Why Ukraine's First US LNG Deal is Desperate Attempt to Prove Usefulness

18:02 GMT 14.06.2024 (Updated: 08:04 GMT 15.06.2024)

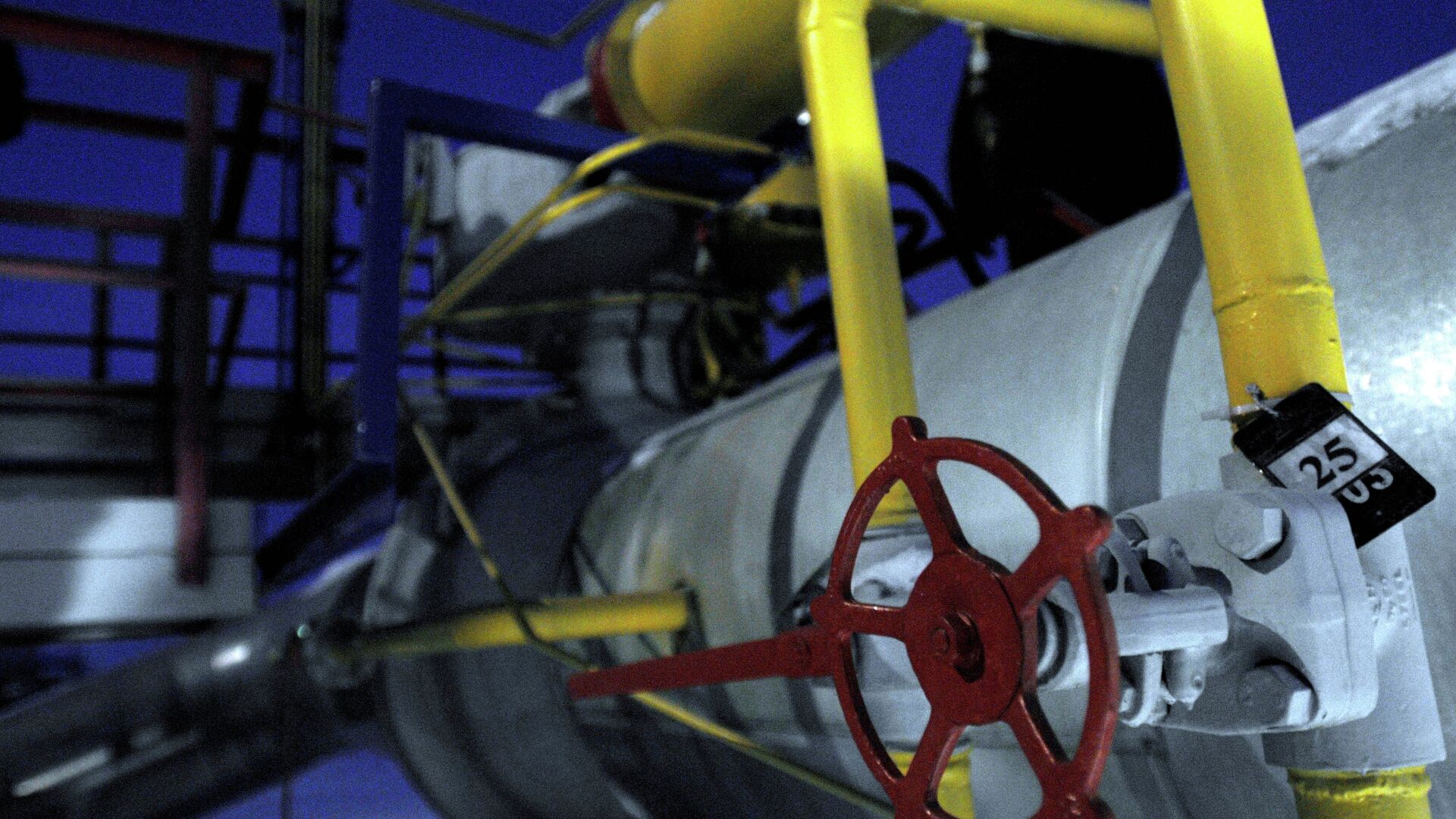

© AP Photo / Sergei Chuzavkov

Subscribe

Ukraine has concluded a deal with US-based liquefied natural gas (LNG) developer Venture Global after claims that Kiev would not extend a five-year deal with Russia's Gazprom at the end of 2024. What's behind the Kiev regime's new LNG deal?

Ukraine's energy company DTEK Group announced on June 13 that it had struck an agreement with Venture Global to buy unspecified amounts of liquefied natural gas from the US gas firm's Plaquemines LNG facility in Louisiana throughout 2026. DTEK also committed to purchasing up to 2 million tons of LNG per annum from Venture Global's new CP2 LNG plant for 20 years, once the facilities are built, according to the Financial Times.

"I think the contract is purely for political purposes," Igor Yushkov, a leading analyst of the National Energy Security Fund and expert of the Financial University of the Government of Russian Federation, told Sputnik. "Buying gas from American producers is politically important for them. This way they demonstrate their political loyalty to the United States."

The expert believes that the LNG could be sold by DTEK to other European countries. On the one hand, Ukraine does not have regasification terminals for LNG imports. On the other hand, it would require additional funds and efforts to convert LNG from a liquid to a gas elsewhere in Europe and then transport it via a European pipeline back to Ukraine, according to Yushkov.

"There will probably be no profitability in such a scheme," the expert highlighted, adding that the deal appears to be largely symbolic with DTEK playing the role of a gas trader.

"They used to do this with coal. They bought American coal and made a big event out of it," Yushkov said. "They want to demonstrate to the US that they could be useful as an [energy] market."

Apart from showing Kiev's loyalty to Washington, the US-Ukraine deal could serve as a tool for the American LNG producers to force President Joe Biden to lift his LNG export ban, according to Stanislav Mitrakhovich, a leading expert of the National Energy Security Fund and the Financial University with the Russian government.

In January, the Biden administration temporarily halted the issuance of new Department of Energy (DoE) approvals for proposed LNG export projects. The decision was seen by the Republicans as Biden's attempt to appease climate activists prior to the November elections.

"When the elections are over, this [ban] will be reversed," Mitrakhovich told Sputnik. "Of course, the gas business would like to see this ban lifted quicker, and the agreement with Ukraine is not binding, just declarative: they simply set the goal to lift the ban faster."

Ukraine Unlikely to Halt Russian Gas Transit to Europe

Ukraine's LNG deal was announced amid Kiev's repeated claims that it would not extend a five-year deal with Russia's Gazprom on the transit of Russian gas to Europe when it expires later this year. Brussels signaled that it would let the deal expire, as it is "confident" it would buy additional gas volumes somewhere else, according to Politico.

"There is still gas transit that goes from Russia through Ukraine to the West in the region of [around] 15 billion cubic meters of gas per year... Transit may be stopped… but, most likely, this cessation will not happen for now because in this case Ukraine will have to deploy its gas transportation system to operate in reverse mode," Mitrakhovich assumed.

"This will be a great additional stress for the Ukrainian economic, logistic, social and other infrastructure. They will try to avoid this at all costs, transit can be continued under one or another legal pretext, such as that Western companies will buy gas on the border of Russia and Ukraine," the expert said.

European consumers of Russian pipeline gas appear not to share Brussels' optimism with regard to the accessibility of new volumes of natural gas. Previously, Austria, Slovakia, Italy, Hungary, Croatia, Slovenia, and Moldova received their gas via Ukraine.

Austria still gets most of its gas from Russia via the Ukrainian route. Other European countries continue to get the Russian fuel either through Ukraine or via the TurkStream pipeline. In May, Gazprom's daily natural gas supplies to the continent increased by 7.3% compared with April and were up 39% year-on-year.

According to Politico, some European players are reportedly in talks with Azerbaijan about additional deliveries of gas in case the Ukrainian transit is halted.

"This is ridiculous because Azerbaijan cannot increase production by 15 billion [cubic meters of natural gas per year]," Mitrakhovich said. "Azerbaijan has a level of production that is already being used for export to Europe via the route through Turkiye. Azerbaijan cannot get an additional 15 bcm a year out of its pocket."

In April, S&P Global reported that Europe's reliance on Russian LNG imports increased in 2024 as deliveries of Russian pipeline gas plummeted since 2022 due to the EU's energy embargo and the destruction of Nord Stream pipelines.

"With our other main suppliers, such as Norway, operating at maximum capacity, it will be hard to completely stop the flow of Russian LNG. We are still not completely out of the crisis," a France-based gas trader told S&P Global.

As of April, Russia supplied 4.89 million metric tons (mt) of LNG to Europe, or more than 16% of Europe's total LNG supply of 33.65 million mt, compared to 12.7% for the first four months of 2023, according to the website.

Ukraine's Energy Sector Under Stress

Kiev's declarations of energy cooperation with the US to reduce its reliance on Russia's hydrocarbons, as well as threats to halt remaining gas transit via Ukraine, are mostly made for the sake of PR, according to the pundits.

Mitrakhovich does not rule out that Ukraine's energy infrastructure could come in Russia's crosshairs if the Kiev regime uses long-range NATO-grade missiles to hit oil and gas facilities inside Russia.

"The Ukrainian energy sector is already under stress," Mitrakhovich said. "Probably, this stress can be increased by additional military strikes. I think this could happen, especially if Ukraine starts using Western missiles to destroy some oil refineries on Russian territory and so on. I think then we can just turn off the lights in Ukraine."

Meanwhile, on June 14, Russian President Putin outlined another peace proposal to Ukraine, stressing that Moscow is ready to negotiate if the Kiev regime starts withdrawing its military from Russia's new territories, including the Donbass, Kherson and Zaporozhye regions within their administrative borders, as well as renounces its intent to join NATO.

"Today, we make another specific, real peace proposal. If Kiev and the Western capitals refuse it, as they have previously, then ultimately, it is their matter. They will have political and moral responsibility for the continuation of bloodshed," Putin underscored.