient than Western policymakers ever imagined.

Back in March-February 2022 they projected that a bunch of restrictions would be effectively a knockout punch against the Russian economy, that they would bring military production to a halt and that they could even potentially cause mass political unrest. None of that has materialized. Why did Western analysts get Russia so wrong?

"When it comes to Russia, the idea that this would be some kind of a 'knockout blow' for the conflict in Ukraine was utterly naive and predictably a failure," renowned economist and Columbia University Professor Jeffrey Sachs told Sputnik. "But I think the Russian economy also was clearly vastly underestimated. And what the West gets wrong on all aspects of the Ukraine crisis is that the world is not united with the West. The West is just a small part of the world. Most of the world wants to stay clear of this crisis."

"Russia not only has vast domestic capacity in the economy, which Western analysts underestimated, but it has continuing trade links with most of the world and oil that it didn't sell to Europe directly, it sold to Asia. And a lot of that oil turned around and came back to Europe anyway at higher prices for Europe, but through Asian middlemen. So the sanctions regime is generally a failure. And in the case of Russia, it failed in two fundamental ways. One, not achieving at all the aims of the sanctions. And two, not even hindering the Russian economy to any significant extent," the professor continued.

What's Behind Russia's Economic Resilience?

Western politicians have a long record of belittling Russia's economy. Barack Obama used to call the Russian economy small, weak, isolated and "in tatters"; late Senator John McCain went even so far as to smear Russia as "a gas station masquerading as a country"; late ex-Secretary of State Madeleine Albright predicted that Russia would be "economically crippled and strategically vulnerable" after launching its special operation in Ukraine; Joe Biden asserted to the press in March 2022 that the Russian ruble was almost "reduced to rubble."

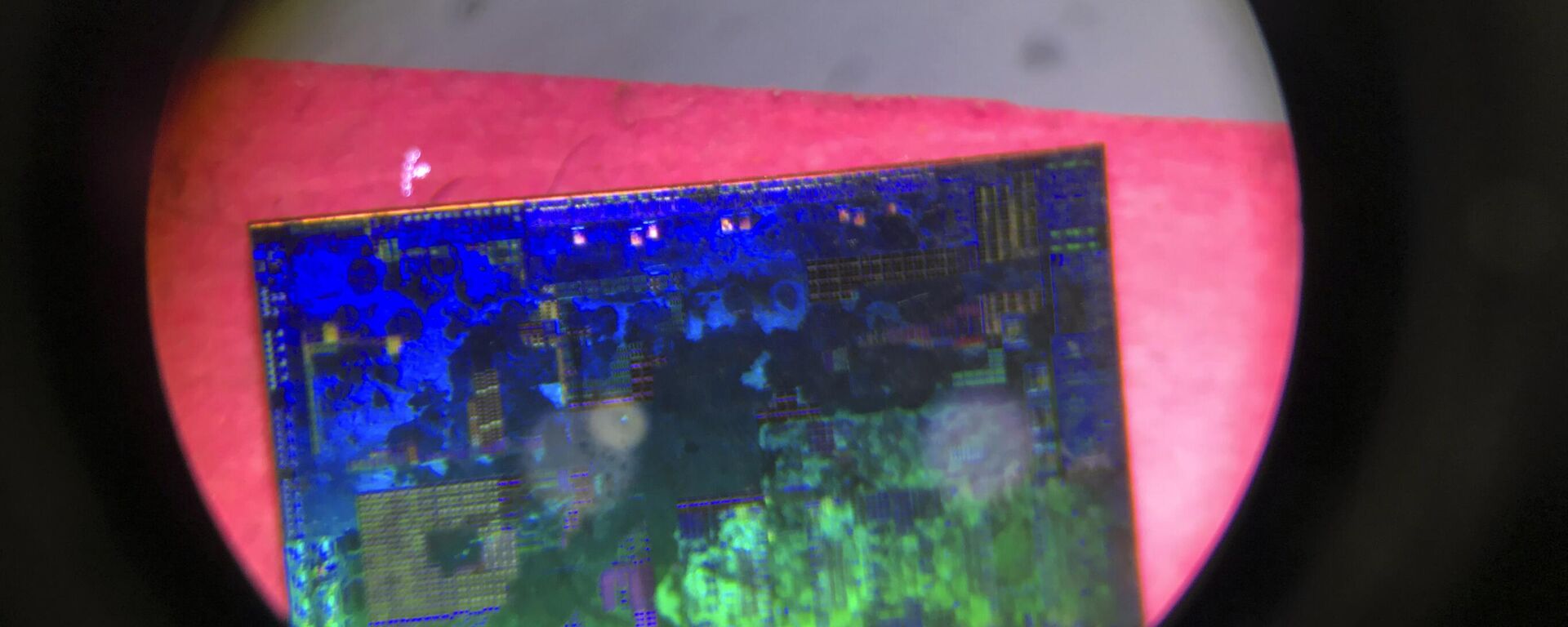

"Well, clearly, Russia has a lot of resilience because it has a vast food production base," Sachs said. "It has a vast mineral base, it has a vast industrial base. The assumption in the West was that it did not have a high-tech base. So as was said by the German foreign minister, I believe, Russia would be scrounging washing machines imported from Germany to get the chips for its military capacity. These kinds of absurdities were part of the mythology, and Russia's high-tech capacities were clearly constantly neglected and discounted. Russia obviously has a very sophisticated digital industry, and that's both for civilian and for military purposes."

"So there was a lot of ignorance, I would say, in the West or make believe or wish fulfillment in Western capitals, especially Washington, about what Russia can and can't do and what would happen with the sanctions. I remember at the start of the sanctions, of course, in the conversations that I had with Washington, they really did believe this was the absolute definitive weapon cutting Russia out of SWIFT. This was going to be it. This was somehow so dramatic, it would decisively end the conflict. Yeah, completely naive."

25 August 2023, 12:37 GMT

Who Has Forged the Biggest Alliance?

In addition, the US miscalculated its capability of drumming support for its initiatives, according to the professor. It has turned out that the US alliance is not that big, actually. The US has the UK, the EU, Japan, South Korea, Australia and New Zealand, but the group constitutes just 10 to 12% of the world population, meaning that it's not a dominant power, he noted.

When one looks at the gross domestic product (GDP) indicator, one would see that the main industrialized powers, known as the

Group of Seven (G7), constitute about 30% of world GDP measured at international prices. At the same time,

BRICS 11, the expanded version of the five-member group of developing nations, accounts for 37% of world output, seven percentage points greater than the G7. And all

BRICS members are actively engaged with Russia, the professor emphasized.

"All of this is to say that there are two dimensions to this question about whether Western sanctions will destroy Russia's long-term growth. One is that it completely overestimates the US chokehold on cutting-edge technologies and underestimates Russia's indigenous capacities, as well as those of its partners. And second, it completely misjudges the scale of the so-called US-led alliance, which is now smaller than the group that Russia firmly belongs to, BRICS+. And even beyond BRICS+ most of the developing world and emerging market economies just are going to continue to have normal relations with Russia, though they will find the US secondary sanctions and threats and cajoling uncomfortable. But they don't want to succumb to a US determined and dominated order."

14 September 2023, 14:17 GMT

Why US Can't Stop China's Rise

Another member of BRICS, China, has also been targeted by Washington, being seen as the most "comprehensive and serious challenge" to US security. However, most recently, US thought leaders declared the end of China's economic miracle while US President Joe Biden called the People's Republic a

"ticking time bomb.""China is a ticking time bomb ... China is in trouble. China was growing at 8% a year to maintain growth. Now close to 2% a year," the US president claimed in early August, misstating the nation's growth indicators. In reality, in the second quarter of 2023 the Chinese economy expanded by 6.3% year-on-year which is the highest in the world among major economies.

"Let me just say, if you've been around long enough as I have, you see this kind of, again, wish fulfillment writing come in waves," Sachs said. "In the 1990s, we had articles, for example, by Paul Krugman on The Myth of the East Asian Miracles, I think was the title, but basically saying, 'Look, there's nothing there to East Asia's rise, there's nothing there to China's rise. China's going to collapse, an authoritarian or totalitarian state can't succeed. It's all a house of cards. It's all going to crumble.' This comes in waves. What's funny for me this time is that last year was 'China's the great threat to the world, taking over the world!' Suddenly the narrative changed. 'China's in collapse!' And as soon as the narrative changed, every columnist, including many I'm sure there who have never been to China, started writing articles about the Chinese collapse and the Chinese failure and the end of the Chinese economy. It's all nonsense, basically. It's just nonsense."

The economist explained that advanced complex economies sometimes face slowdowns and even recession. That happened to the US; that happened to Europe. "But to use the early glimmerings of a little bit slower growth than had been forecast to mean the end of China's growth prospects is absurd," he said.

Besides, there's no evidence whatsoever that China is getting stuck at the level of economic development, he continued: "China is a powerhouse of scientific research, a powerhouse of innovation, a powerhouse of new productivity, and it has a worldwide market for its export goods." And the US is trying to break this, the economist underscored.

"There is an active policy to break China's growth," Sachs said. "The US denies this. The US says, no, no, no, no, no. We just want to prevent a few technologies getting into the hands of the Chinese military. Nonsense. One reads, really, the US's approach and you can find it in many, many places. It is that 'China's a threat and we have to stop China's rise'. We have to find ways to create an international system that is unfavorable to China's continued rise. One part of that is the controls on technology exports to China, which we've discussed. Another part is basically more intensively closing down the US market to China's exports."

Still, US policymakers have apparently forgotten that there is a big world out there, the professor highlighted. Even if China's ability to export to the US is curtailed by Washington, "China will develop continuing robust trade relations with most of the world and will continue to have, in fact, export-led growth with most of the world or much of the world," he said.

"So to sum it all up, the US is aiming to stop China's growth the same way that it aimed to crimp Japan's growth at the end of the 1980s, in the early 1990s, and the same way that it worked overtime to halt any kind of economic progress in the Soviet Union. China, of all of those cases, has both the internal capacities, orientation and the geopolitics to surmount the US challenge," Sachs underscored.

8 September 2023, 16:54 GMT

Who is the Biggest Loser From Sanctions?

While Western sanctions have failed to cripple Russia's economy and hinder China's rise, they at the same time have given a boost to the development of the two countries, prompting them to explore new markets, develop new technologies and forge new partnerships.

For instance, over the past two years, one has seen Chinese auto companies become major players on the international market, even overtaking German car producers. And one of the major markets for Chinese cars has been the Russian market, in large part because last year a lot of Western brands, a lot of Japanese brands left the Russian market, which created a void that the Chinese companies could fill.

"Well, I think certainly there is a huge boomerang effect of these sanctions. Europe is the biggest loser of the sanctions, this is for sure, because Russia's low-cost production, both of primary energy certainly, but also of fertilizers and many other commodity-based manufactured goods going to Europe are now going to China and going to the rest of Asia. And Europe is in outright recession," said Sachs.

"If there is a particular loser from all of this, it's the German industry which had probably the closest symbiotic relationship with the Russian economy over the last 30 years," added the professor.

Germany is the only G7 nation that will see economic

contraction this year, according to the International Monetary Fund (IMF). The IMF attributes the trend to weak production output as well as a contraction in two consecutive quarters (Q4 in 2022 and Q1 in 2023). The latter factor prompted international economists to conclude in mid-July that the country had fallen into a technical recession.

24 August 2023, 14:02 GMT

The destruction of the Nord Stream natural gas pipelines, as well as Berlin's decision to follow in Washington's footsteps and slap energy sanctions on Russia, backfired on German manufacturers, leading to relocation of businesses and, eventually, deindustrialization.

"All of the fervor against Nord Stream, for example, was a part of the US desire to ensure that Germany and Russia never got too cozy economically," Sachs remarked.

"And as Russia therefore turns to the broader BRICS world and the rest of the world, it's those countries that benefit from these linkages," the professor continued. "And it's Europe that is absolutely left behind. One of those beneficiaries is China. Clearly. Because China is a crowded, densely populated economy with natural resources, but on a per capita basis, relatively low. So it's very complementary with Russia. Add in the common shared high-tech element, and that's an added benefit of this increasingly strong relationship between China and Russia on the economic side, because there is a lot of technology transfer that can go in both directions. Add in the building of infrastructure across Eurasia, connecting Russia and China in a number of ways. That also is of great strength."

So, in the end, the Western sanctions policy has not led to any kind of a deep, prolonged crisis for either Russia or China. Quite the contrary, according to the professor.

"The more energetic and dynamic part of the world, the faster growing part of the world quantitatively, is not on the US-European side of the story," Sachs concluded.