https://sputnikglobe.com/20230825/bidenomics-forces-us-budget-deficit-to-balloon-to-crisis-size-1112876381.html

Bidenomics Balloons US Budget Deficit to Bloated 'Crisis-Size'

Bidenomics Balloons US Budget Deficit to Bloated 'Crisis-Size'

Sputnik International

The United States is currently mired in crisis-size deficits as a result of the policies enacted by the administration of President Joe Biden.

2023-08-25T11:35+0000

2023-08-25T11:35+0000

2023-08-25T12:54+0000

americas

us

joe biden

us economy

economic recession

budget deficit

inflation

us federal reserve

interest rates

https://cdn1.img.sputnikglobe.com/img/107034/46/1070344646_0:100:1921:1180_1920x0_80_0_0_07604d3a5ec3a143f410b64d56fe4c52.jpg

The United States is currently mired in crisis-size deficits as a result of the policies enacted by the administration of President Joe Biden. There are few hopes of any improvement in the near future, as forecasts issued by the Congressional Budget Office show. Small wonder that investors have been jittery, with their mounting unease translating into yields on benchmark 10-year Treasuries hitting a 15-year high of over 4.3 percent this week. It should be noted that most US corporate borrowing and mortgages are benchmarked to the 10-year yield, resulting in the 30-year fixed-rate mortgages surging to their highest point in more than 20 years, at above 7 percent. American housing is now less affordable than at any time since the 1980s, with home sales plunging by 16.6 percent in July 2023, according to the National Association of Realtors. The yield on 2-year Treasury Bonds has been even higher, with the situation that is called an “inverted yield curve” indicating that investors expect a recession within a year’s time. The data on yields comes as the Federal Reserve’s effective federal funds rate has been hovering at a 22-year high amid the central bank’s efforts to clamp down on inflation. Excessive Spending & Surging DeficitsCurrently, the US national debt stands at more than $32 trillion, and continues to soar. Forecasts predict it to exceed $44 trillion by 2027. To somehow stabilize the situation, trillions in spending cuts and tax hikes would be required, according to media-cited analysts. Looking ahead, the chasm between government spending and tax revenue collecting is only expected to widen, with CBO anticipating that the federal deficit for fiscal year 2023 will be about $1.7 trillion. This figure is $200 billion larger than the original, May-issued forecast.The fiscal shortfalls forecast by the CBO come after Fitch Ratings announced it was downgrading the US federal government’s credit rating from AAA to AA+, the second time it has done so, due to shaken confidence in the US government to properly handle its debts.The move resulted in US stocks posting big losses, with the Nasdaq suffering its worst loss in six months after shedding 2.17% of its value on August 2, closing at 13,973.45. On the heels of the credit rating downgrade, the US Treasury jacked up debt issuance. The size of quarterly bond sales was upped for the first time in two and a half years in a bid to help cover the surge in budget deficits. The Treasury had announced it was selling $103 billion longer-term securities at its quarterly refunding auctions.These developments came in the wake of the protracted debt ceiling battle that dragged on for months, with the threat of a government default looming. A tentative deal was finally reached in early June on lifting the budget ceiling. In that agreement, Republicans succeeded in extracting commitments to spending cuts from Democrats that they would not otherwise have agreed to.'Bidenomics' FailThe US president's so-called 'Bidenomics' that he has been bragging about, purportedly geared to “strengthen the middle class” and ensure “the highest economic growth among the world’s leading economies since the pandemic,” has not lived up to the needs of everyday Americans. The Consumer Price Index released this month revealed that inflation rose 3.2 percent in July compared to 2022. There was also a 0.2 percent increase in the price of consumer goods as of June. When it comes to the US gross domestic product (GDP), last year it grew only one percent, December to December, as per economists.However, amid the bleak economic growth and other woes plaguing the country, Biden is intent on continuing with his spending spree. This month, Biden asked Congress for $40 billion in additional spending, with more than half of that earmarked for the Kiev regime. Of the total, $13.1 billion is slated for direct military spending. In addition, Biden is seeking an additional $2.3 billion for Ukraine through the World Bank. As for the deadline for a new budget bill to be passed, it is September 30. This would require the passage of a dozen appropriations bills, only one of which has been sent to the president. As the US teeters on the brink of an economic calamity, Biden's approval rating has been tanking. Just 36 percent of US adults believe Biden is doing a good job handling the economy, with 42 percent saying they approve his performance overall, according to a poll by the AP-NORC Center for Public Affairs Research.

https://sputnikglobe.com/20230824/feds-latest-victim-us-mortgage-rates-hit-20-year-high-1112868616.html

https://sputnikglobe.com/20230802/us-stocks-suffer-worst-losses-in-six-months-following-fitchs-credit-rating-downgrade-1112356934.html

https://sputnikglobe.com/20230818/bidens-approval-rating-tanks-as-us-teeters-on-brink-of-economic-calamity-1112702433.html

americas

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rossiya Segodnya“

bidenomics, joe biden's economic policies, us budget deficit, us ballooning federal deficit, federal reserve interest hikes, soaring us inflation, risis-size deficits, economic recession in us

bidenomics, joe biden's economic policies, us budget deficit, us ballooning federal deficit, federal reserve interest hikes, soaring us inflation, risis-size deficits, economic recession in us

Bidenomics Balloons US Budget Deficit to Bloated 'Crisis-Size'

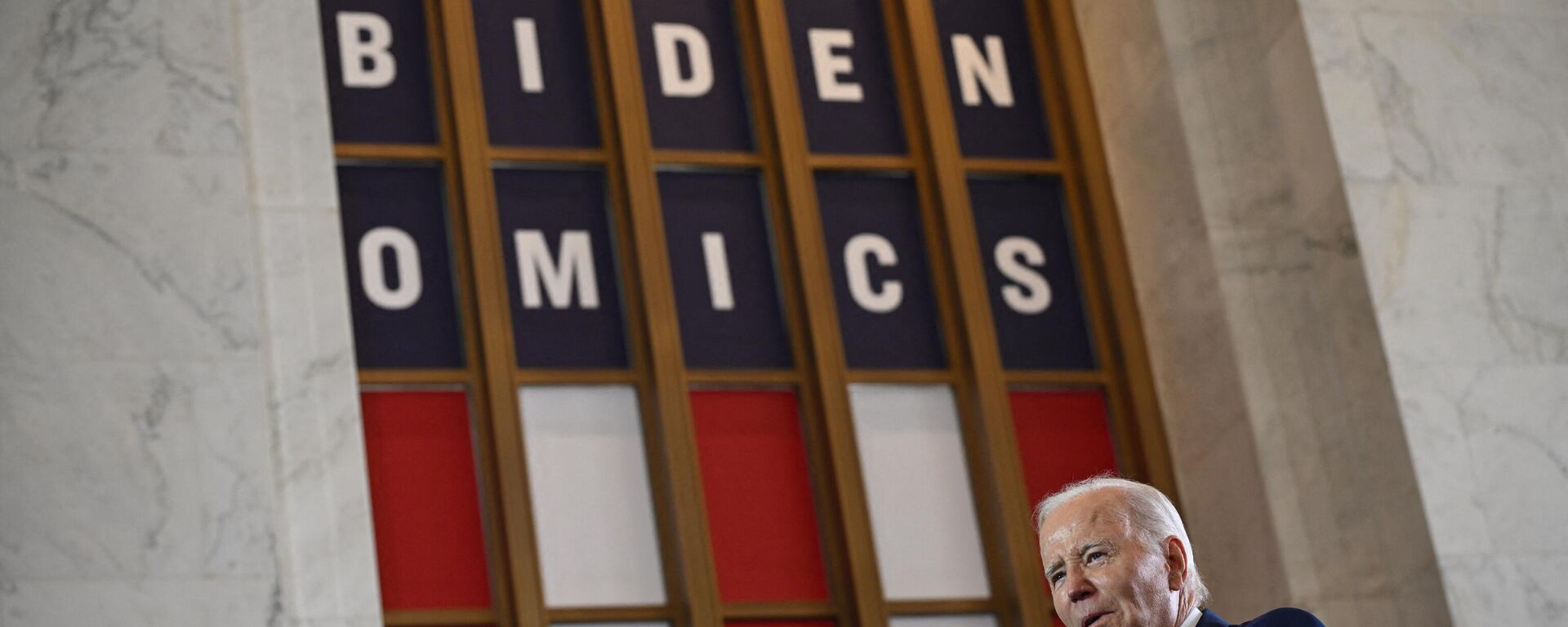

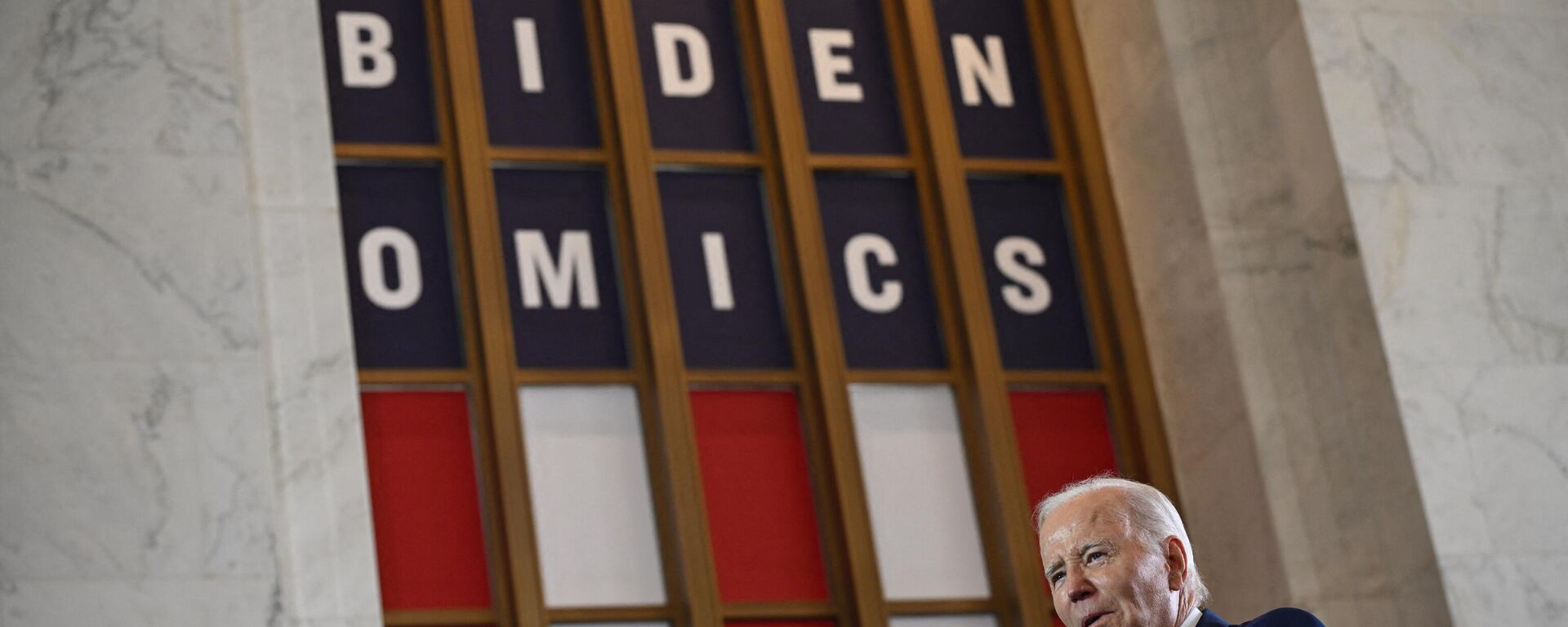

11:35 GMT 25.08.2023 (Updated: 12:54 GMT 25.08.2023) The Biden administration's economic policies have already triggered fears that the US may be heading towards an economic crisis worse than the 2008 Great Recession, amid fallout from the Fed's interest rate hikes, mounting debt, surging home prices, and a spending spree as part of proxy, trade and tech wars against Russia and China.

The United States is currently mired in crisis-size

deficits as a result of the

policies enacted by the administration of President Joe Biden. There are few hopes of any improvement in the near future, as forecasts issued by the

Congressional Budget Office show. Small wonder that investors have been jittery, with their mounting unease translating into yields on benchmark 10-year Treasuries hitting a 15-year high of over 4.3 percent this week.

It should be noted that most US corporate borrowing and mortgages are benchmarked to the 10-year yield, resulting in the 30-year

fixed-rate mortgages surging to their highest point in more than 20 years, at above 7 percent. American housing is now less affordable than at any time since the 1980s, with home sales plunging by 16.6 percent in July 2023, according to the

National Association of Realtors.

24 August 2023, 20:12 GMT

The yield on 2-year Treasury Bonds has been even higher, with the situation that is called an

“inverted yield curve” indicating that investors expect a

recession within a year’s time. The data on yields comes as the Federal Reserve’s effective federal funds rate has been hovering at

a 22-year high amid the central bank’s efforts to clamp down on inflation.

“You have a tremendous amount of fiscal spending — an unprecedented amount in non-war times. There are a lot of factors coming together to push long-end rates higher… History tells us that no asset class is really going to escape this entirely,” Oksana Aronov, head of market strategy for alternative fixed income at J.P. Morgan Asset Management, told US media.

The federal government's budget deficit more than doubled through the first 10 months of the current fiscal year, as compared to a year ago, the Congressional Budget Office (CBO) announced earlier in the month. In its budget review, released on August 9, the CBO stated that the federal deficit was $1.6 trillion as compared to the $726 billion deficit the federal government incurred for the same period last year. Federal spending was 10 percent higher than it was a year ago, while tax revenues were 10 percent lower.

Excessive Spending & Surging Deficits

Currently, the US national debt stands at more than $32 trillion, and continues to soar. Forecasts predict it to exceed $44 trillion by 2027. To somehow stabilize the situation, trillions in spending cuts and tax hikes would be required, according to media-cited analysts. Looking ahead, the chasm between government spending and tax revenue collecting is only expected to widen, with CBO anticipating that the federal deficit for fiscal year 2023 will be about $1.7 trillion. This figure is $200 billion larger than the original, May-issued forecast.

The fiscal shortfalls forecast by the CBO come after

Fitch Ratings announced it was downgrading the US federal government’s credit rating from AAA to AA+, the second time it has done so, due to shaken confidence in the US government to properly handle its debts.

The move resulted in US stocks posting big losses, with the Nasdaq suffering its worst loss in six months after shedding 2.17% of its value on August 2, closing at 13,973.45. On the heels of the credit rating downgrade, the US Treasury jacked up debt issuance. The size of quarterly bond sales was upped for the first time in two and a half years in a bid to help cover the surge in budget deficits. The

Treasury had announced it was selling $103 billion longer-term securities at its quarterly refunding auctions.

These developments came in the wake of the protracted

debt ceiling battle that dragged on for months, with the threat of a government default looming. A tentative deal was finally reached in early June on lifting the budget ceiling. In that agreement, Republicans succeeded in

extracting commitments to spending cuts from Democrats that they would not otherwise have agreed to.

The US president's so-called

'Bidenomics' that he has been bragging about, purportedly geared to “strengthen the middle class” and ensure “the highest economic growth among the world’s leading economies since the pandemic,” has not lived up to the needs of everyday Americans. The

Consumer Price Index released this month revealed that inflation rose 3.2 percent in July compared to 2022. There was also a 0.2 percent increase in the price of consumer goods as of June. When it comes to the US gross domestic product (GDP), last year it grew only one percent, December to December, as per economists.

However, amid the bleak economic growth and other

woes plaguing the country, Biden is intent on continuing with his spending spree. This month, Biden asked Congress for $40 billion in additional spending, with more than half of that earmarked for the Kiev regime. Of the total,

$13.1 billion is slated for direct military spending. In addition, Biden is seeking an additional $2.3 billion

for Ukraine through the World Bank. As for the deadline for a new budget bill to be passed, it is September 30. This would require the passage of a dozen appropriations bills,

only one of which has been sent to the president.

As the US teeters on the brink of an economic calamity, Biden's

approval rating has been tanking. Just

36 percent of US adults believe Biden is doing a good job handling the economy, with

42 percent saying they approve his performance overall, according to a

poll by the AP-NORC Center for Public Affairs Research.

18 August 2023, 11:49 GMT