https://sputnikglobe.com/20240125/west-could-face-300bln-boomerang-in-gamble-to-seize-russian-assets-sputnik-estimates-1116380567.html

West Could Face $300Bln Boomerang in Gamble to Seize Russian Assets, Sputnik Estimates

West Could Face $300Bln Boomerang in Gamble to Seize Russian Assets, Sputnik Estimates

Sputnik International

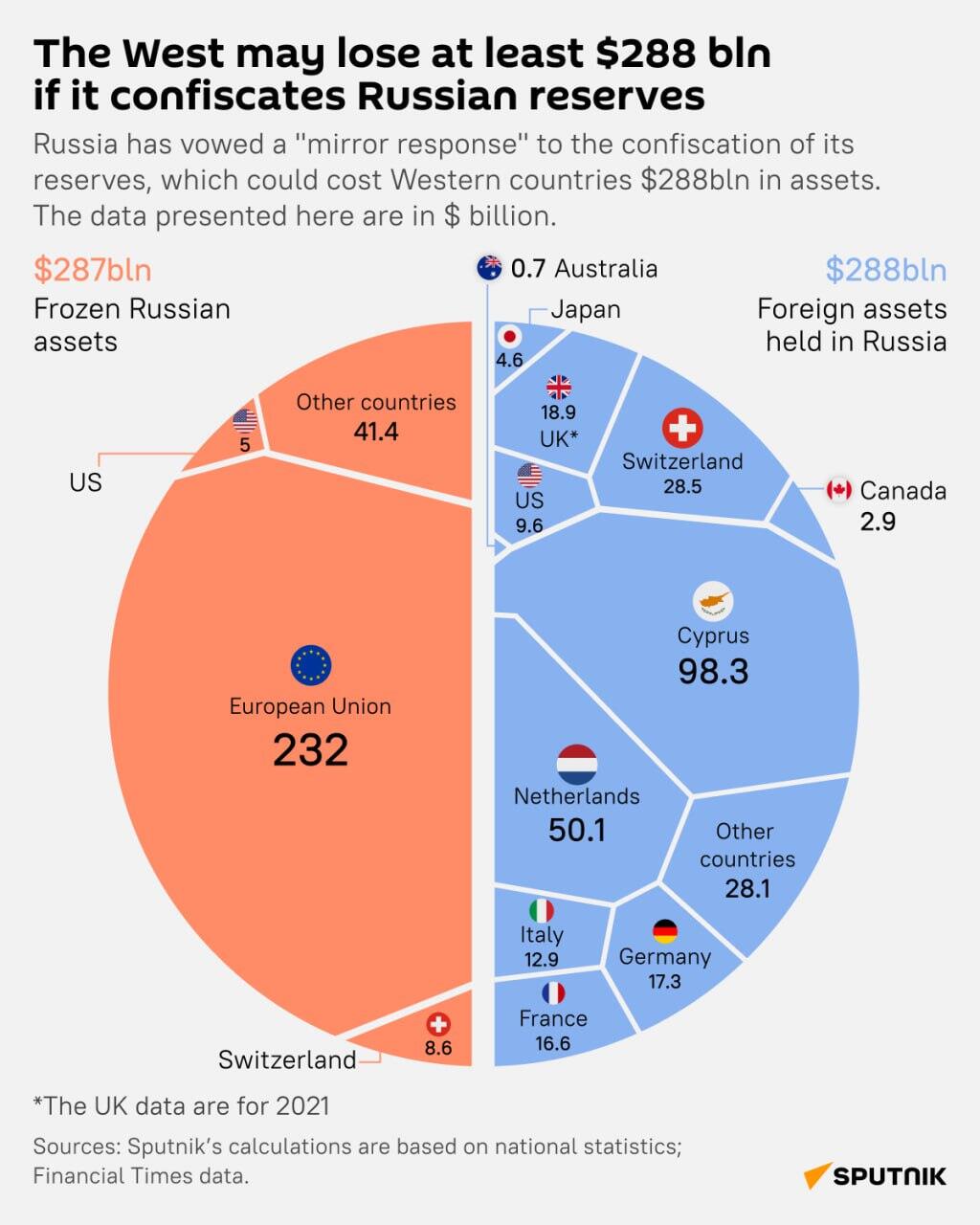

Various proposals for confiscating frozen Russian assets have been mulled over by EU and US officials for months now, but there is a new twist to the story following recent developments in the US Senate. However, Russia's tit-for-tat countermeasures would come at a greater price.

2024-01-25T15:05+0000

2024-01-25T15:05+0000

2024-01-25T15:05+0000

economy

russia

european union (eu)

assets

foreign assets

frozen assets

dmitry peskov

west

kiev

sputnik

https://cdn1.img.sputnikglobe.com/img/07e8/01/19/1116380997_0:176:3018:1874_1920x0_80_0_0_fe2061118b017081abab32905ed8b01f.jpg

Russian officials have warned of tit-for-tat actions as a response to transferring frozen assets to the Kiev regime, which may cost the West some $288 billion, according to Sputnik's calculations. In the light of recent developments in the US Senate, the issue has taken a new, dramatic turn. On Wednesday, the Senate Foreign Relations Committee was looking at a new draft bill, aimed at transferring Russian frozen assets over to Ukraine, Politico reported, citing two anonymous sources. This unprecedented move would entail major consequences, as Russian officials have vowed to take similar retaliatory steps. Sputnik has made calculations based on Russia's national statistics and the open data presented by the Financial Times. Per the estimates (see the graph below), Russia is currently holding some $288 billion worth of foreign assets, a billion more than that threatened to be seized by the West. Moscow has maintained that such an attempt goes in violation of the international law. The Russian Foreign Ministry has dismissed the freezing of Russian assets as theft.Last year, Russian President Vladimir Putin dubbed the West’s asset seizure as “unseemly business,” and stressed that “stealing other people’s assets has never brought anyone good”.The numbers support the fact that this not worth the gamble. However, if the West follows through with this ploy, grave global repercussions and serious distrust in the West's financial system would be far costlier.

https://sputnikglobe.com/20240112/biden-backing-bill-to-seize-russian-assets-bound-to-deepen-dedollarization-1116126197.html

russia

west

kiev

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2024

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

what are russian frozen assets, how can you take russian frozen assets, what’s the deal with russian assets, is seizing russian assets legal, are there implications for taking russian assets, russian assets transferred to ukraine, russian assets transferred to kiev

what are russian frozen assets, how can you take russian frozen assets, what’s the deal with russian assets, is seizing russian assets legal, are there implications for taking russian assets, russian assets transferred to ukraine, russian assets transferred to kiev

West Could Face $300Bln Boomerang in Gamble to Seize Russian Assets, Sputnik Estimates

Various proposals for confiscating frozen Russian assets have been mulled over by EU and US officials for months now, but there is a new twist to the story following recent developments in the US Senate. However, Russia's tit-for-tat countermeasures would come at a greater price.

Russian officials have warned of tit-for-tat actions as a response to transferring frozen assets to the Kiev regime, which may cost the West some $288 billion, according to Sputnik's calculations.

In the light of recent developments in the US Senate, the issue has taken a new, dramatic turn. On Wednesday, the Senate Foreign Relations Committee

was looking at a new draft bill, aimed at transferring Russian frozen assets over to Ukraine, Politico reported, citing two anonymous sources.

A follow-up session's agenda was to include amendments seeking to water down the initial bill. The draft law provided for a transfer of the seized funds from Russia’s Central Bank and other institutions to Ukraine for reconstruction needs. New amendment seeks to permit asset transfer only upon the agreement of all G7 member nations, the report said on Monday.

12 January 2024, 10:14 GMT

This unprecedented move would entail major consequences, as Russian officials have vowed to take similar retaliatory steps.

Sputnik has made calculations based on Russia's national statistics and the open data presented by the Financial Times. Per the estimates (see the graph below), Russia is currently holding some $288 billion worth of foreign assets, a billion more than that threatened to be seized by the West.

Moscow has maintained that such an attempt goes in violation of the international law. The

Russian Foreign Ministry has dismissed the freezing of Russian assets as theft.

"Those who are trying to initiate this, and those who will implement it, must understand that Russia will never leave those who did this alone. And it will constantly exercise its right to a legal battle, internationally, nationally or otherwise. And this, of course, will have — both Europeans and Americans understand this very well — it will have legal consequences for those who initiated and implemented it," Kremlin spokesman Dmitry Peskov cautioned commenting on the issue.

Last year, Russian President Vladimir Putin

dubbed the West’s asset seizure as

“unseemly business,” and stressed that “

stealing other people’s assets has never brought anyone good”.

The numbers support the fact that this not worth the gamble. However, if the West follows through with this ploy, grave global repercussions and serious distrust in the West's financial system would be far costlier.